The Biggest Bargain in Gold

By: Lynette Zang,

Gold is in a positive trend clearly showing higher and higher lows.

The kind of gold you choose depends on your goals. Let’s compare the difference between the physical and spot markets.

| Spot Gold Market | Physical Gold Market |

| Short Term | Long Term |

| Used for Trading | Used for Insurance |

| Unlimited Amount | Finite Amount |

| Use of Leverage | No Leverage |

| Never takes possession | Takes possession |

| Visible to markets | Invisible to markets |

| Controlled market | Partially controlled market |

| Can go to 0 | Never gone to 0 |

| Non monetary unit | Monetary unit |

| Not held by central banks | Held by central banks |

| Priced in fiat currency | Maintains Purchasing Power |

| Been around since 1974 | Been around 6000 years |

Since I know this to be about currencies, I only want physical metals. Basically, there are several ways to own physical metals. Let’s compare.

| Bullion | Semi Numismatic | Numismatic Coins |

| Asset Protection | Asset Protection | Asset Protection |

| Growth | ||

| Instantly liquid | Instantly liquid | Instantly liquid |

| May be reportable | Non Reportable | Non Reportable |

| Bars, Ingots, Coins | Coins | Coins |

| Tied to spot market | Tied to spot market | Free Market |

| Used in IRA’s |

While asset protection maintains your current purchasing power, growth expands your purchasing power.

Example: In the early 1900’s, with a savings based currency, either a $1 gold coin or $1 bill (gold certificate) would buy 11 loaves of bread. Today, with that same configuration, a raw $1 gold coin is worth approximately $350. Therefore, you could still buy 11 loaves of bread with that gold coin. Today the US Dollar is debt based and you are lucky to get ¼ of a loaf with that paper dollar. That’s asset protection.

That same exact coin in a MS65 condition would currently cost $2660. You could certainly purchase a lot of bread for $2660 at this point in the trend cycle. That’s growth.

Every portfolio should be diversified between asset protection and growth. The percentage is based upon your personal goals and circumstances. For the growth part of your portfolio, you must discover the biggest bargain in the positive asset class and do so before everyone else does. It may require patience, since markets can do anything, however the biggest bargain, are numismatic gold coins.

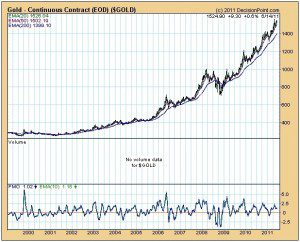

Here’s a long term chart on spot gold, which is trading near all time highs in this positive trend.

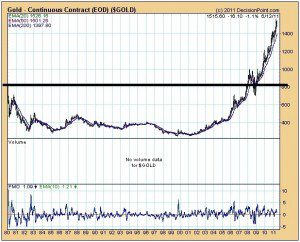

Let’s compare growth numismatic coins. Both are in a long term positive trend, showing higher and higher lows.

But the numismatics are trading 63% below its all time high in 1989! In fact, as you can see from the chart, the current pricing is lower than the high that was created in the panic of 2008 and according to my spread sheets (based on common dates to ease of data analysis) the current pricing on a percentage basis, is the most narrow that it’s been as compared to the spot market. Now that’s a bargain!

At different times in a trend cycle certain things lead and others lag. At his time the numismatics are lagging. Why? Several reasons: Stock brokers can only sell paper. This is the last vestige of free market. It has been the middle class that has felt the biggest brunt of this economic down turn and were forced to sell their coins. For these reasons the coins are in a consolidation. In a consolidation, things move from weaker hands to stronger hands and provide a huge buying opportunity.

Every portfolio needs to be appropriately diversified. But for the growth part of your portfolio, no doubt the biggest bargains in this long-term positive trend are the numismatic growth coins. They won’t stay that way forever.