Centralized Control of Everything. What Are You Doing About It?

A silent shift into a New World Order is unfolding before our eyes, taking more than just our financial control, but seeping into our social and economic fabrics. Friends, the four key pillars of the Great Reset are not just shaping our world, but they’re shaping our future, our children’s future. It’s urgent, it’s deliberate, and it’s happening now.

I’ve sounded this alarm before and will continue to do so – because the stakes? They’re monumental. Let’s revisit

CHAPTERS:

0:00 “New World Order”

1:10 One World, One Currency

6:34 World Economic Forum

8:35 “Great Reset”

12:46 BRICS

16:48 United States GDP

19:10 Gold Demand

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

You know, the silent shift into the “new world order” is unfolding before our eyes. And I’m hoping you can see it because it’s taking more than just our financial control, but seeping into our social and economic fabrics as well. Friends, the four key pillars of the Great Reset are not just shaping our world, but they are shaping our future, our children’s future. It’s urgent. It’s deliberate, and it’s happening now. I’ve sounded this alarm before and I’ll keep doing that because the stakes, they’re monumental. Let’s resist. Let’s talk about it. Coming up.

I am Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical, gold and silver dealer, specializing in custom strategies so that you don’t have to comply with those one percenters that are in charge of everything.

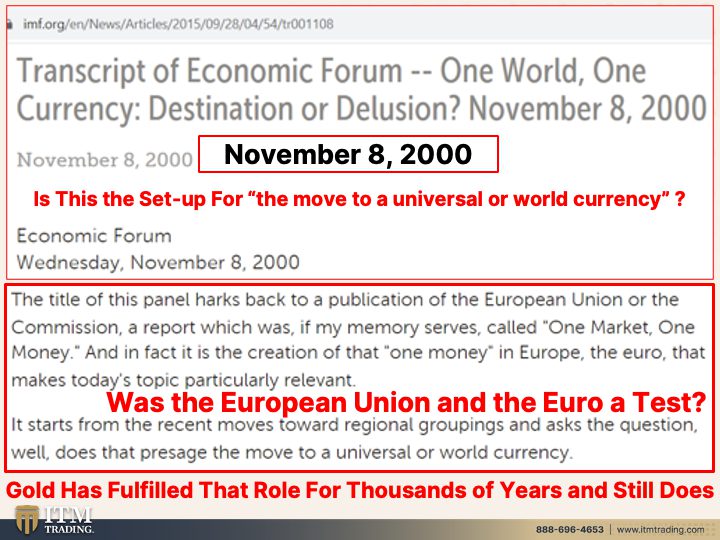

And I wanna show you how this is evolving because people think, oh, okay. I mean, we’ve got the short term. They, they’ve taught us to think really, really short term, but they don’t think short term, they think long-term. This is back in November, eighth of 2000. I think it’s so interesting, “one world, one currency” destination or delusion. They made it a destination. The title of this panel harks back to a publication of the European Union or the Commission, a report, which was, if my memory serves, called “One Market, One Money.” In fact, it is the creation of that one money in Europe, the Euro that makes today’s topic particularly relevant. And it starts from the recent moves towards regional groupings and asks the question, well, does that presage the move to a universal or world currency? Now, I wanna go back to this because I’ve talked to you over the years a lot about how pegged currencies never last. And we’ve seen the threat to the European Union in Greece during their, their sovereign bond crisis in 2013 and 14. And all they did and, and also Brexit when Great Britain left the Union. So the reality is, is that as long as you have all different economies around the world, they cannot all behave as one because they have different needs. But the point of this is that the European Union was a test. And I can’t say that the test was successful and nobody can actually say that. Has it held together up to this point? Mm. You be the judge. You be the judge. But I think that this was the setup and the test to making a universal government and a one world money. There’s really no doubt in my mind, but you know, hey, I could be wrong. You’ve gotta come to your own conclusions. You have the links to everything. Do your own due diligence. Because the reality is, is if they’re looking for a one world currency, gold has fulfilled that role for thousands and thousands of years because it does indeed level the playing field and it gives you purchasing power anywhere you go in the world. That’s why I travel with them. And quite honestly, it was pretty easy for me to travel with gold and silver. When I recently went to Australia, New Zealand, it was not an issue or problem at all.

