Two Paradigm Shifts On The Dollar And Gold

Stocks, bonds and cash have a foundation in dollars as opposed to Gold. Look at the dollar chart and you will see that the trend is clearly down.

By: Lynette Zang

When all dollar based assets become suspect, the wealth will shift toward physical metals as the only trusted asset class. We are not there yet, but there is change in the air.

I believe we are about half way through two paradigm shifts that began last year.

The first is around sovereign debt (government bonds). Many countries rely on borrowed money to fund spending. We are trained to have full faith in our government’s ability to pay all debt obligations. But with the arguments around the US debt ceiling and the questions surrounding the sovereign debt of Euro Zone countries, that blind trust is coming under suspicion. Here in the US, Standard and Poor’s has lowered our AAA credit rating one notch, which is something previously unheard of.

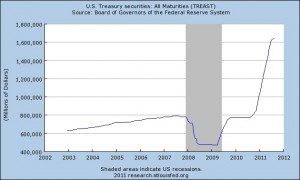

Anything that says “I promise to pay you back with interest†is a debt instrument. When there were not enough buyers of our bonds to fund deficit spending, the Federal Reserve stepped in with Quantitative Easing (buying back our own debt). Notice that we didn’t take such action prior to 2003, but have done so quite dramatically since March 9, 2009.

Quantitative Easing is occurring in the Euro Zone as well, with the ECB purchasing 22 billion Euros worth of Italian and Spanish bonds just last week.

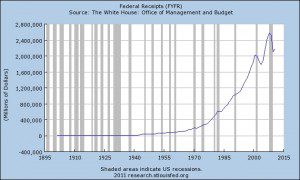

It is a problem when governments and central banks have been loading their books up with debt at the same time that the revenues (taxes) to pay the debt have been falling, revealing a systemic debt problem that has been growing over many years which the markets are now starting to recognize.

With all of the market volatility, some of the “flight to safety†has gone to government bonds. At some point, this will change, as the realization that you cannot fix the problem of too much debt with more debt, sinks in to the public’s psyche. Then the flight to safety will be to physical gold and silver.

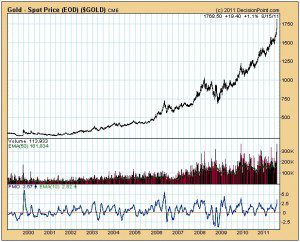

The second paradigm shift is in the way gold is thought of. Last summer was the first time I heard main stream TV refer to gold as “an alternative currency†and a “flight to safety asset.â€Â Now even Cramer of CNBC refers to himself as “a gold bug and proud!†Gold is now referred to as the reserve currency for governments and since July 2011, gold is on CNBC’s bottom scroll bar and for the first time there are volume numbers on the decision point charts. Let’s take a look.

Look at the middle of the chart at the volume of digital gold traded. The green line is moving in an upward direction as the spot price is moving up. This indicates an influx of buyers, a sign that we are now in the “awareness†phase (2nd phase of a typical 3 phase bull market). You may also notice that volatility in the spot price has grown as the volume has grown. This is normal action in this phase and is indicative of a paradigm shift. While it is mostly market pundits in a primarily digital market so far, there is also a shift out of digital and into physical that is beginning to happen. The general public is only minimally participating as physical gold is the most under owned asset.

But when you own gold and silver, you are up against every central bank in the world. They do not want gold to become too visible. Therefore, the CME raised the margin requirement to control the digital price. Perhaps Ben Bernanke doesn’t think of gold as money, but the markets do now.

Eventually, the masses will as well. As they fly to the safety of physical monetary metals, there will be a wall of wealth move like never before to gold.