What happens if we don’t raise the Debt Ceiling?

As the government has maxed out its credit card a question must be raised, if we don’t raise the debt ceiling what could happen? It seems as though most experts agree that a failure to raise the debt ceiling would be disastrous.

The main reason it would be disastrous is this, one thing we do know for sure is that if the ceiling isn’t raised, eventually a default on the debt will occur as we will not have the money to be able to repay our debtors. This is in addition to Medicare, military expenses and many other items the government spends money on which would not receive funding.

A default would tarnish the credit rating of the US, making it more difficult for us to borrow in the future. White House spokesman Jay Carney said “We have to raise the debt ceiling because the United States is the United States. It’s the most important, powerful economy in the world. The full faith and credit of the United States is essentially our reputation in the world. And to default on those obligations would be calamitous, would have calamitous consequences.”

All seem to agree that the US cannot continue to run massive deficits forever and that doing so would be disastrous in itself. Republican House Majority Leader Eric Cantor had this to say, “It is reckless for us to increase the credit limit of this country without cutting spending, without reforming entitlements, without getting our fiscal house in order just as any family would have to do if they’re seeking an increase in their credit limit. They’ve got to have the wherewithal to pay the loan back and that’s what we’re trying to do here.”

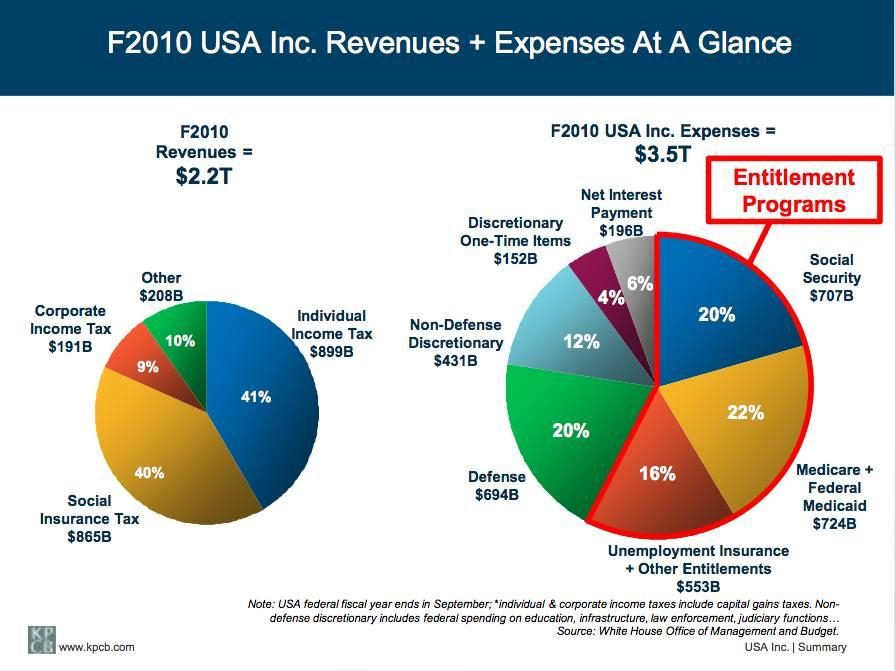

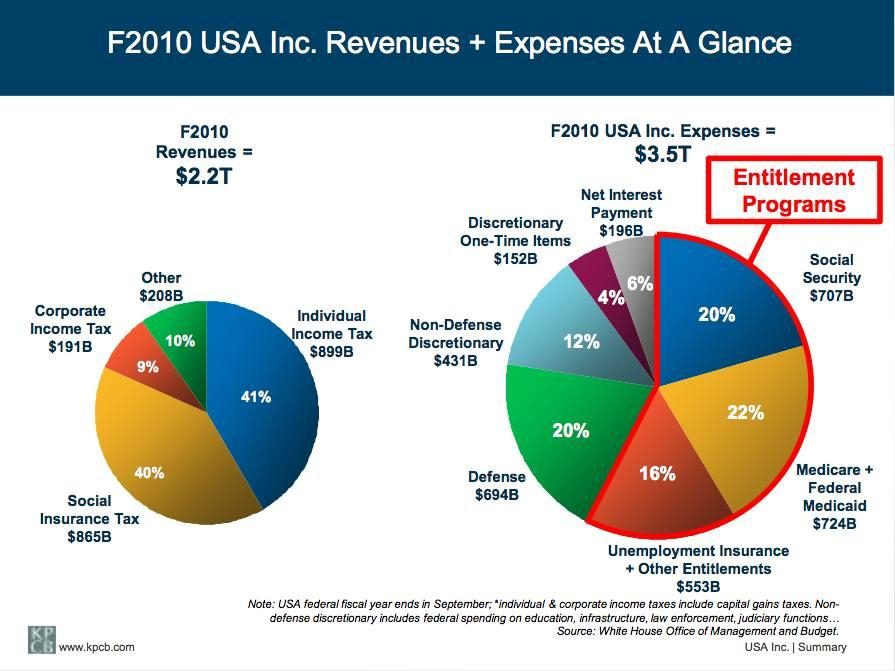

Real cuts are going to have to be made in order to make up the gap between revenues ($2.2 trillion) and expenses ($3.5 trillion). That is a $1.3 trillion deficit per year. Look at the chart below:

Something needs to be done about Medicare/Medicaid as well as other entitlement programs, which is why I believe this is where republicans will target for their cuts.

If a default occurs I believe it will be painful. The dollar would probably lose its status as the world’s reserve currency which would create a dramatic loss in value of the dollar via inflation/hyperinflation. Therefore I believe that the congress will raise the debt ceiling to overt a crisis.

Hopefully for future generations’ sake we do something about this deficit spending (which is the real message here) otherwise we are going to continue to print ourselves into oblivion.

If the government defaults on the debt it will benefit gold and silver, just another reason to position some of your assets into precious metals before its too late.