THE UNSEEN TRIGGER How Consumers Can Cause the Next Crash by Lynette Zang

Governments, bankers, Wall Street and main street media want you to believe that all is well. That the economy is growing, fiat markets are not overvalued, and THIS TIME IS DIFFERENT.

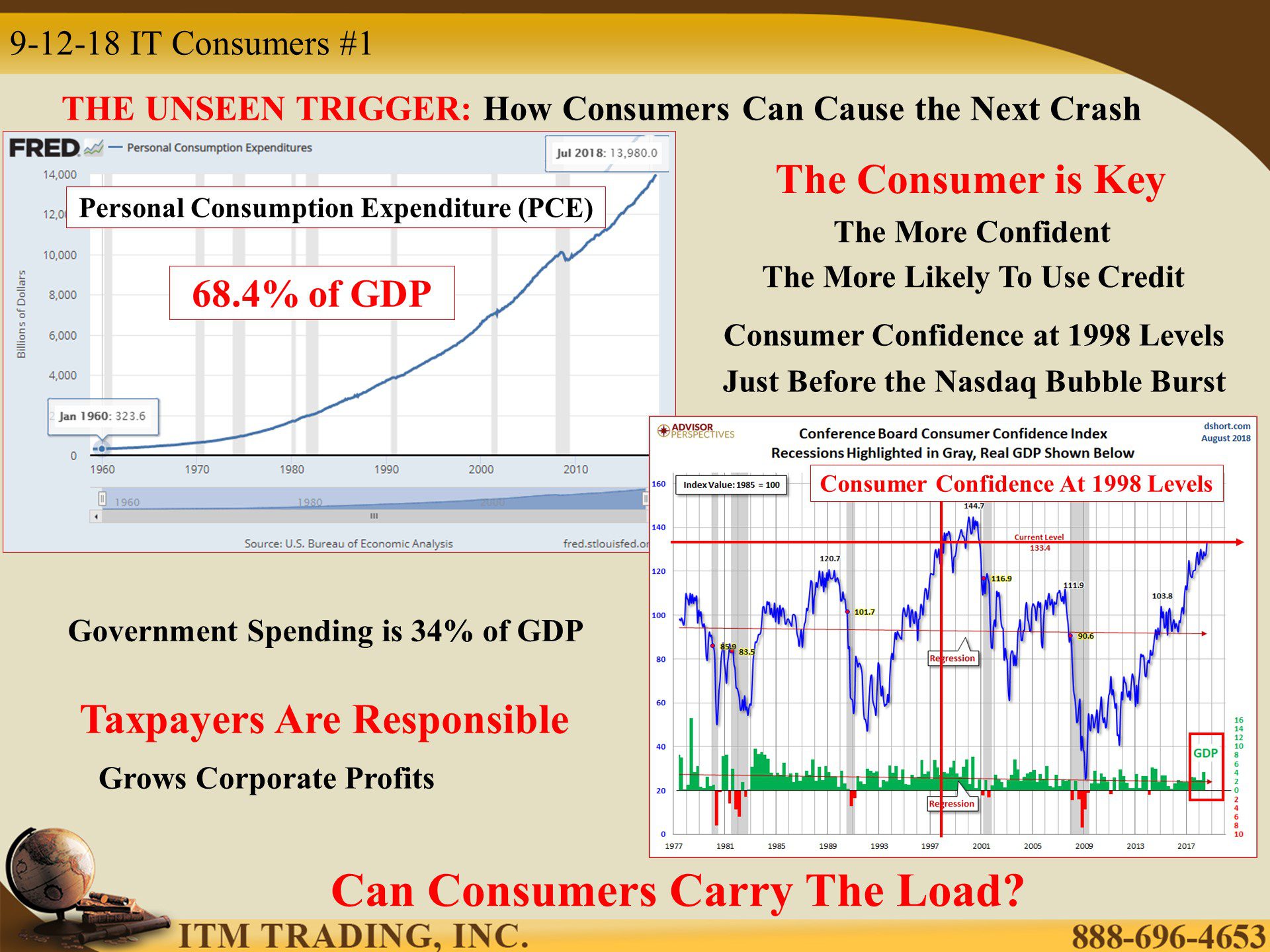

Their goal is to keep you inside a fragile and dying system making wealth transfer voluntary. In fact, they NEED you, the consumer, to stay the course and continue to borrow and spend since consumer spending is 68.4% of the US GDP. Government spending is 34% of GDP and taxpayers are responsible to repay that.

