YOUR BANK FUNDS VISIBLE: Proposal for IRS to Review Your Accounts

TRANSCRIPT FROM VIDEO:

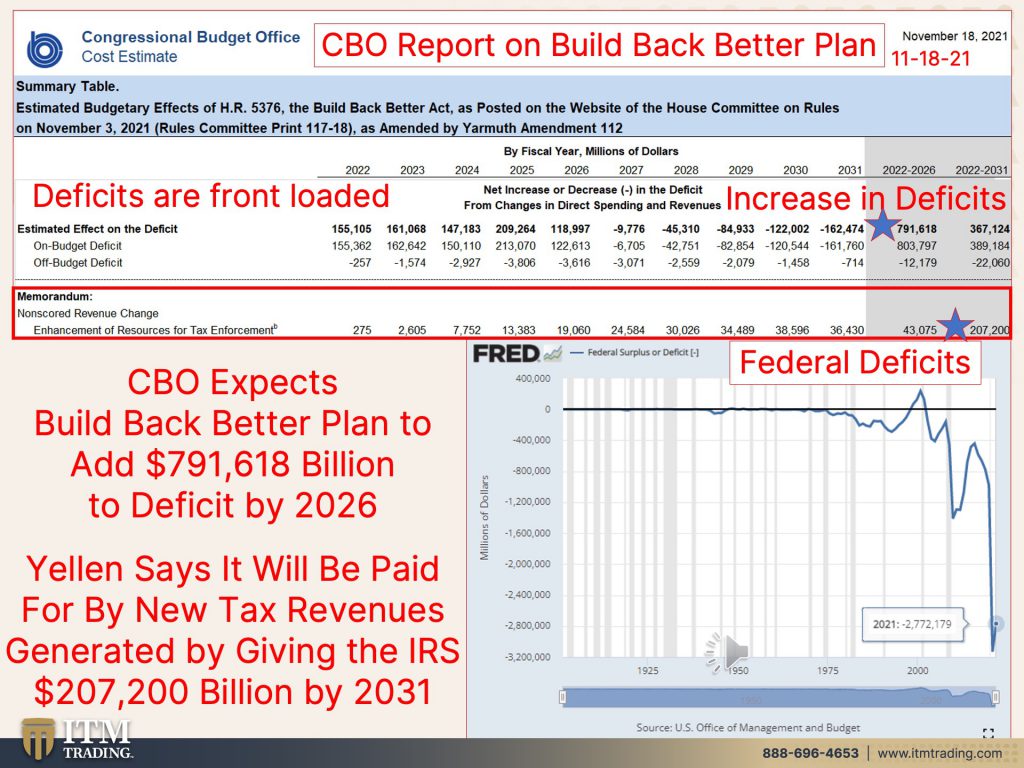

I’m Lynette Zang Chief Market Analyst here at ITM Trading, a full service, physical golden silver dealer. Now there, I know I already did a video, but there was just something I needed to talk to you about. As I was listening to Fed Chair Powell and Janet Yellen in front of the Senate banking committee today and it is about Biden’s Build Back Better Plan. The congressional budget office recently came out on November 18th, came out with their report on whether or not this would be neutral in other words, paid for itself. And while Janet Yellen want you to think, and of course that always happens in a new plan, yes, this is going to pay for itself. This is even going to make us money. It never does. And we always end up paying for it, you know, probably more than we would realize. But the deficits are front end loaded and it is definitely showing an increase in deficits over time, over time by like, oh, let’s see. By 2026, just a few years away, they expected to add 700, almost 792 billion to the deficit. My bet is it’ll add more because the big piece that nobody gets is if you’re running deficits, that means you’re not touching the principal and you’re not touching a lot of the interest. And so you’re compounding interest in the deficits, but Hey, what do I know? You know, not only that, but you know, that plan that Yellen came out with about tracking anybody that has $600 worth of activity in their accounts. Well, let’s listen to what she says about that because they are giving the IRS a heck of a lot of money. And this is one of the reasons why she said, no, it will be neutral because the IRS is going to collect so much. Well, here we go.

“The IRS more power to keep them to catch tax cheats. By starting with the IRS bank, reporting proposals seems farfetched at best because the original proposal literally said that if you were a successful lemonade stand operator, making 12 bucks a week, putting $600 into your checking and savings account, would cause that account to be reported to the IRS. So then they revamped that proposal to 10,000 said differently. If you’re making minimum wage working almost full time, your accounts would then also be transfer at least available for heightened inspections by the IRS. If you’re looking to catch complex business partnerships in cheating, their taxes, you don’t need the IRS bank reporting proposal. Can you tell the American people today, secretary Yellen, whether you still support any form of the IRS bank reporting requirements, your department proposed earlier this year, which would provide the IRS with currently undisclosed taxpayer information for the purpose of targeting, essentially every single working American at minimum wage or higher. Do you still support that or not?”

Yellen: I do support it.

Now she went on to justify why she supports it, but the reality is is once those CBDC’s get in place, everything’s going to be disclosed. All I can ask you is this, you got gold and silver physical in your possession? I rest my case.

SOURCES: