Swiss Franc vs. Euro

Today the Swiss Franc plunged the most ever against the euro after the SNB (Swiss National Bank) announced that they would create unlimited amount of francs and sell them versus the euro in order to weaken the franc.

By Lynette Zang:

The last time they did this was in 1978, the year they removed themselves from the gold standard.

Switzerland is thought of as a more stable economy. Therefore, when European stocks and bonds are sold, that money must go someplace and recently it has been going into the Swiss franc as a safe haven which has been pushing the currency’s value higher.

The SNB does not like the impact that this has on exports, making them more expensive to their most important export market, Europe. As you devalue a currency through inflation, the population that is forced to use the devalued currency experiences price inflation, so they may be consuming less. This could have a negative impact on tax revenues, which might force the government into deficit spending, consequently forcing them to issue more government bonds. The ability to pay those bonds is the problem that forced the safe haven flight to begin with. Whew! It seems like a vicious cycle to me.

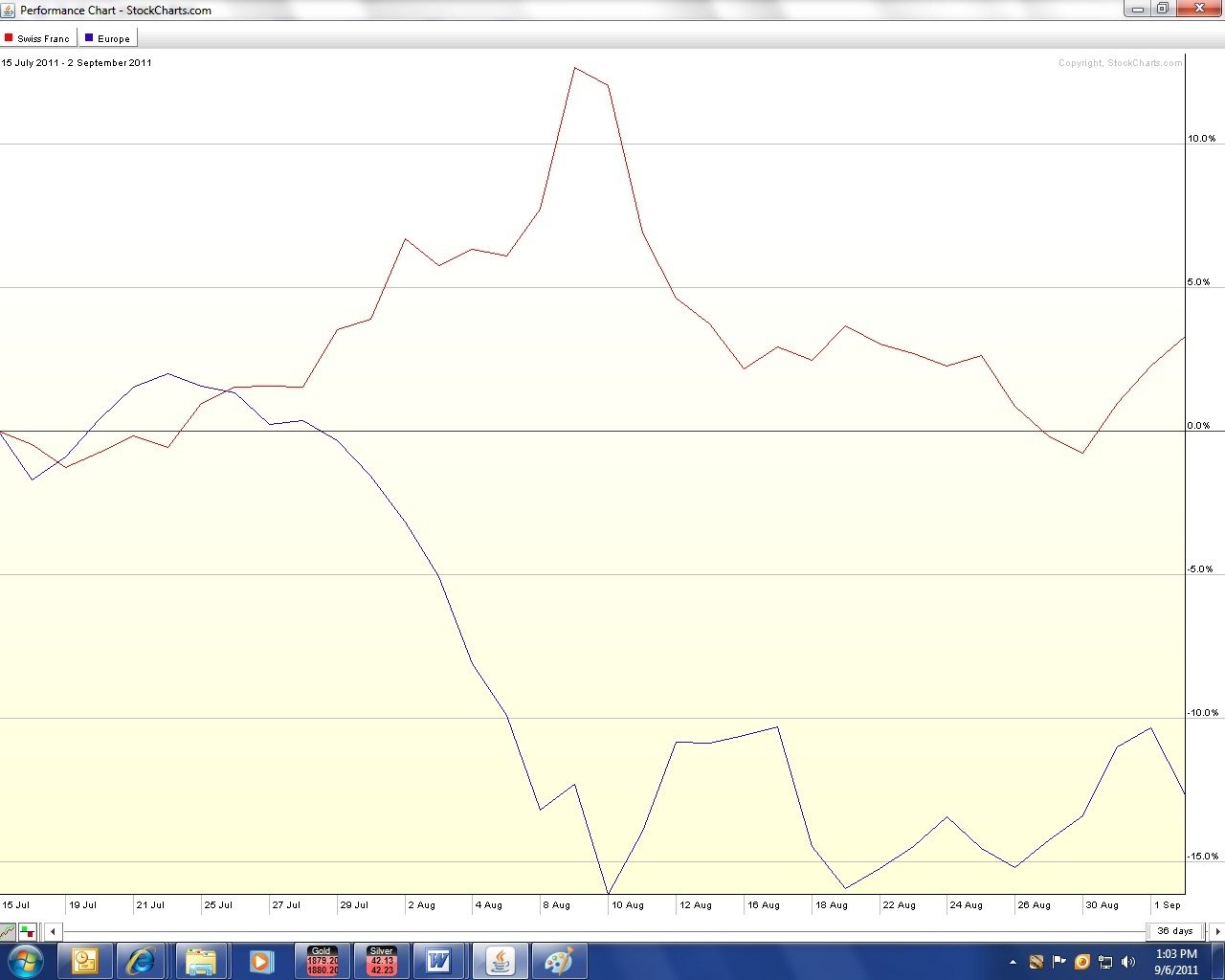

There are only two ways to value a currency. The first is against other fiat currencies. Let’s look at the Swiss Franc (red) vs. the Euro Dollar (blue). The chart below shows relative performance between the two fiat currencies over the last month. You can see that the Swiss Franc has gone up as the Euro has gone down.

