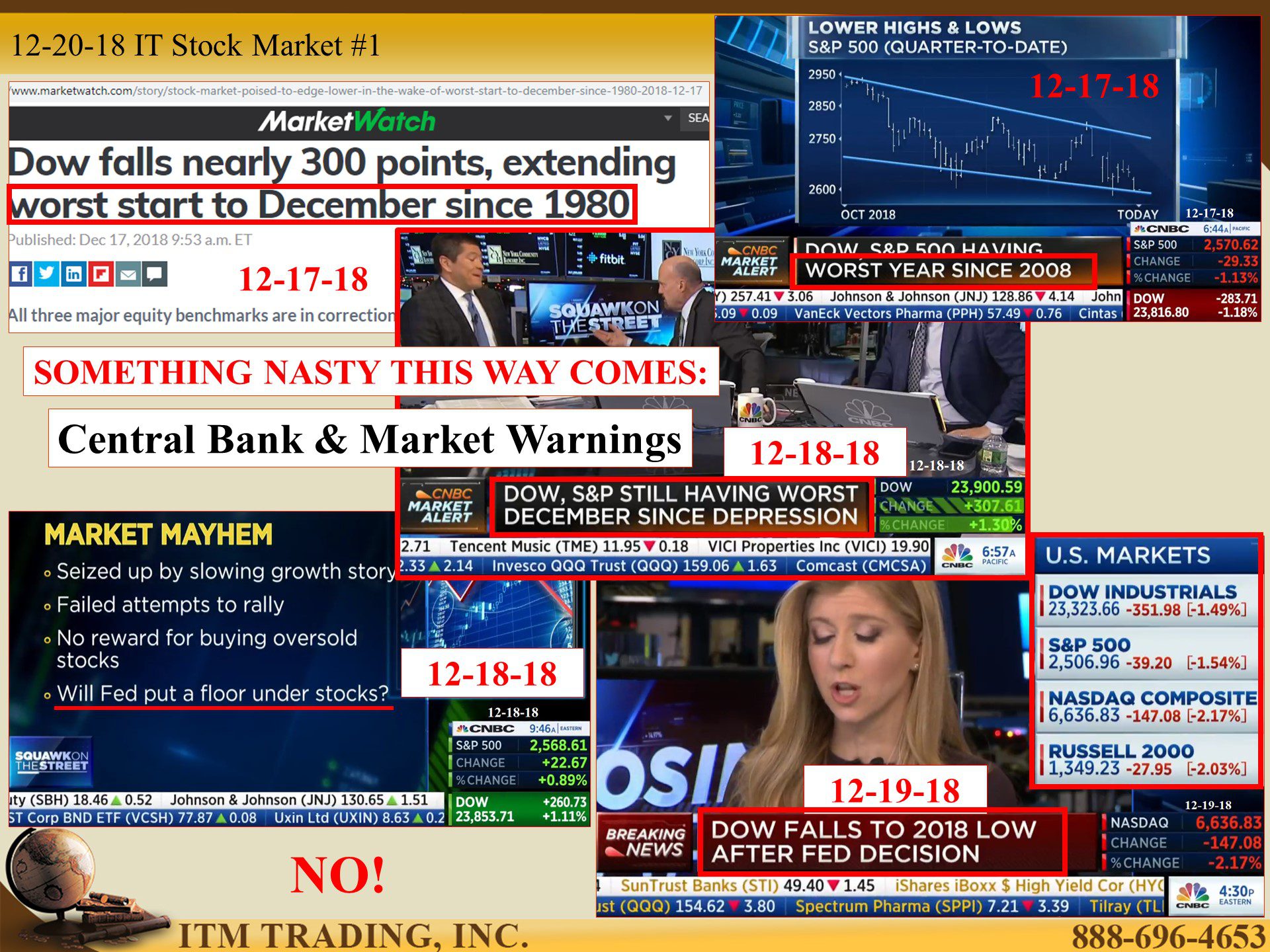

SOMETHING NASTY THIS WAY COMES: Central Bank and Market Warnings By Lynette Zang

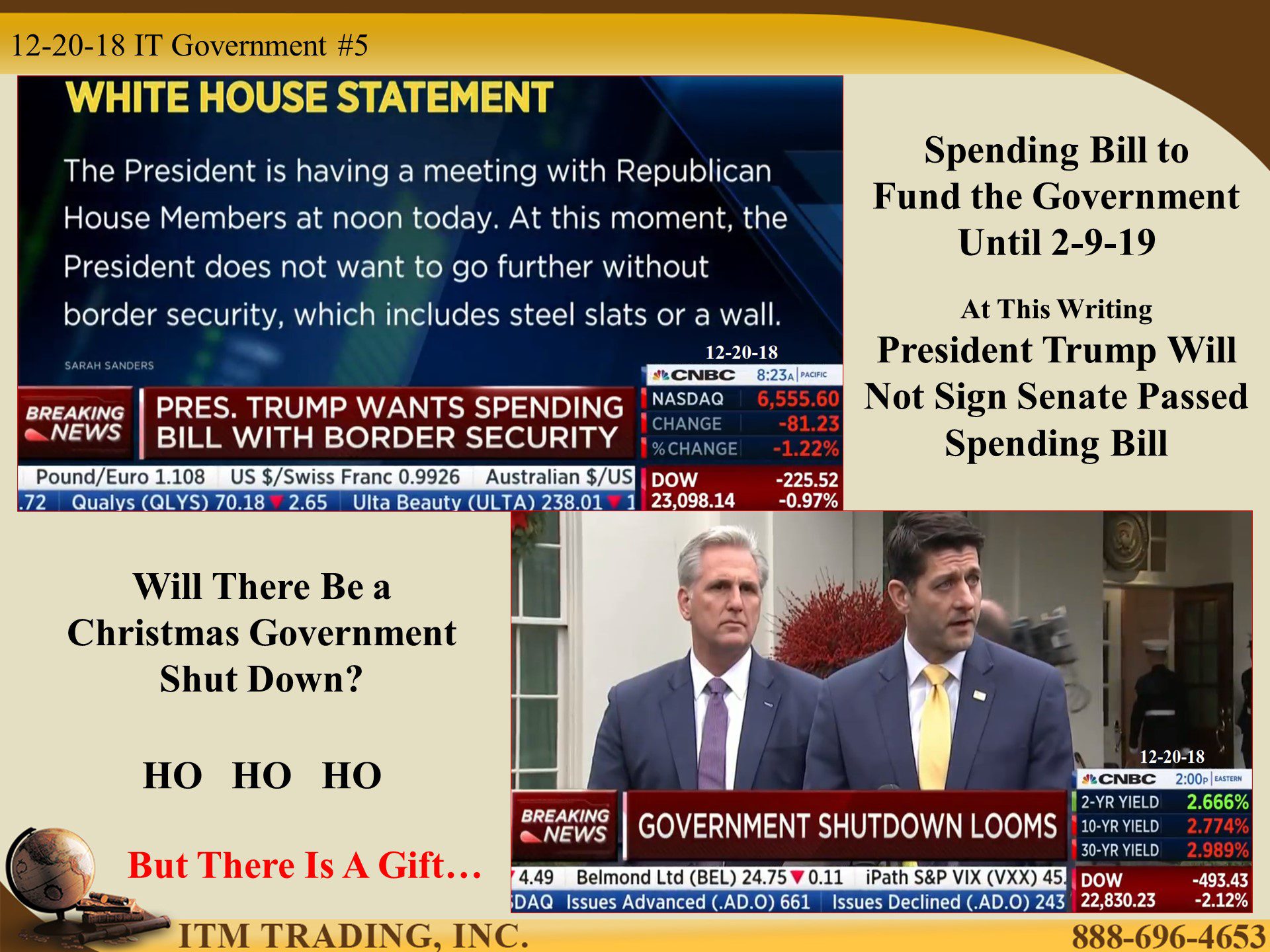

President Trump tried to insure a continued market surge via tax law changes. It didn’t work. The markets cracked the end of January and at this writing, every major index and almost every stock is in bear market territory. The negative trend escalated in October after stock markets made record highs. By November markets began indicating that this was more than just a normal market correction as one after the other exhibited a technical “Death Cross.† The last holdout was the Dow.

