Why Invest In Gold

For the most part, when people ask themselves, “Why invest in gold?†there is usually only one answer first and foremost: profit. The general idea is buy in at low price, and hopefully sell it soon for a profit of 50% or so. Seems like a good idea, right? Maybe not so fast….If you have ever watched Shark Tank on TV, then you have seen Kevin O’Leary. He is also known as “Mr. Wonderfulâ€, and you know exactly who he is.If you have not seen Shark Tank, then here is the premise in a nutshell; people with ideas or small companies put on a presentation in front of millionaires and billionaires like Mark Cuban, Daymond John (of FUBU, etc.) Lorie Greiner (of QVC), Paul Mitchell (Paul Mitchell haircare, etc), and Kevin O’Leary. These “Sharks†listen to the presentation, and then either choose to invest their own money, or walk away from the proposal. Mr. O’Leary walks more often than not, because he is choosy and wise in the ways of money. Mr. O’Leary holds a portion of his sizable wealth in physical gold. You can watch him discuss his strategy in detail in this interview. If you have not or did not see the interview, O’Leary holds gold as a kind of financial insurance. You see, any stock or bond or even banking product is only as valuable as the company or government that issues it. If the company goes belly-up, or the government is seen as hopelessly insolvent, then your investment just went to money heaven, unlikely to ever return to Earth. Gold bullion, old gold coins, rare gold coins, and graded numismatic gold coins, on the other hand, can be sold anywhere at anytime for any currency, and do not rely on banking systems or markets or governments to redeem them for wealth because they are wealth. This is the kind of insurance Mr. O’Leary wants, and the type you should want as well. Craig Griffin, President and Founder of ITM Trading, has long suggested that gold be held in a portfolio for just this reason; to hedge against uncertainty, and profit in times of market unrest.

BUY GOLD AND SILVER BARS AND COINS ONLINE

Insurance From What? If you are wondering why you need gold coins or rare gold coins or even numismatic gold coins and gold bullion to protect you from financial uncertainty, then you only need to look back at the market crash of 2008 to find your answer. Remember AIG, or Bear Stearns, or Citigroup, or General Motors, or Lehman Brothers, or Washington Mutual, or any number of big, or too big to fail companies that technically failed? Some went away completely almost overnight leaving investors with worthless statements and phone numbers to brokers that were quickly disconnected. Other companies labored on with government (read: taxpayer) bail-outs and unsecured loans, some made it and some did not. Jim Rickards, Author of “The Death of Money†gives tremendous insight as to why you want to have financial insurance via gold.

let’s c look back at the crash of 2008… I remember when Citigroup had to be taken off of the stock exchange because it’s shares fell to under $5.00. When this happened, several 401k funds had to sell their shares in Citigroup because they could not have shares with a cost of under $5.00 in their plans because these shares were seen as “too volatileâ€. This forced selling did not help raise the stock’s price, needless to say. Perhaps I should remind you, at the time Citigroup was one of the largest banking companies on the planet, yet their stock was too volatile for retirement funds. What would have happened if Citigroup was allowed to fail? We can only surmise, but my guess is a lot of clients and depositors would have been hurt, and a few golden parachutes would have opened on the top executive floors and a bunch of rich people would have become even wealthier. Is this the type of financial insurance you want in your portfolio? The kind where you pay to make banking elites wealthier than wealthy when things go absurdly wrong on their watch? I didn’t think so.

Learn Why We Suggest Owning Physical Gold

Get Your Free Investors Guide

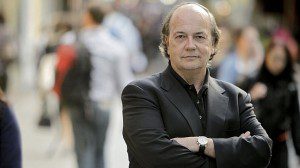

On To Jim Rickards’ Analyses If you don’t know who Jim Rickards is, I’ll clue you in a little. Jim is a Partner at Tangent Capitol. Jim also was recruited by the U.S. government to work as insider intelligence for Project Prophecy. Project Prophecy was the codename for a plan to put together a system, or systems if need be, to ferret out trades that might be linked to terrorist acts within the United States or worldwide that either intentionally or unintentionally expected to make stock market profits by knowing that a terrorist act was about to or going to occur. While this may seem a bit far-fetched to some, I’ll lay a little background. You may have heard that the airlines that lost planes and therefore lives on 9/11/2001 had seen unusual trades regarding their stocks in the days just prior to 9/11. This is in fact the case. The records are there and they are undeniable. A few days before 9/11, shorts and puts, which are basically bets that the stock price of a particular company is about to fall, were placed in unusual and large numbers / amounts against the airlines involved in 9/11. This did not go unnoticed to the U.S. government, and Project Prophecy was born. To continue reading about Project Prophecy, Jim Rickards, and how gold bullion, gold coins, rare gold coins, and even numismatic gold coins can help protect your portfolio from financial terrorism, and just how prevalent financial terrorism and currency wars.

