Why is Gold Demand Surging as The Safe Haven Asset?

Economic uncertainty is growing with high inflation, soaring debt, and global conflicts. This video analyzes what really makes an asset a “safe haven asset” during turbulent times. We break down key factors like liquidity, limited supply, high demand, and permanence to help you figure out the best option for you.

CHAPTERS:

0:00 US Debt

3:32 Safe Haven Assets

4:02 Liquidity

4:40 Supply & Demand

6:00 Permanence & Correlation

7:05 Gold Demand

TRANSCRIPT FROM VIDEO:

You are being told day in and day out that the US economy is strong,

“Americans are concerned about inflation. Really we have a strong and resilient economy.”

But it doesn’t take much digging to figure out that that is not the reality between the New War and the Middle East and record high US debt. The already gloomy economic outlook just got a whole lot darker. Amidst these turbulent times, is there really such a thing as a safe haven asset? And if so, how do you know what that asset is and how can you use it to best protect yourself?

Hi everyone. I’m Taylor Kenney with ITM Trading. With everything that’s been going on recently, people are running to put their money into safe haven assets to make sure that their wealth is protected. But with so much noise about Safe Haven assets out there, what exactly is it that makes them safe? And have you looked at all the various options to make sure that you are making the right decision for you?

Well, don’t worry, we’re gonna break down all of the qualities of what makes a good safe haven asset safe together. But before we do that, I think it’s important that we take a look at what we’re being told versus what’s actually happening.

Earlier this week, US Treasury secretary, Janet Yellen, was quoted as saying that the United States could absolutely support both Israel and Ukraine in their respective war efforts. Without hindering the United States economy,

“The American economy is doing extremely well. Inflation has been high, and it’s been a concern to households. It’s come down considerably. We have about the strongest labor market we have seen in 50 years with 3.8% unemployment. And um, we’re creating good jobs, especially for people who’ve been don’t have a college education. So the United States economy is in a good place.”

She put it simply, and I quote, “the American economy is doing extremely well.” As a quick reminder, the United States currently has a debt to GDP ratio of 122%. We have added over half a trillion dollars in debt in the last few weeks alone. And any agency that theoretically oversees or regulates the impacts of said debt are ringing alarm bells. Yes, I’m referring to the International Monetary Fund or IMF for short, stating that the US debt is unsustainable and various credit rating agencies saying that they might be forced to continue with their downgrades based on what they’re seeing. The reason why I even bother to mention this and why I think it’s important that we pay attention to this is because it’s not in their favor to ring these alarm bells. So anytime they say that something is bad, I pay attention because in reality, it’s probably much worse when times are turbulent like this and there’s a lot of uncertainty about what’s going to come next. This is when we see people start to forego riskier investments and instead look for investments that are deemed more secure. Ideally, these investments are expected to either hold and retain value or even increase in value even during turbulent times when other assets are seen to be depreciating. These assets are commonly referred to as safe haven assets. You might’ve heard this term tossed around quite a bit in the news in the last week, but there are many assets being touted as great options that might not be so safe or great.

So how can you determine for yourself what a safe haven asset is? Well, there are a number of factors that you should look for such as liquidity, supply, demand, permanence, and correlation. We’re going to break down all of those together, but I do think it’s really important to note that a lot of the assets that I’m hearing tossed around on the news might only tick one, maybe two of those boxes and fall terribly short in other areas. So it’s important to keep that in mind as we go through them.

Let’s start with liquidity. Whatever asset you have, you wanna make sure that it’s something that you can have immediate access to so that you can use it without having to jump through hoops, especially during times when things could be changing rapidly with the economy. Obviously, anytime you hear liquidity, the first thing that pops into your mind is cash, whether that’s the US dollar, Swiss Franc, you name it. Yes, cash is important. I keep cash on hand. I think everyone should have some cash on hand. That being said, do not race out and put everything into cash because this is only one box, liquidity.

We need to look at the next attribute of a safe haven asset, which is supply your asset is going to mean nothing and be worth nothing if there’s too much of it, too much supply. And I think you know where we’re going with this because we all know what happens when there’s volatility in the economy. We print more money, suddenly that cash you had goodbye. It’s worthless, not looking so safe anymore, is it?

