THE WICK HAS BEEN LIT: How Long is the Fuse? by Lynette Zang

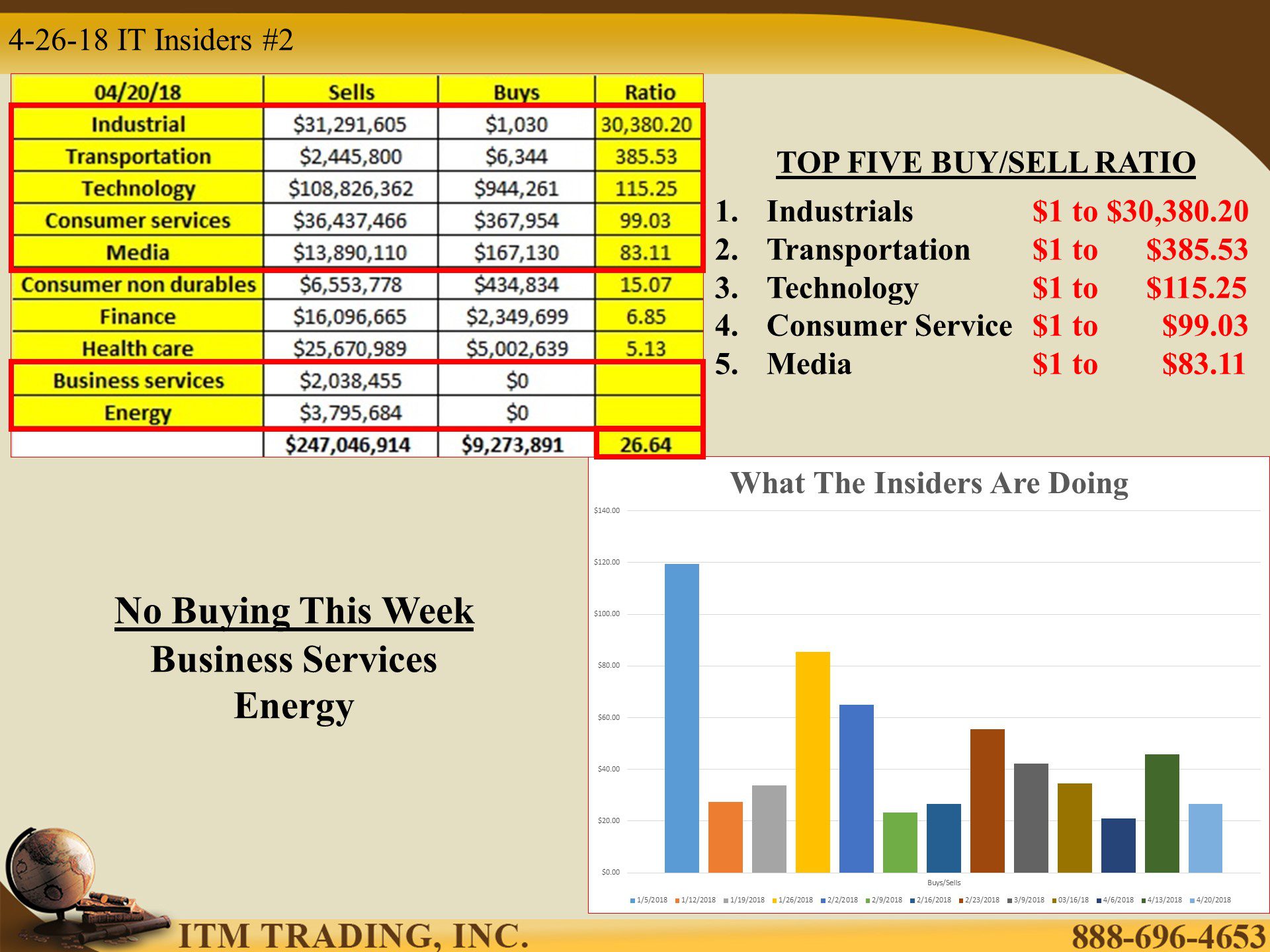

What the Insiders Did Last Week

Seems like every week there is one sector whose selling is through the roof. This week that’s Industrials with a Buy/Sell Ratio of $1 to $30,380! Since this sector represents stocks related to producing goods used in construction and manufacturing, why do you think the insiders are fleeing?

