UK FUELS GLOBAL UNCERTAINTY: Why Gold is certain in an Uncertain World, UK & Brexit Update by Lynette Zang

Disillusioned by growing income inequality and broken promises, on June 23, 2016 the British people voted to leave the European Union. Almost three years later, how to leave is still up for grabs. As of May 24, 2019, Theresa May resigned as prime minister of Great Britain, after many failed attempts at negotiating an exit from the European Union. The most stunning failures came from within Great Britain’s political system.

At the same time, Nigel Farage’s new Brexit Party has come into being and risen in popularity. If he takes Theresa May’s place, a hard Brexit is the most likely outcome.

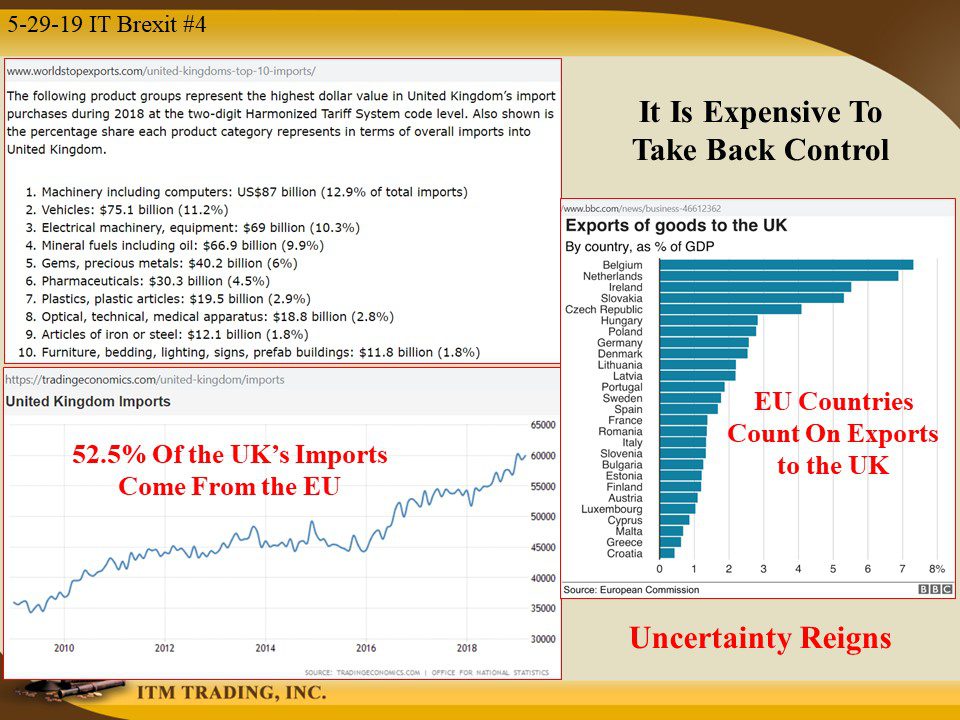

The biggest threat to the global financial system plumbing, the derivative bets traded through the City of London, was removed in February when the world agreed to continue trading there, but what happens with imports and exports remains an issue. A hard Brexit would negatively impact the flow of goods and services between Great Britain and the EU and exacerbate the global trade crisis already evolving.

Great Britain imports 52.5% of all goods and services from EU members. Conversely, these same countries are dependent upon the purchases of their goods by Great Britain. A hard Brexit stops this flow and would have a negative impact on EU/UK GDP and the public that is dependent on the income and cash flow of imports and exports.

Populism and nationalism have been growing globally, particularly since the financial crisis of 2008. This is the real issue for the traditional elite. Because it shows the erosion of public confidence.

The entire fiat system is faith based and requires confidence to remain in power. Importantly, the fiat currency is backed by “The Full Faith and Credit of the Government†and the markets are supported by public participation, if not in new money, then, at the least, by keeping wealth inside the system.

So what happens when that confidence is lost? Credit freezes and markets crash as the illusion of fiat wealth is shattered. Right now, uncertainty reigns as a plethora of black swan events threaten global financial stability.

That is why central bank gold buying is at the highest on record in the latest four quarters. Perhaps that is also why, in UK, citizens have boosted their gold purchases to the highest level since 2012, just before the sovereign debt crisis became apparent in Europe. This IMF told us in their global financial stability report, that government bonds of advanced economies (US, EU, Japan, UK) are now 100% vulnerable, which means a shock would topple the government debt house of cards. Central bankers know this, they’re members of the IMF.

They also know that gold is certainty in an uncertain world.

Slides and Links:

https://www.bbc.com/news/live/uk-politics-48394091

https://www.cnbc.com/2019/05/24/theresa-may-step-down-as-uk-prime-minister.html

http://www.worldstopexports.com/united-kingdoms-top-10-imports/

https://www.bbc.com/news/business-46612362

https://www.tradingeconomics.com/united-kingdom/imports

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q1-2019/investment

YouTube Short Description:

As of May 24, 2019, Theresa May resigned as prime minister of Great Britain, after many failed attempts at negotiating an exit from the European Union. At the same time, Nigel Farage’s new Brexit Party has risen in popularity. If he takes Theresa May’s place, a hard Brexit is the most likely outcome.

A hard Brexit would negatively impact the flow of goods and services between Great Britain and the EU and exacerbate the global trade crisis already evolving.

Populism and nationalism have been growing globally, particularly since the financial crisis of 2008. This is the real issue for the traditional elite. Because it shows the erosion of public confidence.

Perhaps that is also why, in UK, citizens have boosted their gold purchases to the highest level since 2012, just before the sovereign debt crisis became apparent in Europe. They also know that gold is certainty in an uncertain world.