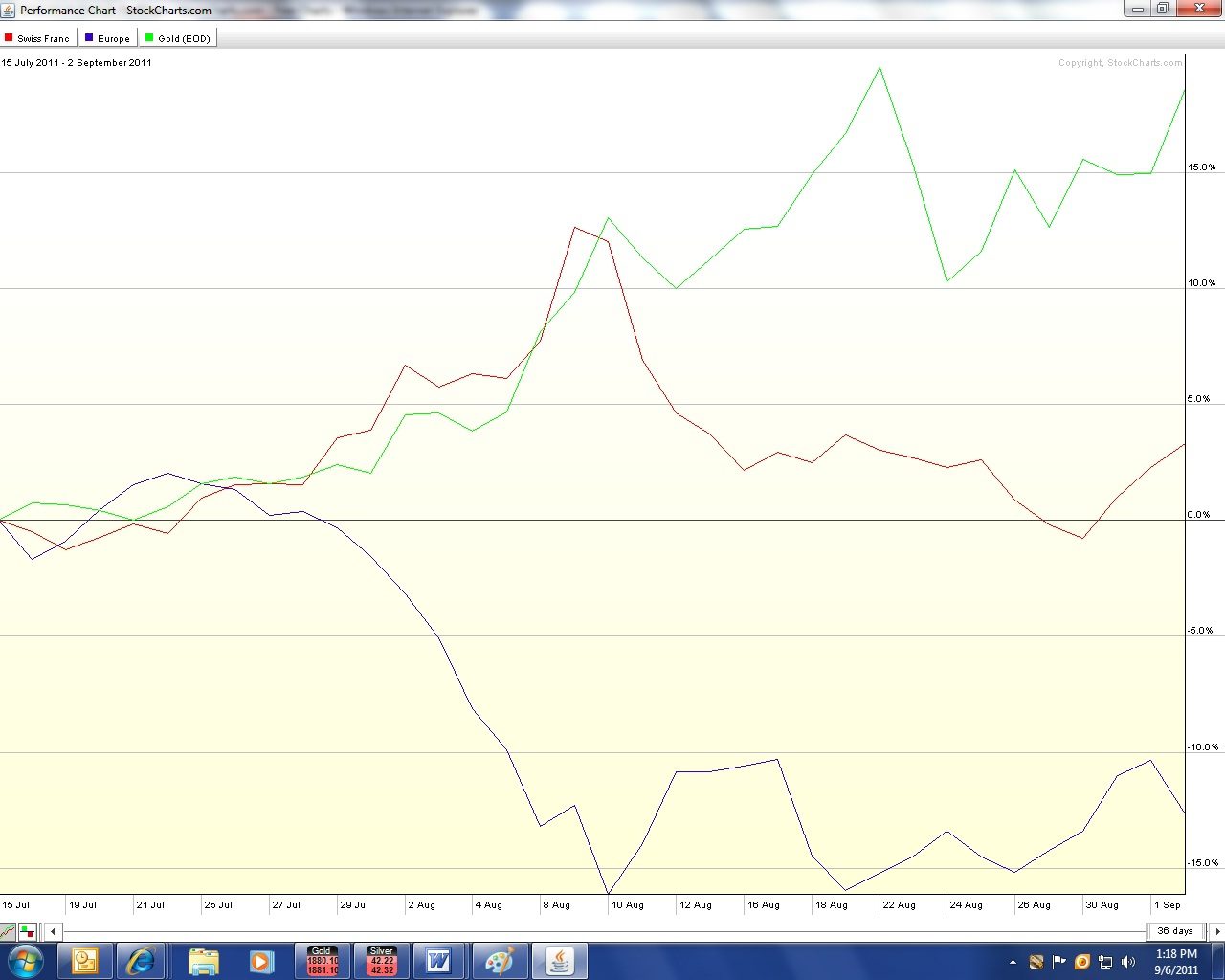

The other way to value a currency is against the primary currency metal, gold. The chart below shows relative performance between the two fiat currencies gold (green line) over the same period.

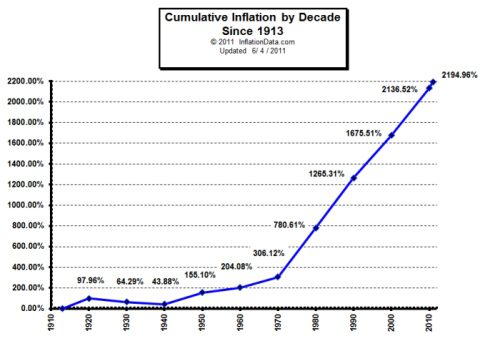

The problem is that this is a global race to rob the population of purchasing power through inflation and has been going on in earnest since the 1970’s.

