WALL STREET’S HIGHWAY ROBBERY: The Ultimate GLD & SLV Scam… By Lynette Zang

As central banks and market forces push yields into unchartered waters and pull the stock markets down with them, wall street touts gold and silver. They don’t want you to buy physical metals because that would remove wealth from their system, rather they want you to remain in fiat money products, like GLD and SLV, gold and silver ETFs.

Most people who buy these ETFs, perceive they own gold and silver, but they are merely beneficial owners of a wall street product designed to mimic the price moves of spot gold. Hidden in the prospectus contract, is the fact that the “amount of gold represented by the Shares will continue to be reduced during the life of the Trust due to the sales of gold necessary to pay the Trust’s expensesâ€, in other words, the amount of physical gold held for GLD and the amount of physical silver held for SLV will decline until, ultimately, no physical gold or silver will remain in the trust.

Additionally, the Shares are only issued in “book†form held by DTC, which means that you, as the investor, pay all fees, but can never be the legal registered owner, merely the beneficial owner. Regardless of perception, as an investor you have no ability to convert your shares into physical metals. Only “authorized participants†can take physical possession. Who might that be? Broker dealers like Fidelity or a commercial bank, like JP Morgan Chase. Of there are other brokerage houses and / or banks, but both of these examples have metal storage facilities. So, the investor in GLD and SLV would pay fees to them yet have no direct ownership or access.

There is an old adage that possession is 9/10th of the law, I would add that if you don’t hold it, you don’t own it. But even more can happen in the intangible world of Wall Street.

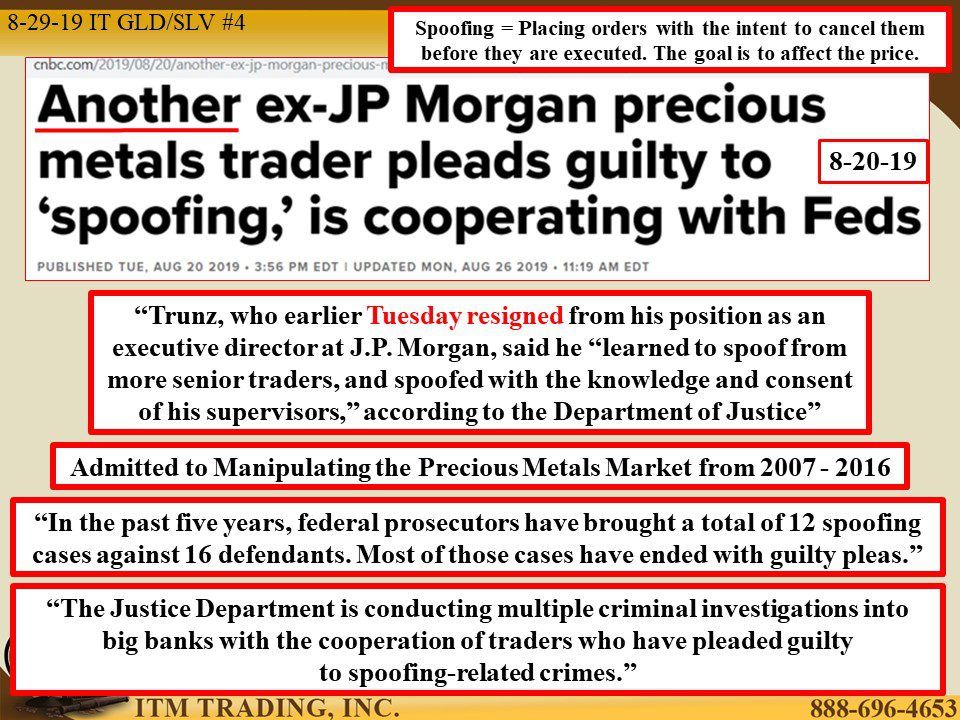

ANOTHER JP Morgan Chase precious metals trader just pleaded guilty to manipulating the gold and silver markets from 2007 through 2016. Further, he said, on the record, that he learned the manipulation technique from more senior traders who had the consent of Chase supervisors. What I found particularly interesting, is that this person was employed by Chase until September 17, 2019 as an executive director. Now, however, he is cooperating with the Justice Department in their ongoing investigation into big bank manipulation of the precious metals.

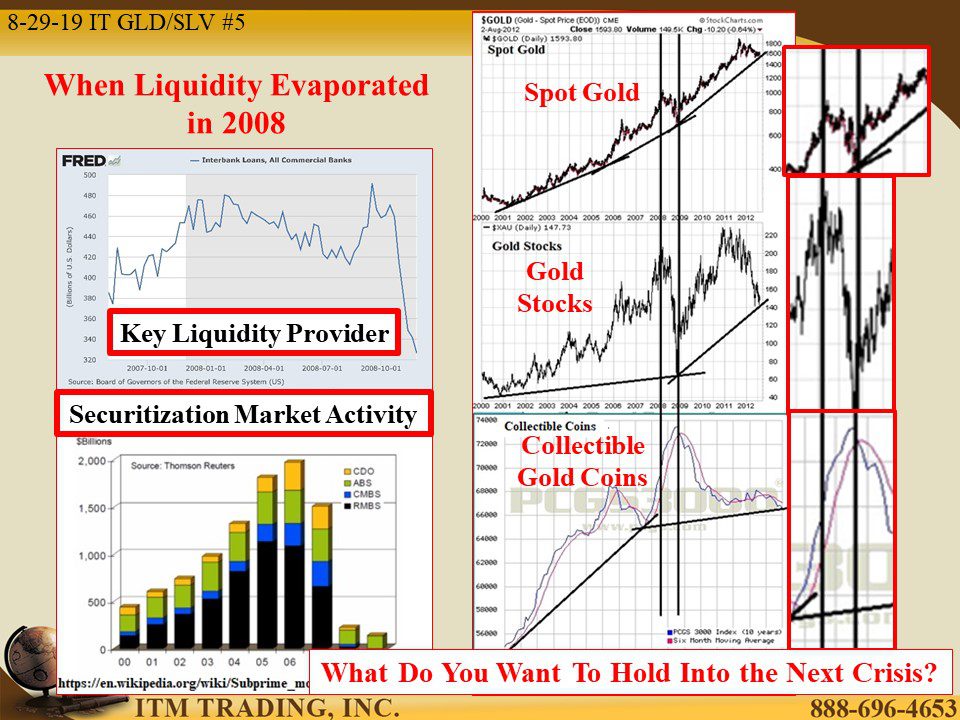

The 2008 market meltdown is a good example of what happens between wall street’s intangible gold and the physical only collectible gold coins. What happened?

When liquidity froze, wall street products dropped but the physical only, collectible gold coins made their this trend high. Why? Because wall street can and does create unlimited product with a computer key stroke, but anything physical has a finite amount. Therefore, it is the physical only markets that reflect true supply and demand dynamics. And that’s our opportunity today.

As central banks opened the QE money printing spigot, those intangible wall street markets have been inflated to severe overvalued levels as demand for real money declined. But that may now unwind in the reverse as the flight to safety picks up as bond markets scream risk on. Do you think an intangible contract will protect you?

Slides and Links:

https://fred.stlouisfed.org/series/IBLACBW027NBOG

YouTube Short Description:

As central banks and market forces push yields into unchartered waters and pull the stock markets down with them, wall street touts gold and silver. They don’t want you to buy physical metals because that would remove wealth from their system, rather they want you to remain in fiat money products, like GLD and SLV, gold and silver ETFs.

Do you think an intangible contract will protect you?