THRESHOLD BREACHED: Critical Fed Report…by Lynette Zang

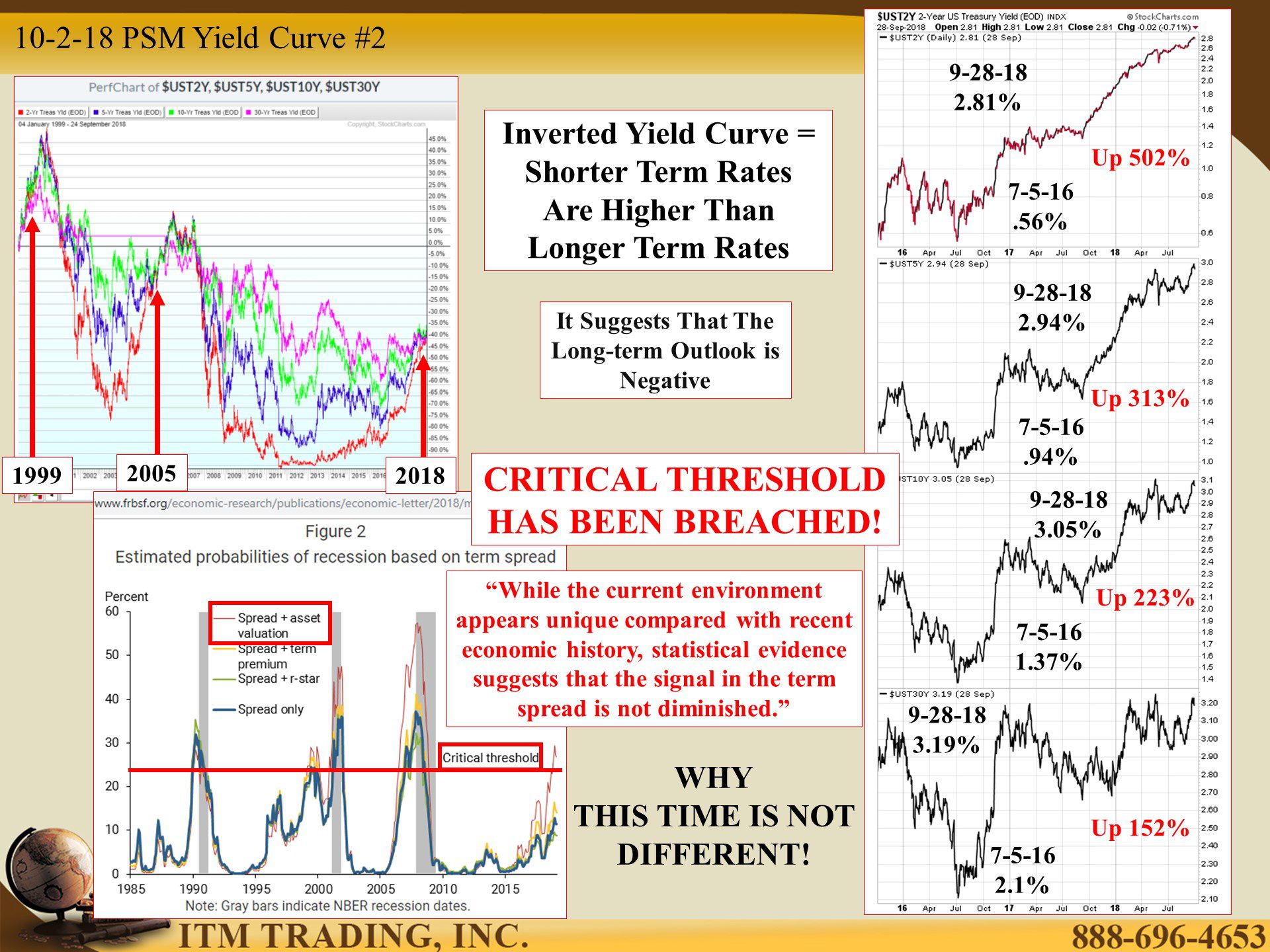

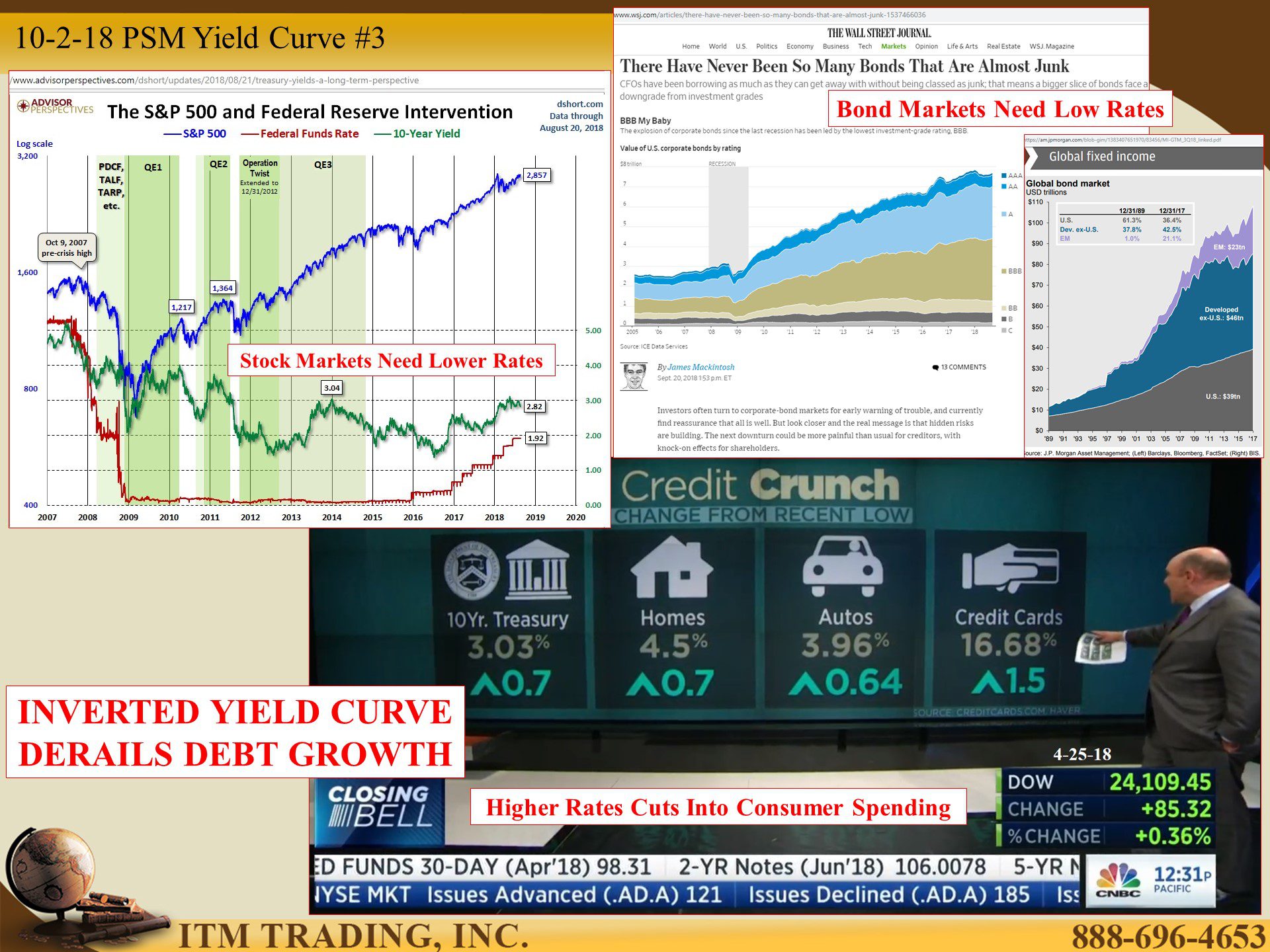

Interest rates have risen substantially since July 2016, with shorter term rates rising faster than longer term rates. At this time, the US is in jeopardy of a yield curve inversion which means that shorter term rates are higher than longer term rates.

Why does that matter you ask? Because this inversion has indicated a recession 100% of the time including the brief inversion the US experienced on December 27, 2005.

We are being told, once again, that this time is different just like it was different in 2000 and again in 2005, but it never is.