And on the flip side of supply, we have demand. Whatever safe haven asset you’re looking at, you wanna make sure that there’s still going to be demand for it in times of turbulence. And it’s important to do your research because this is where I keep hearing the same tired story. Bonds are the safe bet. Bonds are always in demand. Bonds can never fail. People always want bonds. I hear it on the news, I hear it from relatives, but guess what? It is simply not the case because people don’t have faith anymore. Between the catastrophic federal deficit and the uncertainty around the economy, bonds have been more volatile and unpredictable in the last week or two than the stock market. So this is why it’s really important, and I’m really passionate about making sure that you do your own research and don’t just assume that because someone else labels something, a safe haven asset, that it’s actually going to be safe or right for you.

Moving on to permanence. It is incredibly important that whatever asset you choose cannot decay or decline in value. Intrinsic value over time. Again, we’re looking for long-term wealth preservation here, so it has to be something that can stand the test of time. A terrific example of something like this would be physical, tangible gold, which is a great segue into our last attribute of a safe haven asset correlation. When things aren’t looking so great like they are right now, you’re gonna wanna actually look for assets that have a negative correlation or move in a way that is opposite from maybe the traditional market movement.

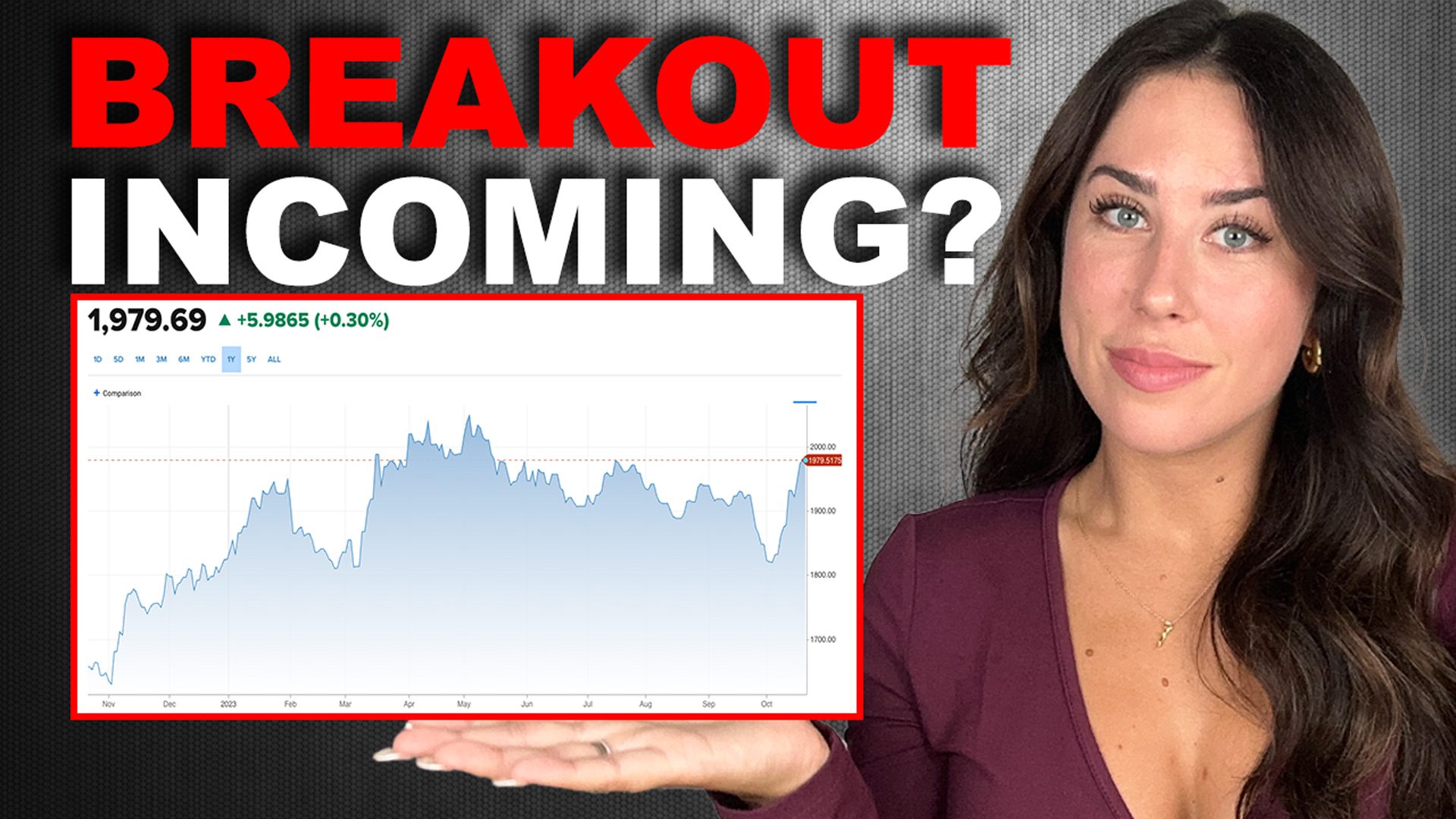

So if the market’s moving down, these assets historically go up, when there’s significant stress in the financial system, you can actually count on gold value to rise, which is why we’ve seen prices of gold rise over the last week because people are looking for safe haven assets, they’re flocking to them. And historically, gold is the only asset that ticks all of the boxes that I just went over.

Gold demand goes up when markets go down or there’s any kind of economic uncertainty. And the beautiful part is, is that while that demand is increasing, the supply stays the same. So unlike traditional fiat money where we know that the supply can change or increase to meet demand or as demands change, gold is a finite resource, which is why also historically during times of war, gold has always been viewed as the number one safe haven asset. And with the war now in the Middle East and the ongoing Ukraine, Russia war, who knows what kind of long-term effects these are gonna have on the global economy. But my guess would be that we’re going to see people continuing the flock towards gold.

