World Reserve Currency Status

Currently, the United States dollar holds world reserve currency status. If you are unfamiliar with the term “world reserve currency†I offer this simple definition.

A reserve currency is a currency (there are currently several) that nations agree to accept as payment for international trade. Governments also stockpile certain foreign currencies in order to settle debts and build wealth. The world reserve currency has traditionally been the currency of the country (or company) that is dominating world trade during a given time.

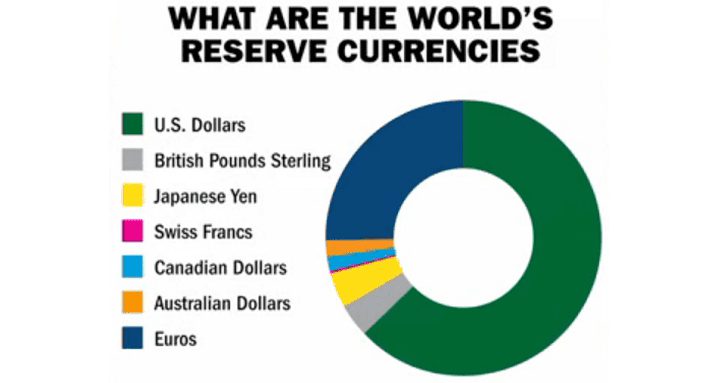

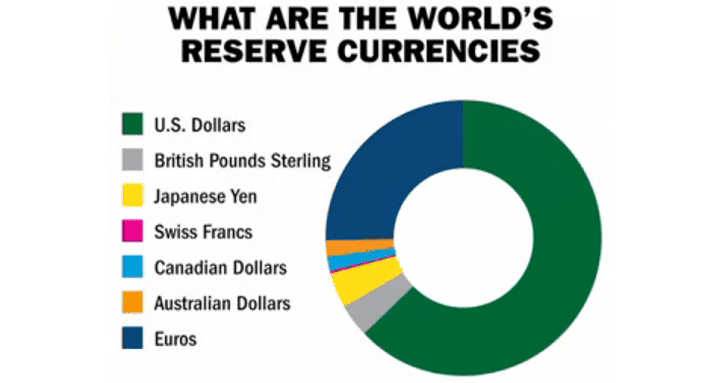

The Reserve Currencies Of The World.

In the case of the US dollar becoming the world reserve currency, the situation is different. The US dollar became the world reserve currency in 1944 after an international agreement was signed. This agreement, known as the Bretton Woods Agreement, ushered the US dollar in as the dominant currency in the world.

World War II had just ended, and the US and her allies were victorious. The US also had the largest gold reserves on the planet. A particularly interesting part of the Bretton Woods Agreement fixed the legal international price of gold  at $35 an ounce. Foreign nations and banks could redeem a US dollar at any time for 1/35th of an ounce of gold. This is known as convertibility.

Convertibility gives a currency honesty, and people have faith in an honest currency. There were a lot of problems, both financial and humanitarian, in 1944. The Bretton Woods Agreement was seen as a way to help stabilize a troubled world.

The Bretton Woods Agreement Offered Financial Stability.

In addition to stabilizing a troubled world, the world reserve currency status also did a few other things, too. Some help us as United States Citizens and some don’t. Please read on.

World Reserve Currency Status: Print, Print, Print.

Holding world reserve currency status is better than having a printing press in the basement that makes $1000 bills. For instance, let’s say France wants to purchase $200 million worth of fighter jets from the US. France has to pay the US in US dollars. The only way France can get US dollars is to trade real items for those dollars. About $200 million worth of real items, in reality.

If the US wanted to purchase $200 million worth of wine and cheese from the French government, the United States can simply print up $200 million instantaneously and go shopping in France. If this doesn’t seem fair, it is not. Economics and currencies are almost never fair, however.

