SMART MONEY MOVES: Don’t Be Left Behind by Lynette Zang

Many of you are here because you hope to increase your wealth over time but are unsure how to move forward. You believe, as I do, that the markets are in real trouble and that’s where you hold most of your wealth. In fact, many of you cannot touch your retirement assets, so what do you do?

Simply this, do what the smart money does for themselves.

Smart money, for me, is anyone that has proprietary information, the tools to manipulate markets and the ability to profit from this information and activity. Therefore; money managers, corporations, insiders, central banks and the top 1% wealth holders who rule the world.

Is it possible they would know something before you? Is it possible that by the time you’re aware of that information, it might be too late to protect yourself, let alone benefit from it?

What would you do if you knew what they were doing for themselves? Would you follow their lead? That’s my personal preference. Therefore, my goal today is to show you some smart money indicators that can show you what they know and what they are doing to benefit from this information.

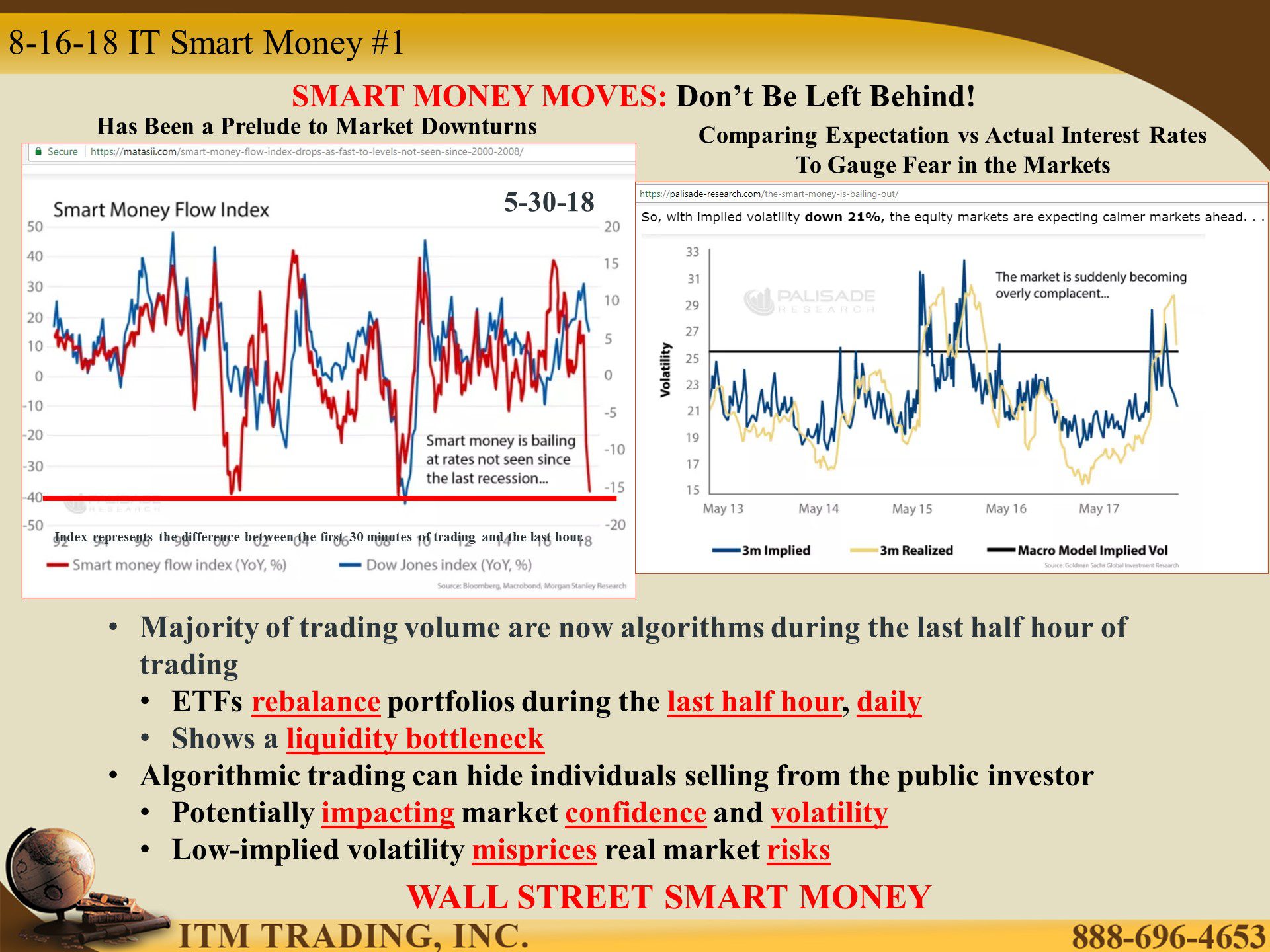

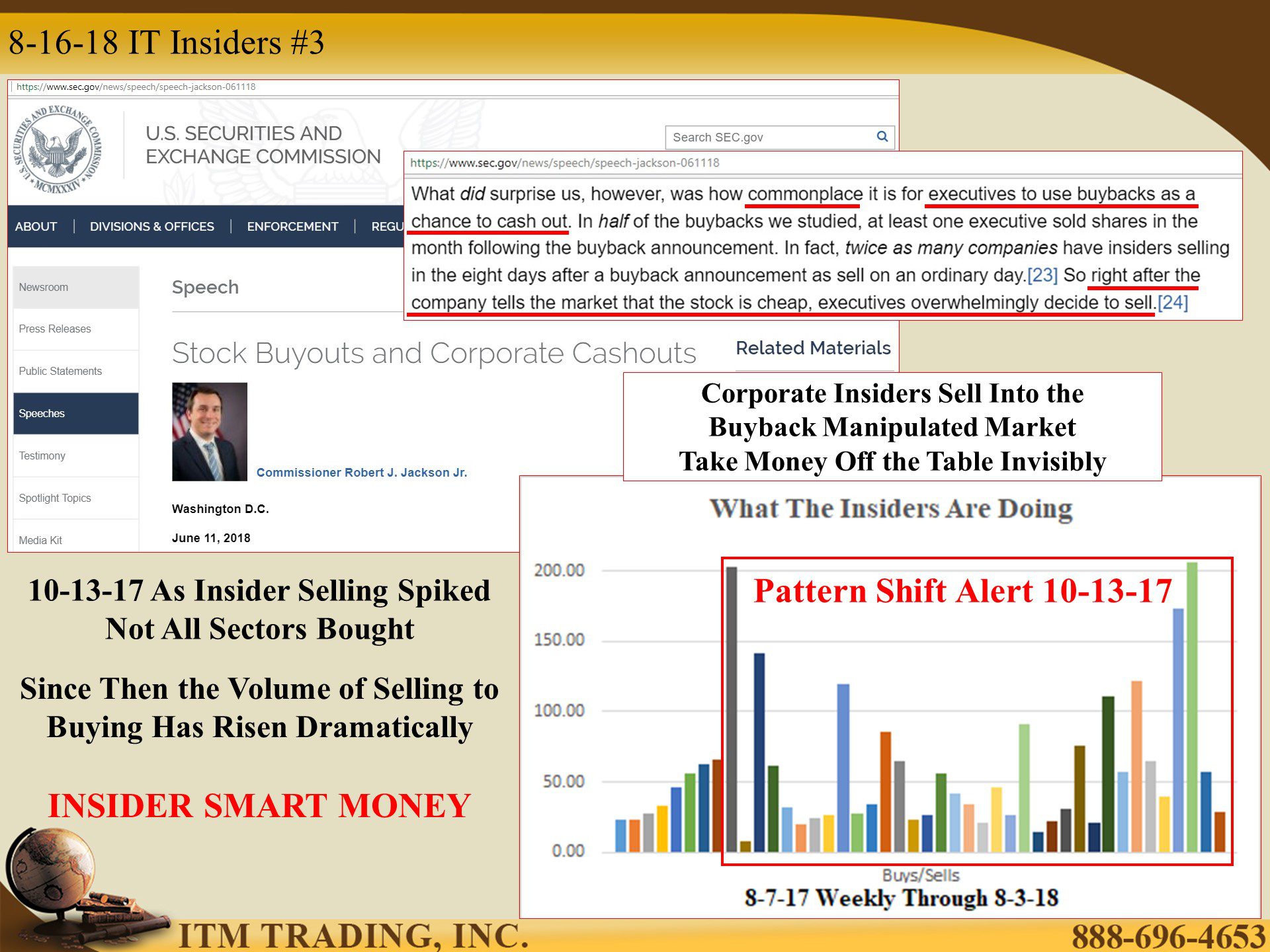

Wall Street and corporate insiders know these markets are severely overvalued and mispriced for the hidden risks brewing just below the surface of the markets. They know the shift to ETFs has created an end of day liquidity bottleneck. The advantage for individuals is to enable those wanting to liquidate with minimum market impact to do so almost invisibly, but there is almost no liquidity during the balance of the day. This was tested during the 2010 flash crash. It is a worse problem now.