(THE WICK) PATTERN SHIFT ALERT – 10 Year Treasury Yield Hit’s 3%

Since mid-2016 interest rates have more than doubled, from a low about 1.37% to (at this writing) 3.03%. We must go back to 2014 to see that level. If this is indeed a breakout, the next most likely level would be 3.5%.

Wall Street talking heads seem perplexed that rising rates are having a negative impact on markets. Particularly since earnings are so strong. Don’t worry, be happy and certainly do NOT look at the man behind the curtain…he may be losing control. All major stock averages are lower for April. Thanks to the central bankers, the world is now synchronized. It’s great on the way up, my guess is it will be painful on the way down. I ask myself if this activity is in preparation of the death of the IBORs.

We may have begun the beginning of the pain.

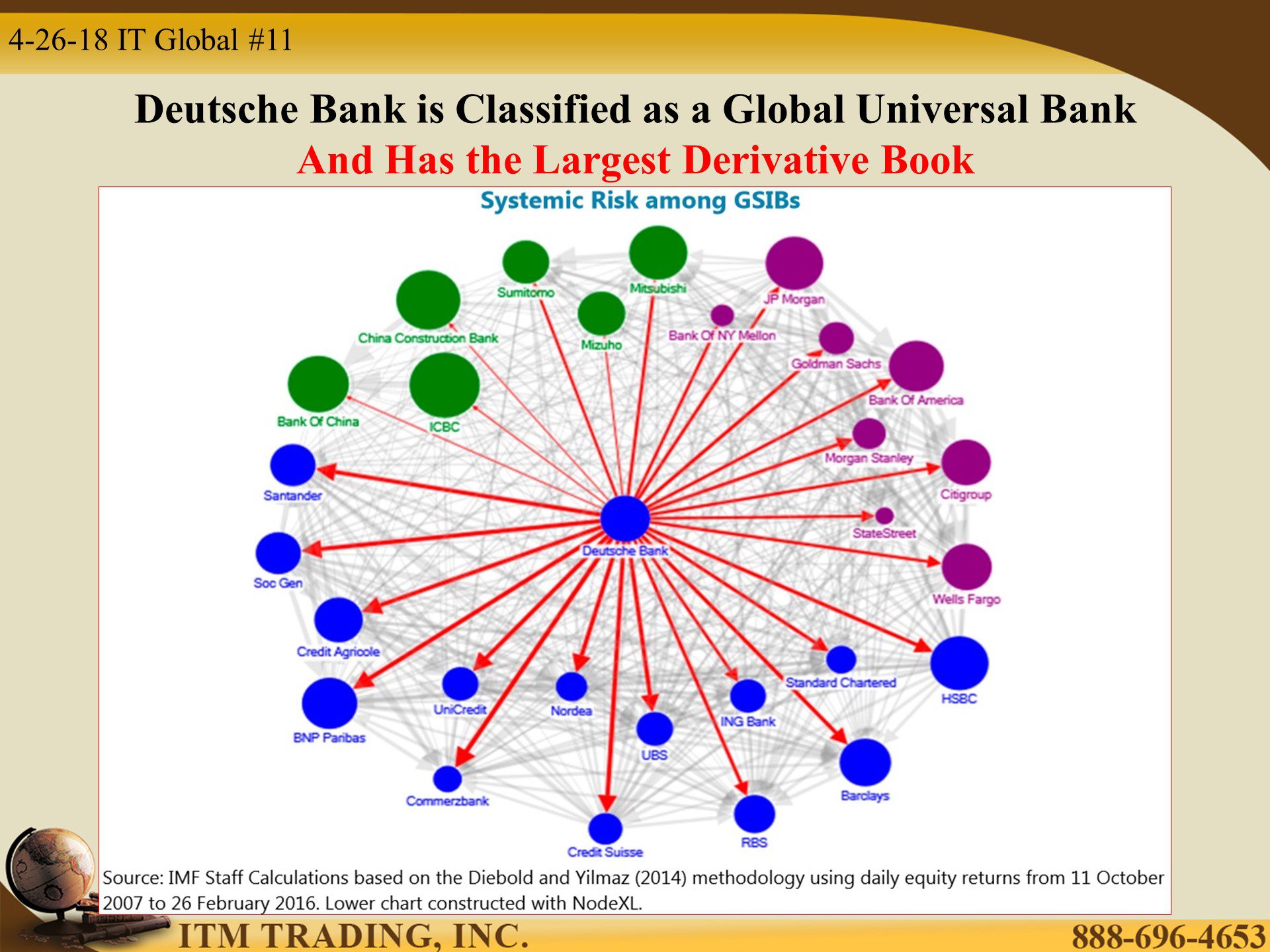

(THE FUSE) Deutsche Bank

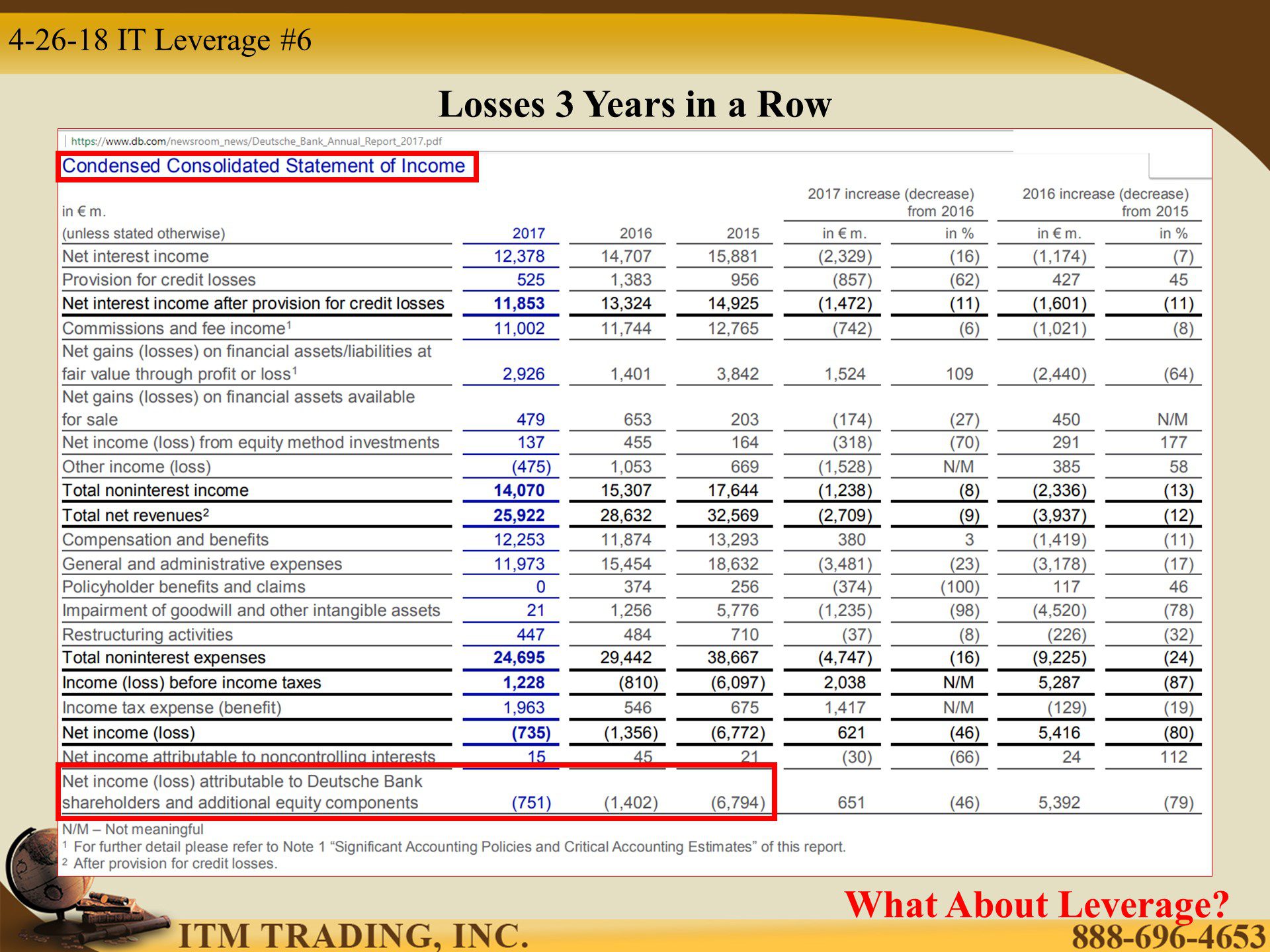

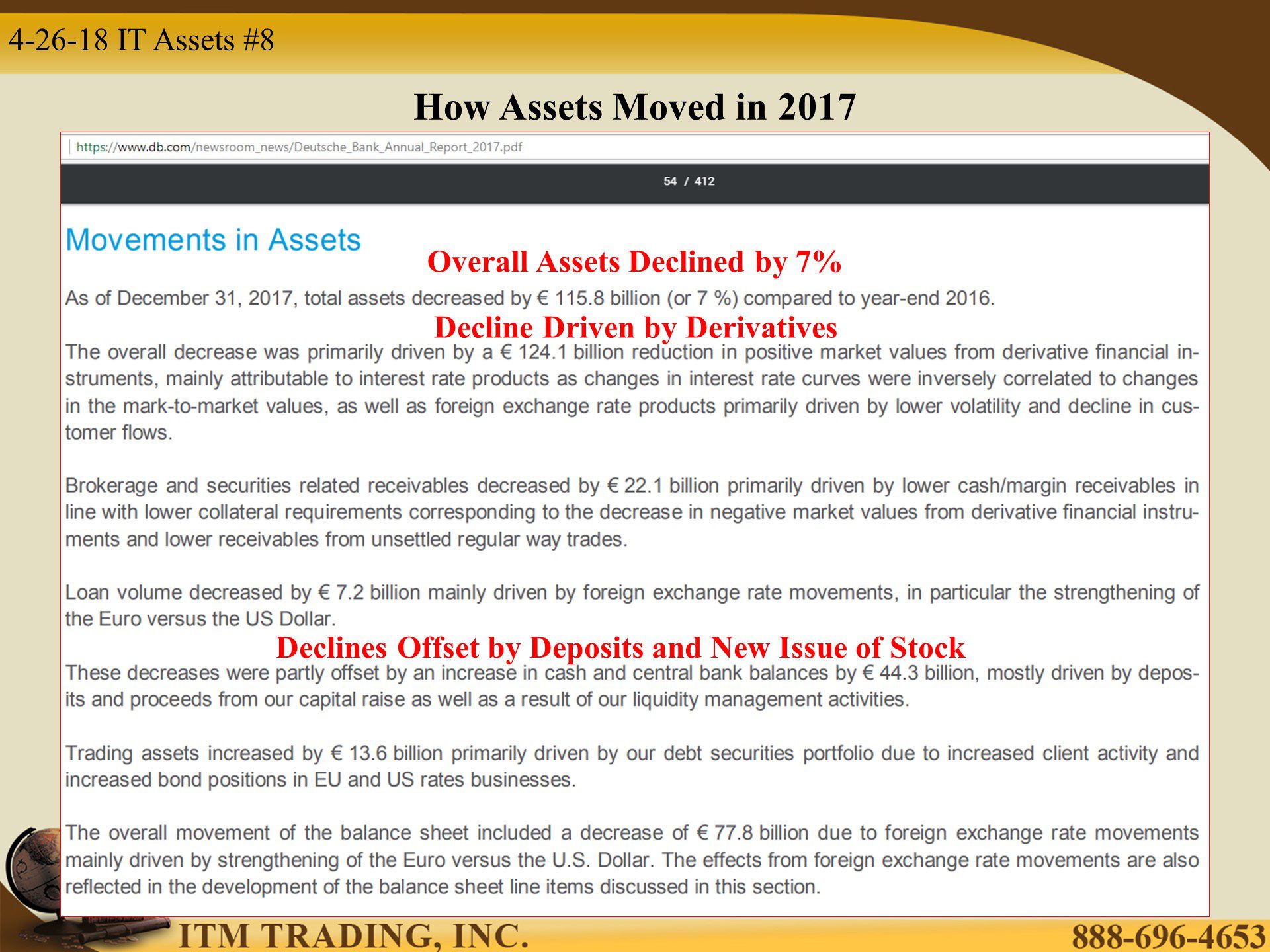

The bank that can transmit that pain globally, according to the IMF, is Deutsche Bank has now had three years of losses. Most of 2017 losses were attributed to its derivative book which impacted their assets to the tune of 7%. This happened in a one way…up market. I wonder what’s happening now?

