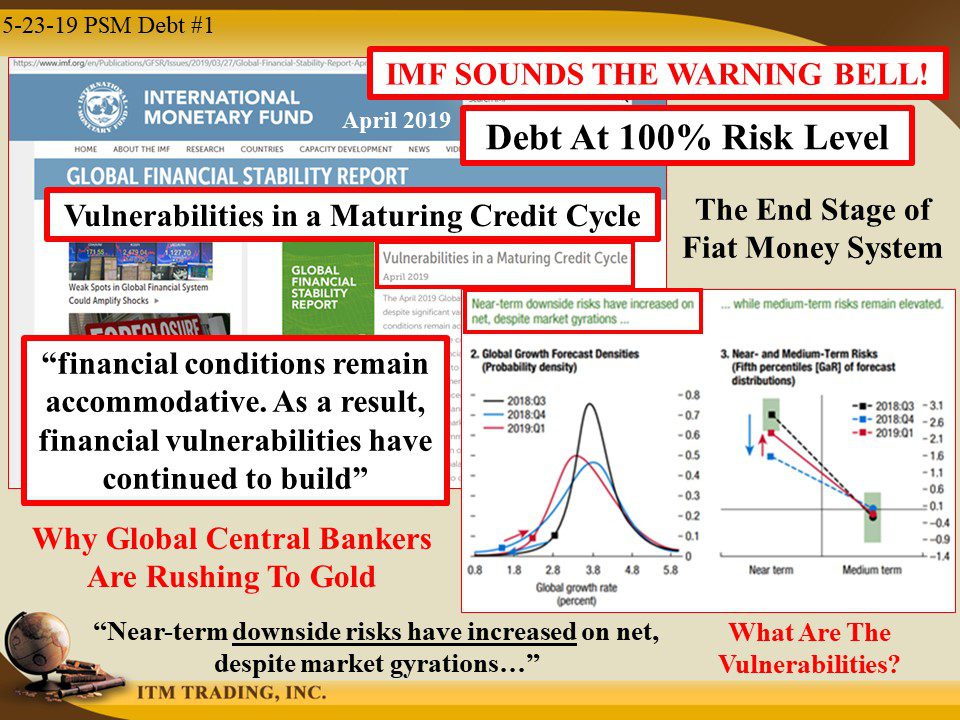

WARNING BELL 100% RISK LEVEL: Central Banks Rushing to Gold as IMF Shows 100% Risk by Lynette Zang

In the most current “Global financial Stability Report†the IMF (International Monetary Fund) examined the “vulnerabilities In a Maturing Credit Cycle†which is really a discussion on the end stage of the currency fiat money financial system. Like every aggressive disease, if you don’t make the life style changes that have a chance to reverse the disease, the most likely outcome is the death of the patient.

