SILVER AND THE SHORT: JPM Behind the Scenes… by Lynette Zang

A couple of weeks ago I was asked why JP Morgan was accumulating physical silver. I didn’t really have an educated answer for you, so I jumped into the JP Morgan Chase rabbit hole.

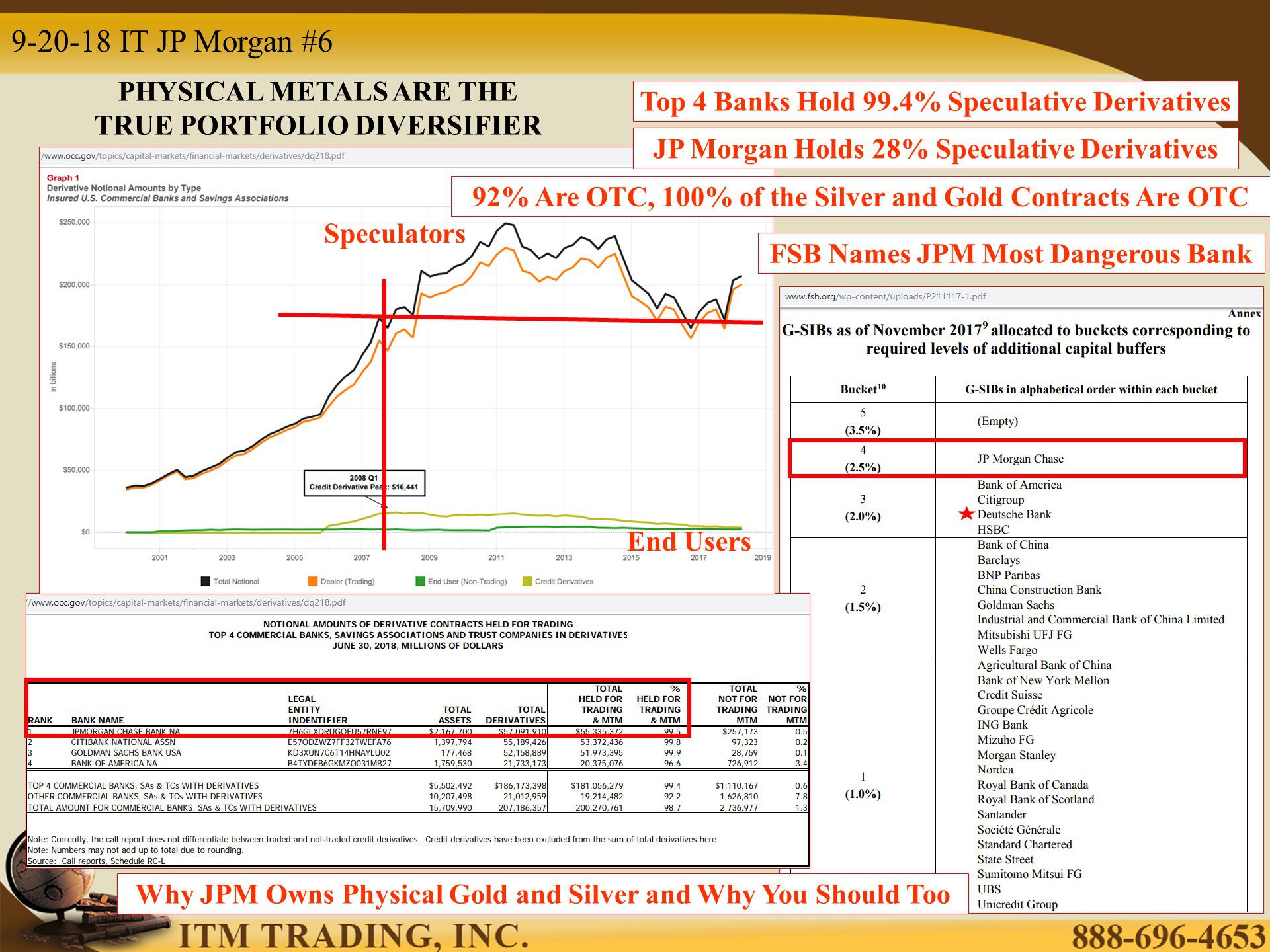

Today we’re looking behind the scenes of JP Morgan Chase, arguably the biggest and most powerful bank in the world. In fact, the Financial Stability Board (FSB) classifies them as the most dangerous “Systemically Important Financial Institution†due to their size and how they are integrated globally, because If their business fails, so would the entire global financial system.