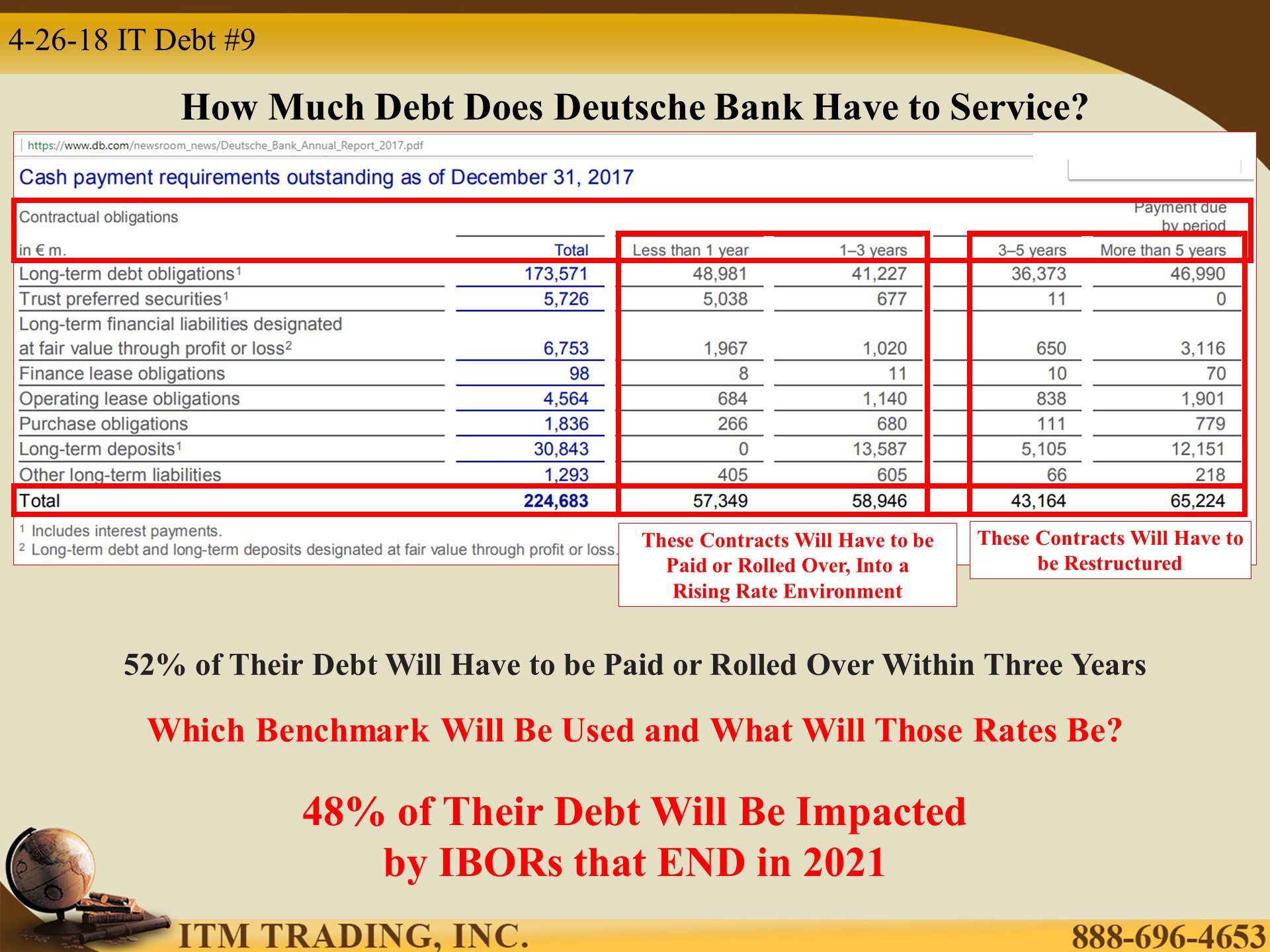

Debt also plays a big part in the Deutsche Bank Bomb. Fifty-two percent of their debt comes due within the next three years. With interest rates on the rise, that debt will have to be paid or rolled over. The additional interest cost will put further pressure on their bottom line. But even worse is that forty-eight percent of their debt will have to be restructured because the IBOR benchmark against which it’s written is going away.

