The Difference between the Physical & Digital Gold Markets

By: Lynette Zang

The CME raised the margin requirements on gold by 27% and silver by 21% for the second time in September. The Shanghi Gold Exchange raised margin requirements on gold too. That means that if hedge funds and private trading desks have borrowed to buy spot gold and spot silver, they have to come up with more money or close out some of their positions. This puts additional downward price pressure on the digital gold and silver markets. At ITM Trading we only operate in the physical gold market, and there exists some significant differences between the two.

The spot price is what you see on TV, in the newspapers and on the internet (which is what the world considers the value of gold). It is open somewhere in the world 24 hours a day, 5 days a week and according to Wikipedia, is the price that is quoted for immediate (spot) settlement (payment and delivery). Spot settlement is normally one or two business days from trade date. This is in contrast with the forward price established in a forward contract or futures contract, where contract terms (price) are set now, but delivery and payment will occur at a future date.

There are many products that have been designed around the spot price or what we will call digital or paper gold (since most spot contracts never take delivery); gold ETFs, gold futures, gold options, and derivative gold. In these cases, the intention is to trade the price movement and not take physical possession of actual gold. As a result of computer generated program trading “The robots that are making FX prices are doing so a rate 150 times faster than the blink of an eye,†according to a study by the BIS (Bank of International Settlements). Clearly, physical metals do not have the ability to trade this fast since only humans would execute a physical metals trade.

Digital/paper gold is referred to these days, as the “liquidity trade.†That is because it is in positive territory (true every year for the past 11 years) and when cash is needed quickly, institutional buyers sell-off and take profits. This can create wide price swings/volatility, as we have experienced recently.

It is impossible to accurately discover all of the digital gold traded on all of the global exchanges. Most don’t list the number of open contracts. It is also impossible to discover exactly how much physical gold is held for delivery, since this information is not necessarily published. Silver is even harder to discover because the BIS, which is the entity that tracks OTC derivative contracts, lumps silver with other metals, but the CFTC (Commodity Futures Trading Commission) reports silver separately. So there is no consistency in reporting. In addition, the BIS recently changed the way they report the derivatives and when I tried to get the number of contracts for gold, I found that they no longer report in that way. Here is the response from the email that I sent them. “We regret to inform you that we don’t have any data available on the number of traded contracts.†And here I thought that was what they were supposed to track, silly me, but of course they don’t have to share.

In any case, when you are dealing with the physical metal, there is a finite amount. Not so with digital gold and silver which is estimated to be levered 100 to 1 (100 digital ounces for every 1 physical ounce) on the Comex Exchange and London Bullion Market and leveraged quite a bit more in gold derivatives tracked by the BIS.

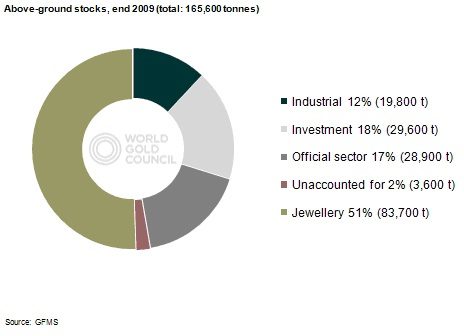

We do know how much gold most likely exists above and below ground. So let’s work with what we have and see what that looks like. According to the US Geological Survey (www.usgs.gov) and The World Gold Council gives these numbers for gold and silver.

Troy Ounces Mined   5,324,371,200

Gold in the ground   1,060,983,000

Total Physical Gold   6,385,354,200

Silver in the ground   16,719,560,000

All of the gold ever mined would fit into, roughly, two Olympic size swimming pools. Where is all of this gold?

You know I love my charts, so let’s look at what is happening in the spot/digital gold market, which is predominantly digital with a component in physical in the form of bullion and the numismatic gold coin market, which is only physical.

