Tomorrow’s Rate Cut: Can the Fed Really Engineer a Soft Landing?

As we approach the Federal Reserve’s highly anticipated Fed Rate Cut decision on interest rates, the weight of uncertainty looms large over the U.S. economy. Investors, financial experts, and everyday Americans are waiting with bated breath to see how the Fed’s decision will impact markets, jobs, and personal wealth. In her latest analysis, former Federal Reserve insider Danielle DiMartino Booth provides a candid look at the swirling controversies and economic challenges that come with a potential Fed rate cut in 2024.

At ITM Trading, we believe that understanding these critical shifts is essential for safeguarding your wealth, especially in times of economic turbulence. In this blog, we will break down Booth’s key insights, explain what the Fed’s actions could mean for your financial future, and provide strategies to help you protect your wealth during these uncertain times.

The Fed Rate Cut in 2024: A Tipping Point for the Economy

Danielle DiMartino Booth describes the current debate within the Federal Reserve as one of the most contentious moments of her career. With inflation pressures, job losses, and recession fears all building, the Fed is stuck between two difficult choices: cutting rates by 25 basis points (0.25%) or making a more aggressive 50 basis point (0.50%) cut.

Why does this matter so much? Because interest rates play a central role in the economy. Lowering rates can stimulate growth by making borrowing cheaper for businesses and consumers. But it also carries risks—especially for retirees and savers who depend on the interest income from their bonds or savings accounts. The prospect of a Fed rate cut in 2024 could have significant effects on those with fixed incomes, making it harder to preserve wealth through traditional savings vehicles.

Many experts are split on the issue. Some believe that the Fed should make a significant rate cut to stimulate the economy and avoid a deeper recession. Others, including some major Wall Street banks, argue that a slower approach with smaller cuts would be more prudent. Whatever the outcome, the Fed’s decision will have ripple effects across the economy, influencing everything from mortgage rates to stock prices.

