TIME IS RUNNING THIN: Now, Even The 1% Are Scared… by Lynette Zang

A recent IMF survey of 17 advanced economies looked at every financial crisis between 1870 through 2013 and found that there is “a strong link between inequality and financial stability.†A quick look around the globe verifies that populism and political upheaval fires are indeed burning. (Hong Kong, Iran, US, Brexit etc.)

Further, this study states that financialization (wall street more important than main street) is the root cause stating that “complicated financial instruments, influential lobbyists, and excessive compensation in the banking industry can lead to a system that serves itself.†SHOCKER!

Have more questions that need to get answered? Call: 844-495-6042

Let’s remember that the IMF members are global central bank chiefs and treasury secretaries, bankers and politicians that have positioned and funded the global shift and it began in 1913 when the Federal Reserve and fiat money (government legalized money) was created.

Inflation was the key component of this new monetary system because it creates nominal confusion where numbers hide the decline in purchasing power value. For governments, inflation imposes a tax that does not need to be legislated and made visible. For corporations, wage inflation creates the illusion of higher pay while hiding the decline in real wages.

In 1971 the average wage was $9,870. In 2019 the average was $48,672 according to the BLS (Bureau of Labor Statistics). Which would you rather have? Additionally, a family of four needed one wage earner to meet their basic needs and today it takes two.

Had the average worker been paid in ounces of gold in 1971, that would have been 282 ounces at $35 per ounce. At the current spot price of $1,570.40 per ounce, without a raise, that total wage would be $442,852.80 and most families of four could live well on that with one wage earner.

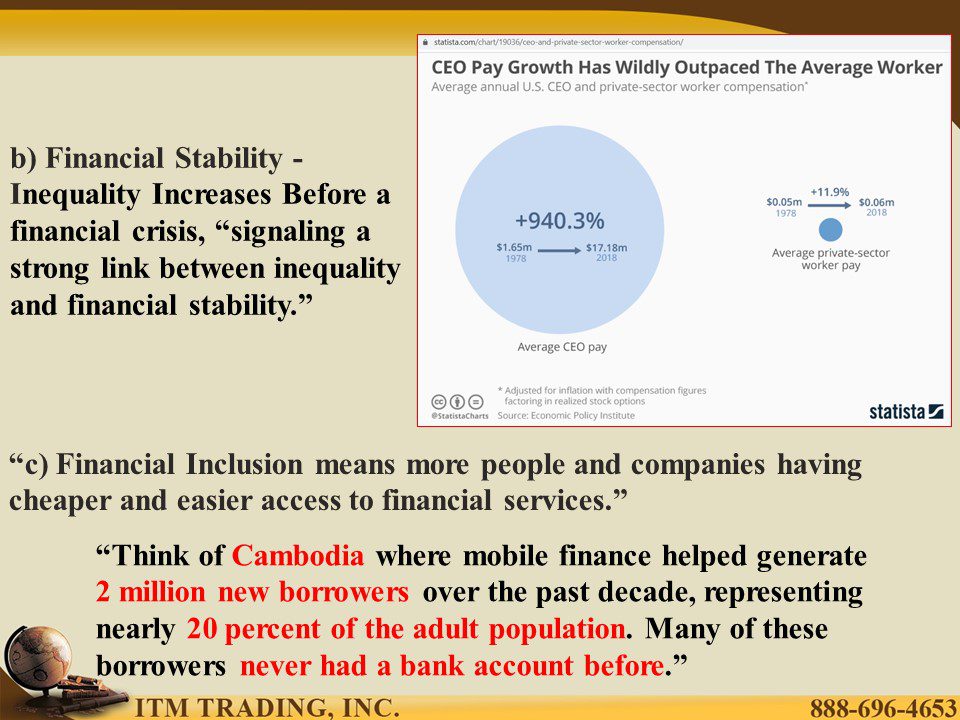

Where has all that wage inflation gone? Into CEO pay. According to data from statista, between 1978 and 2018 CEO pay has increased 940.3% while the average workers wage has only increased 11.9%. In fact, income inequality is now greater than it was in 1929!

What’s their answer? Financial inclusion, which means getting the unbanked into the debt system. Using Cambodia and Fintech as an example. Adding “2 million new borrowers†or “20 percent of the adult population†many who have “never had a bank account before†seems to me like more of the same.

Nowhere in their documents do they mention financial education about debt.

Of course, not all debt is bad. Self-liquidating debt can be a very good thing (i.e. taking on debt to build a business that generates the money to repay the debt) but consumer debt that requires debt to be serviced out of wage income may mean the debtor becomes a debt slave. Unfortunately, I believe that is the goal.

Further, a recent study by the Atlanta Federal Reserve shows that “when banks face liquidity shocks (aka funding stops), they are more likely to pass on these shocks to consumers who are least able to hedge against them. Consequently, our results show who bears the real costs†Another SHOCKER!

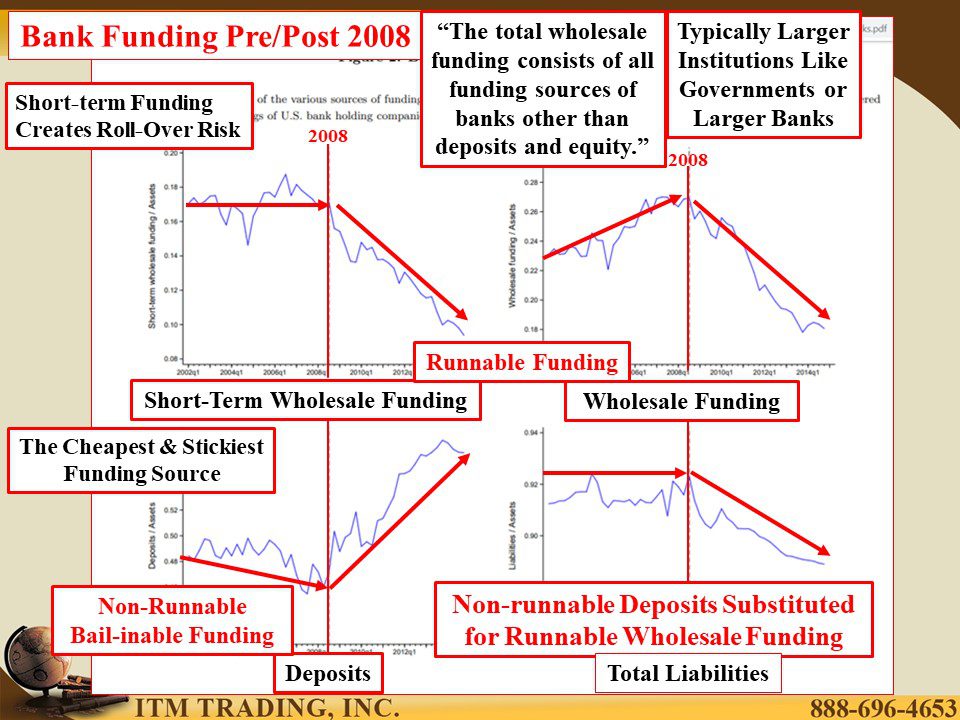

While central bankers want you to believe they just have your best interest at heart, the data in this report shows how funding the banks have shifted from the elite few (wholesale funding by governments, central banks and larger banks) to public deposit funding (after the great recession began in 2008) and QE free money printing hid the shift.

Why the shift? Because wholesale funding is “runnable†and could stop in an instant as we saw in 2008 when liquidity dried up in 24 hours, remember that? But bank deposits are considered “sticky†and with deposit insurance, not likely to run (FDIC was created on June 16, 1933).

Fed data shows that non-runnable deposits, which are also bail-inable, have been “substituted†for runnable wholesale funding. This matters to all of us because when it gets too expensive to keep these truths hidden, the music will stop and we know that the public will be left without a chair.

Who will have chairs? Those who hold real money gold. It really is that simple.

Slides and Links:

https://www.imf.org/en/News/Articles/2020/01/17/sp01172019-the-financial-sector-in-the-2020s#_edn11

https://www.imf.org/en/News/Articles/2020/01/17/sp01172019-the-financial-sector-in-the-2020s#_edn11

https://www.statista.com/chart/19036/ceo-and-private-sector-worker-compensation/

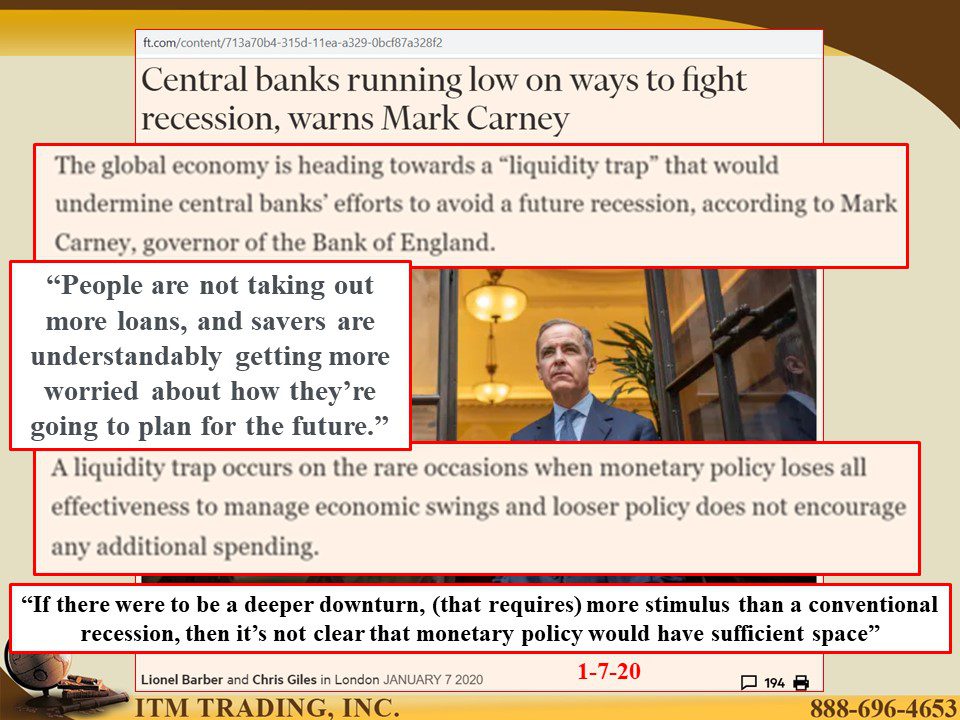

https://www.ft.com/content/713a70b4-315d-11ea-a329-0bcf87a328f2

https://www.ft.com/content/b19b3458-3d25-11ea-b232-000f4477fbca

https://fred.stlouisfed.org/series/CUUR0000SA0R

https://fred.stlouisfed.org/series/GOLDAMGBD228NLBM

https://fred.stlouisfed.org/series/CPIAUCSL

YouTube Short Description:

A recent IMF survey of 17 advanced economies looked at every financial crisis between 1870 through 2013 and found that there is “a strong link between inequality and financial stability.â€

In 1971 the average wage was $9,870. In 2019 the average was $48,672 according to the BLS (Bureau of Labor Statistics). Which would you rather have? But a family of four needed one wage earner to meet their basic needs and today it takes two.

Had the average worker been paid in ounces of gold in 1971, that would have been 282 ounces at $35 per ounce. At the current spot price of $1,570.40 per ounce, without a raise, that total wage would be $442,852.80 and most families of four could live well on that with one wage earner.

Where has all that wage inflation gone? Into CEO pay. According to data from statista, between 1978 and 2018 CEO pay has increased 940.3% while the average workers wage has only increased 11.9%. In fact, income inequality is now greater than it was in 1929!

In addition, Fed data shows that non-runnable deposits, which are also bail-inable, have been “substituted†for runnable wholesale funding which is provided by governments and central banks.

This matters to all of us because when it gets too expensive to keep these truths hidden, the music will stop and we know that the public will be left without a chair.

Who will have chairs? Those who hold real money gold. It really is that simple.