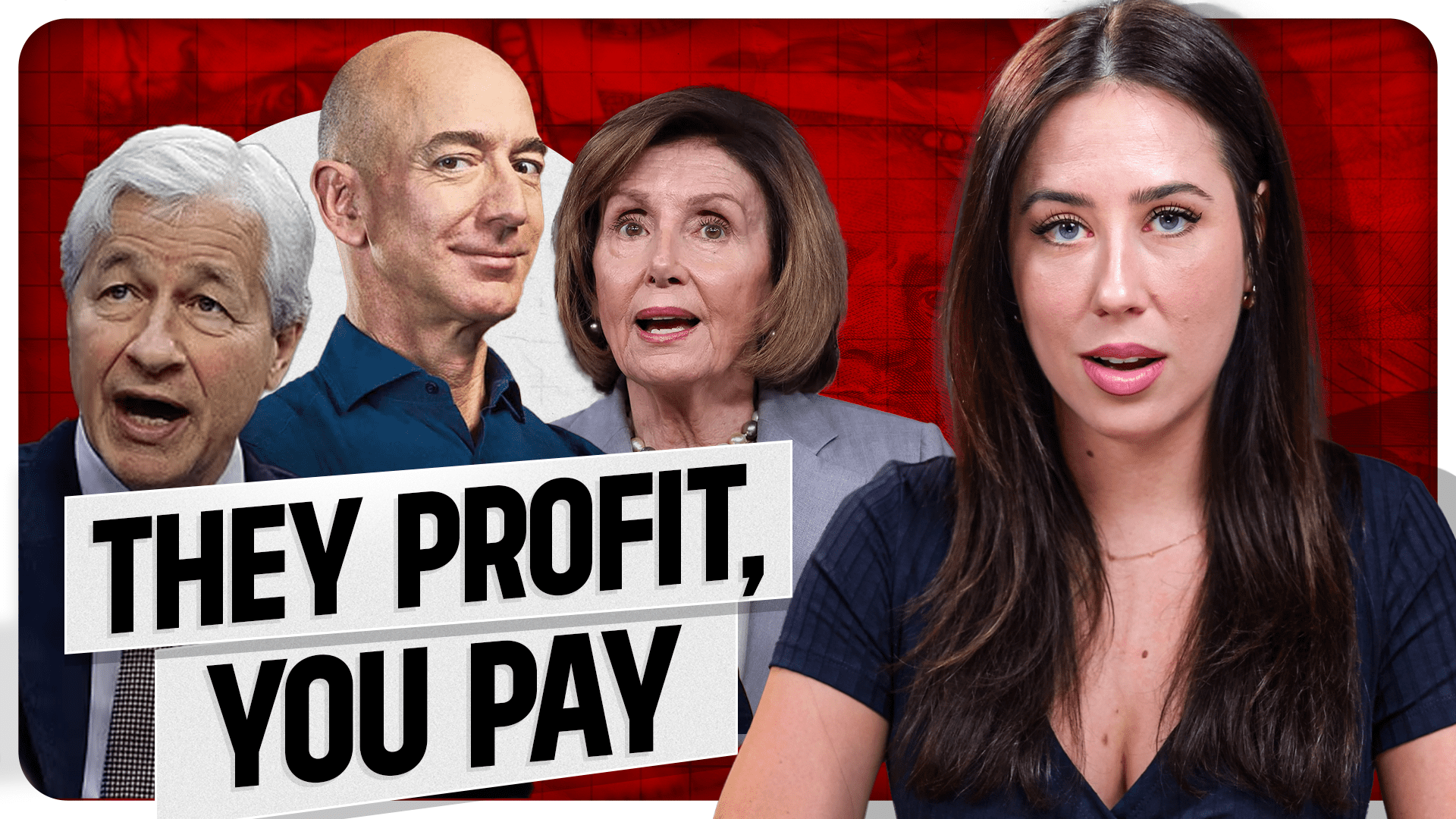

The Greatest Wealth Transfer In Human History

A massive wealth transfer is underway, creating a stark divide between the elite and everyday Americans. As inflation rises and middle-class savings lose value, wealth shifts to the top 1%, widening the economic gap. Discover how inflation, government policies, and an impending currency reset are impacting your wealth—and what steps you can take now to protect yourself with gold and silver.

CHAPTERS:

00:00 – Introduction: The Wealth Transfer We Didn’t Agree To

00:34 – Growing Economic Divide: The Rich vs. The Rest

01:06 – GDP and the Reality Behind Economic Data

01:44 – The American Dream and 1971’s Gold Standard Shift

02:19 – Protecting Wealth vs. Losing Purchasing Power

02:55 – Who Benefits from a Declining Dollar?

03:29 – The True Cost of Inflation and Overprinting

04:07 – Politicians and the Incentive to Overspend

04:43 – Manufactured Growth and Illusion of Prosperity

05:16 – Punishing Savers and Declining Savings Value

05:50 – Preparing for Currency Reset and What’s Next

06:20 – Central Banks and Wealth Preservation Moves

07:22 – Why It’s Not Too Late to Protect Wealth

07:59 – The Importance of Taking Action Outside the System

08:32 – How to Protect Your Wealth Today

TRANSCRIPTION:

00:00 – We are currently experiencing a wealth transfer that we never agreed to, one that will not only change our lives but define future generations to come. If you don’t believe me, all you have to do is look at the growing divide between the wealthy elites and the have-nots. Just how out of step or underprepared are we for this great wealth transfer? The rich appear to be getting richer, and it may be at the expense of everyone else. The growing gap between rich and poor Americans is one of the biggest challenges facing the country.