And there is one other reason for this too, and that’s during times of war, economic uncertainty. People wanna feel like they have control. There are so many factors involved that could make things go wrong. The last thing you wanna do is put your money or have your money tied up in an asset that has high counterparty risk. What I mean by that is, is there a chance of default? Is there a chance of your money disappearing? Is there a chance of things going wrong because of who’s sitting on the other end of the table because of who shares the agreement with you?

Who might that person be? When you think about bonds, when you think about the US dollar, is it the Federal reserve you wanna be in business with? Or maybe some kind of stock or commodity? It’s JP Morgan sitting at the other end of the table. Or worse yet, maybe you don’t even know who it is that you’re sharing this counterparty risk with. You’re at their mercy.

Listen, I’ll let you draw your own conclusions, but the thing that brings me peace is that gold is the only financial commodity that runs zero counterparty risk. It is just you and the gold. I want something that is going to stand the test of time, time permanence. I wanna make sure that there’s always going to be demand for it no matter what. I want the supply to not be managed by people, persons, governments, or institutions. I wanna make sure that there’s zero counterparty risk and I want it to be a dependable long-term store of value.

I know this is a lot to take in, but do not worry because there is a resource available that’s going to help you. The 2023 ITM Trading Gold & Silver Guide. Now this is completely free. It was literally designed to help you and your goals. All you have to do is click the link below. There is a ton of educational information in it and it’s where I recommend that everyone starts. It’s really quick, it’s a download, do it. You won’t regret it. I can speak personally that these guides really helped me when I was getting started because it gave me knowledge and empowered me to make sure that I knew what to do for my own goals. So give it a read. Let me know what you think. And as always, if this video was helpful for you, please make sure to like and share with your loved ones. I know we’re all trying to figure out what the best move is together, and if this was helpful for you, I’m sure it would be helpful for them. As always, I’m Taylor Kenney with ITM Trading, breaking Down Complex Financial Topics and helping us all learn and grow together. Thank you so much. Until next time.

SOURCES:

https://learn.itmtrading.com/buyers-guide-tk

https://finance.yahoo.com/news/threat-war-affects-gold-prices-150728317.html

https://www.cbsnews.com/news/why-gold-is-a-safe-haven-asset/

https://www.cnn.com/2023/09/25/economy/moodys-us-government-shutdown-credit-rating/index.html

https://www.nytimes.com/2023/10/15/us/politics/us-military-israel-gaza.html

https://www.cnn.com/2023/10/15/economy/stocks-week-ahead-deglobalization/index.html