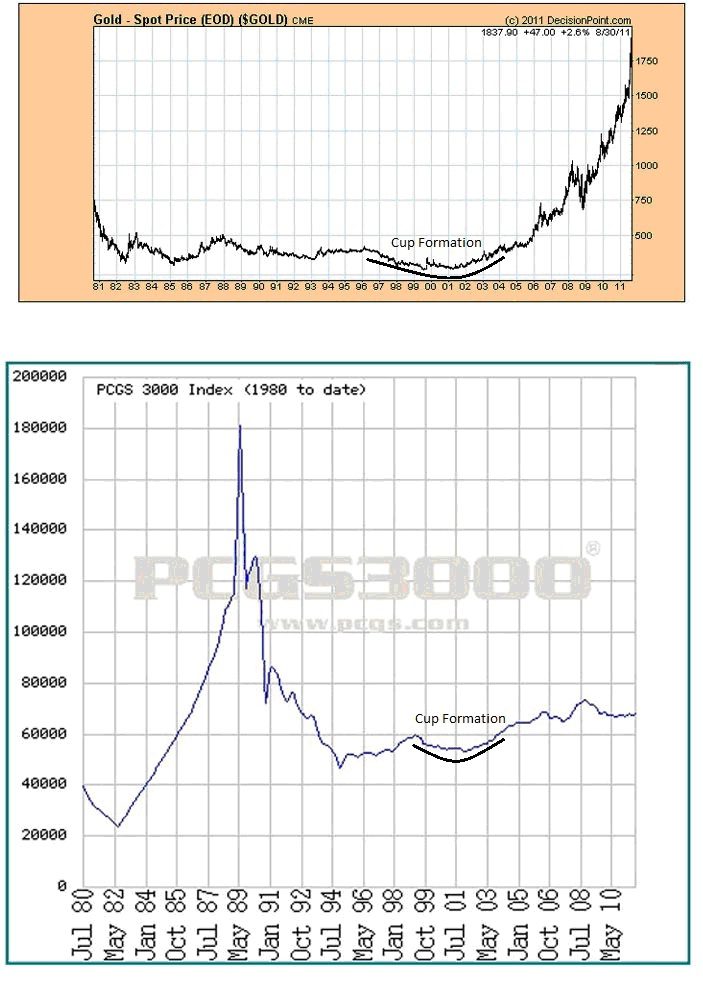

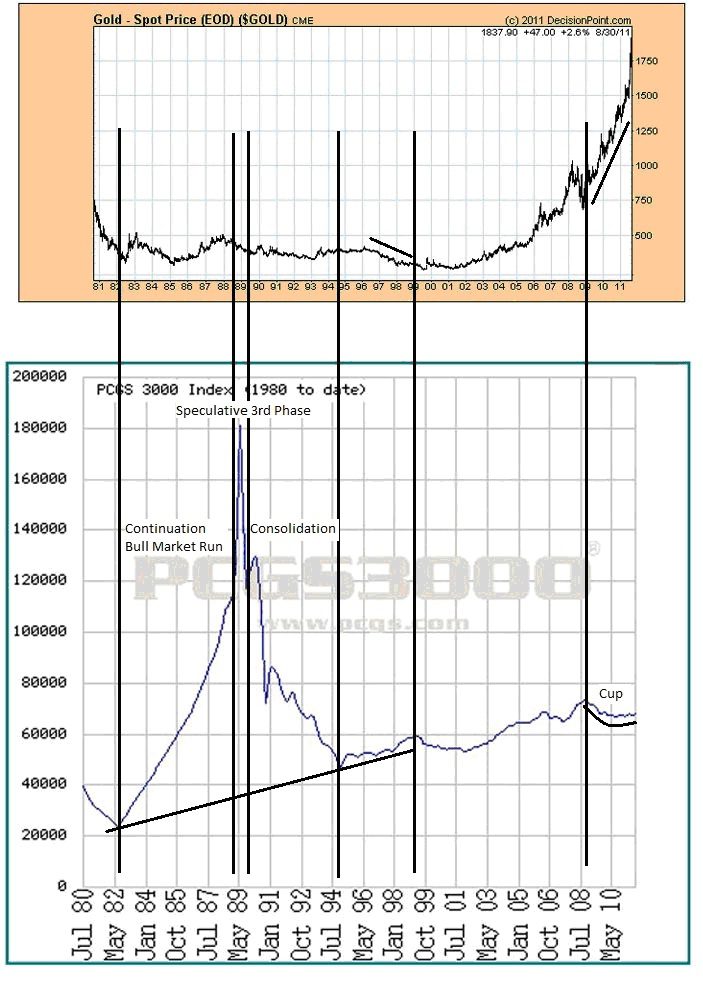

I normally like to start with a long-term view and then work backwards. The charts below represent the Spot Gold market and the numismatic coin index. You can see that there are similarities and differences and that is what I want to talk about.

