WEEKLY MARKET UPDATE – May 17, 2012

Change is in the Air

Many analysts are saying these markets are changing. From Richard Russell’s Dow Theory Letter, “Even as the Dow continued to creep higher, the internals of the market started to deteriorate. Finally the internal deterioration caught up with the generals and the Dow was caught in the weakening. Up until now, the rising Dow masked the deterioration that was occurring under the surface. Recently the Dow declined on 9 out of 10 trading sessions, the longest losing streak since February 1978.”

If the stock markets’ down-turn is pervasive some think it might impact the “wealth effect” in a negative way. Economists use this term referring to the link between the level of personal wealth and our decisions about how much to spend or save on goods and services.

Since we are told that 70% of the U.S. GDP (Gross Domestic Product) is personal consumption, the Federal Reserve is likely concerned about this possible decline and has been warning of a “Fiscal cliff” in 2013, particularly as their most current stimulus program winds down in June and some tax breaks disappear at the end of this year. Some economists have called for the central bank to do more stimulus even though many think the previous stimulus attempts have not generated a self sustaining recovery.

Read the article from CNN here:

http://money.cnn.com//2012/05/16/news/economy/federal-reserve-minutes/index.htm?section=money_topstories&utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+rss%2Fmoney_topstories+(Top+Stories)

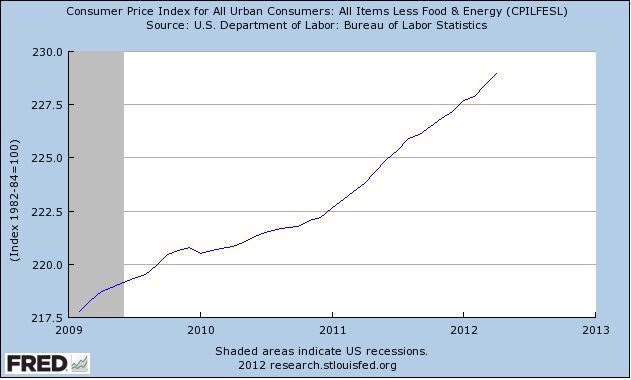

When the Fed began the first round of stimulus on or about March 9, 2009, spot gold was at $918/oz, and spot silver was $12.93/oz. Since then there have been two additional rounds of stimulus, QE2 and Operation Twist. Today, spot gold is 68% higher, spot silver is 110% higher and the cost of living has inflated as witnessed in the CPI (Consumer Price Index, less food and energy) chart below. Many agree that the spot markets have kept pace and perhaps surpassed the increase in the cost of living over this period of time.

The Greek Tragedy Continues

Some think a bank run in Greece is in play with the announcement of almost $900bn leaving the Greek banking system. The Financial Times reports that the ECB has cut off support of 4 unnamed Greek banks fearing that recapitalization of Greek banks could be delayed. Many feel that if Greece leaves the EU and returns to the Drachma, there will be a bank holiday and when the banking system reopens, they will be left with rapidly devaluing Drachmas.

Read the articles here:

http://www.latimes.com/business/money/la-fi-mo-greece-banks-20120516,0,2374245.story

& here: http://www.cnbc.com/id/47424014

According to the Financial Times, Greek citizens have been emptying savings accounts and buying gold as they brace for a bank holiday and/or a Greek debt default. Another payment on outstanding Greek bonds becomes past due on June 15, and if this payment is not made it will be classified as a “Hard default”. History shows us that while the new Drachma is likely to lose purchasing power rapidly, gold is most likely to maintain it.

Reuters reports that this issue is not isolated to Greece as depositors in Belgium, France, Spain, Italy and the other peripheral eurozone banks are experiencing similar depositor flights. This jeopardizes the already fragile solvency of the European banking system.

Read the articles here:

http://www.reuters.com/article/2012/05/17/us-banks-deposits-idUSBRE84G0MG20120517

In addition, some economists are calling for a decade long depression in the United Kingdom.

Read the article here:

JPMorgan Chase Announces $2bn or More in Derivative Losses

Derivative contracts are “off balance sheet”, so there is no oversight and no reserve requirements. According to the OCC (Office of the Comptroller of the Currency) the top 5 FDIC insured banks control 95% of all derivatives and JPMorgan Chase is at the top of the list. From the beginning of the credit crisis in December 2007 until the OCC’s latest quarterly derivative report in December 2011, the value at risk of the top 5 FDIC insured banks has grown by almost 39%. Many on Wall Street and in our government blame derivative bets gone bad for the downfall of Lehman Brothers and Bear Sterns. These failed bets are also considered the reason AIG needed to be bailed out by the taxpayers.

When Jamie Dimon, JPMorgan’s chief executive, announced the losses last Thursday, he indicated they could double within the next few quarters, but this has actually happened over the last four trading sessions according to CNBC. Many in government think that this reinforces how dangerous derivatives can be.