Jim Rickards Has Worked For The CIA On Matters Of Financial Terrorism

Project Prophecy was to develop a system or systems that could in effect foretell a terrorist act in the United States or world wide by looking for anomalous stock market trades that would profit heavily by betting on an unforeseen (to most) terrorist event to occur. For instance, if a peculiar or odd amount of trades were placed saying that the stock of a particular cruise-ship company was going to go down dramatically, the U.S. government could place assets and surveillance on the ships etc. of that company to be on the lookout for terrorism, and hopefully stop the act before it was able to be executed. Also, by tracing back the questionable stock market trades, the government might be able to see who knew what at what time and perhaps track down the responsible terrorists in this fashion. Get the idea?

Want To Learn More About Investing in Gold?

Get A Free Guide To Gold Investing Delivered To Your Home

Project Prophecy Is Shelved Jim Rickards and the team working on Project Prophecy were successful. They built a system that monitored hundreds of stocks and companies that they considered vulnerable to terrorist activity and financial gain. In fact, the system they built predicted the thwarted attack on an American airline company which was quashed by New Scotland Yard. The terrorist’s ostensible plan was to blow up a few international flights, the ones with the most Americans on board. While Project Prophecy was not a part of stopping the attack, the data and corresponding happenings did show that their thinking and programming was working. Unfortunately, as you might expect, the very government that envisioned, conceived, planned, paid for, and executed Project Prophecy, shelved project Prophecy. Not because it did not work, but perhaps because it worked too well.

Project Prophecy Breathes Again, But Under A Different Name Project Prophecy was resurrected after a time. This time it was known as MARKINT. MARKINT was a derivation of project prophecy. However, rather than focus narrowly on terrorist activities, MARKINT used technology to track nearly any kind of trade that might be harmful or be seen as financial warfare in the markets. After all, the U.S. government realized that financial warfare, or currency warfare, was the new battlefield, and they needed intelligence. A hundred years ago, international trade and international markets were limited, and declaring war basically meant sending soldiers, but these days, very destructive financial cannons can be fired on purpose or by accident from a keyboard halfway across the world in the middle of the night. Jim Rickards understands this, and perhaps this is why the U.S. government called upon him once again to help explore the field known as “Currency Warsâ€.

Gold Prices Over The Last 5 Years

This article “Why Invest In Gold†is an  informative on the topics of “Project Prophecy†and the financial terrorism and potential currency wars that it was capable of predicting by scouring financial market trades looking for anomalous trades and dealings that might foretell that trades were being placed in order to profit from terrorist events. Jim Rickards was instrumental in developing project prophecy and it’s later iteration known as MARKINT. Gold coins, rare gold coins, numismatic gold coins, old gold coins, and gold bullion all react inversely (eventually) to falling markets and crashing currencies, and this is one reason that Jim Rickards suggests that financial portfolios should include gold.

What Jim Rickards Knows About The History Of Collapse Of The International Monetary System First of all, in his book “The Death Of Moneyâ€, Jim points out that the international monetary system has collapsed three times in the past century – in 1914, 1939, and 1971. Therefore, his call that the system will collapse again is not far fetched in the slightest. Remember, in 1971 Richard Nixon removed the United States from the last vestiges of the gold standard, a one ounce gold coin or a one ounce gold bullion bar could be bought for under $50. Today that same gold coin or gold bullion bar would cost nearly $1400. Since 1971 the U.S. dollar has seen substantial inflation and subsequent devaluation. Stocks have come and gone, annuities and bonds have collapsed one after the other, and bank deposit funds now pay a fraction of a percent for a year-long deposit. These are reasons that you should own gold, and these are reasons that many of the brightest minds in economics have been imploring the people of the United States to own gold in order to protect their financial interests.

