Webinar The Retirement Time Bomb

The Ponzi Retirement Plan, The Retirement Time Bomb!Â

The Retirement Time Bomb Watch the Recorded Webinar Here.

By Lynette Zang, Chief Market Analyst at ITM Trading.

In the early 1970’s I remember thinking that Social Security would not be there when I would be ready to take it, and that it was really just one big Ponzi scheme. That seems prophetic since today many key retirement systems are severely underfunded with a near future forecast of when they’ll run out of money. The plans that were created in the 1930’s and on, are unraveling just as the baby boomer generation (1946 – 1964), the largest demographic group in history, reaches retirement age.

What Would A Ponzi Retirement Scheme Look Like?

The main contributing factors that have built the retirement plan time bomb that we face today are the aging population, market financialization (Wall Street is more important than Main Street) and years of financial repression (inflation out paces taxes, income and appreciation). This study will look at why these plans are breaking down now.

While I liken these plans to a Ponzi scheme, they may not have started out that way, however these plans certainly seem to mimic that form and function now. I say that because every Ponzi scheme counts on three important things, the most important is confidence, secondly, that there are an ever greater number of new entrants to support the scheme and thirdly, that participants do not ask for too much money back. Today, all of these important elements are breaking down.

Confidence in the Financial System

Most people participate in some kind of retirement plan where confidence is required. Some people count entirely on Social Security to fund their retirement, but with the average monthly benefit of $1,335 these people will likely have to choose between essential needs. Forty-one million people count on defined benefit pensions that they’ve built over years of service and contributions. Still others are depending on defined contribution plans, like 401K’s and IRA’s. Typically these plans count on stocks, bonds and other Wall Street products to fund their current and future retirement.

Government programs, like Social Security and State Pension Plans depend on current contributions to fund current benefits. Therefore, anyone relying on those benefits has to have confidence that these programs are well funded and secure.

The implicit assumption in many actuarial forecasts is that states and cities can simply raise taxes as pension costs mount. But reality is very different from assumptions as many cities are finding out. Once this reality becomes obvious to residents via increased taxes and decreasing benefits, confidence erodes, people move and take their tax dollars with them.

Private programs count on Wall Street products to fund their future plans. Wall Street counts on continued contributions from businesses and individuals to push prices up and buy new products that Wall Street creates. If confidence in Wall Street is lost, individuals are less likely to buy Wall Street’s products and more likely to sell. This could easily exacerbate market declines in a righteous feedback loop.

Expansion of Participants

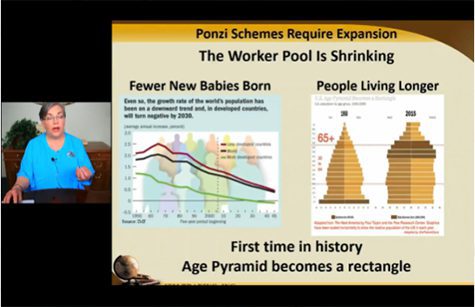

The second critical element is an ever expanding level of participants. As China can attest, long-term birth trends are extremely hard to change. Globally, fewer babies are being born, and in developed countries, the birth rate is expected to turn negative by 2030. As a consequence, for the first time in history, the age pyramid now begins to look like a rectangle. As more people retire and less people enter the workforce, more stress gets put on available funds to pay current demands… you can see the problem in the slide below.

If you missed the live webinar you can watch the recording here.

Participants Don’t Demand Too Much Money

That takes us to the third critical element of any functioning Ponzi scheme. There must always be more deposits than withdrawals. The first baby boomers hit retirement age in 2013. They contributed into this system, their entire lives and they want their money back.

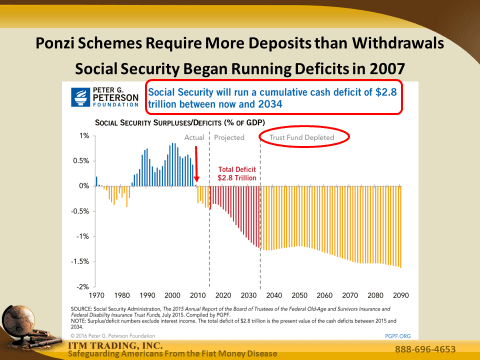

Unfunded plans, like Social Security and defined benefit plans administered by the Pension Benefit Guaranty Corporation (PBGC), a government agency, depend upon current revenues to pay current benefits. Social Security has been running deficits since 2007 and the PBGC has been running deficits since 2001.