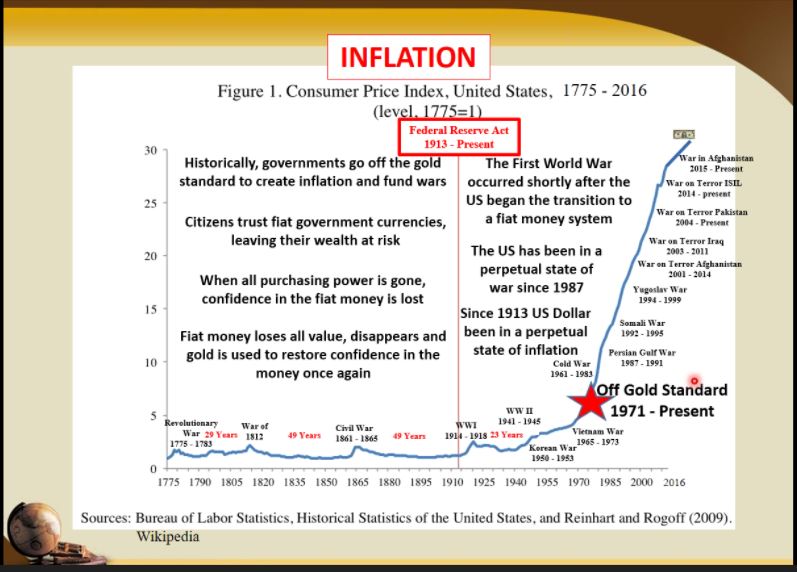

Because the United States can “print to pay†for whatever she wants, she does. Ridiculous amounts of dollar creation result in dollar devaluation. In fact, the ITM Trading graphic below shows how most of the purchasing power of the dollar has been lost over time.

World Reserve Currency Status: A Fleeting Title.

Historically, world reserve currency status is a relatively fleeting title. Portugal held the honor for eighty years. Spain and Portugal then partnered to dominate international shipping. The Spanish currency became the world’s reserve for the next one hundred and ten years.

The first international corporation ever formed would grow into a behemoth. This corporation would not only dominate international trade, it’s own currency would become the world reserve currency. This company was the Dutch East India Company, also called VOC. VOC’s currency would hold world reserve currency status for eighty years.

The VOC Company Created It’s Own Currency Called The Guilder.

After war and competition crushed VOC and it’s currency, the “guilderâ€, France became the next to dominate international trade. The French held the world reserve currency status for the next ninety-five years.

Once France imploded, mainly due to poor economic policy and war, Great Britain’s pound sterling held world reserve currency status. This British reign over international currencies would last for one hundred and five years. This brings us back to 1944 and Bretton Woods.

World Reserve Currency Status: What Happens Afterward?

History has a lot to teach us. Portugal and Spain and The Netherlands and France and Great Britain still exist, the VOC corporation doesn’t. Each country that held world reserve currency status encountered hard economic times and war. The US is no different.

Failing Economic Policies In Venezuela Currently Leave Many Citizens Hungry And Without Electricity.

If you were to study economic history, perhaps you would see the pain and poverty ordinary citizens were faced with when government policies failed. When your government goes from rich to poor and currency problems develop, life can get tough fast.

We don’t live in the fifteenth or sixteenth centuries anymore, however. International shipping is not the dominating force it once was. Another change is wealth. When France and Britain and Spain, etc. held world reserve currency status, they were very wealthy nations.

When the US dollar was given world reserve currency status, the US was the largest creditor nation on Earth. Today the US is the world’s largest debtor nation. Not only are we in debt, the US dollar has not been convertible at the Bretton Woods Agreement price of $35 an ounce since 1971.

How Long Does The Dollar Have?

The Bretton Woods Agreement lasted only twenty-six years or so. The world reserve currency has been backed by politics, credit, and military force since 1971. This policy is now forty-five years old. If the US has held the world reserve currency status for seventy years, and the average span of a country holding this title is eighty to a hundred years, what does that say?

This article, titled “The Dollar Reigns Supreme, By Default†was published by the International Monetary Fund. The title doesn’t sound too positive, does it? If you are not familiar with the International Monetary Fund, or the IMF, the IMF was created by the Bretton Woods Agreement at the same time the US dollar was given world reserve currency status.

World Reserve Currency Status: Own Gold.

In the US we are living in uncertain times in uncharted financial waters. Never has a country had so much debt as the United States. Never has a country relied so heavily on a very expensive military to protect the value of it’s currency. Never has such an empire existed without gold and silver acting as a true currency.

If the stability of the dollar and the international financial system concerns you, then perhaps you should own gold. Owning gold is a way for you to establish your own financial independence and reserve currency. Call ITM Trading. ITM Trading makes owning gold easy.