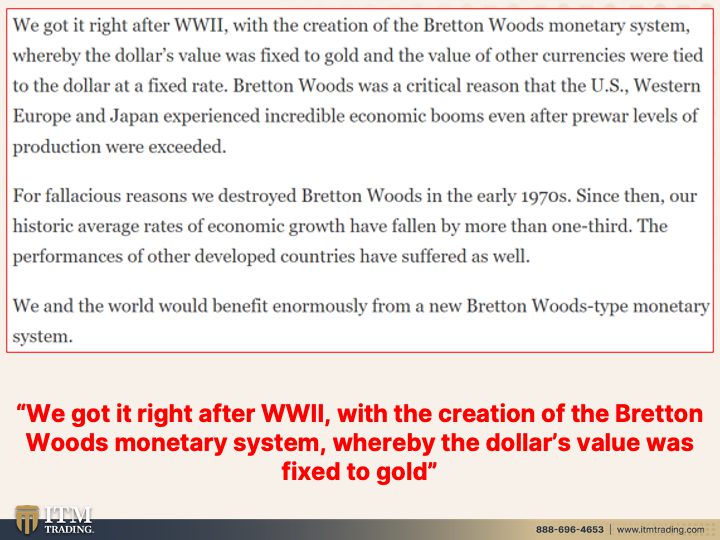

We got it right after World War II with the creation of the Bretton Woods monetary system, whereby the dollar’s value was fixed to gold and the value of other currencies were tied to the dollar at a fixed rate. Bretton Woods was a critical reason that the US Western Europe and Japan experienced incredible economic booms even after pre-war levels of production were exceeded for fallacious reasons. We destroyed Brett Woods in the early seventies. Yeah, the U.S. Reneged on that agreement, but they had reneged prior to that by exporting inflation to the world during the Vietnam War. Since then, our historic average rates of economic growth have fallen by no more than a third. The performances of other developed countries have suffered as well because that’s when we became completely dependent on debt and never ending, rolling that debt over. As I’ve shown you a gazillion times in the U.S. The public debt is it over now it’s over 33 trillion. And so if you have to service that debt, that leaves you less wealth and less money for growth. And, and by the way, that is all non self-liquidating debt. Right? What we needed and what we had when we were on the gold standard was more self-liquidating debt, not completely, but more so we in the world would benefit enormously from a new Bretton Woods type monetary system. Yeah. One that puts restrictions on the abuse that governments and central bankers have on the monetary system. Because this is so much easier than going out and digging the gold out of the ground. There’s an infinite amount of this garbage. There’s a finite, there’s a finite amount of this and this. There’s only so much that is available.

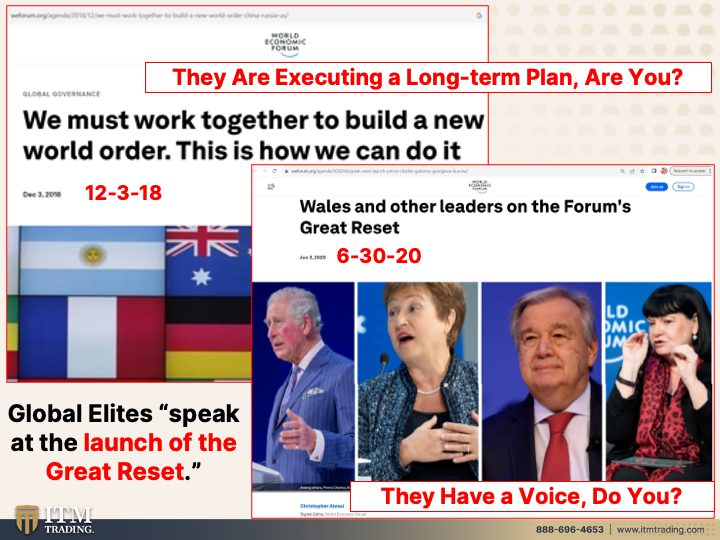

All right, well let’s take a look at that because they’re executing a long-term plan. Are you? I would rather be two weeks, 10 years. I don’t care how early I am, but I do not wanna be even one second too late. And I see way too many people that are dependent upon those short-term games. Yeah, we’ve been taught to think short, short, short. But they don’t think short because they know that the way to make that change is slowly like the frog and the pot of water.

