FRONT ROW SEATS, THE BOND MARKET DIE… By Lynette Zang

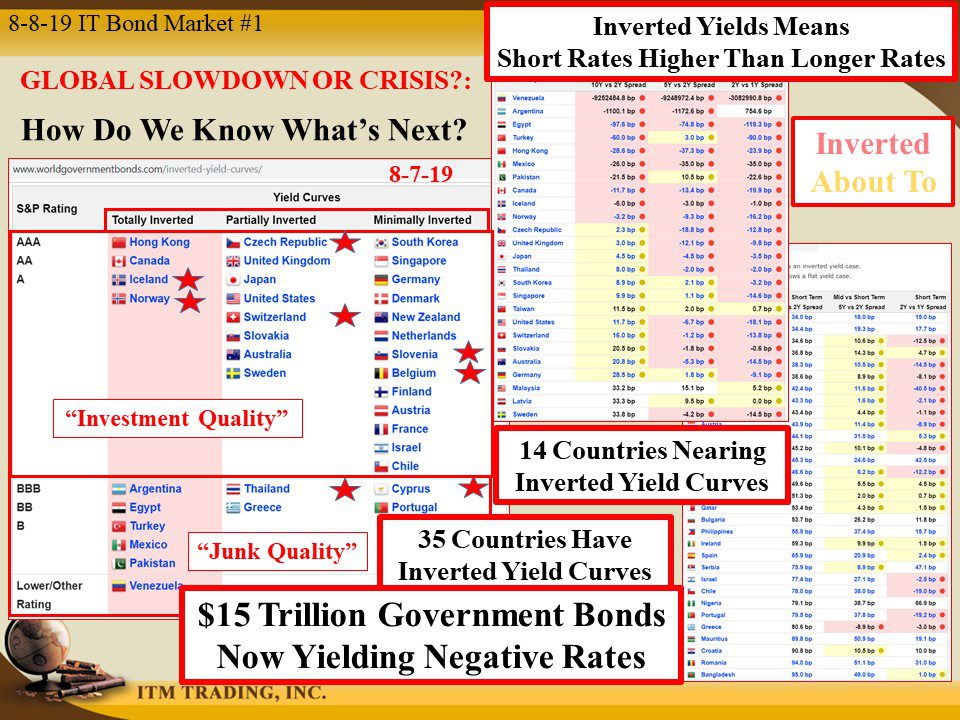

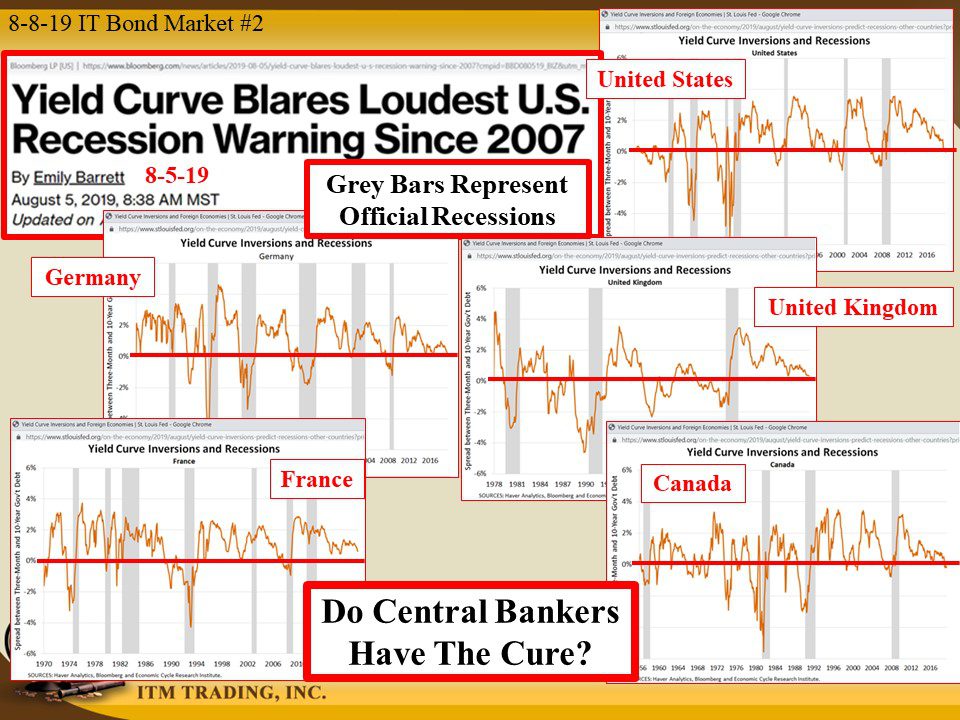

Interest rates are supposed to be a barometer of risk. Typically, central bankers control the overnight rates and leave the longer-term rates to the markets. An interest rate inversion is when short-term interest rates are higher than longer-term interest rates. What are inverted interest rates telling us? There is risk in the near term.