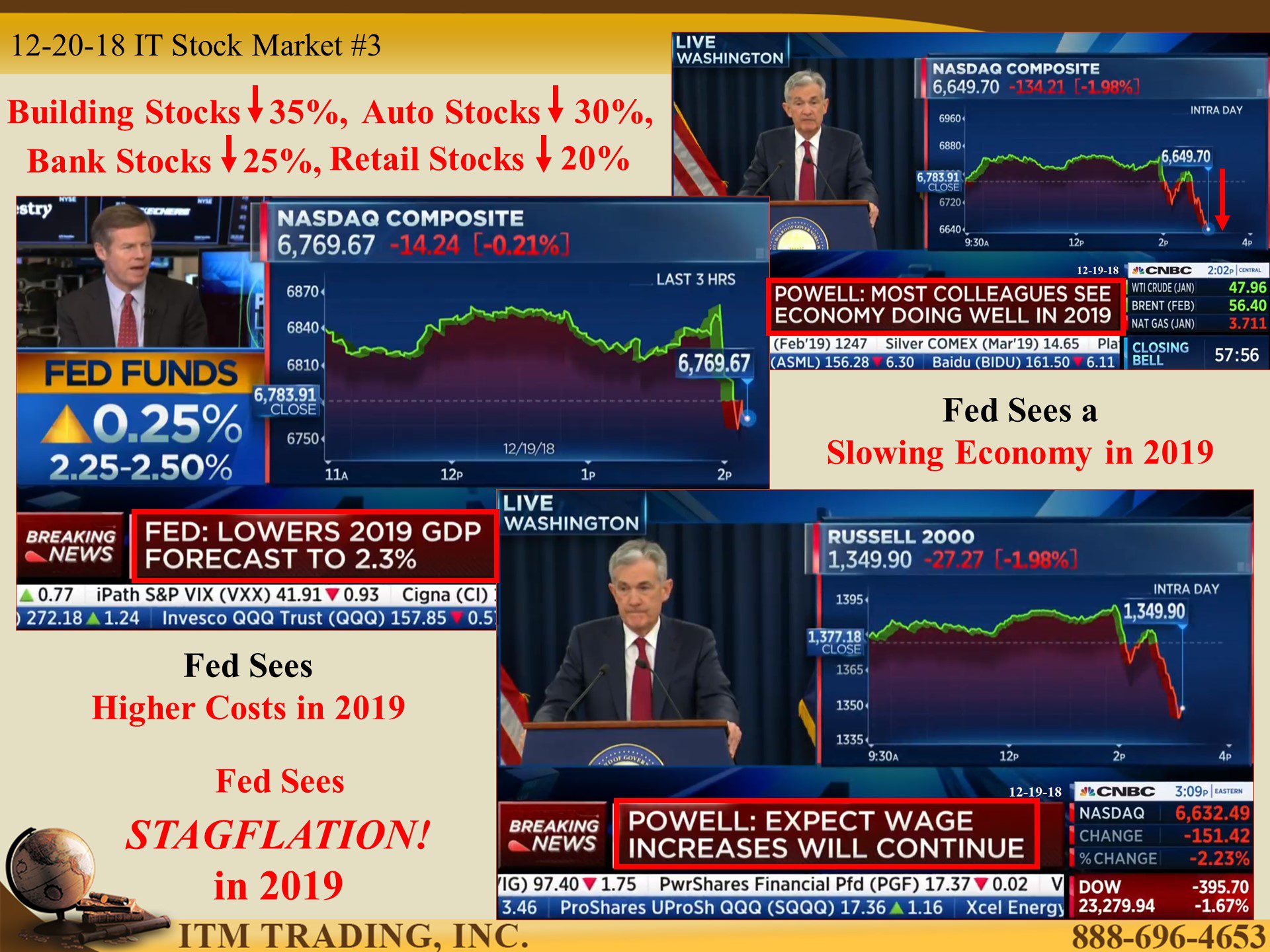

During this time, Fed Chief Powell has been systematically raising rates and allowing maturing treasury bonds to roll off their balance sheet. This is referred to as Quantitative Tightening. While pressure had been put on the Fed to halt these activities to support the markets, all hope was dashed yesterday, and the markets were not happy. The Dow exhibited a technical “Death Cross†and confirmed that the bear market is most likely to get a lot worse.

Why? What do the markets see that most don’t? The key was in Fed Chair speech, though this is not what I hear them talking about on main stream media. In fact, last week if you were listening carefully, ECB Chair brought it up too.

What they are seeing is stagflation ahead. Stagflation is slow economic growth (falling or stagnant prices) occurring simultaneously with high rates of inflation (rising costs). The last time the US had to deal with stagflation was during 1970s as the US was transitioning from a gold backed to a debt backed financial system.

We are in process of transitioning the financial system now and it appears that enough risk has been transferred from the elite to the masses. If I’m correct, the next financial crisis has begun.

As a result, spot gold and silver charts show a pronounced cup formation. While silver must break above resistance level of $15, gold has already completed that task. The next technical resistance level, at this writing, is $1,280, though none of the fiat markets reflect true value.

And that is the opportunity. Will you take advantage of it?

Slides and Links:

https://fred.stlouisfed.org/series/TREAST

https://www.investopedia.com/articles/economics/08/1970-stagflation.asp

https://stockcharts.com/h-sc/ui

YouTube Short Description:

We are in process of transitioning the financial system now and it appears that enough risk has been transferred from the elite to the masses. If I’m correct, the next financial crisis has begun.

As a result, spot gold and silver charts show a pronounced cup formation. While silver must break above resistance level of $15, gold has already completed that task. The next technical resistance level, at this writing, is $1,280, though none of the fiat markets reflect true value.

And that is the opportunity. Will you take advantage of it?