The “Perverse Feedback Loop†of Sovereign Debt

Sovereign Debt default would likely set off a chain reaction that would ultimately lead to a financial crisis.

By: Lynette Zang

The IMF calls it a “Perverse Feedback Loop†between sovereign risk and financial risk. To postpone the inevitable, governments and central bankers are relying on “Bailouts.”

A “bailout†in these cases, is giving tax payer funds to an entity when they can’t service the debt they already have, so they don’t default. There are “austerity measures†required for this. This means that taxes go up, wages go down and services go down. In addition, they may be required to sell off (privatize) income producing government assets. These measures would make repaying the loans even harder but at least the current payment has been met today.

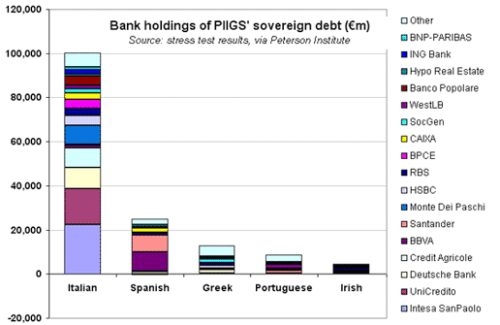

Global banks are interconnected. So if sovereign bonds default, the impact is likely to be felt in every part of the world by every citizen in one way or another. In addition, they are highly leveraged by credit default swaps, those pesky derivatives. And since many of those transactions are invisible, no one really knows what the full impact is likely to be, but we do know that the impact is likely to be worse than the financial crisis that began in 2008.

The European Central Bank has been using quantitative easing, money printing, to buy excess bonds from these high risk countries. Some think this has turned the ECB into a “Bad Bank.” Their solvency is in doubt should these countries default. Since the ECB is the lender of last resort to the European banks, this could put banking liquidity into question. In addition, the European banks themselves have exposure to sovereign bonds they hold.

Money Markets are mutual funds that look to maintain principal with a little bit more interest than one could get on a traditional savings account. In order accomplish this, the fund managers must find short term debt instruments that pay enough to cover their fees as well. With interest rates at artificially low levels, many fund managers have gone to Europe to get those increased interest payments. So when that peripheral sovereign debt defaults, it is probable that money market funds here in the US would “Break the Buckâ€, in other words, drop below $1. This would likely cause a flight out of money market funds.

For all of the above reasons and more, governments around the world support a “bailout†with the taxpayers footing the bill, transferring taxpayer wealth the banks way, both through increased taxation and inflation. Of course they prefer these issues remain invisible because if you started to pay attention, you might loose confidence and it is the job of those in power to maintain that confidence at all costs. You might even convert those pieces of paper into physical gold!

We all live busy lives, so we don’t pay attention. Ignorance does not make you immune, it just leaves you vulnerable. If governments are worried about a perverse feedback loop between sovereign debt risk and financial risk, and are therefore building their gold reserves, shouldn’t you too? Historically, the best way to protect yourself is with physical gold and silver that you have possession of. It protects your purchasing power and you control it. I can’t control what governments and central bankers do, but I can sleep well at night no matter what they do, because I’ve been building my portfolio since 2002. Get that position built and you can sleep well too in spite if sovereign debt.