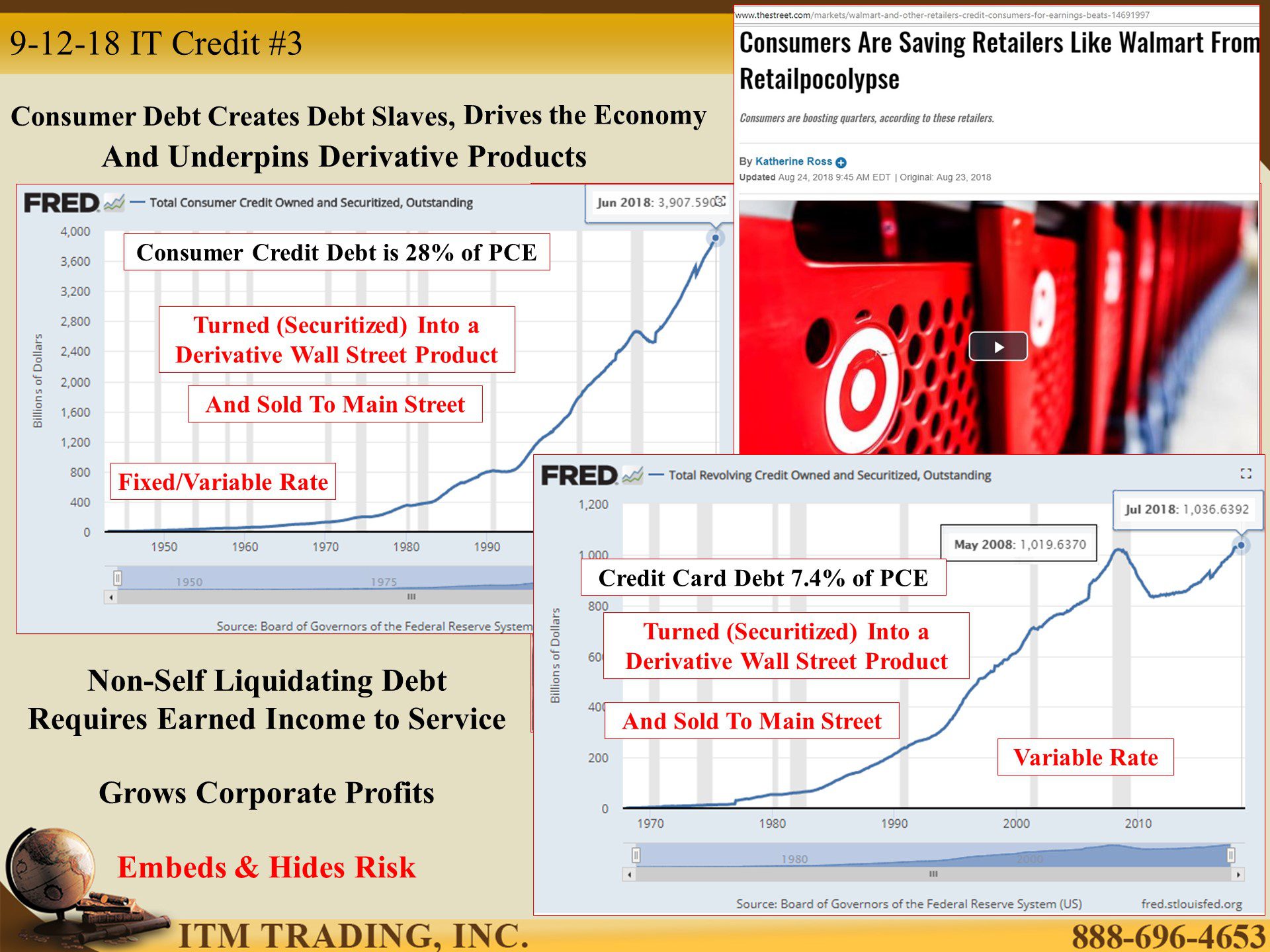

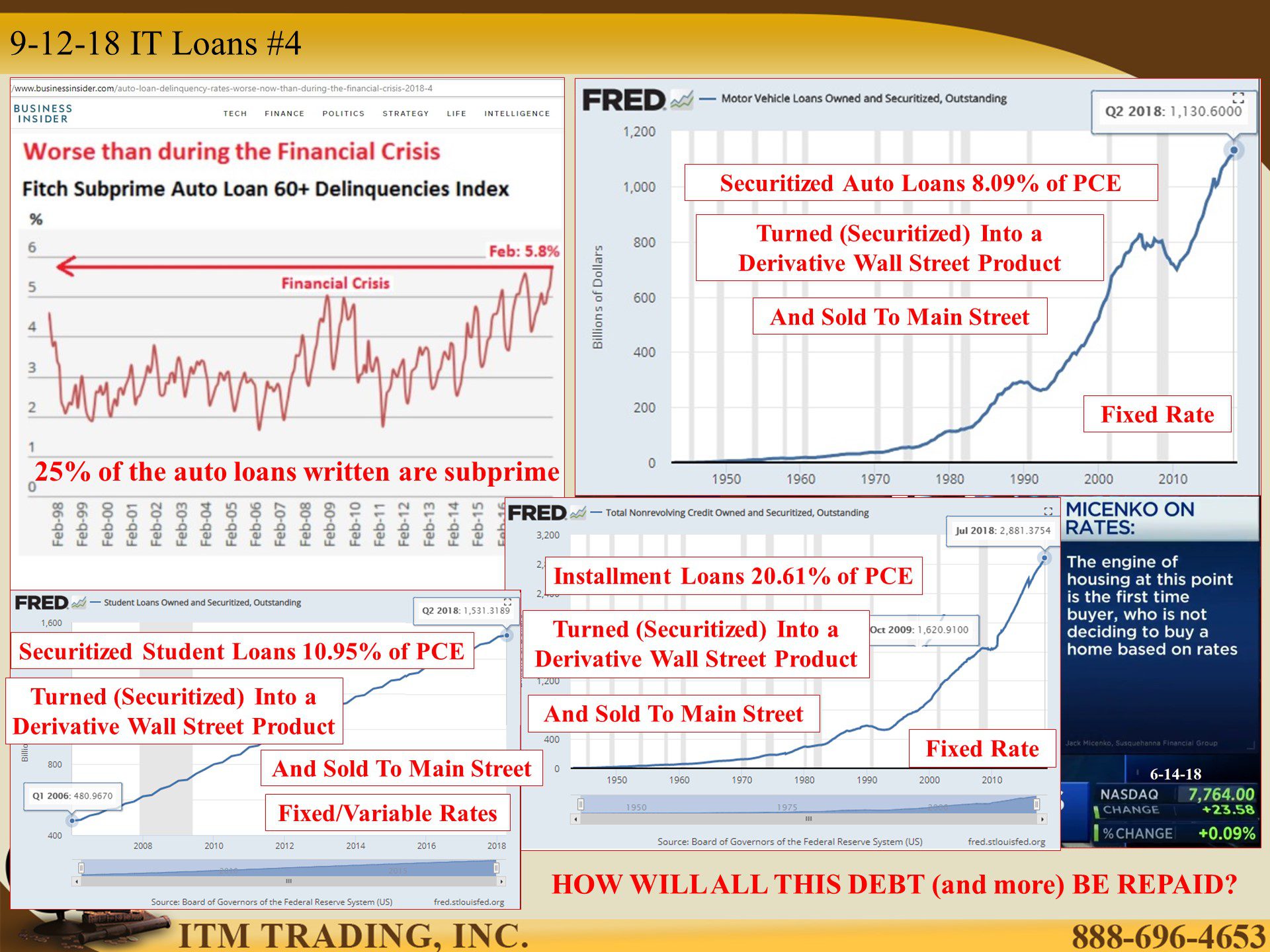

Most of that spending is funded by debt. Wall street then turns that debt into derivative products and sells it back to main street through mutual funds and ETFs that are held in private and retirement accounts.

Which is genius really. After all, banks collect interest on the debt and fees to create and then “manage†these wall street products, all the while transferring risk back to main street.