We must work together to build a “new world order” and this is how we can do it. And this is from the World Economic Forum. You know, one of my favorites, Wales and other leaders on the forum’s, great reset. So you see they’ve been planning this, they’ve been talking about it, they’ve been moving it forward for a very long time. Global elites speak at the launch of the “Great Reset.” So the great reset actually started in 2020. Is that a surprise to you? Because it is not a surprise to me. They did their planning and now they’re executing. Are you ready for it? Because they have a voice. Do you have a voice? And how can you get your voice? You vote with your wallets.

And it’s not just the monetary base, it’s Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Because that’s what enables you and me and all of us out there, the 99% to retain our freedoms when they just want those freedoms to go away. They wanna be ruling. And by the way, none of these people that were speaking and launching the Great Reset are elected officials. We will have no voice if we allow this to happen.

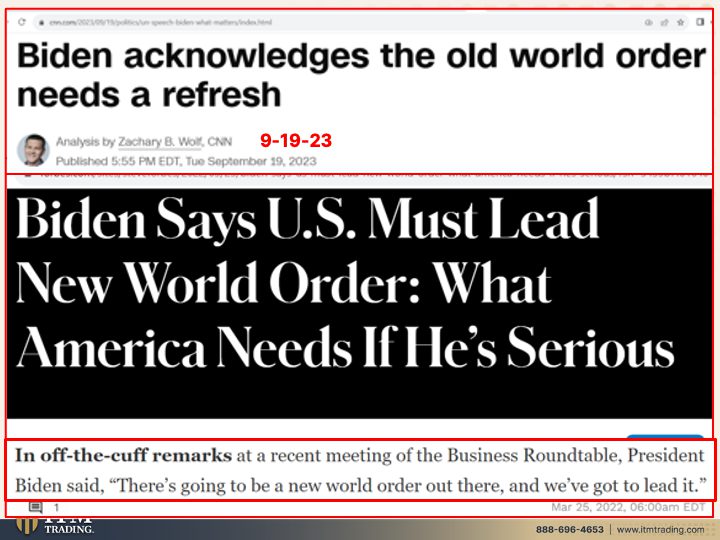

Biden, our president, acknowledges the “old world order” needs a refresh and the US must lead the new world order what America needs if he’s serious and he is serious, they’re all serious. And it isn’t just America. It’s the world. In an off the cuff remark, at a recent meeting of the Business Roundtable, President Biden said There’s going to be a new world order out there and we’ve got to lead it. Well, I’m gonna tell you that there’s going to be a “new world order” out there and we need to lead it because if we allow them to lead it, all we’ll get is not just more of the same, but we will get less and less and less of our freedoms, our voice, our choices. Does that matter to you? Because it matters greatly to me and not for me. Ah, I’m 69. I have probably another 31 years on this planet ’cause I think I’m gonna live to a hundred. But my children, my grandchildren, my great-grandchildren, how about your children, your grandchildren, your great-grandchildren, and past that, we have to do this for them. We have to lead the new world order, not allow them to take away those freedoms. Don’t allow that.

