When Collecting and Investing Mix.

Some things, like peanut butter and jelly, and peas and carrots, just go together. Other things, like oil and water  don’t ever mix. But, from time to time, you get a combination that can work out for either good or bad; like combining collecting and investing. Consider the case of Joel Waul, who currently holds the Guinness World Record for having the largest rubber band ball. It weighs 9032 lbs. While I’m sure the ball is worth something, I doubt Waul is planning on using his ball to fund his retirement, but you can’t doubt that in many forms of the word, he is invested in the 4 ½ ton over-sized office toy. We’ll have to wait and see if the price of rubber skyrockets in the next few years. In the meanwhile, Joel will have to keep his ball in the garage, away from his HOA.

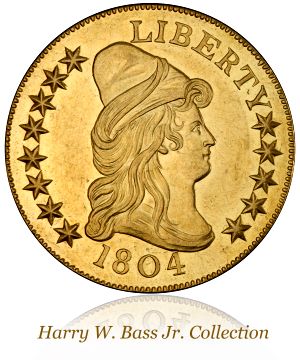

Perhaps of more noteworthy success, are the accumulations of Harry Bass who began coin collecting somewhat by accident, but not without a goal: to make profit! Mr. Bass used to work at a bank and one day an employee of the bank came to him and asked to buy a bag of dimes. Several years later that employee bragged to Mr. Bass that he had tripled his money on that bag of dimes, and Harry’s fate was set. Being a man of means, Harry Bass could afford gold coins, and rare gold coins. Mr. Bass believed in buying gold as an investment, and bought gold from coin dealers, gold brokers, as well as gold investment companies. After Mr. Bass passed, his collection was valued at over $25million though his wife believes they never put anywhere near that amount of money into the coins.

So, what makes Bass a visionary and Waul a YouTube phenomena with over 100,000 hits for dangling a ball of rubber off of a crane? Perception. Bass had perception. He knew the finite details of thousands of coins. He knew how money is created. He bought when it was time to buy, and sold when it was time to sell. Waul lacks the perception of Mr. Bass, but he does have something else – an addiction – to rubber bands.

As you make choices as to where and how you save for the future, remember the successes of Harry Bass, who built a millionaire’s empire on the knowledge he gleaned from a sack of dimes. If you would like to speak with one of ITM Trading’s Senior Analysts about your current investments, whether they be balled up in a 401K or in the garage, call 1.888.OWN.GOLD and begin the conversation!