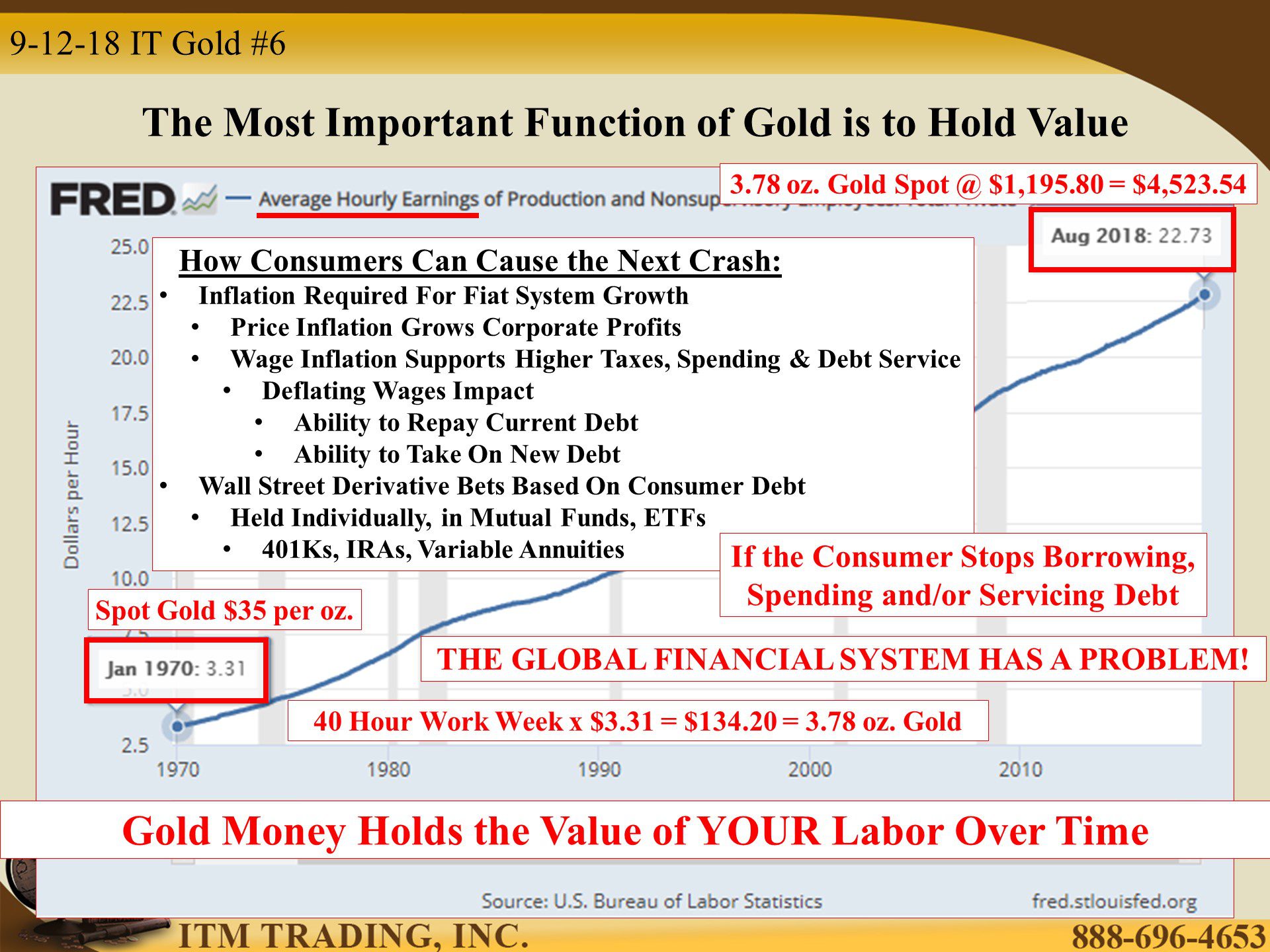

Which really means that the fate of the inflated, leveraged and debt bloated US economy rests fully on the shoulders of consumers and taxpayers (main street). If, for any reason, enough consumers stop paying, borrowing or spending, central bankers will not likely to be able to avoid the next visible financial crisis.

And the cracks in the system have begun to show. As example, 25% of all auto loans are to subprime borrowers. According to Fitch Grading Services, subprime auto loan delinquencies are higher now than during the last financial crisis. Do you know if you are exposed?

