The Hidden Signs of Economic Collapse You’re Missing with Danielle DiMartino Booth

Join Danielle DiMartino Booth, CEO and Chief Strategist at QI Research, as she explores how the mainstream and financial media are persuading Americans that their economic hardships are merely figments of their imagination. Emphasizing the importance of recognizing manipulation, through the media’s narrative.

CHAPTERS:

0:00 Market Volatility & Bank of Japan

3:21 Federal Reserve Rate Cut

7:07 Job Market Trends & Recession Indicators

17:08 Economic Outlook

TRANSCRIPT FROM VIDEO:

00:00

Danielle DiMartino Booth, she’s CEO and Director of Intelligence for Quill Intelligence LLC, a research and analytics firm and the author of the amazing bestseller, Fed Up, an insider’s take on why the Federal Reserve is bad for America. Danielle, it’s the front page of the Wall Street Journal above the fold. Fed may slow interest rate hike pace. She is considered one of the best in the street and I happen to respect her judgment as much as anyone else.

00:28

Greetings and salutations. This is Danielle DiMartino Booth, CEO and Chief Strategist at QI Research. Joining you again, partnered up with my great friends at ITM Trading. There’s a lot to talk about in this coming episode. So let’s just jump in with a song that was really popular in the 80s when I was, oh, let’s just say when I was in diapers, I’m kidding. It was a Manic Monday.

00:58

And that got a lot of people wondering. They said, hey, the Vicks shot up to the second highest extent on record. The only time it’s gone up even more was in February of 2018. That episode was called Volmageddon. But it really spiked on Monday. The Kerry trade was unwinding. Some estimate $7 and 1 half trillion.

01:27

huge numbers that are being thrown around because of the Bank of Japan raising interest rates to positive territory. That’s what it’s been since the 1990s. And more importantly, cutting quantitative easing in half. The Bank of Japan had been one of the last of the central banks really to be pumping liquidity into the financial system. And if there’s one thing that I learned working at the Federal Reserve for nine years,

01:54

It’s that liquidity is the financial markets, the equity markets, especially lifeblood. The unwinding of the carry trade sent currencies on the other side of the trade. You’ve got the Japanese yen on this side. Mexican peso was the biggest recipient on the other side of the carry trade. You had that come down in a very violent fashion. Now, since then, as you know,

02:24

we’ve seen a large rebound in markets. In fact, it was just a few days ago that we were talking about how much the markets had gone up before they started trading down in the Thursday and the Friday after the Federal Reserve met. So the big debate on Wall Street, and I think a debate that’s going to persist through the month of August and into September is,

02:53

Was it the unwinding of the Japanese carry trade and just a manic Monday like what we saw in 1987 when markets bounced back quickly and the economy really didn’t skip a beat? So is this a replay of the crash of 1987 and we’re just going to jump back on the rally trade? Or did the Federal

03:21

beginning to lower interest rates at its July 31st Federal Open Market Committee FOMC meeting. We now have as a base case, we’ve heard that from Nick Timrose at the Wall Street Journal. He is known to be the spokesperson for the Federal Reserve, unofficial of course, but the latest he’s written suggests that in September, despite Federal Reserve Chair Jay Powell denying that it was a possibility,

03:48

The base case now appears to be this first rate cut on September the 18th is going to be a half a percentage point, 50 basis points. And why is that? And here we get to the crux of the debate. Again, was it the Bank of Japan or was it the Federal Reserve? And it comes down to the state of the US job market. The most frequent data that we receive.

04:17

And certainly the most high profile frequent data is weekly jobless claims. A gauge of how easy or difficult it is to get a job if you lose yours is revealed every week in continuing claims. Of course, we’ve had continuing claims cross over into now the highest level since 2017. I’ll give you some stats if you want to write them down.