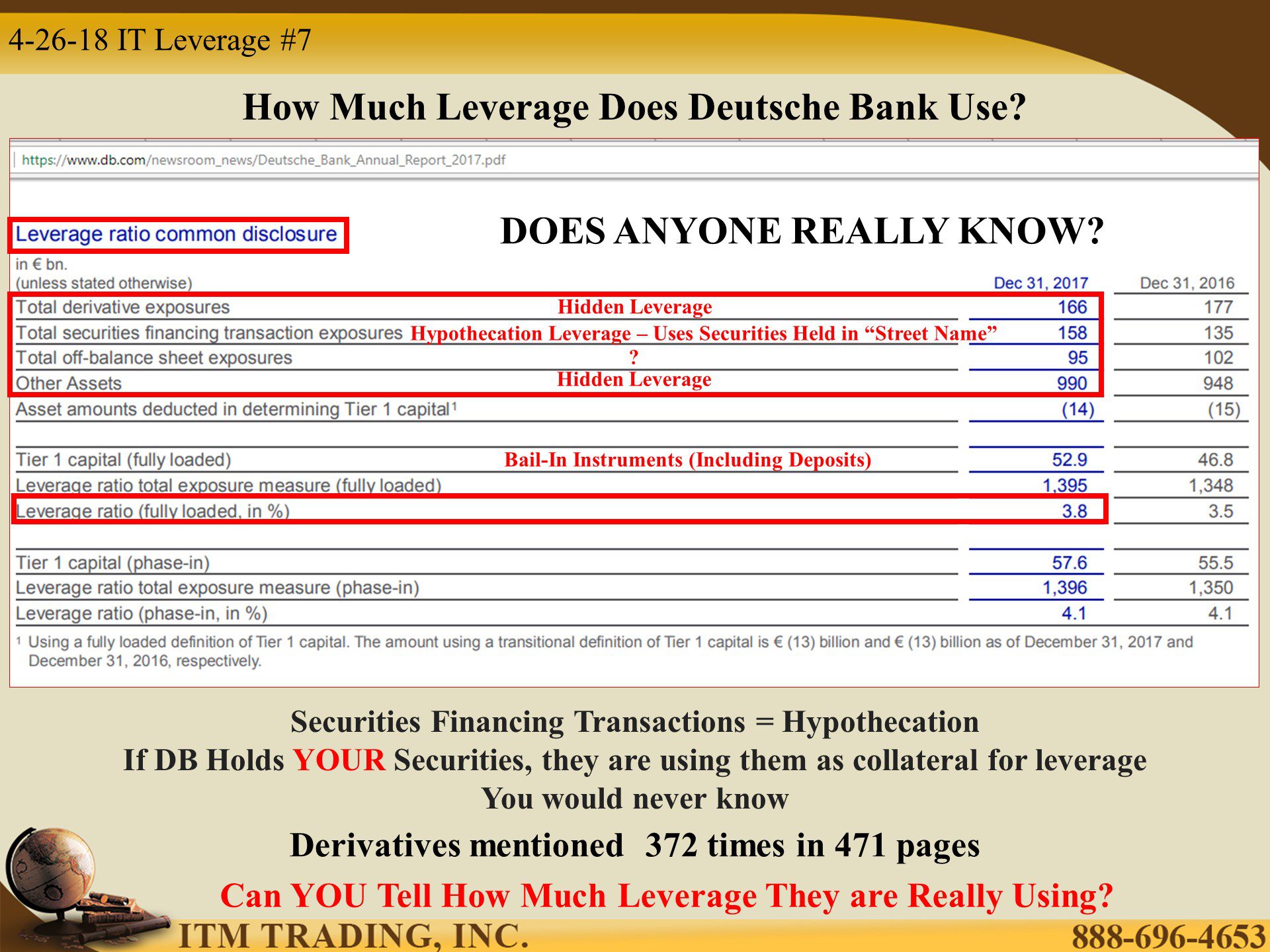

In addition, their reported leverage ratio is 3.8%. That indicates that they’ve borrowed $26 to generate $1 in equity, an extreme level of leverage. Therefore, a decline of 7% in the value of their assets would have wiped out all equity. Of course, it’s possible that I’m misunderstanding all of this very complicated math, but it might also be possible that Deutsche Bank is now a full zombie bank that must be kept “looking†alive because acknowledgement of it’s death threatens the global financial system.

That begs the question, are those in charge ready for the next crisis?