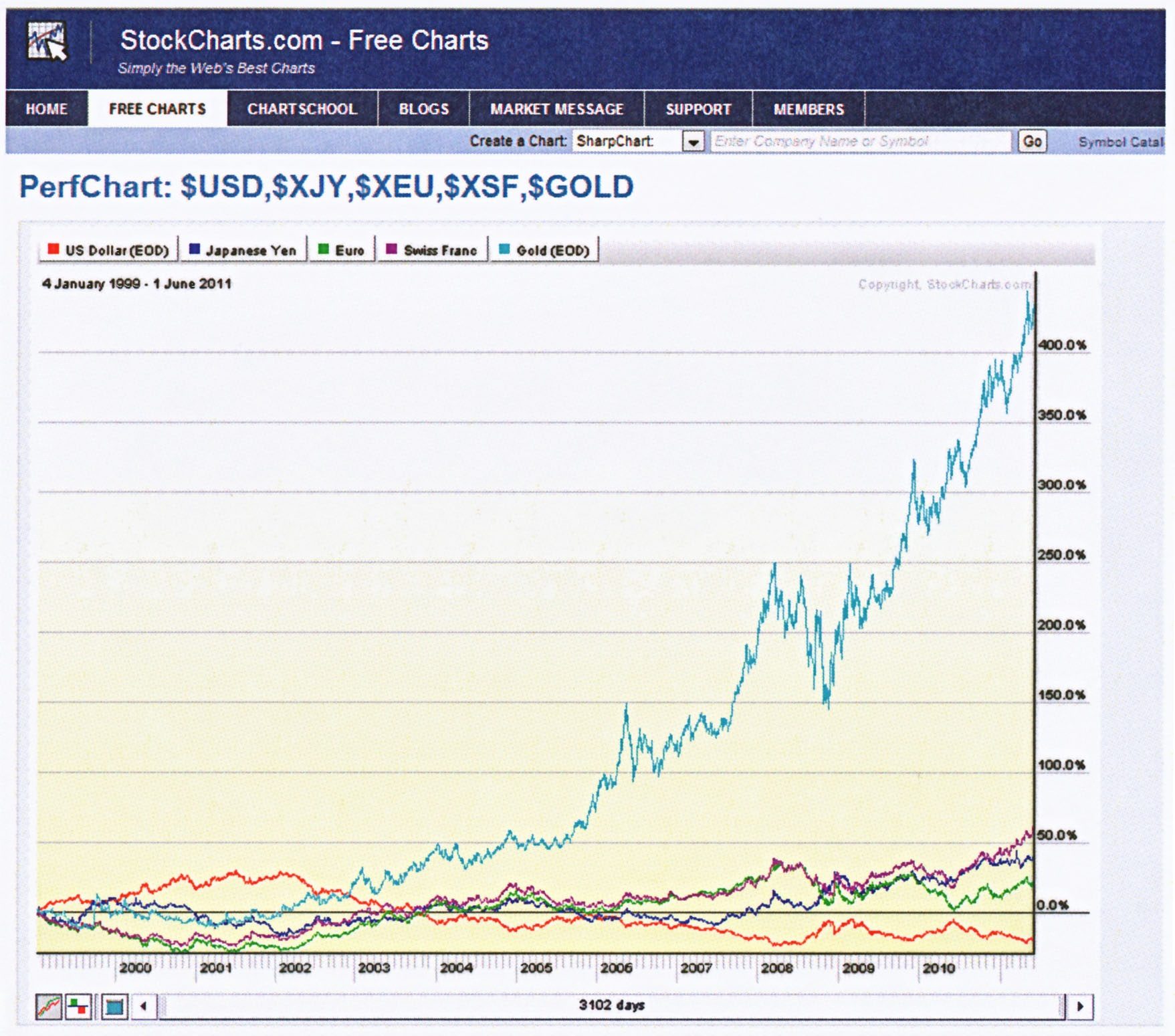

This particular trend started to escalate around 2000, since then the dollar has lost over 33% of its purchasing power. Look at the following chart of gold against key currencies.

I know that the talk is all about fighting deflation, but what is deflating and why is deflation a bad thing? After all, if the cost of goods goes down you can buy more. So for the individual, it might not be such a bad thing. For governments and central bankers it reduces the money supply and tax revenues.

There is only one way to fight deflation and that is with inflation. That’s the choice that governments and central bankers have chosen for us. The chart above is misleading because it isn’t gold going up, though it certainly is in terms of all fiat currencies. It is really about all of those fiat currencies dropping in value and purchasing power against the one true store of wealth, gold.

While we cannot control the choices that the powers that be make, we can choose how we’ll participate. As long as you have the ability to convert those devaluing currencies into gold, it is not too late. Just make sure it is the physical kind if you truly want protection unlike the Swiss franc.