04:45

I would jot them down just so you have them in the back of your head. The last 12 of the 14 weeks, we’ve seen the four week moving average which smooths out the volatility in initial jobless claims. So the last 12 of 14 weeks, we’ve seen initial jobless claims on a four week moving average increase. The only time you see a streak of that duration is 82% of the time you were in recession.

05:12

We’ve seen continuing jobless claims pictured here increase in 14 out of the last 14 weeks. Again, in 78% of the instances we’ve seen this in the past, the US economy has indeed been in recession. So score one on that count when you’re looking at the weekly data. Looking back at the job report that really sent such ripples.

05:41

through the markets and screamed, oh, the Fed has made a policy, or looking at the breadth, B-R-E-A-D-T-H, of job creation, you can see that outside of low paying positions in leisure and hospitality and healthcare, and of course the government sector, there was virtually no jobs, there were virtually no jobs created in the month of July.

06:10

And of course, when you see this type of low breath, the diffusion index, which measures the percentage of sectors in the US economy that are employing Americans, the diffusion index dropped underneath 50%. When less than 50%, this is another way of measuring the breadth of the strength of the economy. When that drops underneath 50%, as it did in July.

06:39

the US economy tends to be in recession. Something else that we saw, and this is actually, you’re gonna say, Danielle, you’re such a wonk, you’re such a dork, you’re such a geek, say what you will. The metric that I follow the most closely in the jobs data, especially in the post-pandemic era, where we’ve seen systematic downward revision since January of 2023. So it’s a situation where

07:07

What’s reported is not actually the reality on the ground, if you will. A lot harder to kind of fudge hours worked. So how does the job market, how does it cycle through, if you will? Think of it as waves washing onto a shore. The first thing you see when the US economy is slowing down is a reduction in job openings. That’s the first wave.

07:35

The second wave that you see is the number of hours worked. And that’s a really critical metric. Again, it’s the one that I follow the most closely because as I always say at QI research, hours precedes bodies. When you’re cutting hours, the next step is to actually cut positions. So where am I going with this? Well, the work week, that red line, we saw drop to 34.2 hours.

08:05

Now, this is in the far, far, far tail, 96th percentile, in all of the data of this series, where was 34.2 first seen in, for example, the 2007 to 2009 recession, started in December of 2007, ended in June of 2009. When did we first see a 34.2 hour?

08:35

work week. Well, that happen to be September 2008. Not only were we nine months into recession at that point, there was a cataclysmic moment when Lehman Brothers failed that caused the work week to shrink that much in September of 2008. Again, these types of readings are not seen outside of recession.

09:03

We’re also seeing a large increase in what we call the under employment rate. So these are people who are working less than they would otherwise if they could get a full-time job, a better paying job. And what we’re seeing is this spike up to 7.8%, this four tenths of a percentage move in one month.

09:31

We don’t see these types of increases in the underemployment rate, which is risen from five and change to 7.8%. You say, well, gee, the unemployment rate, we call that the youth three, that’s only risen from a low of 3.4% to 4.3%, 0.9 percentage points, which by the way, I don’t have a graph on, but once you’re 0.9 percentage points north of your low point, you are in dot, dot, dot, recession.

10:01

But when underemployment begins to make major moves like we’re seeing on a month over month basis, we typically are in recession. Again, people have to make enough money to cover the rent. They have to make enough money to cover the costs of the essentials, food, shelter, gasoline, how I get back and forth to work, or if you’re Ubering, all of that has to be covered. And if you’re underemployed, you’re struggling.

10:30

to accomplish that. My hat’s off. Actually, Chair Powell himself mentioned indeed.com data two FOMCs ago in his post FOMC press conference. He made mention of indeed.com as well as conference board, consumer confidence data in saying that other metrics of that gauge the strength or lack thereof of the US job market.