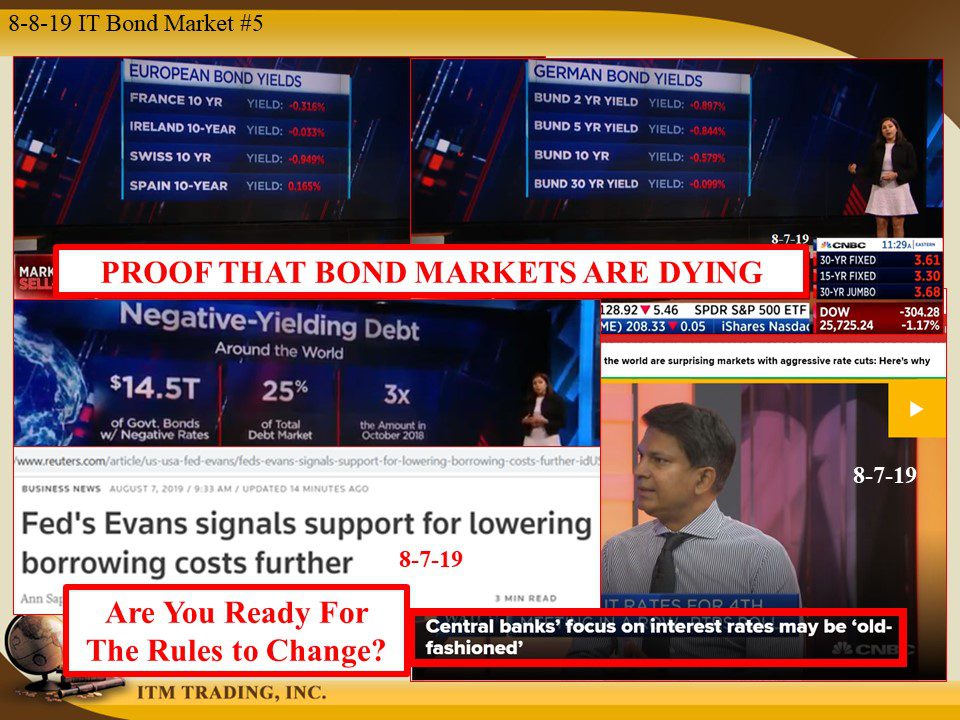

In fact, at almost 100% accuracy, an inverted yield curve is a warning that a recession will most likely occur within 18 months. When the difference between those rates expand, it indicates that a recession is either imminent or it’s already here. In the US, the inversion has been rapidly widening since early July. But what about the rest of the world?

As of August 7, 2019, thirty-five countries now have inverted yield curves! Fourteen more countries are on the verge of inverting, according to worldgovernmentbonds.com. Is this telling us there is just a global slowdown or global financial crisis in our near future? Is there anything that can be done to reverse it?