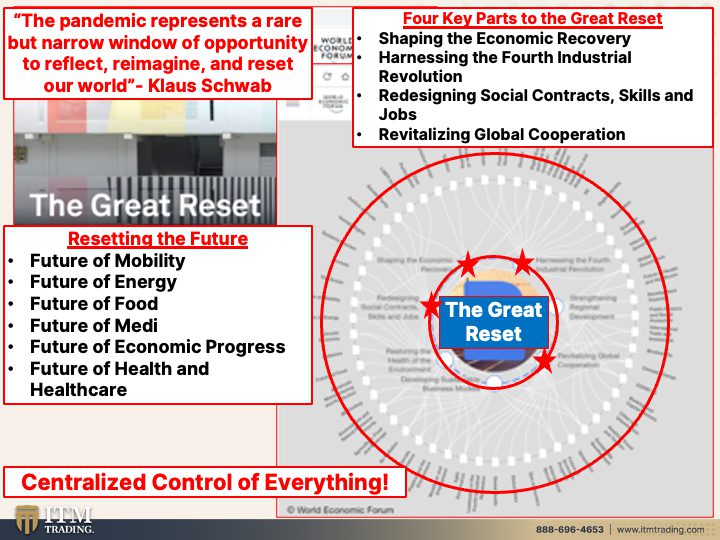

But hey, here’s the opportunity. Oh my goodness, the pandemic represents a rare but narrow window of opportunity to reflect, reimagine, and reset our world. Thank you, Klaus. I appreciate your words. I don’t appreciate him at all. But you gotta take a look at it because this is what they have in mind for us. And remember, the links are there. Don’t take my word for it. Go in and look at them on your own. So there’s “the great reset” and I just highlighted some of the key pieces of that. So they’re talking about resetting the future, right? Of mobility. That’s your ability to move between states, between countries, etcetera. The future of energy, which would all be in their control so they can dole it out, right? Future of food, right? We’ve already heard where, you know cows, after all, they pass too much gas and sheep, but bugs don’t, right? So they have all of these things in mind. The future of medicine, the future of economic progress, the future of health and healthcare. I mean, I don’t really want them dictating that to me because what they’re doing in all of this is shaping the economic recovery. Harnessing the fourth industrial revolution, redesigning those social contracts, skills and jobs and revitalizing global cooperation. Bringing it all into one place that they control. Because once everything is centralized in one place, I mean people my age, we’ve had this experience. Younger generations not so much. But don’t you remember a time when, if there was a problem, there was somebody you could talk to that could fix the problem? Can we really do that now? No. They’ve distanced. These large corporations have distanced themselves. These central bankers are so distant from us, they don’t know what it’s like to live in the real world. They live in their theory world. And those theories don’t really coordinate with day-to-day life. But if they have centralized control of everything, what if they told us they can have their finger on that economic button 24/7 you’re never gonna know what in the world is going on. And if you’re dependent upon them, you’re gonna have to do what they want. You wanna be independent. This is your foundation because it’s your wealth foundation. It’s why global, central banks are buying so much.

