US Gold Exports Are Up Huge. Where Is All The US Gold Going?

The United States has gold mines. The United States also imports tons of gold every year. The US Treasury says that the US has vaults full of gold. Yet, the government routinely leases and sells gold. In a way, the gold markets of today are much like the shell and pea con-game of old. There are numerous gold trades every day, but who really has the gold? Recently, Goldseek.com published an article written by Steve St. Angelo of SRSrocco Report, which covers precious metals and mining news. This article contained some startling information. US gold exports are up huge, really huge. Where is all the US gold going? This short article will answer the question.

US Gold Exports – What Are The Numbers?

First of all, let me reiterate that the gold referred to in this article is physical gold. Actual metal bars and coins that you can touch and feel, not paper gold contracts or futures or the like. This is the kind of gold that you need a vault in which to stack your bars.

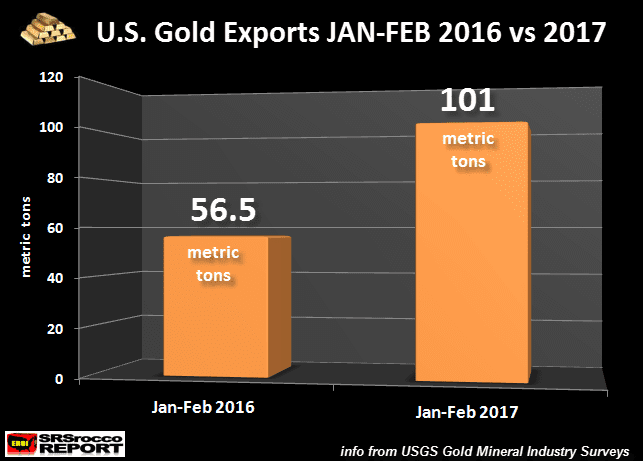

In the first two months of 2016, the US exported 56.5 metric tons of pure gold. During the same two months of this year, physical gold exports nearly doubled to 101 metric tons. An interesting point brought up in the report is that total US goldmine supply for this time period was only 80 metric tons.

Essentially, in addition to foreign interests buying every single ounce of gold produced by the US, they also consumed another 21 metric tons of gold from American vaults. While it would be helpful to know exactly where the 21 metric tons of gold were sourced from, the private nature of physical gold sales and transfers makes this quite unlikely.

US Gold Coins On Sale! Click Here

What we do know, however, is that there is a massive transfer of wealth taking place. When demand doubles, such as in this case, it is not unwise to think that a shift in financial thinking is afoot. To delve deeper into possible motives for US gold exports taking such a big swing, let’s look at where the US gold is going.

US Gold Exports : The Usual Suspects.

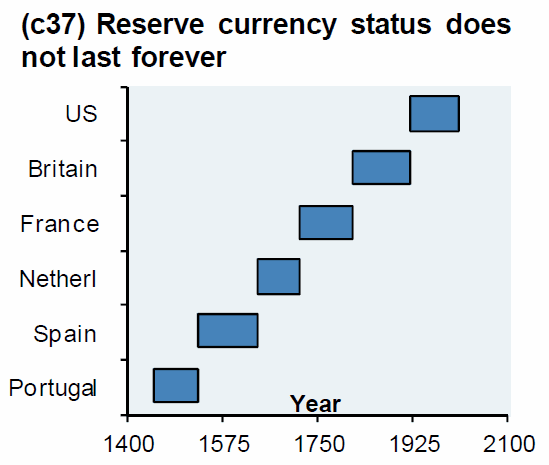

India consumes gold at an astonishing rate. So does China. Both of these countries share a similar financial ideology; they understand that physical gold is a currency, a store of value, and portable wealth. This fact alone, however, should be frightening to you. Chances are that the majority of your savings and market investments are denominated in US dollars.Currently, the US dollar is the reserve currency of the world. This is only true for a small number of reasons.

Perhaps the strongest reason is that the other nations around the world agree to participate in this set-up. When confidence in the dollar falters or collapses, the US dollar will join a long list of currencies that used to be the world reserve currency. Check your history. You will find that many nations have held the world reserve currency at one time or another. When the dollar does lose it’s status as the reserve currency of the world, it will drop in value. No one knows how much. 25%-30% would be a low estimate. Some analysts would say 65%-85% would be a more realistic decline in value.

Yet, the darkest naysayers say the dollar will not survive simply because the debt load attached to the US dollar is just too great. They forecast a 100% or near 100% collapse of the US dollar. In any event, someone will be right, and it is just a matter of time before we know who.

US Gold Exports : Own Your Own Gold.

Add physical metals to your portfolio today. Take heed from the Chinese and the Indians. Do your own due diligence. You will find out that the Chinese economy is quite overheated. They have a huge real estate bubble happening. The Chinese are also tired of purchasing US debt and US Treasury bills. The Chinese are snapping up every bit of gold they can find.

Likewise, is the situation in India.If you do some quick research you will find out that India is in the middle of a currency crisis. Many of the paper notes are forgeries. So many in fact, the Indian government decreed all of the 500 and 1000 rupee notes as worthless. Indians rushed to trade paper for gold. At one point, the government tried to curb or even outlaw gold sales, but that didn’t work. In India, gold demand soared.

Don’t wait until the US dollar is faltering to begin acquiring gold. Don’t wait until the US enters it’s own currency crisis. Open an account with ITM Trading today. ITM Trading makes owning gold easy.