10:58

are appropriate to use. And why is that? Well, because as he said, we’ve come to know, to use his word, that non-farm payrolls are overstated. That’s a very diplomatic central bank type of term to say they’re kind of BS. Back to Indeed.com, of all of the industries that they cover,

11:28

and they get very granular in their tracking of individual sectors, three, one, two, three, have year over year increases in job postings, in job openings. Those three are insurance. I’m sure all of you can say, well, my car insurance sure has gone up or my homeowner’s insurance sure has gone up. I saw a headline a few days ago that said that homeowner’s insurance in the state of Florida was gonna increase by 97%.

11:57

Wow, well, lo and behold, there’s job security when you’ve got pricing power. So there’s job security in the insurance industry. There’s job security in beauty and wellness. A lot of times in times of recession, we follow something called the lipstick indicator. And actually the CEO of Ulta Corporation recently came out and he said, you know what? Ladies aren’t buying lipstick anymore. We really are in the suit.

12:27

but we’re still spending money going to the salon, getting a manicure, getting a pedicure, doing whatever it is that we do. And I shouldn’t be sexist. I mean, I see men getting pedicures all the time. We ladies thank you for it. But there’s also job security, job openings in beauty and wellness, as well as, and here’s the gallows humor, if you’re spending too much on your insurance and you can’t make ends meet, maybe you’re using an.

12:54

a health insurance covered therapist, job openings are also positive for the therapy industry. Other than that, not a single sector. And that is telling you about one of my favorite words, the ubiquity of the weakness in the US job market. If you lose your job in an industry that does not happen to be insurance beauty and therapy.

13:24

then you’re gonna have a really hard time finding one if to differing degrees on a year over year basis, job openings are as negative as they are. I’ve spoken in prior ITM tapings about trueflation, TRU, TRU-flation. I’ve looked into trueflation because it’s come down pretty hard.

13:50

from about 1.92% earlier this year to 1.51% at the time of this taping. And I said to myself, what is causing outright deflation in certain areas of the economy that we’re seeing such a rapid decline in the rate of inflation? Now, I can hear the gnashing of the teeth. I can hear the howling. I am not talking about…

14:16

the latent inflation, the inflation hangover, the price increases since 2019 that are still very much with us in order for that to be corrected, we’d actually have to see outright deflation, falling prices to begin to gain back some of the purchasing power that we’ve lost. So I’m not denying that that inflation that…

14:45

that Rose is still there, a very nasty vestige of the post-pandemic era, driven by government stimulus spending gone wild. It is the case. That does not take away from when most U.S. households are leveraged up to their eyeballs. That does not take away from the dangers of disinflation. There’s a problem if we’re seeing food away from home deflation. It’s exactly what we’re seeing.

15:15

We’re not seeing deflation in recreation and culture yet, but you see a steady decline in the past 12 months in what people are spending. Now it’s just about getting to zero in what people are spending on whatever it is that we call fun. Whether it’s a Taylor Swift conference or going to see Deadpool 3, don’t forget to watch both sets of the outtakes at the end. They’re both good. Love me some Deadpool.

15:44

But the fact that these prices are coming down, the fact that food away from home, that those prices are an outright deflation, what does that tell us? It tells us that people are losing their jobs. It tells us that people are seeing their hours cut. So therefore their income chipped away at, to such an extent, they cannot afford to spend money on the things we consider to be fun.

16:13

Going out to dinner, going out to happy hour on Tuesday nights, you know those spots. Going to a conference, a concert with your friends. See, I like going to conferences. That is fun for me. As an aside, since you mention it, we’re seeing hotel occupancy also decline, especially on the weekends. Again, another reflection. I priced a round-trip ticket from Dallas to LaGuardia to New York just a few days ago.

16:43

Southwest Airlines has got $49 one-way tickets, less than $100 round trip. I mean, wow. But again, it’s a reflection of the fact that American household budgets are so constrained by the inflation that’s still in existence for essentials as job openings dry up, as Intel announces they’re gonna lay off.