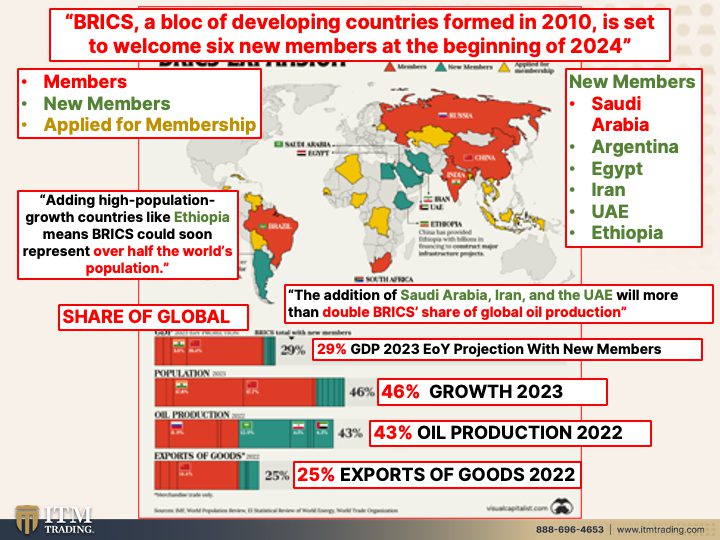

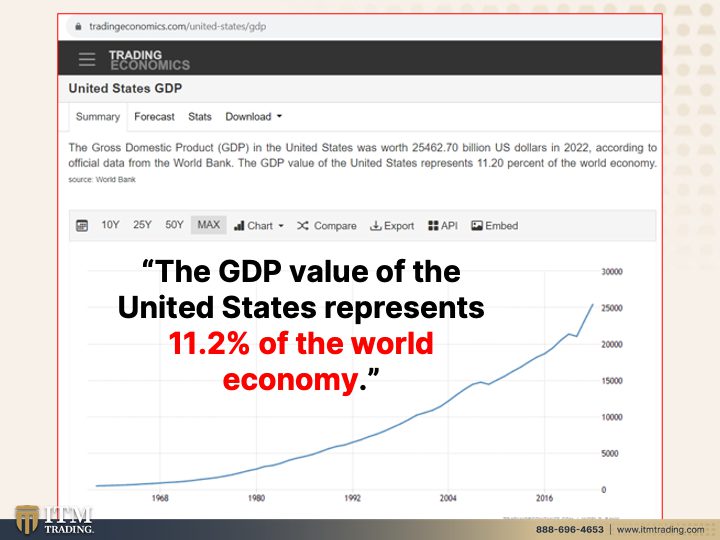

Now, a lot of people talk to me all about the BRICS and how the BRICS, the, the, and it is the power is shifting from the east. So from the US to the west to China, let’s revisit this a little bit. BRICS, a block of developing countries formed in 2010 is set to welcome six new members at the beginning of 2024. Oh really? Okay, well let’s see who are those new members? Okay, so there’s the color code. These are current members, these would be new members. And those are those that have applied for membership. The new members include Saudi Arabia, Argentina, Egypt, Iran, the UAE, and Ethiopia. Hmm. Those kind of seem pretty strategic. Saudi Arabia because that is the reason that we retained since the seventies our status as the world reserve currency. Because you, if you were going anywhere in the world and you’re buying oil or lumber or anything else, you had no other option but to do so with U.S. Dollars. Now that’s been shifting, particularly since 2000 when interestingly enough, the euro came into being and that maybe was designed to take over as the world reserve currency. But technology has given them a much bigger advantage. And let’s look at what happens in 2024. So just a few months away, when these new members are officially part of the BRICS, they will have 29% of the GDP end of year projection with the new members. That’s pretty hefty. The U.S. Only has 11% and we’ll come back to that. So together, 29% of the global GDP. And when you also look at population, and we know, let me go back to that. I shouldn’t have made that disappear, but, and we know that supporting future retirements, societies, etcetera, you need a lot of population growth. And the population growth in major countries like the us, like China and like Europe, etcetera, population growth has been declining. So who’s going to supply that? Adding high population growth countries like Ethiopia means BRICS could soon represent over half of the world’s population. 46% in 2023 alone. And they already had a lot of it. But Ethiopia is the key in there because of all the population now the addition of Saudi Arabia, Iran, and the UAE, well, more than double BRICS share of global oil production, 43%. Hmm. Do you think they can manage the price that we the rest of the world has to pay? The answer would be yes, that’s a huge percentage and 25% of exports of goods. So the BRICS nations will certainly have a much greater say in what happens on the world. But will they become the next world reserve currency? Not likely because they’re still more regional and they are still about being able to easily use the members’ currencies to buy all of those goods and services that we’ve been talking about. And it’s a big responsibility to be the world reserve currency. I still do. And since 2009 I’ve been saying that I believe it will be the SDR ’cause they’re in the best position.