The chart below begins in 1981 through September 2011. Let’s look at the similarities. Both built the foundation of a positive trend via a cup formation, which is a very powerful accumulation pattern that takes place over a longer period of time. The spot market began this pattern in 1996 and concluded it in 2004. The numismatics began this pattern in 1999 and also concluded it in 2004. This formation took place early in the first phase of the trend cycle and was an indication that big money saw the undervaluation and moved in when prices were dirt cheap. Generally, not many on Wall Street or the general population take any notice at this point in the trend cycle and price movements are normally small with very little volatility.

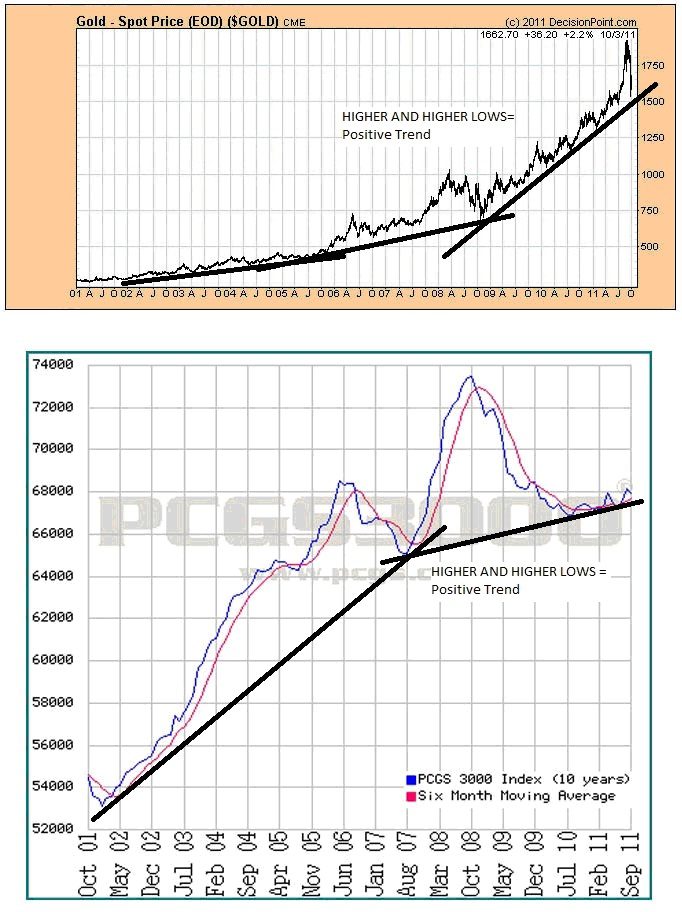

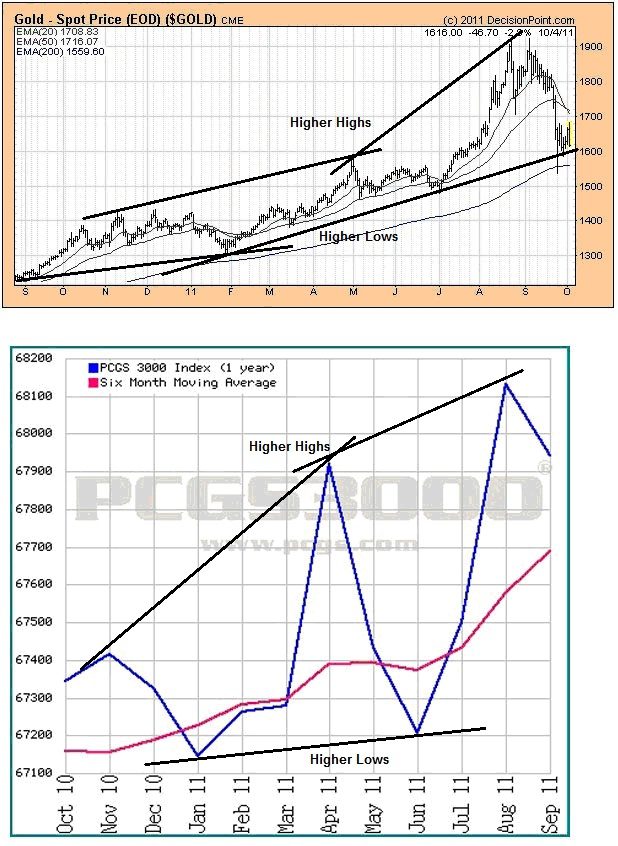

As you can see in the chart below, both are in long-term positive trends. You know this because both clearly show a series of higher lows, which is indicative of a positive trend. I cannot give you many guarantees, but I can give you this one: as long as there are higher lows, you will get higher highs. So if you’ve already bought and then there was a move down, there is no need to worry, as long as you are in that positive trend any move down is simply an opportunity to accumulate more and dollar cost average, bringing your overall costs down.