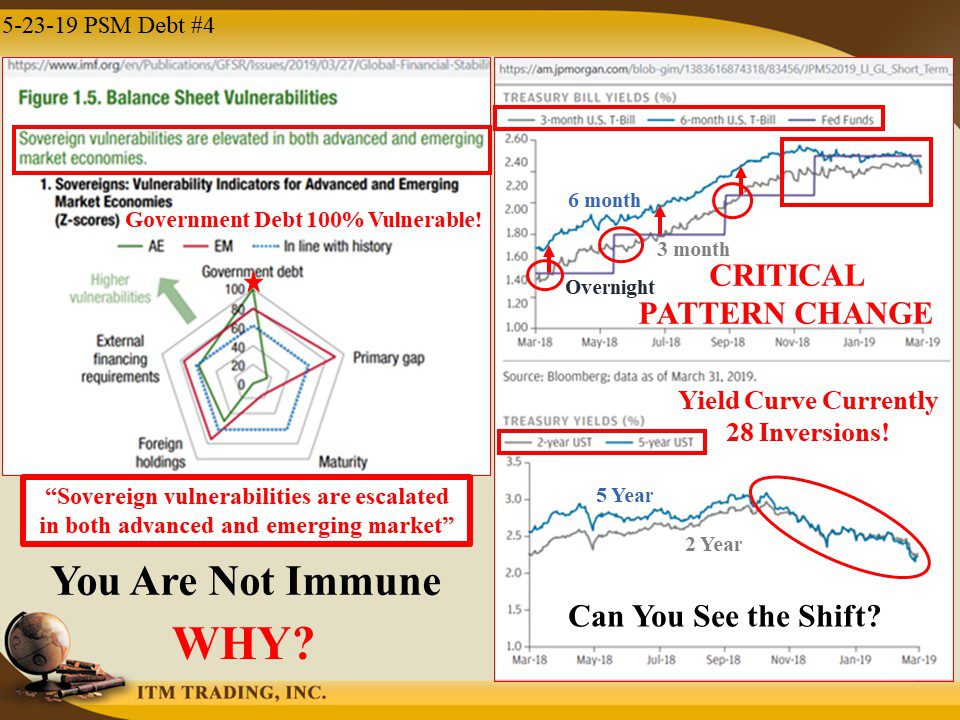

Unfortunately, the global central banks fed the disease rather than fight it. From the report “financial conditions remain accommodative. As a result, financial vulnerabilities have continued to build†and now they say “Sovereign vulnerabilities are elevated in both advanced and emerging market economies†and the risk level for government bonds in ADVANCED ECONOMIES is at 100%!

This is the result of the overt central bank control in place since the 2008 financial crisis.

