The Bond Market Crashed on October 15th

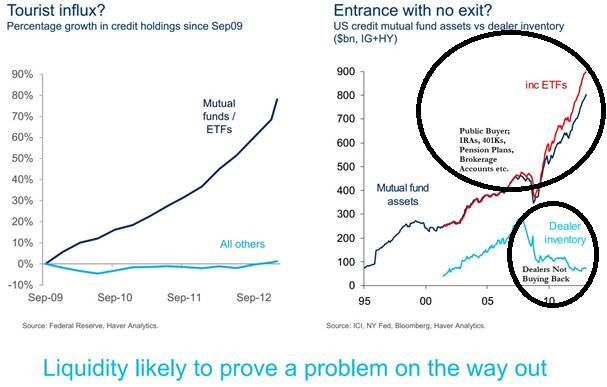

Banks used to buy and sell bonds, which made it fast and easy for you to buy and sell bonds. Since the crisis began in 2007, they are no longer doing that, as witnessed by the chart below and report from the US Treasury which can be viewed here: http://www.treasury.gov/resource-center/data-chart-center/quarterly-refunding/Documents/Charge_2.pdf.

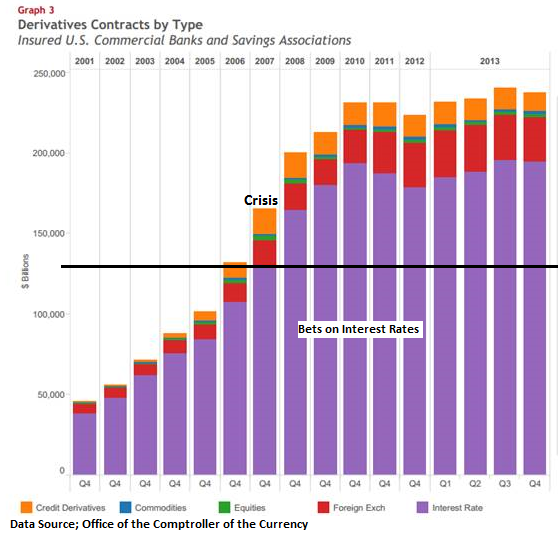

Instead the banks that used to supply that market liquidity are placing bets on bond interest rates (derivatives) at a fraction of the cost of buying the actual bonds, and with fewer reserves required to support their bond positions.

According to the US Treasury “The boom in fixed-income derivatives trading is exposing a hidden risk in debt markets around the world: the inability of investors to buy and sell bonds.†You can see in the graph below from the Office of the Comptroller of the Currency that there has been roughly a 42% increase in reported interest rate bets. The actual amount at risk is most likely higher because not all of these bets are reported and the graph does not reflect global bets, just what is in the FDIC insured banks.

So why does it matter? Because it was bets against mortgages that ignited the current crisis the entire world is still struggling with. Those bets were miniscule compared to interest rate bets.

Ask yourself, “Is it possible that interest rates might rise?†At some interest rate level above where they are today, some big global banks will lose a bet. When that happens, according to the Bank of International Settlements, global central banks have will have no ammunition left to fight like they did in 2008.

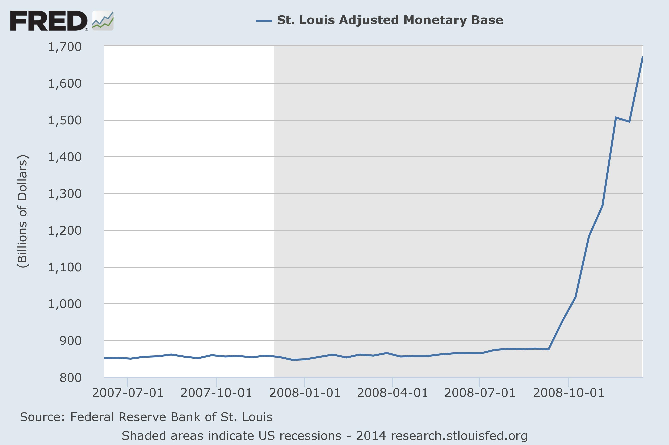

Like AIG’s lost bet against mortgages, taxpayer money paid off the winners of the bet at 100%, when the market value of those bets were zero, because if they didn’t, stock and bond markets would have gone to zero too. The chart below depicts that taxpayer money being given to the banks.

On October 15, 2014 the illiquidity in the markets almost became apparent to all as Treasury Bond trading computers were TURNED OFF because of stock market downward pressure and bond market volatility (rapid price swings)!

“When the day began on Oct. 15, an unprecedented number of investors were betting that interest rates would rise and U.S. government debt would lose value.â€

http://www.bloomberg.com/news/2014-11-18/flash-boys-invade-treasury-bond-market-in-new-era-of-volatility.html

“The market hadn’t been tested until Oct. 15 “and we failed the test,†said Michael Cloherty, head of U.S. rates strategy at Royal Bank of Canada’s RBC Capital Markets unit in New York. “Liquidity is not what it used to be.â€

http://www.bloomberg.com/news/2014-10-19/leveraged-money-spurs-selloff-as-record-treasuries-trade.html

Mr. Carney is the past Central Bank of Canada Chairman and current Central Bank of England Chairman and he says, “Fundamentally, liquidity has become more scarceâ€. This seems to have sparked some bizarre price swings, such as the so-called “flash crash†in the Treasuries market last month.â€

What that means is that US Treasury Bonds HAD NO BUYERS, THE MARKET CRASHED, even though you did not see it. Frankly, neither did I and I pay attention!

So aside from the bank trading computers giving the appearance of your ability to buy and sell, who is really supporting the bond markets?

The October 2014 IMF Financial Stability Report shows deposits into mutual funds and ETFs are funding bond markets. If inflows stop, so does credit. In other words, if you own or buy mutual funds or ETFs…YOU are funding the debt markets. YOU are funding the debt markets and YOU will lose EVERYTHING in fiat money products if a bunch of you stop buying because you are the ONLY BUYERS and you are NOT too big to fail.

“The non-bank sector, particularly mutual funds and ETFs, has become an increasingly important supplier of credit, as many banks continue to have limited balance sheet space to support private sector credit. Since 2007, mutual funds, ETFs, and households have become the largest owners of U.S. corporate and foreign bonds, accounting for 30 percent of total holdings.†“Although steady inflows have boosted one dimension of liquidity, other more structural market liquidity measures, such as its depth and breadth, have deteriorated. This is reflected in lower trading volumes, smaller trading size, a smaller share of large trades, and less frequent trading of many securities in less liquid fixed-income markets such as corporate bonds… This deterioration in underlying structural liquidity may only become apparent when inflow liquidity disappears at times of stress, and thus inflows could be providing a false sense of comfort to investors about underlying liquidity.†Source: http://www.imf.org/external/pubs/ft/gfsr/2014/02/pdf/text.pdf

So to put this in one sentence; anything you have in fiat money instruments can and will go to zero and it almost happened October 15th. If it had, you would no longer have any choices.

If we have not made this clear, please let us know and we will try again because frankly, when it happens, there will be no more advanced warnings!

Also if you would like to attend our webinar on “The Strategy” please let us know and will will email you upcoming dates. The webinar goes into more detail on the Fiat money disease and how it affects your bonds, stocks and cash along with solutions to effectively deal with the issues that are currently unfolding.

Bond limbo: How low can rates go? CNN Video

[Get a Free ITM Trading Gold Investor’s Guide Home Delivered]

“Bonds are a place where people are trying to hide today. Investors have been chased into them,” said Keith Trauner, co-manager of the GoodHaven mutual fund (GOODX).