Stocks and Commodities Manipulated

How Stocks and Commodities are Manipulated

Transcription

Hi guys when that thing she’s market analyst here at ITM Trading a full-service buy sell physical precious metals brokerage hell today we’re going to answer the question i’m going to read it can you please explain why declining volume and rising price is evidence of manipulation and if so what is the mechanism for this manipulation volume as well those are the questions that we’re going to answer today so I i remember that if you click on the link below this you can see all of these images and jpeg form so we’ll get started now first of all here comes a tool for market manipulation of the different entities central bankers government banks and non-bank corporations so that’s what other specific in there you can look at the jpeg but basically we’re going to take a quick look at all of them.

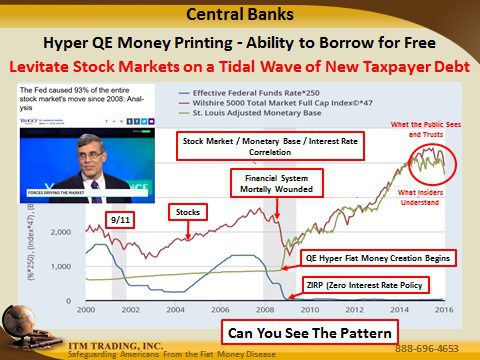

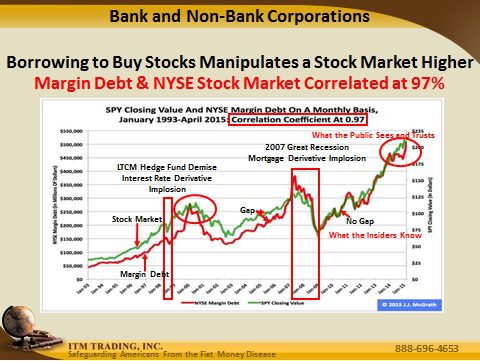

Ok first we’ll take a look at the central bankers and can you see since the crisis hit they lowered interest rates all the way down and then they started printing money to flood the system with liquidity can see that go on and see jpg ok so the stock market and correlated 93% with central bank money creation because when a central bank recreate money or create money the first place that it goes into the banking system and then the bank loan it or create leverage on it so we’re going to talk a little bit more about this so here’s how the banks of some of the ways that the banks and non-bank corporations can push the stock market’s up through that leverage because this is the origin in other words of borrowing to buy stocks ok and you can see that correlation is ninety-seven percent