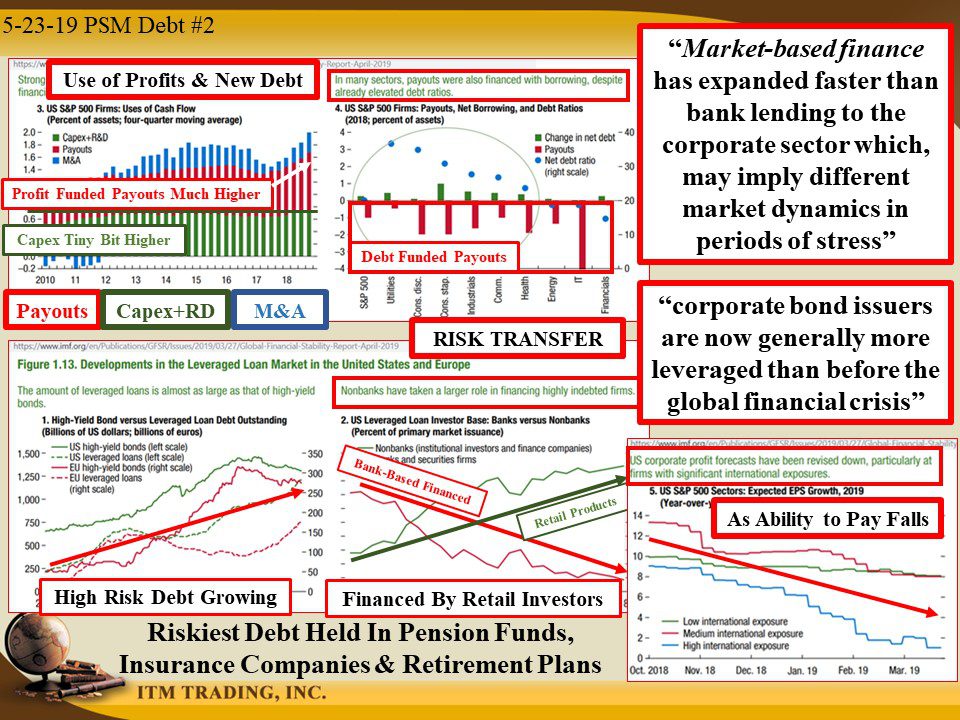

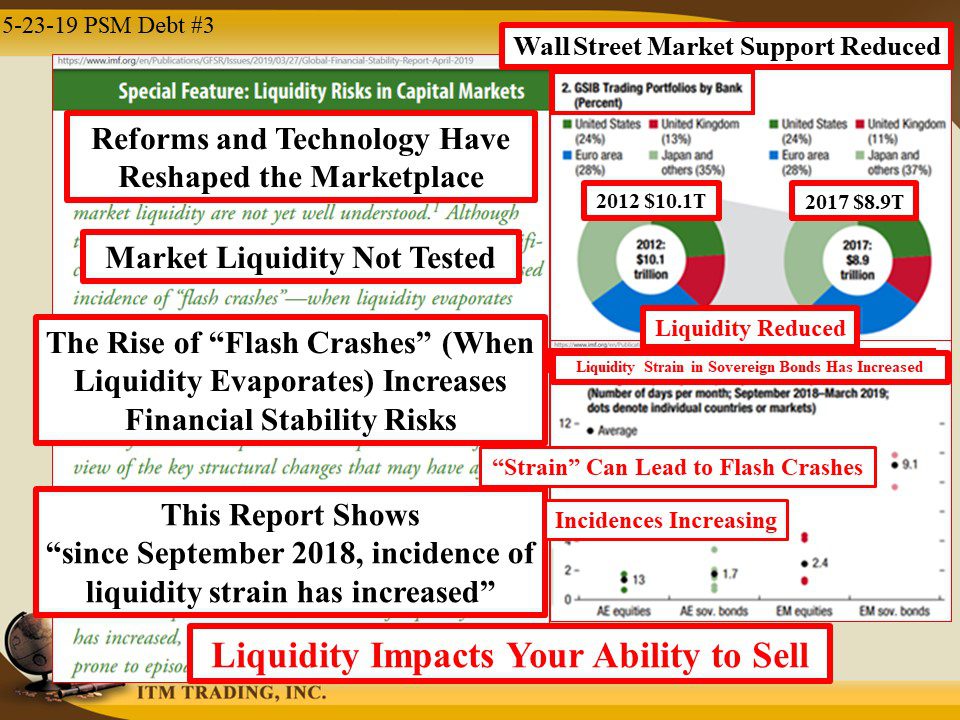

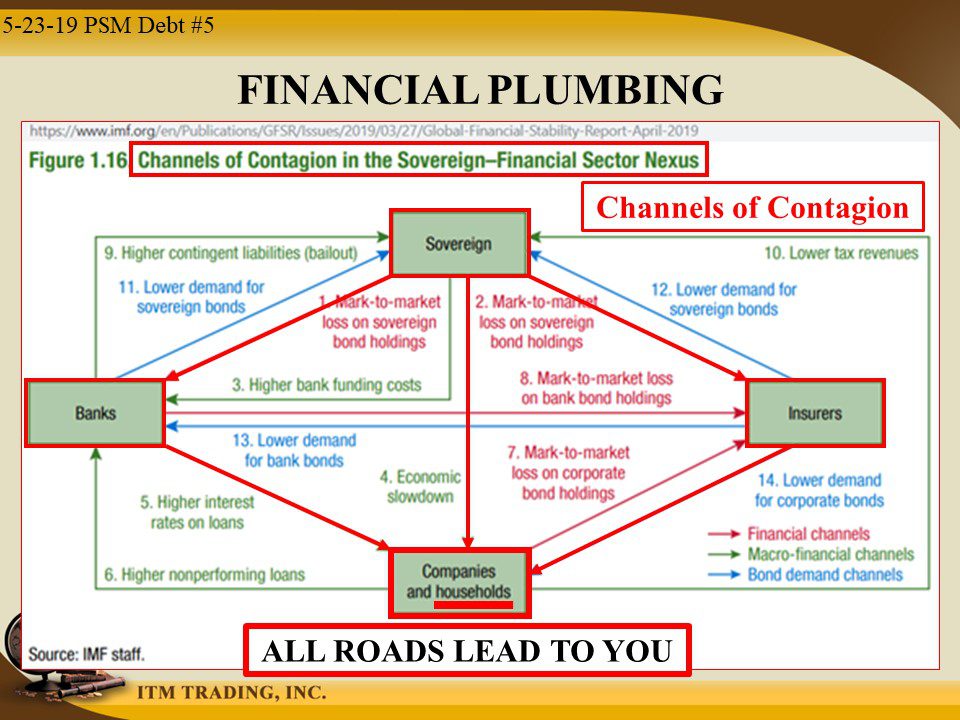

People always think they can keep this going, read the report, they know they can’t. They also know how the debt disease will flow through the global economy through the interconnected channels of contagion. Initially through the governments, banks and insurers and then to households/taxpayers, but at the end of the day the pubic bears the brunt of bank and insurer failures as well as watching their retirement and other fiat product investments evaporate.