Funded plans, like private and public defined benefit plans are also mostly underfunded and defined contribution plans like, IRAs and 401Ks, count on ever expanding markets to support traditional retirement assets. But traditional markets are in a currently deflating bubble as demands on the system are expanding and fewer workers are contributing.

The bottom line is that the foundation of this Ponzi scheme is breaking down now. There is only a thin layer of public confidence holding the game together. My bet is that confidence is on borrowed time, particularly now that there are more withdrawals than deposits.

Let’s explore the current state of some key public and private retirement plans.

Social Security

According to the Social Security Administration, in 1945 there were 41.9 workers per retiree. In 2013 there were 2.8, see the trend? In addition, since the program’s inception, benefits have been paid from current contributions. When revenues exceeded outlays, the government swept the excess into the general fund and spent it.

You can see in the following bar graph below that deficits in the Social Security system began in 2007 six years before the first baby boomer recipient began to take benefits.

Starting of the social security deficit.

Of course that’s not the only retirement scheme under pressure.

Public Pension Plans

Wharton finance Professor Robert Inman, comments on state pension plans, “there were $3 trillion worth of unfunded pension liabilities at the state level, and $400 billion of unfunded liabilities at the large-city level.†Inman noted, for example, that Chicago’s unfunded liabilities are 10 times its revenues. “Just assume that they’re going to have to pay 5% of that [number annually]. That means you’re looking at 50% of their cash that will have go to pensions.†Philadelphia, Boston, New York, Houston and other major cities will face similar challenges.â€

If 50% of a city’s tax revenues are paid out to retirees, how would they fund current services? Like teachers, fire fighters etc. That means that taxes will have to rise or services will have to be cut, or some combination of the two.

Just in case you think the private pension plans are any better, take a look at this chart from Milliman’s “Corporate Pension Funding Study†found here http://us.milliman.com/PFS/ it’s clear that liabilities are greater than plan assets and that, on average most plans have run deficits since 2001.

Just in case you think the private pension plans are any better, take a look at this chart from Milliman’s “Corporate Pension Funding Study†found here http://us.milliman.com/PFS/ it’s clear that liabilities are greater than plan assets and that, on average most plans have run deficits since 2001.

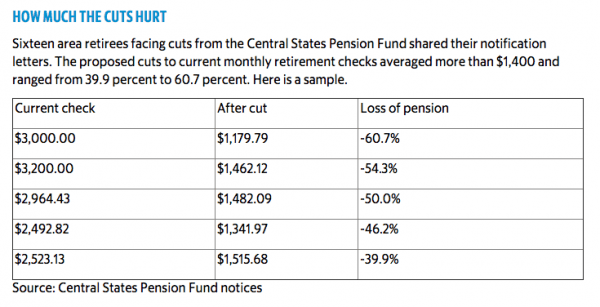

If corporations end their pension plans, they’re turned over to the PBGC. When a pension plan is turned over to the PBGC, benefit cuts are inevitable.

If corporations end their pension plans, they’re turned over to the PBGC. When a pension plan is turned over to the PBGC, benefit cuts are inevitable.

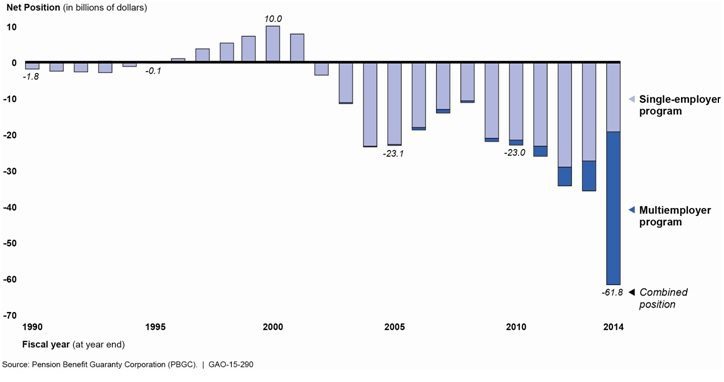

What is the current state of PBGCs finances? From their own projections found here, http://www.pbgc.gov/news/press/releases/pr15-09.html Single-employer plans held at the PBGC cover 31 million individuals and have been running a deficit since 2002. Multi-employer plans held at the PBGC cover more than 10 million people. The bar chart below tells the grim story.

