USA Today’s look back, and ITM’s Long-view of the 2008 Market / Banking Collapse

This week – September 9-15 – USA Today is doing a multi-part series looking back at the banking crisis and stock market collapse of 2008. They ask several questions such as, “Could it happen again?â€, and “What exactly happened?†The writers so far have done a keen job of tracing back to root causes of the domino-like collapse of America’s largest banks, International Insurance companies, and a Dow that dropped by more than 50%.

As far as answering the “Could it happen again?†question, Author Kevin McCoy points the reader in the direction of Alistair Barr’s article entitled “Beware: Wall St. debt re-packaging machine is back†which deftly points out that the out-of control practice of leveraging debt and packaging together securities that crippled Lehman Bros and reduced AIG to a colossal beggar is once again growing out of control, but his time “More intenselyâ€.

McCoy brings facts to bear regarding the timeline of the collapse, and it’s far reaching effects on what turned out to be a rather incestuous problem: Lehman Bros had exposure to billions of Dollars of bad debt and crumbled into bankruptcy, Merrill Lynch was not immune to the infected instruments and securities and was forced upon Bank of America like an unwanted growth. AIG had written Billions of Dollars of insurance on these now failing but far reaching financial viruses and the only one big enough to spread the bail-out ointment on the emaciated insurer was Uncle Sam. Uncle Sam was also rubbing GM with the same financial salve (read: your tax dollars)  to keep it from dying off. Meanwhile, everyday Americans were raiding their savings and 401K’s as costs and interest rates climbed. More banks failed, and the Money Market Mutual Funds had to be government guaranteed after so much was drawn out of the fund by nervous investors who didn’t want to end bearing the financial brunt of Lehman’s contagious collapse.

We recall these days and events at ITM Trading vividly. It was a tricky time in precious metals investing. Gold investing and investing in silver were hot topics. The precious metals prices were not immune to the sicknesses manufactured on Wall Street and in it’s minion banks. As the markets crashed, many who were holding long positions in gold had to sell in order to cover losses they were taking in other areas, the over-abundance of sellers pushed the metals’ prices down to near or even possibly below production prices. Inventory was tight. Silver was tough to come by, and the premium over spot silver pricing was growing by what seemed like leaps and bounds. Gold bullion was hard to come by, and even the rare coins were in short supply at times. Depending on what channel you had on at what time, investing in precious metals was either the smartest or dumbest thing you could do.

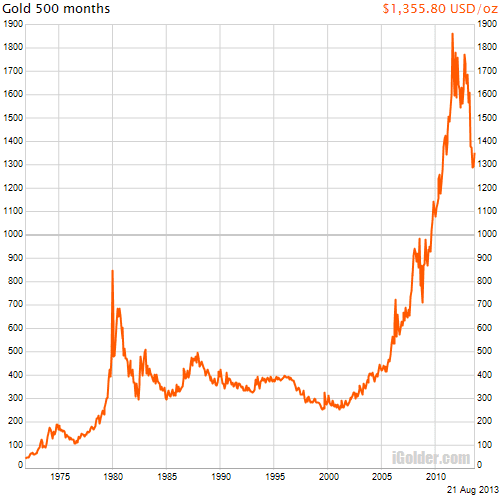

If hindsight is 20/20 the look back over the last 5 years casts some keen insights. Not only did gold and silver bounce of their lows and each respectively surpass their previous all time highs, they went on to outperform many analysts’ calls. Silver peaked at around $50 an ounce and today, at $24, has solidly rebounded from the $16 range that it fell from during the crash.

Gold performed similarly. Gold’s all time high pre-crash was about $1000 an ounce. Its bottom during the crash was about $750 an ounce. Gold then streaked to $1900 an ounce before pulling back to the current $1365 /oz. level.

There are plenty of people who lost it all in the market collapse of ’08. If you were holding Lehman shares, Citi stock, GM shares, or AIG certificates you can relate firsthand. Conversely, even if you bought in at the top of pre-crash precious metals pricing ($16 silver and $1000 gold) then you had a wild ride, but as long as you held onto your position, you ended up doing just fine. If you bought in at the lows of $8 silver and $750 gold you look like a financial genius.

If there is a lesson to be learned from these articles, may I suggest it be this: There will be another collapse. Those in power over the markets and banks haven’t changed. They are still greedy and not particularly brilliant. This time the Boom will be more catastrophic and further reaching. The losers will lose more and the winners will win big again. Take the opportunity to call ITM Trading at 1.888.OWN.GOLD and discuss your opportunity to come out on the right side of the coming 2nd round of a 2008 style stock market / banking instrument collapse.