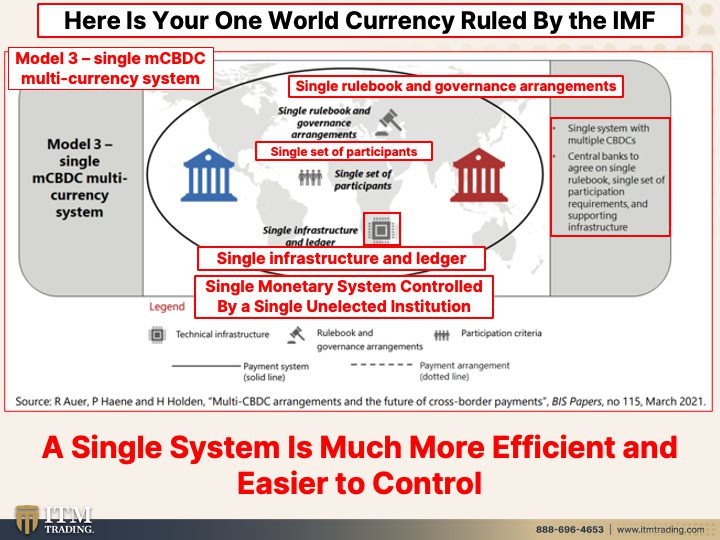

But this is the U.S. GDP. Now inflation definitely fits into this, but the value of the United States, so this is all the money that flows through the United States is 11.2% of the world economy. So if you’re looking at the BRICS nations that have 46%, or no, I’m sorry, 29% of the GDP with the U.S. with 11% who has more clout? So yes, I do definitely agree that things are shifting from the financial power in the east, from the U.S. To more financial power in the west, into the BRICS. And as I showed you recently in a recent video, here’s the one world currency ruled by the IMF, the members of the IMF. It’s a single system with multiple CBDCs, central bank digital currencies. And central banks agree on a single rule book, single set of participation requirements and a single supporting infrastructure. You know, and they are the best to do it because the SDR and their system is a basket of currencies. They can include everyone, so they can have local as well as global. So we won’t know anything has changed, right? Just in 1971, right? I mean if I had a $20 bill in June and I had a $20 bill, even if it was a brand new one in September, they look almost identical. I didn’t know anything has changed. And of course, you had the president coming out and saying, nothing has changed if you buy American made products, nothing has changed. But then of course we went on a major globalization piece and everything had indeed changed. Everything had changed. But did the public realize that? No. So will the public realize this? I hope so, because that’s our, that’s the hope for our future. And you vote with your wallets. I can’t say this enough because if you stay in the system, that is your vote.

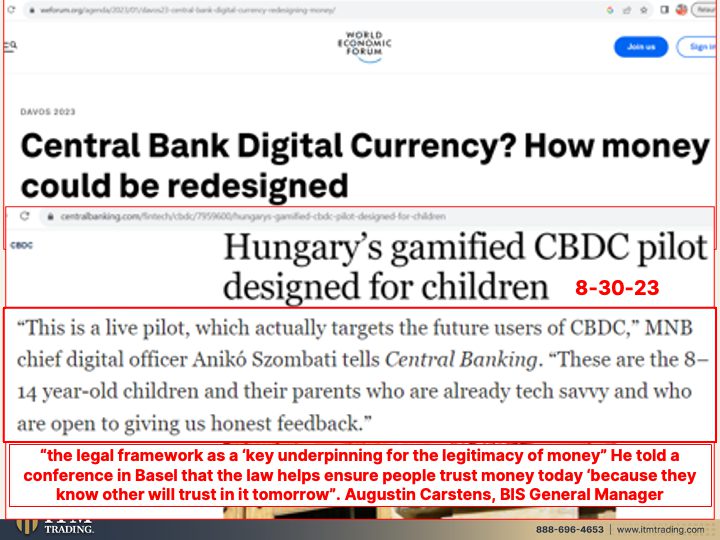

How money could be redesigned. Now, this piece actually scares the Hades out of me because all of this technology knows how to get you hooked. They know how to do it. Hungary’s gamified CBDC pilot designed for children. Are you flipping kidding me? No, they are not. This is a live pilot, which actually targets the future users of CBDC. You see why it’s so important for us to do it for our children and our grandchildren, our great-grandchildren, because they’re gonna make it like a game and they’re going to get people addicted to it. They, these are the eight to 14 year old children and their parents who are already tech savvy and who are open to giving us honest feedback. They’re open to being manipulated and addicted. This bothers me more than I can tell you the legal framework as a key underpinning of the legitimacy of money.