17:08

What 15,000, 17,000 employees as Dell Technology announces that they’re gonna be laying off. 12,500 employees. We see the headlines come in day after day after day. Warner, we heard from today. But it’s an everyday thing. And what happens? There are two things that happened to the mindset of.

17:34

people who have their jobs, right? If the unemployment rate is 4.3%, that means that 96% of the US economy, just about, has a job of the workforce. So, but how does rising unemployment affect the mindset of people who have jobs? Well, what we start to see is kind of the quick rate decline that take this job and shove it element

18:04

dissipates in times like this. Workers work harder, workers try and work more hours, even if they’re not being paid, it’s the fear factor. What are they fearful of? They’re fearful of their cousin on their mother’s side who lost his or her job, and they haven’t found another job. And what you’re looking at with the orange line on this slide is what we call permanent job.

18:32

losers, people who’ve been out of work for 27 weeks or more. When you’ve been out of the workforce for a half year, your job skills start to atrophy and employers attach a stigma. They say, well, if this person couldn’t get re-employed, then maybe there’s something that doesn’t meet the eye that’s even, that’s more wrong with them. So you end up seeing scarring in the job market, picking up to the same extent that we’ve seen in

19:02

dot dot dot prior recessions. And we’re also seeing a record number, the green line. We’re also seeing a record number of US workers who are working a full-time job and a second part-time job. So maybe you’re working nine to five in a cubicle and you’re driving Uber or DoorDash at night and on the weekends to make ends meet.

19:33

And that we have this high of a percentage again, is a reflection. It’s a reflection of how expensive it is to live in America. And it’s a reflection of the fact that your paycheck is not enough, substantial enough to cover your cost of living. What else are, are you hearing? What are you hearing when you are maybe watching?

20:00

Bloomberg or CNBC or reading the Wall Street Journal or cruising around on Twitter at Demartino booth. You’re like, what’s Danielle talking about? Oftentimes I’m talking about macro edge. Macro edge is a fairly new provider of job cuts announcement data. And I have come to rely on their data because of how transparent they are in tabulating

20:29

announced job cuts mainly because they show them one after another after another on their Twitter feed. I’ll always call it Twitter. So sue me. But they track them publicly for us to follow along with them. And what they’re telling us is that we’ve seen on average job cuts north of 100,000 for four months now.

20:57

In a time of the year that we economists say is seasonally benign, that means that we’re seeing very high job cut numbers in months where we wouldn’t normally see them. So far in August, we’re pushing 50,000 and we’re just a portion of the way through the month. In other words, the layoff cycle, the number of job cuts announced is increasing as a factor of time.

21:26

which is again, something that you see in recession. What’s to come? Danielle, where are we headed from here? Well, I think it’s instructive to look back before we can look forward with any certitude. And what we know is at the end of August, we’re going to get data out from the Bureau of Labor Statistics that tells us what the death toll was.

21:56

Death told Danielle that sounds gruesome. Well, the Bureau of Labor Statistics uses what’s called a birth death model to impute the number of businesses that are born and the number of businesses that close in any given month. And of late, it’s been a huge contributor birth wise on a net birth basis to job creation. What we learned in the third quarter

22:25

of 2023 after all of the dust had settled on the revisions and after the census had collected data from all US employers on what their headcount was, we call that the hard data, what we found was that instead of 630,000 jobs that we thought had been created in the third quarter of 2023, we actually had net job destruction of 192,000. You see that red line dips below the line.

22:54

Now it pops back up. Why is that? It’s because the Bureau of Labor Statistics has only released the birth half of the birth death model. At the end of August, we get the death toll. And what we know so far from the Bureau of Labor Statistics is that they’re assuming that small businesses were net contributors and did not have increasing deaths from the third…

23:24

quarter to the fourth quarter. Well, what does DJC, what does dailyjobcuts.com, what does their data, which is on the ground tracking of business closures, what does their data tell us actually happened in the fourth quarter of 2024, which is the next one that we’re getting. Again, I think you have to look back and understand what the data actually is before you can assess where we’re headed.