Are We Already in a Recession? The Signs Say Yes

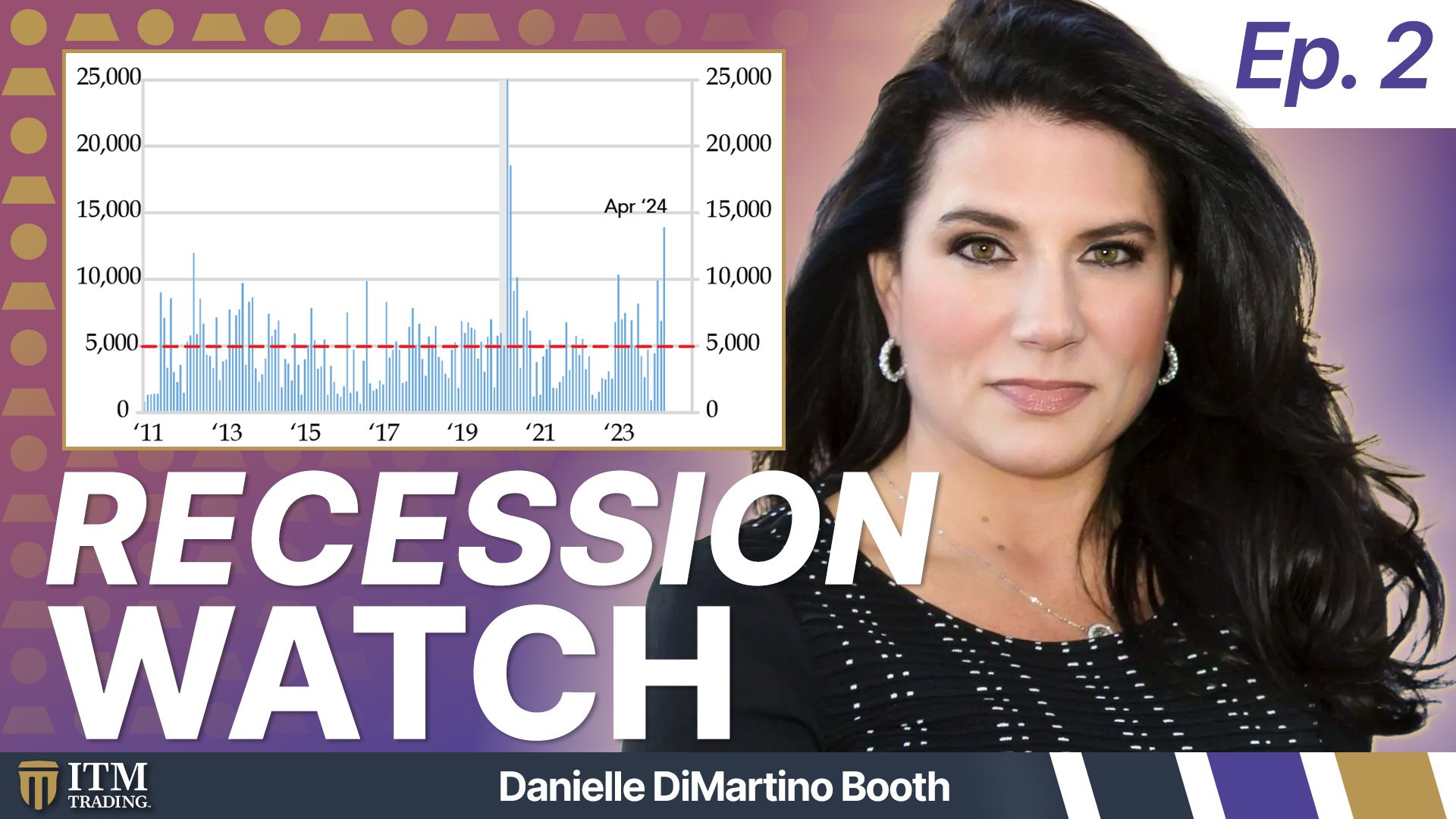

One of the most significant points that Danielle DiMartino Booth highlights is the growing evidence that the U.S. is already in a recession, even if official data has yet to declare it. She points to multiple recession indicators that are sending strong warning signals, including rising layoffs, reduced full-time employment, and a growing number of part-time and gig economy workers.

Why are these indicators so important? Because recessions are often recognized too late. Booth recalls how, during the 2001 recession, it took over a year for the official data to be revised and confirm what many already knew—that the economy was contracting. Similarly, in today’s environment, economic indicators like layoffs from major corporations such as Boeing, PricewaterhouseCoopers, and Verizon signal that the downturn has already begun.

Unemployment and Underemployment Trends

The official unemployment rate has begun to tick upwards from its recent low of 3.4%, but Booth warns that we could see it rise to at least 6% before the situation stabilizes. In addition, underemployment is becoming a major concern, with a growing number of Americans working part-time or in gig jobs (like Uber or DoorDash) because they can’t find full-time employment. The current rise in underemployment mirrors what was seen during the Great Recession, and it serves as a stark reminder of the fragile state of the labor market.

For those nearing or already in retirement, these recession indicators are troubling. A weakening job market and a slowing economy can negatively impact investments, pensions, and overall financial security. With the Fed potentially waiting too long to take corrective action, the risks to personal wealth grow with each passing day.

Inflation, Deflation, and the Impact on Your Wealth

One of the most confusing aspects of the current economic environment is the mix of both inflationary and deflationary forces at play. On one hand, we’ve seen inflation remain stubbornly high in certain sectors like energy, while deflationary pressures are being felt in areas like retail, where companies are slashing prices to stay afloat. This “push-pull” effect makes it difficult to predict where the economy is heading.

In this uncertain environment, traditional financial assets like stocks and bonds are subject to extreme volatility. But one asset class has shown consistent strength throughout economic turbulence—gold.

Why Gold Remains a Reliable Safe Haven

Danielle DiMartino Booth emphasizes that gold remains resilient even as the Federal Reserve prepares for its first interest rate cut in four years. Despite the expectation that the Fed’s actions will push inflation lower, gold continues to be viewed as a safe haven for investors. This is because gold historically performs well during periods of economic uncertainty and market volatility.

Gold’s appeal goes beyond its historical performance. It offers tangible value that isn’t tied to the strength or weakness of a particular currency, government, or financial system. While stocks and bonds are subject to market risks, gold’s intrinsic value makes it an attractive hedge against inflation, currency devaluation, and economic instability.

For individuals over 50 who are focused on preserving their wealth, adding physical gold to their portfolio can provide a layer of protection against the unpredictable swings in the economy. Whether the Fed’s rate cut in 2024 sparks a prolonged downturn or triggers a short-term recovery, the safety that gold offers should not be overlooked.

What Should You Do Next?

If you’re concerned about the impact of the Fed rate cut in 2024, rising recession indicators, or the growing volatility in the markets, it’s time to take action. Gold and silver can play a critical role in protecting your wealth and providing security during uncertain times.

At ITM Trading, we specialize in helping individuals like you safeguard their financial future with personalized strategies that include physical precious metals. Our team of experts will work with you to create a tailored plan that fits your retirement goals and risk tolerance.

Protect Your Wealth with ITM Trading

Don’t wait for another market downturn to take control of your financial future. Protect your wealth today by diversifying with gold and silver. Schedule a free strategy call with one of our specialists to learn more about how precious metals can help secure your retirement during these uncertain times. At ITM Trading, we’re here to help you navigate the complexities of today’s economy with confidence.

Schedule Your Strategy Call Now or call 866-948-1850