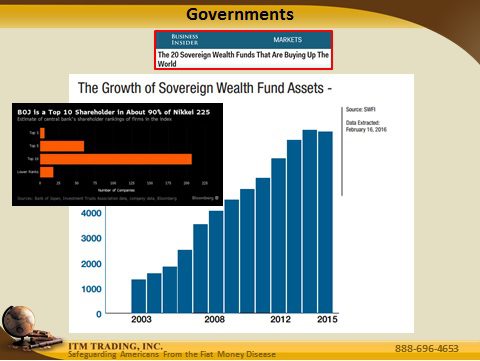

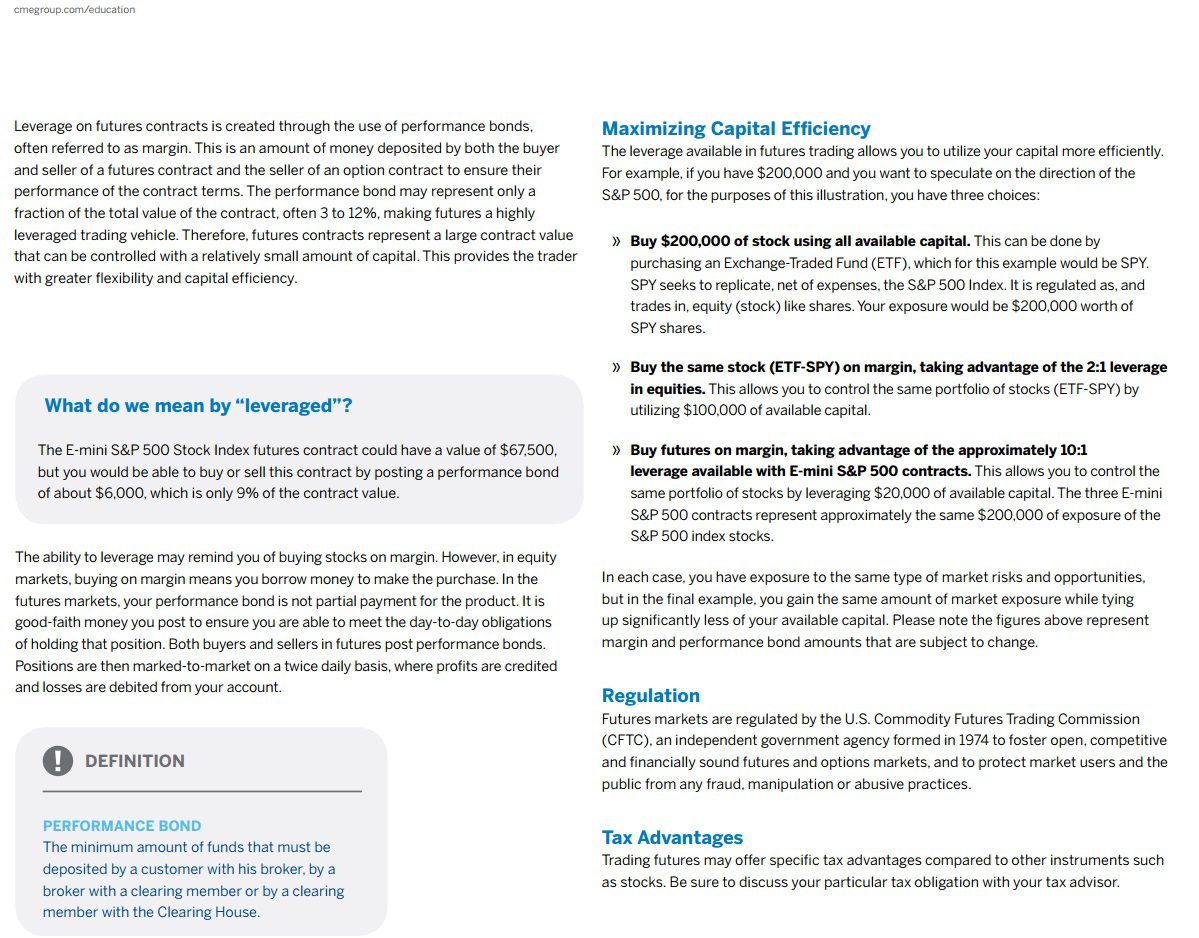

Ok another thing that government can do is they all have one called now sovereign wealth funds this growth has really taken off and 2000 to support the market and I don’t know when you see this black part here that shows you that the bank of japan the central bank of japan has let me read that way that were quite there right at the top ten shareholder of about ninety percent of the 90 stock market index now we’re going to the volume and just a second we’re going there now so this whole part here was about injecting capital into the system so now let me go to how can market go up I declining volume and oh I love the futures markets which is just an electronic market this is up the cme group there were just one of them that doesn’t so I’m just going to focus on one however there are a number of exchanges that create these electronic only product that was a very little bit of money you can control a lot of whatever.