23:55

But what we know from dailyjobcuts.com is that from the third to the fourth quarter, we actually had a large pickup, the yellow bars in business closings. In other words, the Bureau of Labor Statistics assumption is absolutely ass backwards, it’s a technical term. In other words, we’re going to see business closures come in higher than what the Bureau of Labor Statistics was assuming. We should see another.

24:24

net negative revision because they also assumed that large company bankruptcies, large company closings got worse in the month when they actually got better. So both assumptions were incorrect compared to what we know from the data on the ground. My point to you is that it’s likely that we’re going to have six months consecutively of

24:54

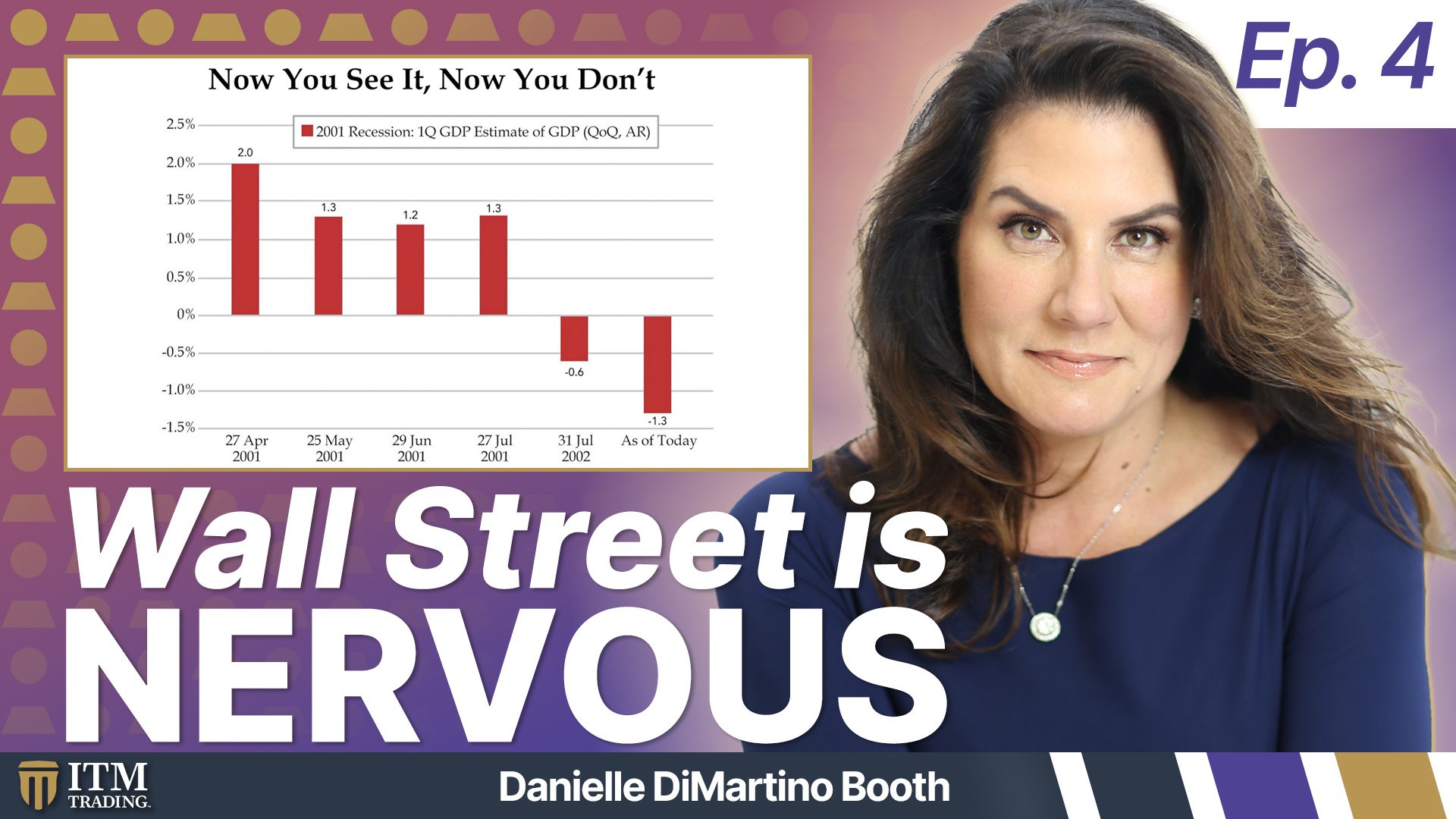

six months of 2023 going into 2024. And we’ve seen continued negative revisions. My point to you, and this is gonna be my final slide today is now you see it, now you don’t. And you’re saying, Danielle, you’re a complete and total crackpot. How can you possibly say that the US is in recession, that the US has been in recession since what I believe is October of 2023?

25:25

And that therefore the Fed should have definitely been cutting rates at the July FOMC and that markets having a heart attack was justified because markets do not like recessions. And of course we’re hearing from one company after another, when they report their earnings in the current earnings season, we keep missing on our revenue estimates. That also is a reflection of, of recession, but the reason I’m showing you the 2001 recession onset.

25:54

And it is because it’s important to appreciate that if you back out all of the jobs that were not created in the third quarter of 2023, it’s a process. You then have to, if those jobs didn’t exist, then the income attached to those jobs was also just as, as much of a phantom and you’ve got to back that out of the GDP accounts. So that’s why it was not until.

26:23

July of 2002 that we first learned that rather than the 2% GDP growth we thought had been put in for the first quarter of 2001, instead of 2.0%, it was actually a negative number. The time all of the revisions were said and done, we found out that it was negative 1.3%. In the case of the Great Recession, we call it the Great Recession.

26:52