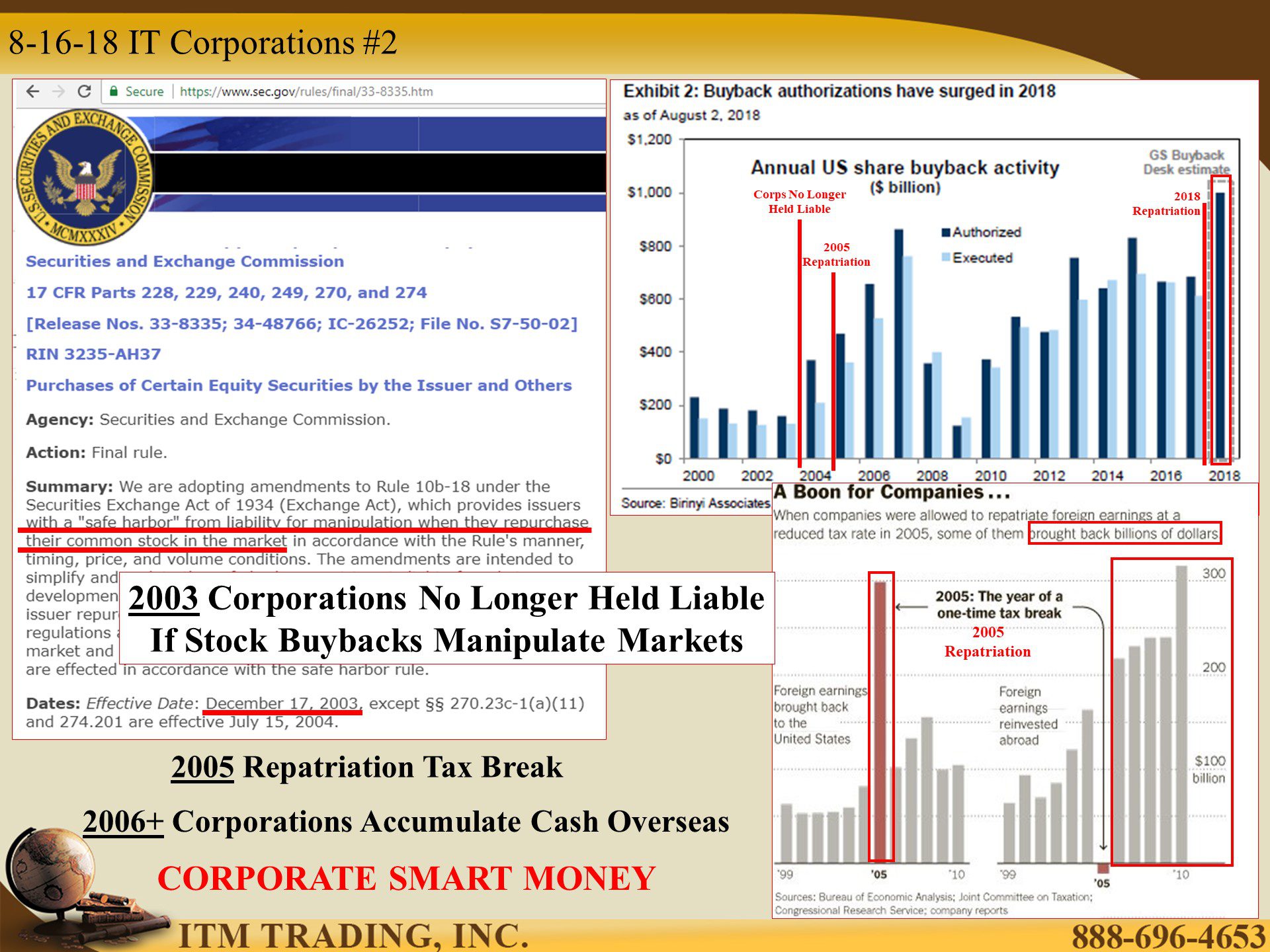

You probably were not aware, but wall street and corporations are. So, what are they doing for themselves? Using stock buybacks to push the markets higher and keep you in it, while many running corporations are selling out stock somewhere near the top of this market.

They also know that corporations are now the biggest price support to the markets since individuals are cutting back on stocks and some central banks are cutting back on QE liquidity. They know these markets will ultimately implode. Therefore, they believe NOW is the time to get out.

Public confidence is the key that enables the maximum level of the wealth transfer that will likely occur at the end of the reset road.