It’s All About the Debt

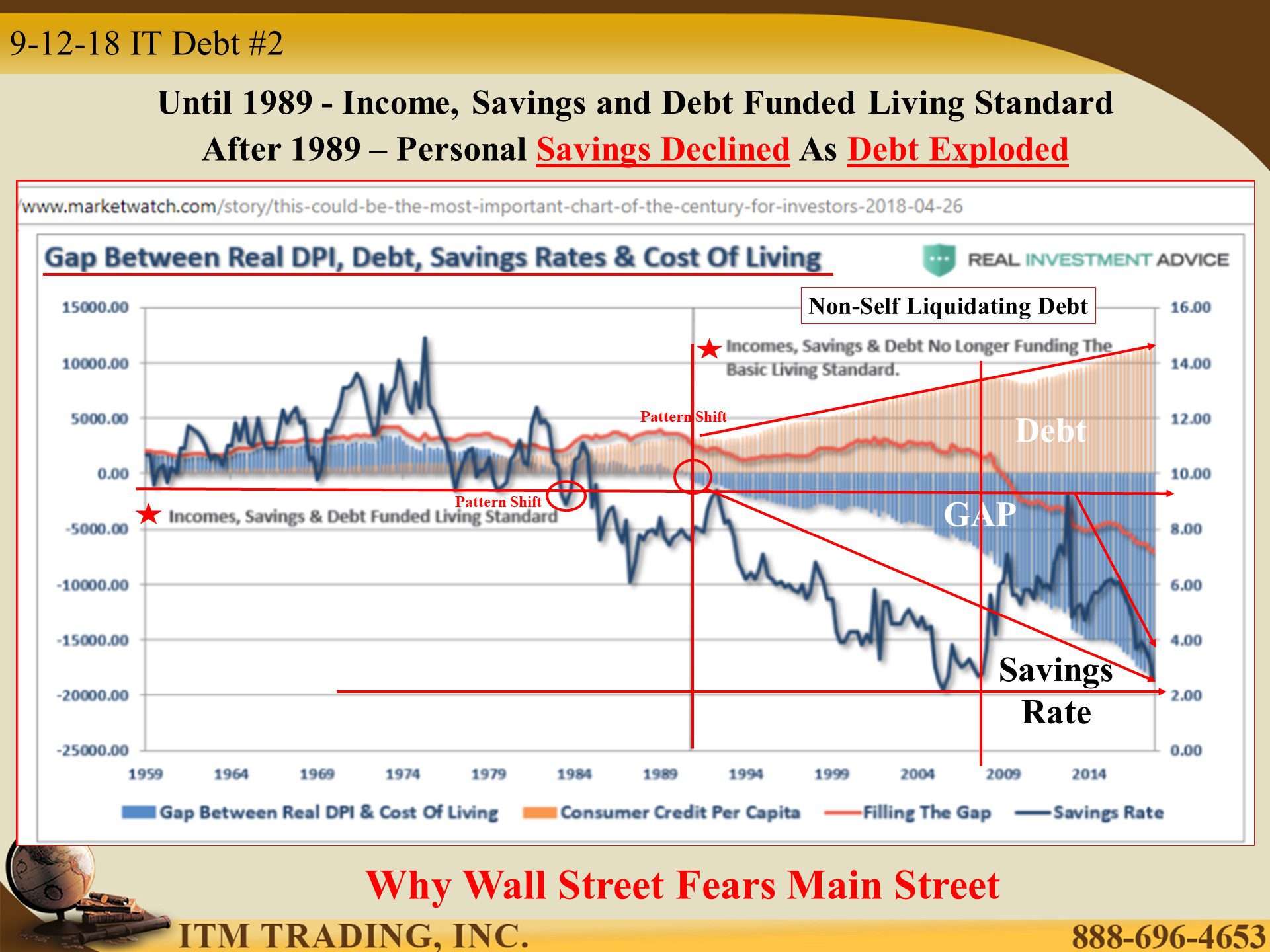

There are two types of debt; Self-Liquidating and Non-Self-Liquidating. Corporations take on self-liquidating debt to expand their business and generate the income to repay that debt. Consumers take on non-self-liquidating debt to consume, therefore, debt is serviced by earned income.