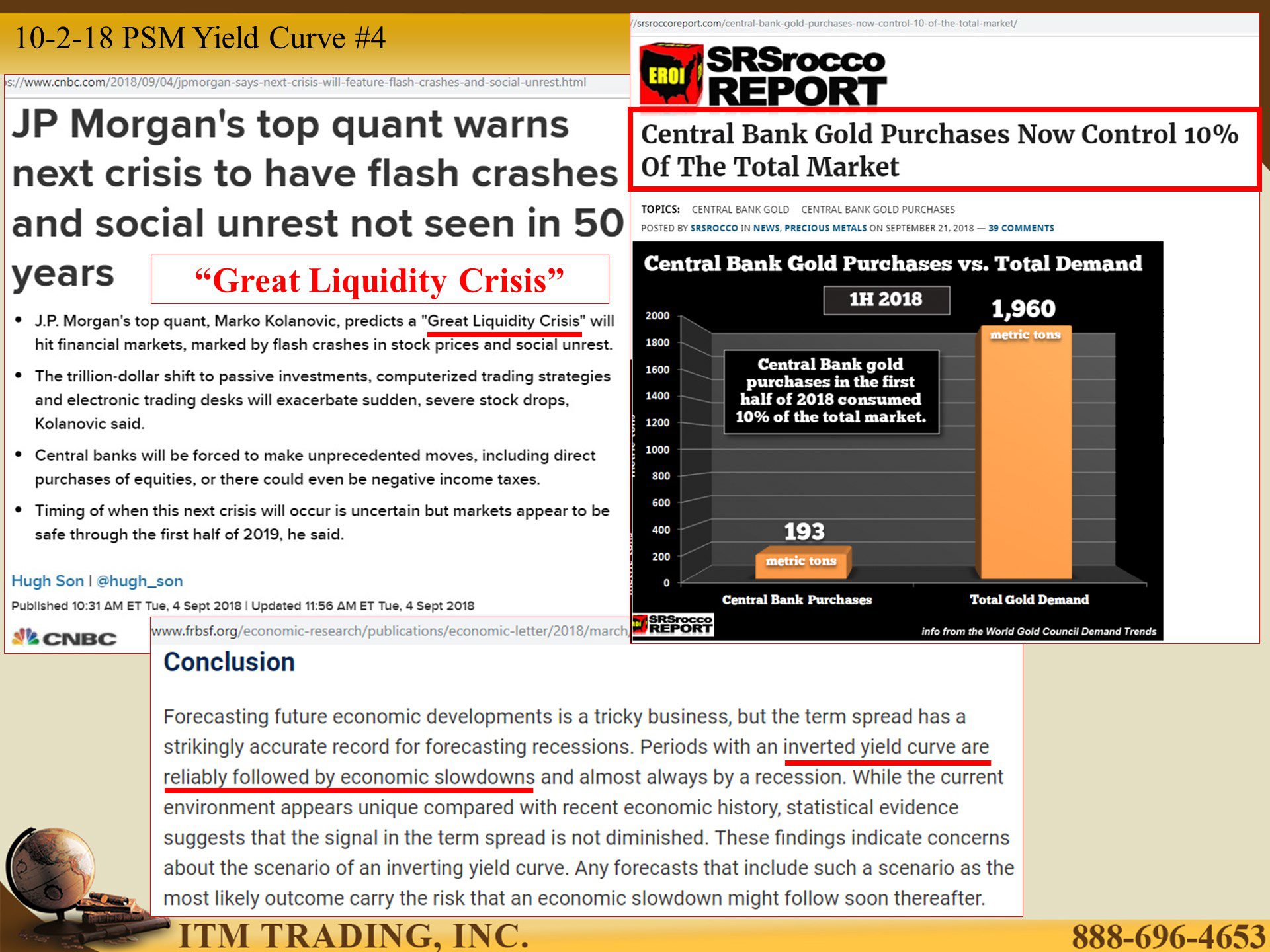

In a recent report from the San Francisco Fed they say, “While the current environment appears unique compared with recent economic history, statistical evidence suggests that the signal in the term spread is not diminished.†In other words, this time is not likely to be different and a major crisis is on the way.

They say this because a key indicator, the spread between the 3-month T Bill and the 10-year Treasury PLUS the valuation of the bonds has crossed a critical threshold. Historically, every time this level has been crossed a recession was not far behind.

To be clear, at this writing, the US bond market has not yet inverted, but it is very close to doing so and needs to be on everyone’s radar particularly with the Fed purposely raising the Fed Funds rate (the rate they pay banks to hold reserves), which is the rate directly controlled by them, as the longer rates remain flat.

With the difference between the 2-year and 30-year treasury yield a mere .38 basis points, it is possible that the yield curve could invert before the end of this year. As the Fed says, “Periods with an inverted yield curve are reliably followed by economic slowdownsâ€.

Perhaps that’s why “Central bank gold purchases in the first half you 2018 consumed 10% of the total market.â€

Slides and Links:

https://www.newyorkfed.org/medialibrary/media/research/capital_markets/Prob_Rec.pdf

https://money.cnn.com/2005/12/27/news/economy/inverted_yield_curve/index.htm

https://stockcharts.com/h-sc/ui?s=$UST2Y

https://stockcharts.com/h-sc/ui

https://www.wsj.com/articles/there-have-never-been-so-many-bonds-that-are-almost-junk-1537466036

https://am.jpmorgan.com/blob-gim/1383407651970/83456/MI-GTM_3Q18_linked.pdf

https://srsroccoreport.com/central-bank-gold-purchases-now-control-10-of-the-total-market/

YouTube short description:

Interest rates have risen substantially since July 2016, with shorter term rates rising faster than longer term rates, thus threatening a yield curve inversion.

Why does that matter you ask? Because this inversion has indicated a recession 100% of the time including the brief inversion the US experienced on December 27, 2005.

Perhaps that’s why “Central bank gold purchases in the first half you 2018 consumed 10% of the total market.â€