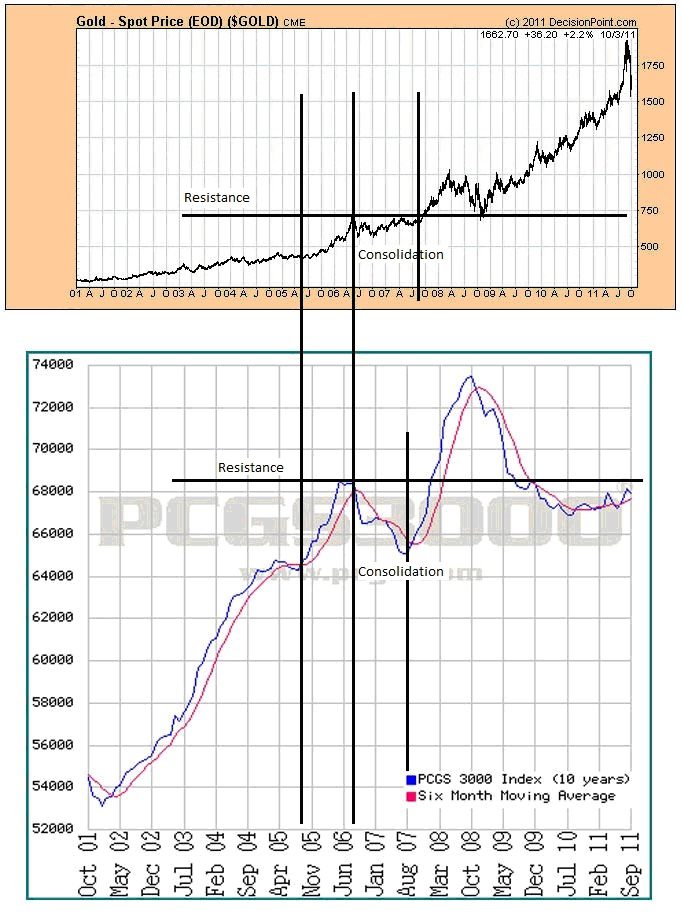

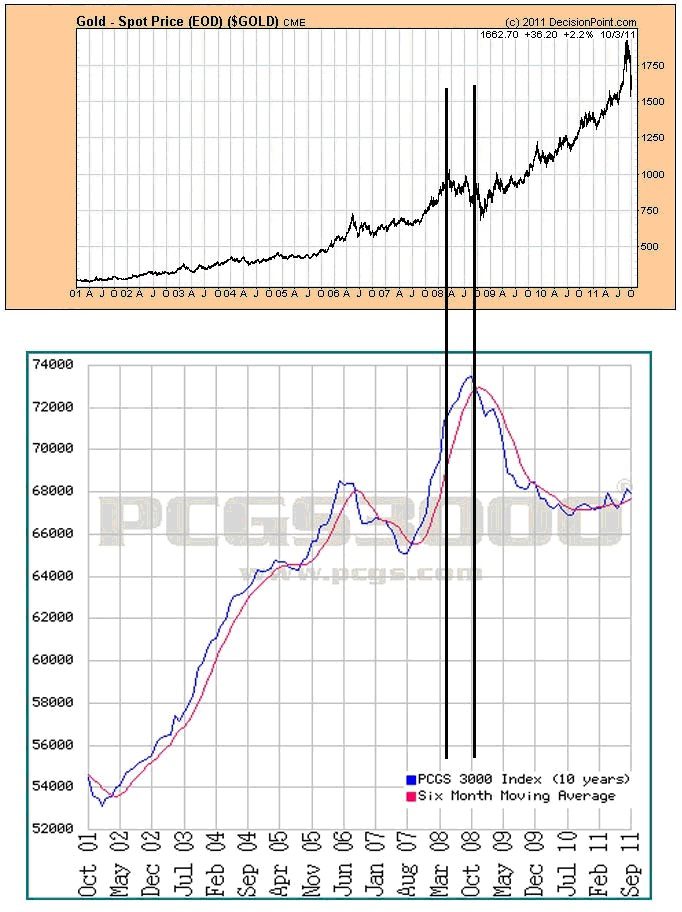

Between June of 2005 and May of 2006, both spot and numismatics rose together at very close to the same rate as viewed in the chart below. This was also the time when gold shifted its behavior, signaling a move into the second, awareness phase. Then both went into a consolidation. A consolidation occurs when something has moved too far, too fast. Think of it this way; you must first build a foundation before you can put a roof on a house. The consolidation is the foundation.

In September 2007, spot gold broke the resistance level that was created in May of 2006 and continued on to a new all time high of $1,003.10 in March of 2008, breaking the old record high of $825.00 that was created in 1980. Spot then began a pull back that bottomed below $700 in September 2008. The numismatics told a different story at that time. This is where a significant shift between the physical and the digital markets began inside of this current trend cycle.

THE DIFFERENCES

Now let’s look at the differences in the charts below. From the highs that were created in both markets in 1980, the spot market pulled back to a bottom support level in 1982 and then created a long-term trading range between roughly $325 on the bottom support and $500 on the top resistance until 1996.

Notice in the chart above that the numismatic coins did not follow spot, but instead, after a reasonable pull back, went on to a bull market peak in 1989 rising over 650%. Notice that the coins went almost straight up as the general population began moving into the physical coins, of which there is a limited supply. You will also notice that when the coins hit a consolidation bottom in 1994, that bottom was higher than the one created in 1982, a good long-term indicator.

From the bottom in 1994, the numismatic coins moved up again hitting an interim peak in May of 1999, but the spot market remained pretty flat until February 1996 when spot began moving down from $414.20 to the bottom of $252.80 in July of 1999. So during that time, you would have been happier with numismatic coins, since they were moving up while spot was moving down.

Then the numismatic coins began to build their cup formation. The formation concluded when the price action hit resistance (same price level) as it was at the start of the formation in 2004. From that point until September 2007 is recapped above, so let’s look at the shift.