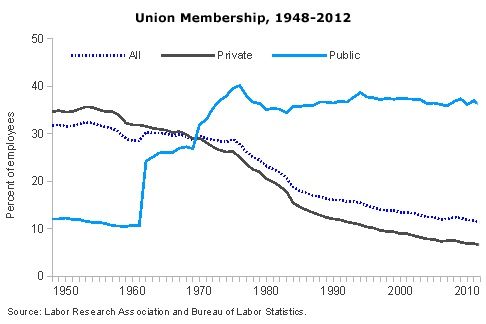

The PBGC has a big problem, like social security, they too depend on current union payments to pay for current benefits. This chart shows that private union membership is on decline while public (i.e. teachers etc.) membership has been on the rise.

Â To add fuel to the fire, a law that forces public employees to pay union dues is being tested in the courts right now. If that long held ruling is over turned, that would put additional stressors on an already stressed financial condition.

To add fuel to the fire, a law that forces public employees to pay union dues is being tested in the courts right now. If that long held ruling is over turned, that would put additional stressors on an already stressed financial condition.

401K’s

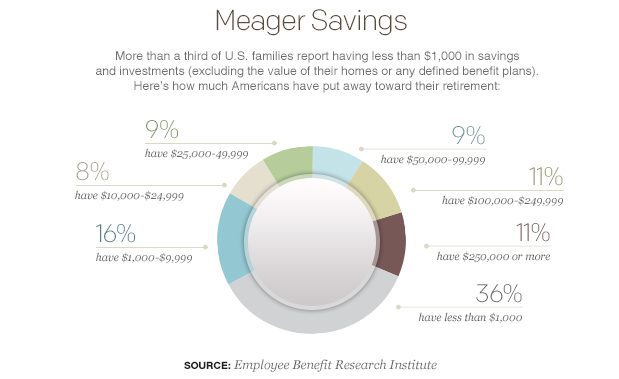

From Employee Benefit Research Institute (EBRI), “39.3 percent of participants had account balances of less than $10,000†https://www.ebri.org/pdf/briefspdf/EBRI_IB_408_Dec14.401(k)-update.pdf

IRA’s

“The median retirement account balance in a typical American working-age household dropped to $2,500 in 2014, down from $3,000 in the previous year, according to a study from the National Institute on Retirement Security.

The institute said that, by its calculation, nearly 40 million households have no retirement savings. The news is perhaps most dire for those closest to retirement: median retirement account balances for pre-retirees was $14,500, with 62 percent of Americans aged 55 to 64 having saved less than one year of their annual income, it said.†http://www.benefitspro.com/2015/03/12/median-retirement-account-balance-drops-to-2500

This wheel graph gives to a good overview of the problem.

The Employee Benefit Research Institute recently estimated that the country’s aggregate retirement savings deficit stands at $4.13 trillion. Who will be left holding the bag when retirees cannot pay their bills? How will that impact the global economy?

Bottom Line If It Walks Like A Duck

No Ponzi scheme lasts forever and this one is breaking down now. Just as seventy-five million baby boomers have or will retire without sufficient private wealth to secure that retirement. Government managed retirement programs are out of money with not enough active workers to support this tidal wave of retirees, let alone prepare for future retirees and that’s in the best of circumstances.

In recent years, governments in Ireland, France, Hungary, Poland, Cyprus, Russia and Argentina as well as others, private pensions were confiscated to cover the short fall. Additionally, taxes were increased and services and benefits were cut. I am not sure that this will happen in the United States, but it is certainly a possibility.

If you missed the live webinar you can watch the recording here.

At this time, you still have a choice. Will your wealth evaporate when the retirement plan time bomb explodes or will you be in position to take advantage of the explosion?

About Lynette Zang

Lynette Zang, has held the position of Chief Market Analyst at ITM Trading since 2002. Ms. Zang has been in the markets on some level since 1964. Her mission is to convert financial noise into understandable language. She has been a banker, a stock broker and studied world currencies since 1987.