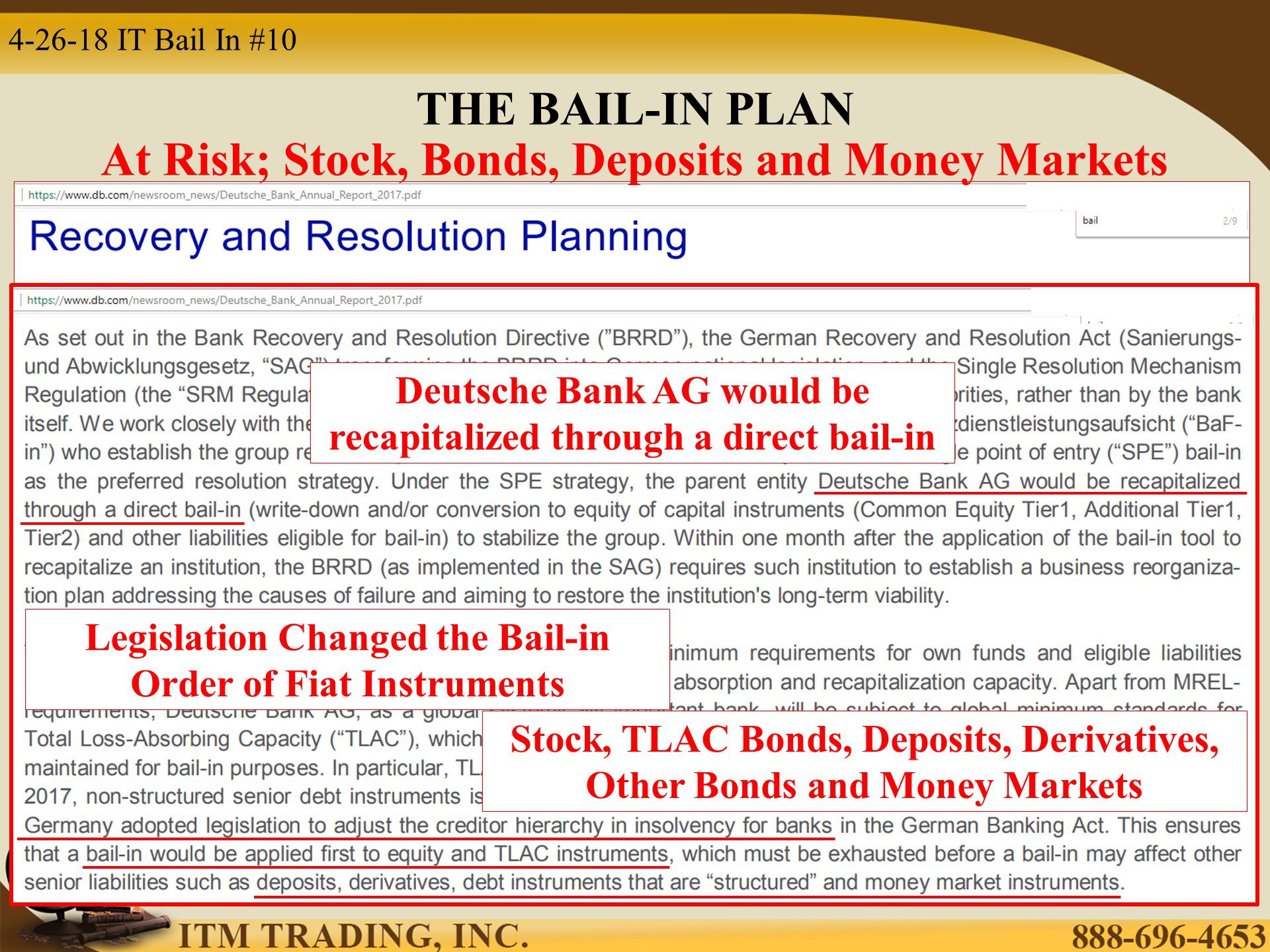

The Bail-in

In preparation of the coming crisis, global rules have been legalized to protect the banks at the publics expense. All banks are required to have a resolution plan. This plan must show how the bank would recapitalize…hello bail-in. Stocks, bonds, deposits and money markets are all at risk of a bail-in. I wonder if the unsophisticated understands what’s at risk?

Because when you look at a chart on the stock, it’s clear this stock is out of favor with Wall Street. Even HNA, who took a 10% position in last year’s stock sale, has been selling since February. That’s likely to put even more pressure on the stock that’s fallen from $120 high to $14.25 at this writing.

A Few More Patterns

In fact, when comparing stocks, bonds, US dollars and spot gold in a longer-term perspective it become very clear which is in a positive trend. Personally, I prefer hold most of my wealth in an undervalued asset that is in a long term positive trend. How about you?

Slides and Links:

http://www.wsj.com/mdc/public/page/2_3024-insider1.html

http://stockcharts.com/h-sc/ui

https://www.db.com/newsroom_news/Deutsche_Bank_Annual_Report_2017.pdf

https://stockcharts.com/h-sc/ui?s=$INDU

https://stockcharts.com/h-sc/ui?s=$UST