From the high of $1,003.10 in March of 2008, spot began a pull back that bottomed below $700 in September 2008 and remained in a consolidation until September 2009. During that same time, March 2008 to September 2008, the numismatic coins did not participate in spot’s pull back and indeed continued to move up contrary to it. Then as the economic crises unfolded, the many of the middle class numismatic holders were forced to shift out of the numismatic coins. Consequently the numismatic coins went into a consolidation (pullback).

During consolidations most people think that nothing is happening or they are unhappy with performance, but that would be both inaccurate and short sighted. That asset, in this case gold, is creating a powerful foundation on which to build and that is what you want. All you need in here is money and patience. In my opinion, this is the time to accumulate as much of that asset as you possibly can and then just wait for the market to do its job.

Let’s look at this past year in the following chart. Notice the black jagged lines on the spot gold chart, they show you that day’s emotions; the longer the line, the greater the price volatility on that particular day. You don’t see any jagged daily lines on the numismatic chart because it takes more time and effort to take physical possession and/or deliver for a physical sale. You can also see that while both are in positive trends, while there is currently a pull back in the spot gold market, the numismatic coins are not experiencing that pull back. I can’t tell you that won’t be the case in the future, but clearly at this time, the numismatic coins are held firmly in hands that do not want to let them go.

Digital/paper markets are easier to control outcomes; market moving up too much? Make it more expensive to trade by margin increases, rule changes etc. Physical metals are much harder to manipulate and can perform differently than spot gold, yet gold remains the most under owned asset with an estimated 1.5% of a portfolio’s position. Don’t believe me? Well who do you know that owns gold? If you haven’t already positioned into gold, we believe that now is the time to do so, before the public rushes in.