ww3 North Korea

Is WW3 Imminent? Its A Mad, Mad World. North Korea – Russia – China – Qatar

hi everybody Lynette Zang chief market analysts here at ITM trading a full-service physical metals brokerage house specializing in gold and silver.

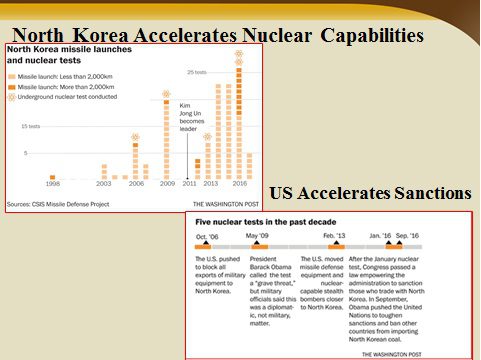

So you may be aware of what’s going on in different parts of the world North Korea tested a missile that could hit the US and of course what’s happening in the Middle East with Qatar and the and our allies Saudi Arabia Egypt etc so could this be the approaching ww3. I don’t know I’ll let you decide and where time is going to tell us anyway but one thing I want you to be aware of is how that the ability for North Korea and their testing of the missiles has expanded particularly since and what the US has done is they have accelerated sanctions so the more aggressive that North Korea gets in developing their nuclear program.

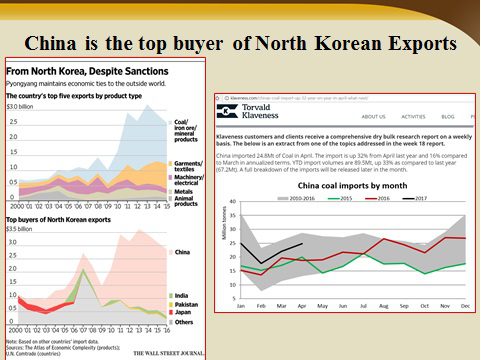

The more aggressive the US gets in sanctions but of course there’s always ways around the sanctions and part of what we need to look at is the relationship that North Korea has with China now China is their largest trading partner and they do get an awful lot of their coal from them so those sanctions. China’s not kind of agreed to not buy the coal from them but this is this year and you can see that they’ve gotten around those sanctions so of course when President Trump met with the Chinese President and they had a little bit of a disagreement over that so the question is do you really think that China is going to do what the US wants them to do?

I don’t think we’re in the catbird seat anymore I don’t think that we can actually ask them that or end expect them to listen to us plus one of their other big allies is Russia and Russia is having a love affair with North Korea again as a trading partner so I’m thinking that you can start to see where the battle lines might be drawn between Russia China and the US and they could certainly use that to justify because as as I look back at history every single time there is a money standard shift there is also a war that is going on and that can be used to justify inflation and it distracts the population etc so this could be what we’re coming int.

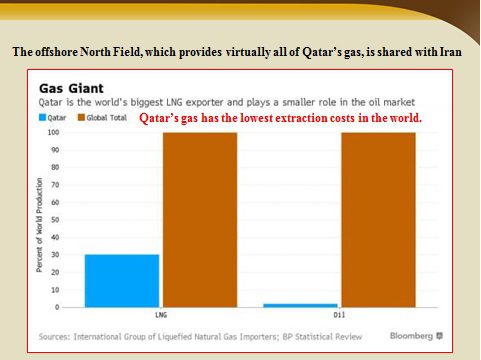

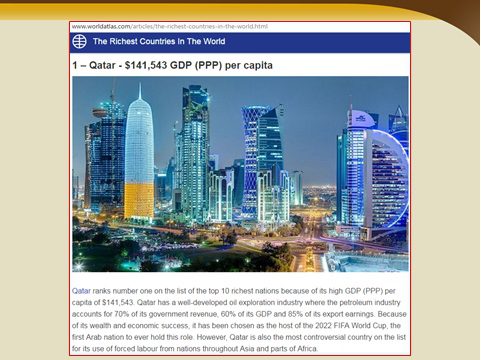

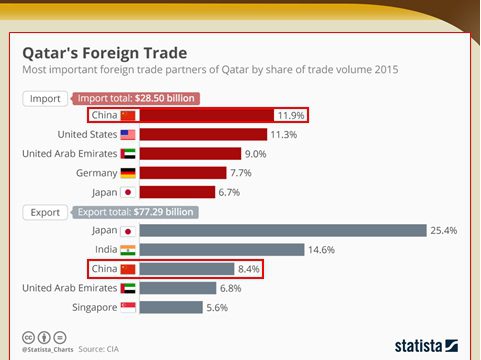

The other hot point that we’re not really hearing all that much about is Qatar in the Middle East now Qatar used to be sort of an adjunct state to Saudi Arabia but they have the largest liquid natural gas reserves of anywhere on the country of the world rather and so they have a lot of wealth there and guess what when you actually have wealth you have a whole lot more independence so all of a sudden the things that were ok before are now not ok and our other trading partners in the Middle East Egypt Saudi Arabia etc have issued sanctions against Qatar well guess what here’s China again China is a big trading partner to Qatar so again we see that kind of triangle or not a triangle but between China and the US and we’ve also been witnessing over the years the shift in power to from the u.s. to China but we also have the petro dollar which supports our retention you know kind of it’s that’s all shifting as we’ve talked about before but it supports our retention as the world reserve currency and so we’re kind of cut caught in the middle because we’re also a big trading partner of Qatar.

So I don’t know what the outcome is going to be in either one of those places but there is certainly a spark that could develop that I’m really am sorry to say this but it could very well turn into ww3 and again typically market reactions currency reactions and war and lots of other chaos is surrounds any kind of money standard shift so we’ll pay attention to the developments there and that’s it for today so like us on facebook follow us on twitter subscribe to us on youtube give us a thumbs up if you like this and please don’t forget to give us a call eight eight eight six nine six four six five three and you be safe out there bye bye you

ww3 images