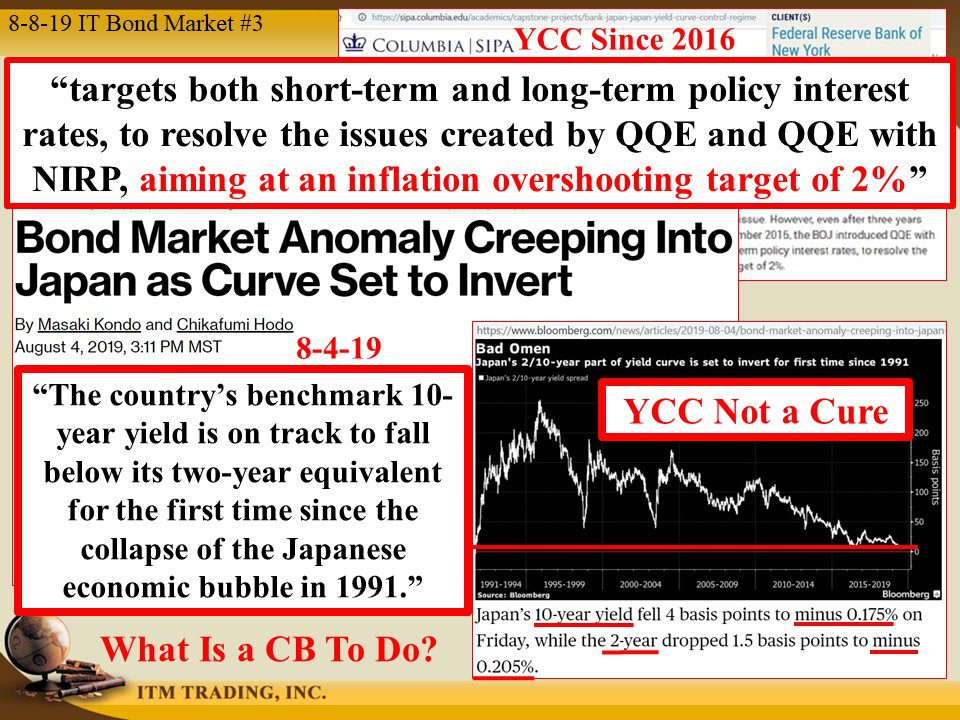

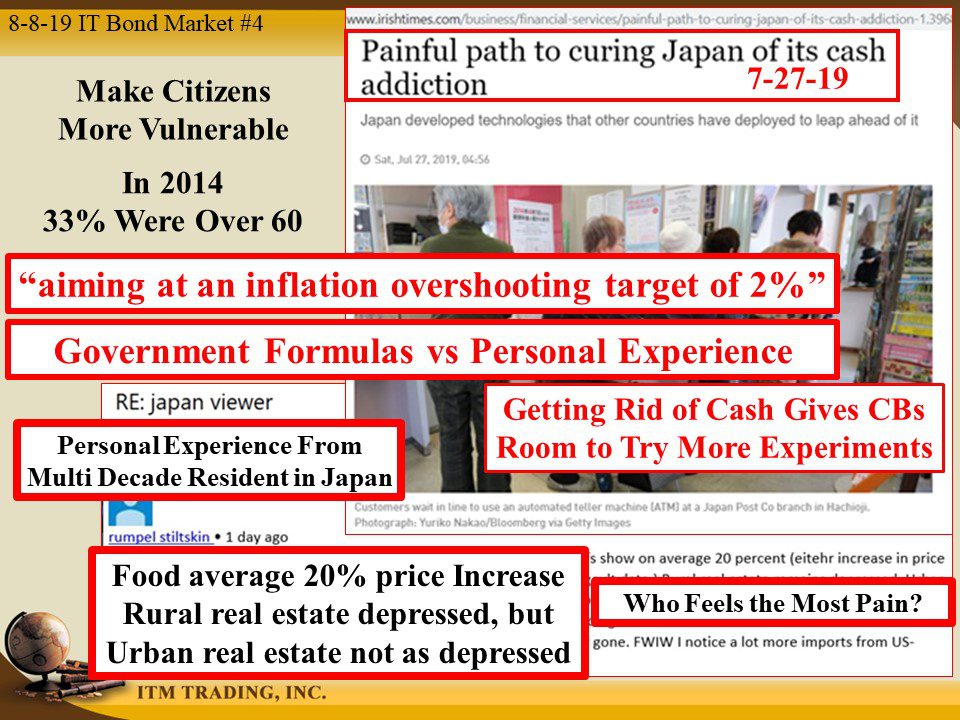

Japan tried. In an attempt to control the entire yield curve, Japan instituted Yield Curve Control (YCC) in an attempt to control both the long and short-term rates to counter the problems caused by massive money printing. As of August 4, 2019, Japan’s 2 and 10 Year treasury bond yields were on the verge of inverting. It should be clear that their experiment has failed.

With the world sinking into an interest rate abyss, negative rates on cash is likely to be the next experiment. Have the markets come to realize the danger? Spot gold and silver markets might be telling us they have with spot golds recent surge above $1,500 oz and spot silvers recent break out from a very stubborn resistance levels.

This price action could be telling us we have entered the awareness phase in the gold trend. We’ll examine this next week.

Slides and Links:

http://www.worldgovernmentbonds.com/inverted-yield-curves/

https://www.cnbc.com/2016/09/21/cnbc-explains-the-bank-of-japan-yield-curve-control.html

https://sipa.Columbia.edu/academics/capstone-projects/bank-japan-japan-yield-curve-control-regime

https://www.cnbc.com/2019/07/30/gold-is-set-to-surge-no-matter-what-the-fed-does-traders-say.html

YouTube Short Description:

You might remember that on June 26th I did a video on “What Scares Me†where I told you that an escalation of the trade wars into a full-blown currency war with all sides weaponizing their own currencies. Unfortunately, this is now officially coming to pass.

On August 5, 2019 the US Treasury Officially labelled China as a currency manipulator.

Of course, spot gold spiked in terms of both the Yuan and the US Dollar but on August 5, 2019, after more massive central bank buying, gold now sits at all-time highs in at least six currencies: Indian rupee, Japanese Yen, British Pound, South African Rand, Australian Dollar and Canadian Dollar.

What is this really telling us? In my opinion, wall street has now begun the fiat money to gold reset. Down the road, the government will finish the reset, but I do believe the gold reset has begun. Are you ready?