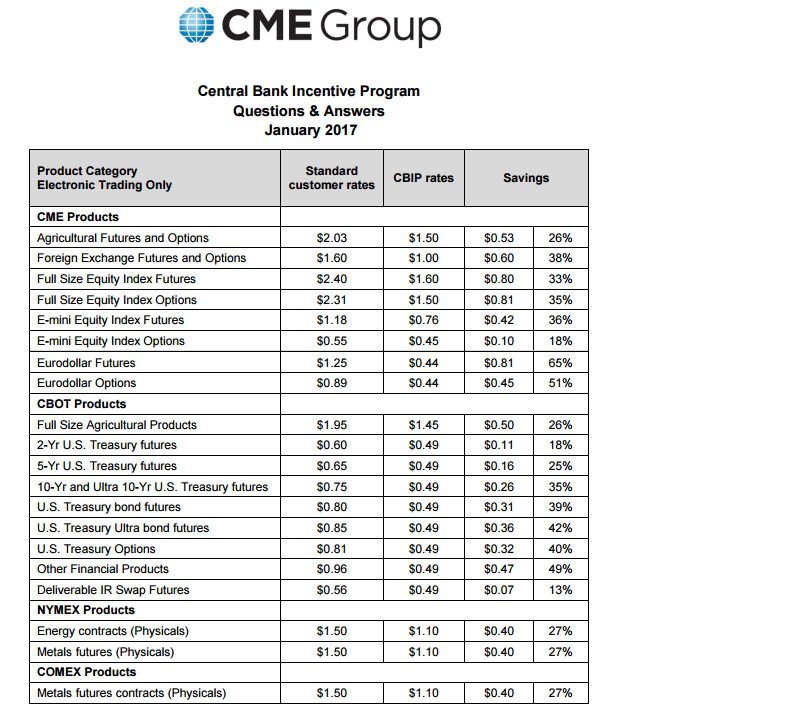

I know you see it i’m going to kinda just a little bit ahead here but these are many not all but many of the products electronic products used to control a agriculture foreign exchange currencies equities bonds euro dollars which is also currencies treasuries ok at bonds and then of course we’ve talked mostly in these about how they control the physical metals market so can you see that long list and can you see the price ranges this column here and you’ll be able to see it better in the jpeg that column there is what it cost banks to control these contracts this column here is what control is controlled by central bank or anybody you know associated with the central bank not just the central bank they have their groups that they work with so all right we’re going to look at just to get a specific plan because they happen to mention mention it in the literature so we’re going to look at the SMP 500 and what we’re talking about here is is basically an example where buy futures on margin taking advantage of the 10 to 1 leverage ratio ten-to-one so for $20,000 roughly you can control were things to control two hundred thousand dollars worth a stock.

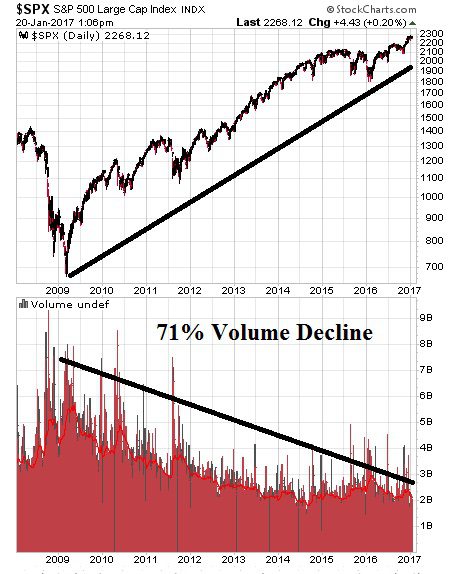

okay got that remember your goal is one dollar and ten cents control hundred ounces of the evening futures each contract is oil complicated equation 252 dollars plus those mne equity index futures cost-based a dollar 18 per contract and central banks and their minions 76 cents and that gets you a ten-to-one leverage ratio that could do a largest you could actually evil ever it up even more so this is one of those um any future contract and this happens to reflect primarily December 16 so just like on the ego can you see this big spike in volume here which then push the stock market higher so if you’re a central banker is 76 cents per contract if you are a regular bank whether they say that is a dollar 18 per contract so it’s that leverage and here’s the result and I’m going to show you long-term so here’s where the crisis-hit in 2008 touch her oh well no I wanted to see the whole Charlie I’ll given that they can get both here okay and you can see that there was a decline and volume of 71 percent since 2009 and the stock market went up to the S&P 500 now let you think that there are maybe not doing that any more this is it for the last year ok but the way that they do that i mean i just want you to think about this logically for a minute in normal free market environment prices go up when demand exceeds supply and prices go down when wait committee ops when supply exceeds demand but we’ve seen how demand has been growing in spot gold and you’ve seen enough of those charts to be that the spot price is declining and it’s because of those futures contracts and your to this indicates a decline in demand but yet the price is going up and it really is all about derivatives you and I don’t get to do that it’s the big boys I get to do that so I hope that answers your question on how is it possible for a market to ride on declining volume and if there was a lot of training going on listing in the electronic world high-frequency trading and all of that that would be reflected in the volume right so understand that you’ve got a 71 percent decline in volume in the SNP and all of the market reflect that so i can show you any of them it doesn’t better.

okay but the way that they do that is through leverage whether it’s money for free margining that out or leveraging that out putting it into I mean there’s so many different ways putting it into contract it’s all digital and i would like to point this out on this was a fake electronic trading only okay if everything goes did it all that’s really easy for that the one push almost no cost so i hope that made sense to today keep those questions coming and subscribe to our YouTube channel also always selecting different questions just like i did with to answer every friday so please be patient with me because i am getting it’s wonderful that I’m getting a lot of questions so we’re kind of trying to organize them to address what most people are asking but I promise I will address them all follow us on facebook to get notifications when we’re doing these live events and look below and there’s the link 4.jpg on all of these images and more and don’t forget we’re just a phone call away have a safe weekend bye guys