Right? It took out what had been referred to as the Great Recession, which was the double dip recession in 1980, 1981. But in the case of the Great Recession, again, December, 2007, until June of 2009, we did not see the final revision. Right? We went into recession in December of 2007, came out in June of 2009.

27:19

We did not see the final revision to GDP from the greatest economic downturn the country has suffered since the Great Depression until 2018, 11 years after it had started. Markets trade off of the initial print that we see, whether it’s non-farm payrolls or the consumer price index or the GDP print, that’s what markets trade off of.

27:48

But eventually, if we are and have been in recession, then more and more companies are firing people, which is exactly what we’re seeing. And more and more companies are missing their top line estimates, which is exactly what we’re seeing. And markets finally wake up as the Fed begins to cut interest rates, which is until that point. That is not when we see

28:19

Until that point, we do not see the stock market correction stick. In other words, all this crazy volatility, the Dow closed up 500 points today, the Dow closed down 700 points today, the Dow closed the next day. Up 2%, down 2%, up 2%, down 2%. We saw the same seesaw pattern in 1999. We saw the same seesaw pattern, great amounts of volatility and trading in 2007.

28:49

until the Fed actually cuts rates, which we fully anticipate will be September the 18th. I don’t think there’s going to be an emergency rate cut. Those are really reserved for times of financial crises, global pandemics. You get my point. At some point, the data catches up. And at some point when the data catches up and reality sets in, you, the investor, need to be

29:18

depending on your appetite for risk taking and your age. And that is my message to you today, is to be prepared. Because once the Fed cuts rates, historically speaking, unless this time is different, don’t ever use those words, unless this time is different, you need to be prepared for when the Federal Reserve does start its interest rate cutting cycle, which we fully anticipate will be in September.

29:48

So with that news, which is great news, right? I’ve got time to prepare. That’s your takeaway today. With that news, I will bid you adieu until the next time. And I look forward to it. Thank you so much for listening. This is Danielle DiMartino Booth, working with my great friends at ITM Trading. Thank you.