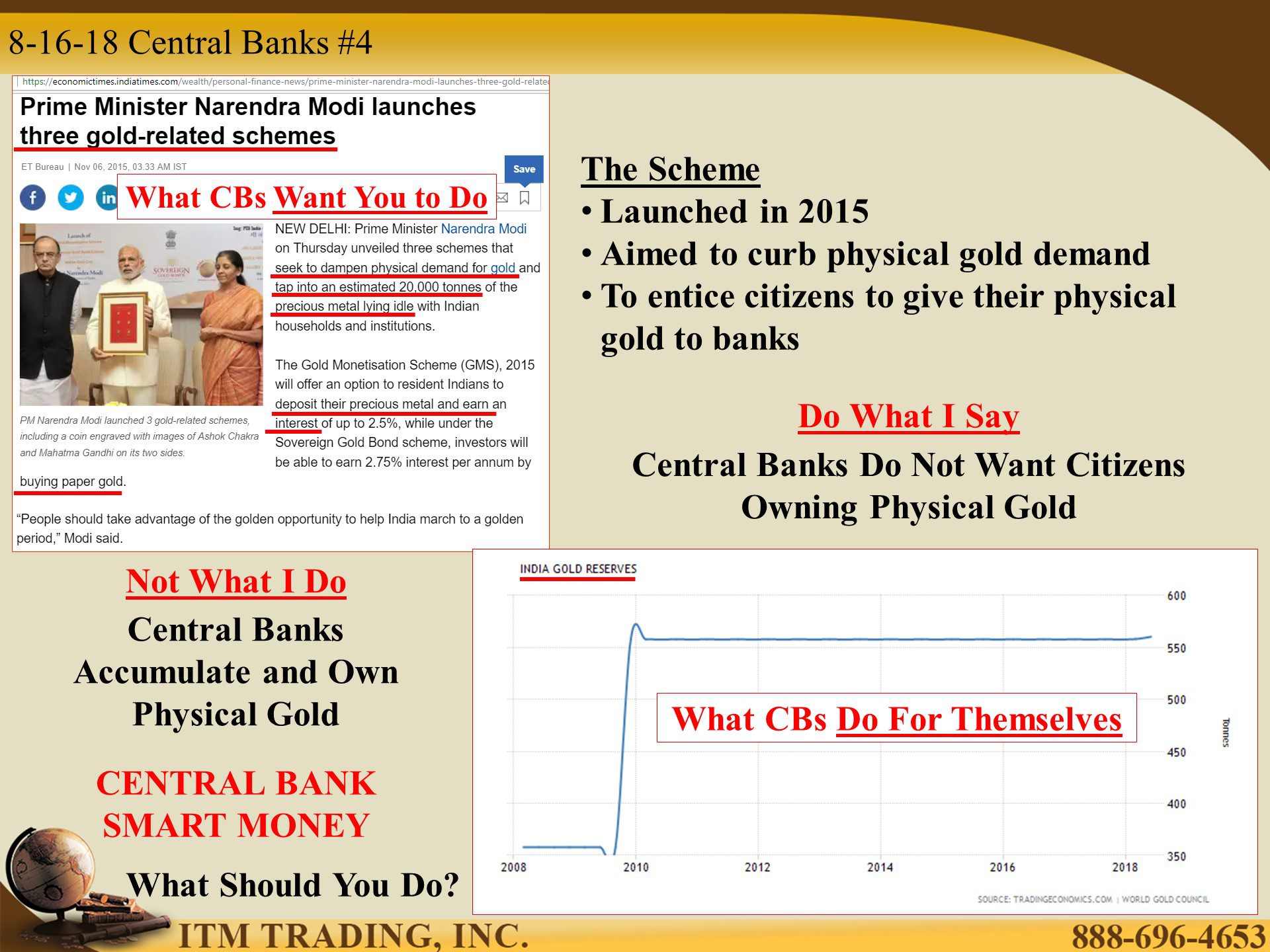

Central banks know they are at the end of this fiat experiment and that they’ve used up the inflation regulation tools (interest rates and debt) used to stimulate economies. They know the last 10 years QE experiments merely bought time to transfer risk from the few at the top to the backs of the taxpayer many. They call for a financial system reset, and their actions support that truth.

Since 2008, central banks have been accumulating massive amounts of physical gold. At the same time, they are waging a war on cash (which can protect your principal) and gold (which protects your wealth long term).

India is an example, having attempted to entice their population to voluntarily give up their physical gold for paper gold promises in 2015, demonetizing 82% of their fiat currency in 2016 and confiscating gold in door-to-door searches in 2017. All as they nearly doubled their gold holdings. Do what I say and not what I do.