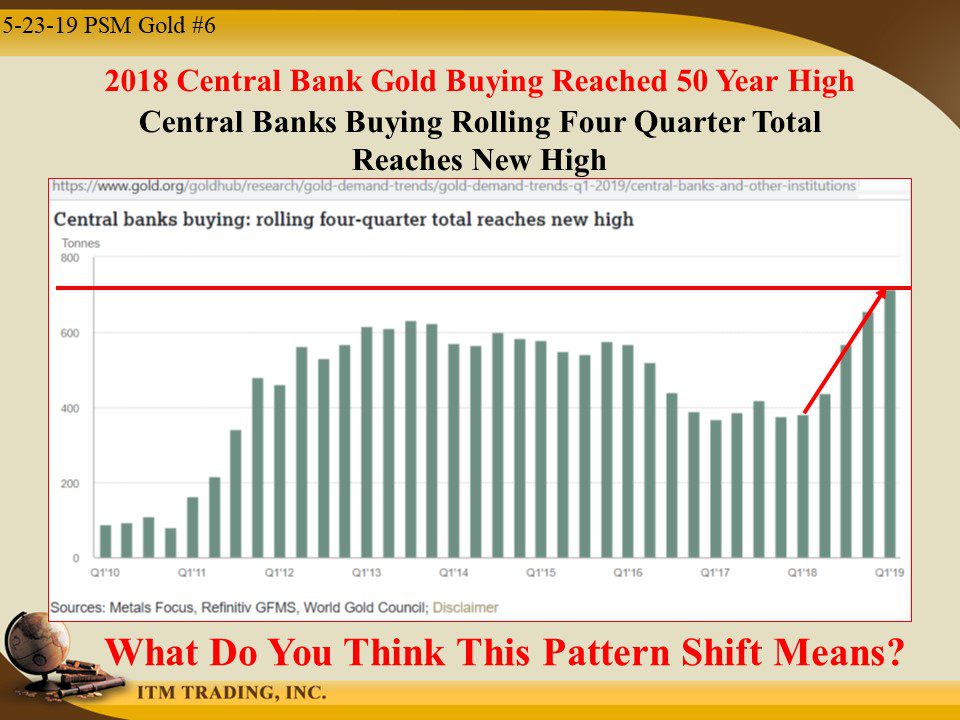

Central bankers know better than anyone, the problems in the fiat money system and how close we are to its demise. It is no accident that, after decades of gold sales, they stopped selling and began accumulating in 2007 as the crisis began to unfold.

It is no accident that 2018 saw the highest level of central bank gold buying in 50 years. It is no accident that the past four quarters saw the highest level of central bank gold buying since the fiat experiment began. They know the current fiat financial system is in their death throws. Now you do to.

Slides and Links:

https://www.imf.org/en/Publications/GFSR/Issues/2019/03/27/Global-Financial-Stability-Report-April-2019

YouTube Short Description:

In the most current “Global financial Stability Report†the IMF (International Monetary Fund) examined the “vulnerabilities In a Maturing Credit Cycle†which is really a discussion on the end stage of the currency fiat money financial system. Like every aggressive disease, if you don’t make the life style changes that have a chance to reverse the disease, the most likely outcome is the death of the patient.

It is no accident that 2018 saw the highest level of central bank gold buying in 50 years. It is no accident that the past four quarters saw the highest level of central bank gold buying since the fiat experiment began. They know the current fiat financial system is in their death throws. Now you do to.