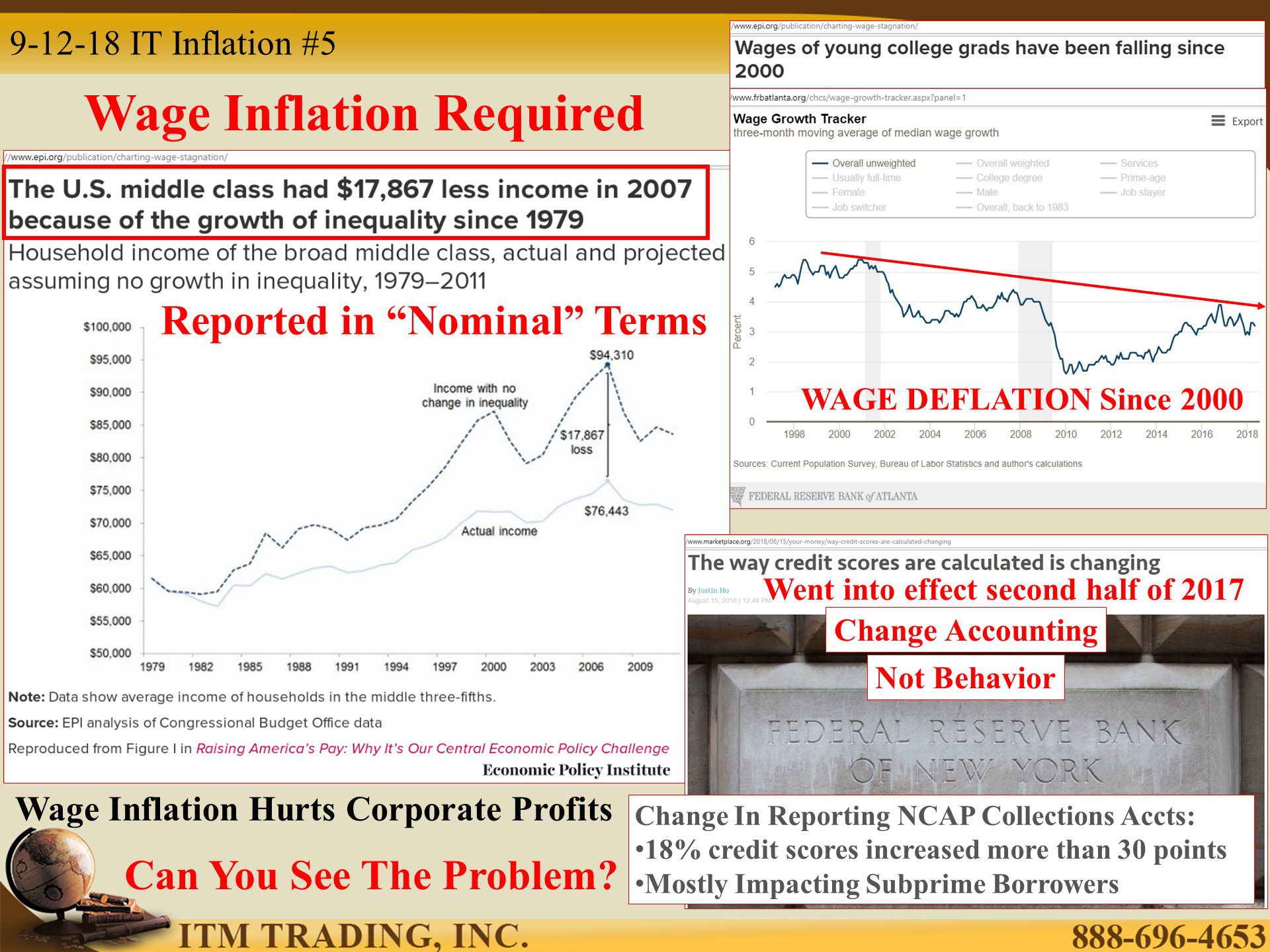

For consumers, income must increase as debt and interest payments increase, if it does not, at some point, default is guaranteed. And that’s where we are right now.

Rather than changing behavior and discouraging borrowing, the way credit scores are calculated changed in the second half of 2017. This has resulted in a large boost in credit ratings, particularly for subprime borrowers. This should allow those who can least afford it, to borrow more.

J. Paul Getty said it best, “If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the banks problem.†But when that debt has been turned into a product and sold back to the public…We all have a problem.

What can you and I do? The same thing that has works for thousands of years. Convert excess fiat money into physical gold and silver. History proves it will hold the value of your labor over time.

Slides and Links:

https://fred.stlouisfed.org/series/PCE

https://www.wsj.com/articles/u-s-consumer-confidence-surged-in-august-1535465989

https://www.advisorperspectives.com/dshort/updates/2018/08/20/margin-debt-and-the-market

https://fred.stlouisfed.org/series/CPIAUCNS

https://money.cnn.com/2018/06/14/news/economy/retail-sales-consumer-spending/index.html

https://fred.stlouisfed.org/series/NONREVSL

www.thestreet.com/markets/Walmart-and-other-retailers-credit-consumers-for-earnings-beats-14691997

https://fred.stlouisfed.org/series/REVOLSL

https://www.epi.org/publication/charting-wage-stagnation/

http://libertystreeteconomics.newyorkfed.org/2018/08/just-released-cleaning-up-collections.html

https://www.cdiaonline.org/resources/furnishers-of-data-overview/changes-to-guidelines/

https://www.frbatlanta.org/chcs/wage-growth-tracker.aspx?panel=1

https://www.marketplace.org/2018/08/15/your-money/way-credit-scores-are-calculated-changing

https://fred.stlouisfed.org/series/AHETPI

YouTube Short Description:

J. Paul Getty said it best, “If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the banks problem.†But when that debt has been turned into a product and sold back to the public…We all have a problem.

What can you and I do? The same thing that has works for thousands of years. Convert excess fiat money into physical gold and silver. History proves it will hold the value of your labor over time.