The Current Threats To The International Monetary System To simply outline the current threats to the current international monetary system, I only need point out that the U.S. dollar is the world reserve currency. What this means is that the U.S. dollar is supposed to be used as the form of payment between countries when they trade between themselves. For instance, if China wants to buy oil from Saudi Arabia, China must first purchase dollars, and then pay Saudi Arabia for the oil using U.S. dollars. This in turn creates an artificial demand for U.S. dollars. Conversely, if the U.S. wants to buy oil from Saudi Arabia, the U.S. can simply create dollars out of thin air and trade them for oil, however, just creating money from nowhere eventually leads to inflation, and a cheapening of the U.S. dollar. As an example, perhaps you may have heard or even remember when gasoline was twenty cents a gallon. Well, it still is if you choose to pay for it with silver dimes, as a silver dime currently costs just under two dollars. When the U.S. dollar loses it’s world reserve currency status, the value of the dollar will plummet, and gold coins, old gold coins, rare gold coins, and gold bullion will rapidly increase in value against the dollar. FREE SHIPPING ON GOLD AND SILVER PURCHASES OVER $500.00

The U.S. dollar was very strong after World War II, and global meetings such as Bretton Woods determined the new world order for international finance and currency valuation. At that time, the U.S. dollar had a set value against one ounce of gold, and many international currencies were “pegged†against the U.S. dollar, which meant that the value of a currency was fixed against the U.S. Dollar for the purposes of international trade and currency manipulation /valuation, and this system in turn created a cap on how much money could theoretically be created by the United States or other countries that were following the Bretton Woods agreements. This system worked for awhile, and during that time prices in the United States were relatively stable, and an American family could live quite comfortably on less than $10,000 a year. Also, during this time period an American family often only had one parent in the workforce because one income was enough to pay the bills and the mortgage and leave money left over for savings.

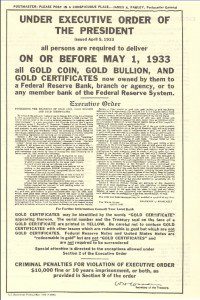

Gold Was Illegal To Own As An Investment In The United States I should also point out that from before the creation of the Bretton Woods Act until Richard Nixon closed the gold window thereby effectively putting an end to the gold standard, Americans were not permitted to own gold as an investment. This meant that there were no gold bullion coins being minted in the United States. You could not buy gold bullion bars, and the importation of foreign gold coins or old gold coins was tightly monitored. Numismatic gold coins and rare gold coins could be had, however thy traded at multiple times the set price of gold generally, and they were seen as collectibles and usually only the very rich (or very wise) owned them. The Idea of buying gold at one price and selling it when the price of gold went up in order to make a profit, was nonexistent, because the government set the price of gold and it did not fluctuate much at all for decades at a time. This is the way the gold market used to operate. Only during the last forty years or so, have the gold markets operated as they currently do in the United States, which ultimately means that our current economic role model is simply an experiment, and this experiment has been run by what is known as the Fed, or Federal Reserve bank. Recently, Craig Griffin, Founder and President of ITM Trading, interviewed Jim Rickards, and he asked Jim about the Fed.

Craig Griffin: “Well, do you think people are putting too much faith in the Fed these days?â€

Jim Rickards: “I wouldn’t put any faith at all in the Fed. The answer is definitely putting too much faith. If you have any faith in the Fed, that’s too much, for a couple of reasons. Number one, the Fed was not created to help the economy, the Fed was created to help the banks and that is still their mission. Anything the Fed does for the economy is by accident, what they really do is try to prop up the banking system, that is why they have a zero percent interest rate policy, they pay savers nothing so the banks can get free money and lend it out on a leveraged basis and get very good returns on their money to build up their equity basis, so that is what is going on there. They demonstrably do not know what they are doing, I mean look at the fact that they have had fifteen separate policies since 2009…..If you have fifteen policies in five years that means you don’t know what you are doing.

Craig Griffin: “That’s a little schizophrenic.â€

Jim Rickards: “Well, they’re guessing, it’s an experiment, we’re all guinea pigs in a central banker experiment, so I wouldn’t have any confidence in them at all, in fact not only would I say that they probably don’t know what they are doing, I would say they definitely don’t know what they are doing, and I have been told that by central bankers. Members of the Federal Market Committee, members of the Monetary Policy Committee of the Bank of England have said to me privately ‘We were making it up…we’d try something, if it worked great, if it didn’t work we’d try something else…’ They don’t know what they are doing so you shouldn’t have any faith in them at all.â€

Jim Rickards And Craig Griffin Both Own Gold For Some Of These Very Reasons

The facts revealed in this amazing interview should be reason enough for you to strongly consider adding gold bullion, gold coins, old gold coins, rare gold coins, foreign gold coins and numismatic gold coins to your investment portfolio.

If you are looking to buy gold please visit

ITM’s Precious Metals Online Store.