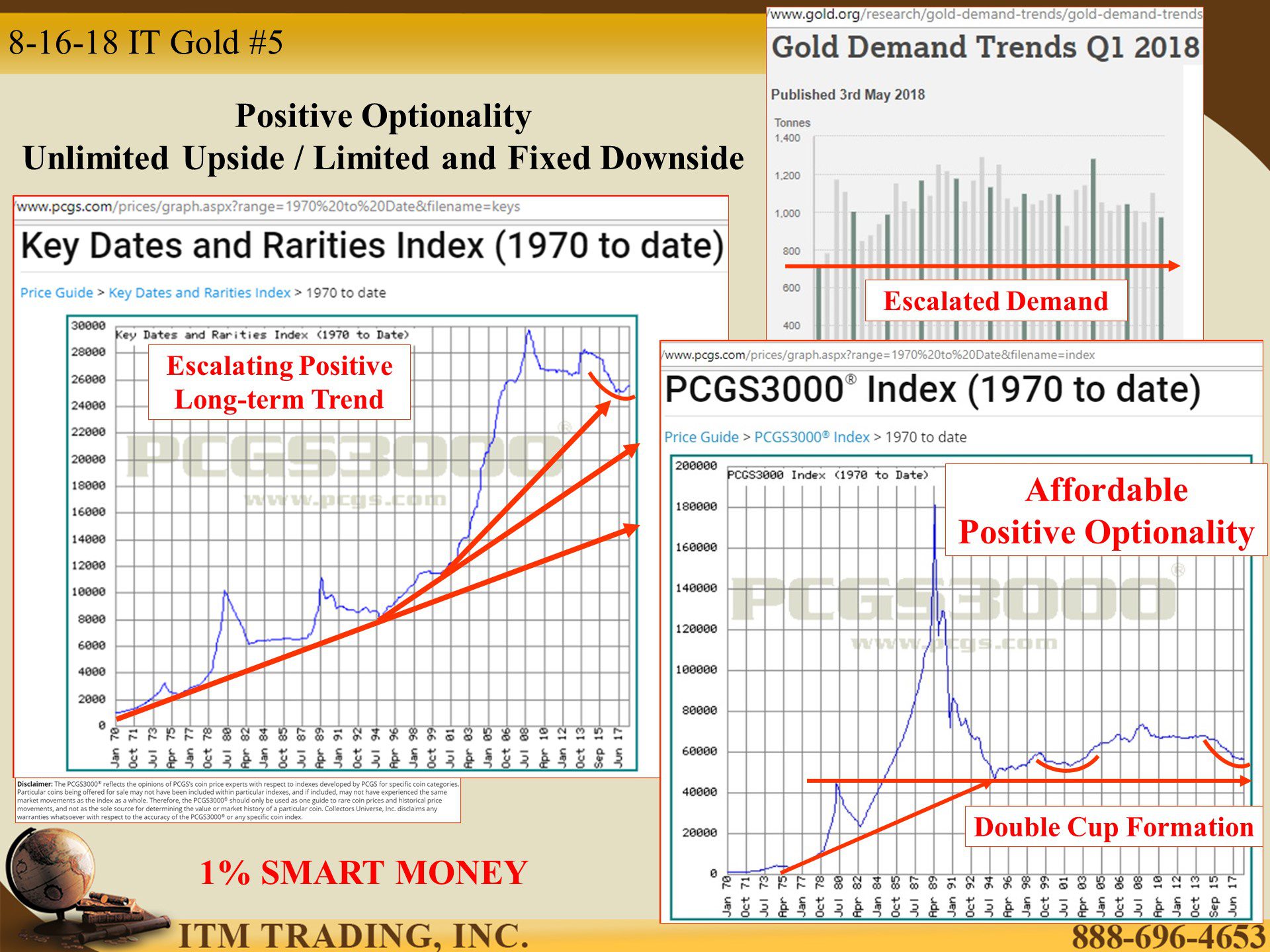

What are the 1% doing for themselves? Positioning the core of their wealth to reflect positive optionality (unlimited upside with a limited or fixed downside). You can see in the key dates and rarities index, the escalating positive trend in coins with prices starting the hundreds of thousands to millions of dollars.

This is a way to hold a lot of wealth in a small, moveable, private package. In fact, once cash is removed, this, along with silver, may be the only way left to accomplish those goals.

Additionally, since gold is used throughout the global economy, there is always demand and thus holds purchasing power value over time.

Finally, fiat money vs gold money is how a reset is executed. Which would put a limit on downside risk. Owning that gold in rare form, possibly the only legal way to own gold if history repeats and global trends continue, may well provide unlimited upside for those who hold it.

Slides and Links:

https://thefelderreport.com/2018/05/30/whats-behind-the-rapid-plunge-in-the-smart-money-index/

https://palisade-research.com/the-smart-money-is-bailing-out/

http://www.wsj.com/mdc/public/page/2_3024-insider1.html

https://www.sec.gov/rules/final/33-8335.htm

https://www.sec.gov/news/speech/speech-jackson-061118

https://tradingeconomics.com/india/gold-reserves

https://www.pcgs.com/prices/graph.aspx?range=1970%20to%20Date&filename=index

https://palisade-research.com/the-smart-money-is-bailing-out/

www.gold.org/research/gold-demand-trends/gold-demand-trends-q1-2018