00:34 – Get this: the richest 1% control more wealth now than at any time in more than half a century. While most understand that our quality of life is being chipped away by inflation, too many people are still blind to the fact that our wealth isn’t disappearing—it’s merely changing hands. In this year’s election, the number one concern for voters is the economy, and it’s no wonder given that the majority of Americans are still struggling to keep up with the basic cost of living.

01:06 – On paper, we’re told that GDP is growing, the economy is strong, and that we have nothing to worry about. But in reality, we’re seeing a propped-up system fueled by government overspending that directly benefits those in power and those who are already wealthy—hurting the average American and creating a further gap between classes, as evident in the rapid disappearance of the middle class.

01:44 – Owning a house, a car, and being able to provide a quality life for your family is the American dream. In the 1950s to the early 1970s, this was attainable for most people. If you set your mind to it and worked hard, you could absolutely achieve that dream. But in 1971, something changed: President Richard Nixon delinked the dollar from gold.

02:19 – “I have directed Secretary Connally to suspend temporarily the convertibility of the dollar into gold.” This allowed the United States to print more dollars, inviting inflation to take hold and chip away at the average American’s purchasing power. This was the beginning of the end of the golden age of the middle class. Now, those who had the foresight to put their wealth in a safe haven asset such as gold were able to protect their wealth, whereas those who stored their wealth in dollars and trusted the government not only lost their savings but struggled to maintain their standard of living.

02:55 – And today, history repeats itself. The confiscation of wealth through inflation has picked up speed, with the dollar losing 25% of its purchasing power in the last four years. Despite this dollar decline, there are those who have still come out on top, boosted by strong gains in income, home equity, and stock market wealth. The wealthiest Americans, the top percentage, are singlehandedly sustaining the U.S. consumer-driven economy. This, in part, explains some of the disconnect between the economic data and the reality that the majority of Americans face every day.

03:29 – This is because income has not kept up with the rising cost of goods and services for most middle-class earners, meaning that the data we’re constantly told about wage growth really just represents a smaller, already wealthy percentage of the population. The rich are getting richer at your expense. There was an influx of cash into the system, an overprinting of dollars that took away your savings. They took from you and directly gave to them, escalating a trend that’s been going on for 50 years.

04:07 – Which brings me to my next point: this growing divide didn’t happen accidentally. Politicians and government officials have no incentive to stop spending. They’re not punished for their overspending. They have no reason to stop accumulating more debt—not when it directly benefits the elites and their wealthy friends. The concern is that the entire system is set up so that there is no end to the spending, meaning that the divide between the haves and the have-nots will continue to grow wider and wider as your dollar loses more and more of its value.

04:43 – And what really gets me is that it’s not bad enough that they’re already taking your wealth—they’re also making you question whether this was your fault. “Well, I’m working hard. I’m doing everything right. Why am I not moving up? It must be something I’m doing.” This only supports their narrative. “Look over here, not at what we’re doing.” The reality is we live in a system that punishes savers. Savings don’t benefit them, they don’t create economic growth—they create stability for you. They don’t allow them to have any control.

05:16 – So, what do they do? They create inflation so that they can still take your savings away from you. They took a quarter of Americans’ savings through inflation in the last four and a half years alone. Once you realize that the system was never designed for us in the first place, everything becomes so much clearer. And the real concern becomes, okay, we know the system is broken, but what happens when it fully cracks—when it fully collapses? What happens next? Those in positions of power are already preparing for this.

05:50 – In the meantime, they’re squeezing out all the juice they can. But when there’s no juice left to squeeze, that’s when they wipe the Monopoly board clean and start over with a new currency—a currency reset, a revalued currency, whatever you want to call it. It’s when the life cycle of our current currency, the currency life cycle we’re in, comes to a close. Now, it’s not happening yet because there are still chips on the board. But we can all feel that it’s moving at a more rapid pace, that that’s what’s coming next.

06:20 – Which is why central banks and some of the smartest people I know see the writing on the wall and are preparing for what’s coming next. There are a lot of naysayers out there who say, “Oh, it’s too late. If you didn’t start preparing years ago, it’s too late.” I say I disagree. I disagree completely, because you can always sit there and look at hindsight being 20/20 and think, “I wish I had protected my wealth four years ago with physical gold because I know everything I had in a savings account lost its value.”

06:48 – That always happens—in the dot-com bubble or in 2008. There are so many people who thought, “I wish I had acted sooner.” But the thing is, we are in a unique position right now where it is evident what is coming next. We can all see it, we can all feel it, but it hasn’t fully happened. It’s started, but it’s a process, and it is not too late to protect yourself with physical gold and silver outside of this broken system before the full end of the current currency life cycle.

07:22 – We are in a unique position right now, and I always talk about how education is key—because it is. But it is action, taking action, that will protect you, that will protect your wealth, that will maintain your standard of living, and that will set you up and position you for opportunities on the other side. I know that’s important to a lot of you watching, so if any of this concerns you, talk to a member of our team.

07:59 – Talk to one of our expert analysts. Unlike traditional financial advisers or someone who might work at a bank or institution, where they are paid to make sure you stay inside of that system—that system that’s not designed for you—our team understands currency life cycles. They have decades of experience in helping people like you protect themselves outside of government control, outside of inflation, outside of policymaking, in a way that will set you up for success.

08:32 – It’s very easy. You can either click the link in the description below and set up a time that works for you or call the number at the bottom of my screen and talk to a member of our team. If you ask me what you can do today to protect yourself, it’s so important to make sure that you have your insurance policy in place for what’s coming next, outside of the system. Our team will help you make sure you have just that in place.

09:08 – As always, I so appreciate you being here. I’m Taylor Kenney with ITM Trading, your trusted source for all things gold, silver, and lifelong wealth protection. Until next time.