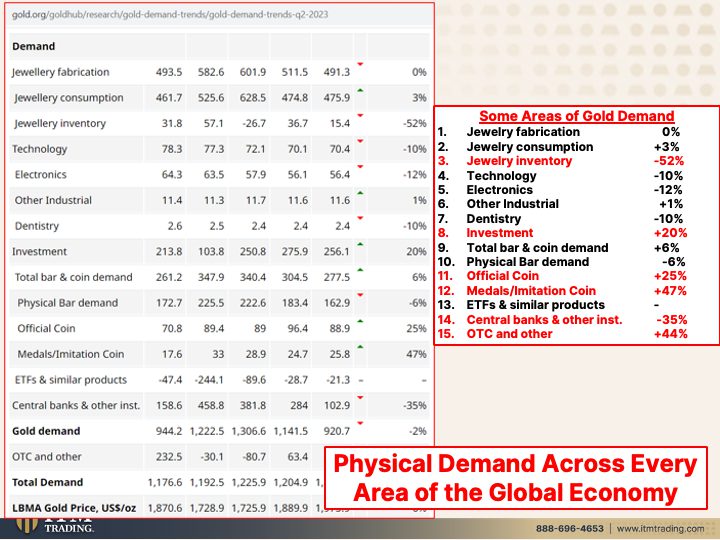

This stuff is legal tender. It loses its value over time, but it’s legal. And they know that people marry the legal money of the state. Oh my God. Let’s take a look for a minute at all the different markets, and this is not all of ’em. This is just some of ’em in which you find gold demand because this has demand in one place, right? In the financial markets as a tool of barter. But look at all of the uses and more that physical gold has and physical silver as well. And they’ve never been able to duplicate that in any lab. So it holds its value, period. I’m not saying that they can’t manipulate the spot market, but why would you wanna believe that lie? Why? Does it serve you well? And I’m always like, well, what if I’m right and what if I’m wrong? And when I can do something that it doesn’t matter if I’m right or wrong, that is what I’m going to choose a hundred percent of the time. How about you?

What are your choices going to be? Because if you have not started your strategy yet, click that Calendly link below, set up a time to talk to one of our specialists and get your long-term strategy in place. What makes I t m different is that we have a long-term strategy with the absolute, I mean, we’ve been doing it. The intention is to continue doing it, help you through this trend cycle, help you see the truth so that you can actually put your best interest first. What a concept. Can I tell you a hundred percent that there will or there will not be a gold confiscation? Well, U.S. History tells me that that is the most likely outcome. And my Uncle Al having the ability to hold at least 3000 ounces of gold when it was legally, legally, when it was illegal to hold more than five every single time it’s in the category that the one percents use. That’s what I want for myself. That’s what I want for all of you. But it does take more than gold and silver. And that’s why if you haven’t been there yet, go check out Beyond Gold and Silver where we talk about the rest of the mantra, Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. And don’t forget to take a look. If you’re feeling alone, you’re not alone. This is why we started thriverscommunity.com. Come in, help us build this community on a global basis. So together there are more of us than there are of them. We can say no to a lot of this. We have the opportunity to create a more fair system on the other side of this mess because the reset has to happen. They’ve used up all their tools. There’s virtually no purchasing power left, and they have no power to raise the rates. The only thing, they still have people marry the legal money of the state, but this rapid inflation makes that lie visible as well. So if you haven’t done it yet, please make sure you subscribe, leave a comment, give us a thumbs up and share, share, share, share, share. That’s our hope spreading the word. And until next we meet. This, my friends, is your wealth shield, physical, gold, physical, silver. And please be safe out there. Bye-Bye.

SOURCES:

https://www.imf.org/en/News/Articles/2015/09/28/04/54/tr001108

https://www.weforum.org/agenda/2020/06/great-reset-launch-prince-charles-guterres-georgieva-burrow/

https://www.cnn.com/2023/09/19/politics/un-speech-biden-what-matters/index.html

https://intelligence.weforum.org/topics/a1G0X000006OLciUAG?tab=publications

Central bank digital currencies for cross-border payments (imf.org)

https://www.weforum.org/agenda/2023/01/davos23-central-bank-digital-currency-redesigning-money/

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q2-2023