Read the article here:

http://www.cnbc.com/id/47455430

As reported by the New York Times, different departments at JP Morgan were taking the opposite sides of this bet. And The Street research shows that this is not likely an isolated situation.

Read that article here:

http://www.thestreet.com/story/11533675/1/jp-morgans-bad-bet-on-derivatives-is-not-an-isolated-case.html

The following graphic puts JPMorgan Chase’s $70 trillion value at-risk derivative bet into visible perspective. While we hold our money in FDIC insured banks and feel safe, due to all of the off balance sheet activity, there are those that believe the only safe asset is gold in your physical possession. This is because there is an unlimited amount of digital dollars and bets that can be created at whim, yet the total amount of gold estimated above and below ground would only fill two Olympic size swimming pools.

NDAA Challenged

Courthouse News reports that a federal judge has granted a preliminary injunction to block provisions of the 2012 NDAA (National Defense Authorization Act) that would allow the military to indefinitely detain anyone it accuses of knowingly or unknowingly supporting terrorism.

Read the article here:

http://www.courthousenews.com/2012/05/16/46550.htm

And now on to the markets.

Goods Producing vs. Goods Moving

Richard Russell says, “Once a primary trend is established, it will go to conclusion despite the intentions of the central banks, the Treasuries or governments. It may be interrupted with QE (money printing) or other short term tricks, but it will not be stopped.” He feels that a primary bear (negative) trend began in 2007. Look at the charts below and you will see that both the Dow and the Transportation averages have broken through one support level and are headed toward the next. Many technicians tell us that nothing goes straight down and with 11 out of 12 down days in a row, we should expect some sort of upward pop before the markets continue the downward trend.

Bonds

It is said that once money is created it never goes away, it simply shifts location. Reportedly, the 10 year German bond is yielding 1.44% which is even lower than the U.S. 10 year treasury at 1.76%. Some think that in a flight to safety out of stocks and European banks, that money is flowing into bonds. This seems to be verified by the charts below. Essentially, between the low yield and inflation, some analysts say we are now at a negative yield.

U.S. Dollar vs. Euro Dollar

Economists tell us that there are two ways to value a currency. One of them is against another fractional reserve currency, and you can see in the charts below that market participants have been selling euros and moving into U.S. Dollars, as the situation in the European banks is becoming more precarious. The euro has broken below the $1.30 and is now trading in the $1.27 range near a one year low.

Gold, Silver and Numismatic Coins

There are many shifts that have come to light in the gold market this week. These shifts tell a different story than the charts below. I will list them here and give you the links so you can read more.

Â

From GATA:

#1 “After years of selling it, the IMF (International Monetary Fund) plans to buy $2 billion in gold” because the Fund is facing increased credit risk as a surge in lending has been prompted by the global crisis. “The IMF’s move could be considered wise and can be seen as an indication of how much trust the mainstream financial community now has in precious metals like gold.”

Read the article here:

http://www.gata.org/node/11357

#2 According to a report in the Bild (A German newspaper) regarding Germany’s gold reserves “The federal auditing office complained of inadequate diligence of the accounting of the gold reserves, which are stored in some foreign countries. Repatriation of the gold reserves is encouraged.”

Read the article here:

http://www.gata.org/node/11362

#3 The Indian central bank is being challenged in court to repatriate its gold reserves now being held in foreign countries as well.

Read the article here:

You will notice in the charts below that the metals in all categories are testing support levels. At the same time there are many reports that global central banks and the IMF are building their reserves as quickly as they can. Like all markets there will be many ups and downs along the way. I believe it is logical to do what the central banks are doing, by converting currency to gold when the price is cheaper.

From all of the above stories and so many more, it is clear that panic is just starting to emerge in Europe. This is the crisis that has been brewing for months, the crisis experts have been warning about and Wall Street has ignored. Timothy Geithner, U.S. Treasury Secretary, warns us that we are vulnerable to the European crisis. We also do not know how the derivative problems currently challenging JPMorgan Chase will impact the banks here.

It would make sense to prepare by positioning into assets that can protect us from a crisis similar to 2008. Keep in mind that the spot markets declined (but rebounded strongly) as that crisis was unfolding but the numismatic coins went to new trend highs as people looked to the safety of physical gold.

There is opportunity in change as long as you are in the right place at the right time with the right asset. And we are here to help.

Lynette

EDITOR’S CORRECTION:

In the last edition we inadvertently defined a CDS as a “Collateral Debt Swap” when indeed a CDS is a “Credit Default Swap”. Please accept our apologies for the error.

To learn more about a CDS follow this link:

http://www.investopedia.com/terms/c/creditdefaultswap.asp#axzz1uICPPQl9