Shockingly, Deutsche Bank is considered less risky.

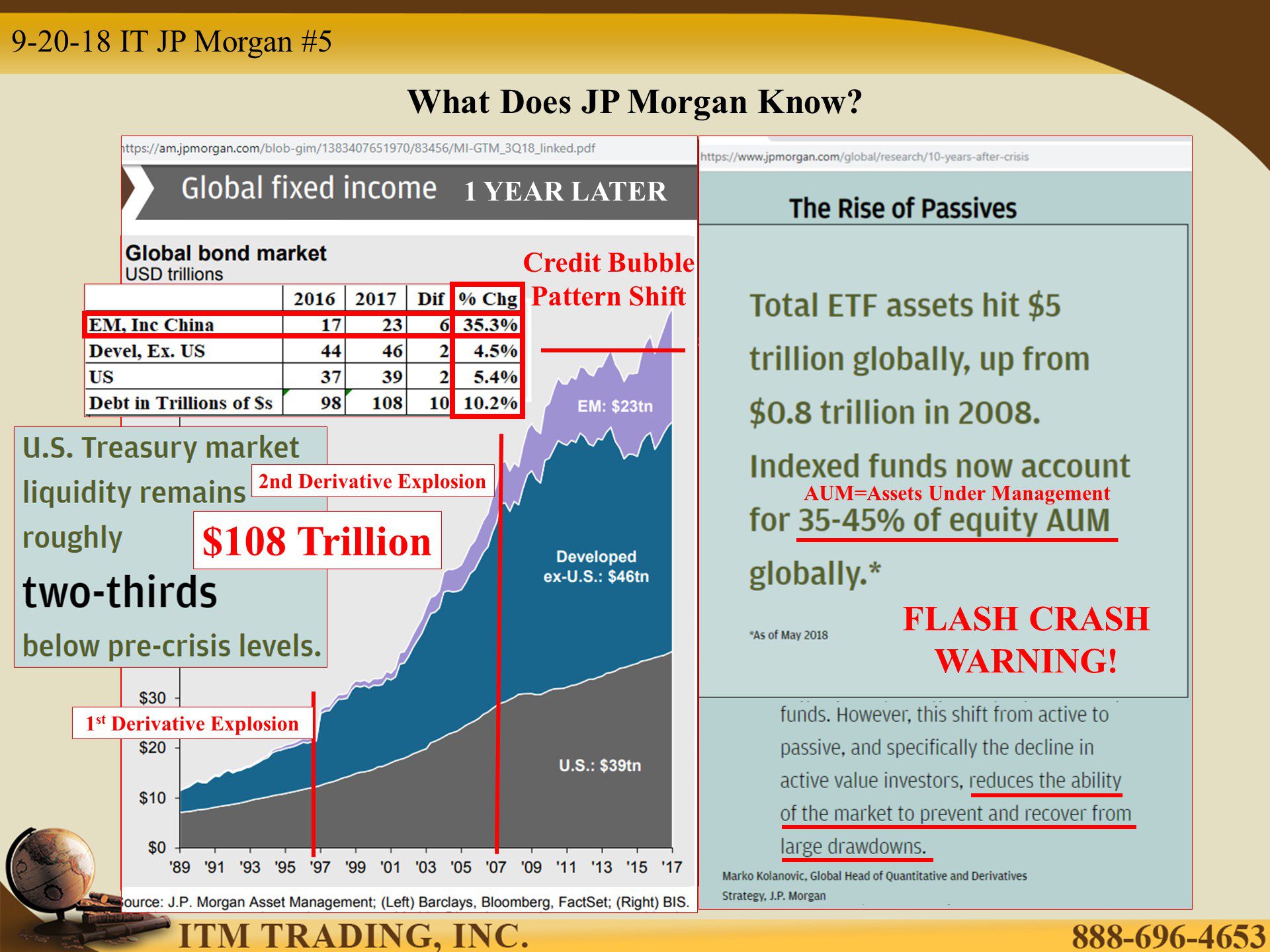

Reviewing research publications from J.P. Morgan Asset Management, you can get a pretty good idea of where they believe we are in this trend cycle. What we see is a clear credit bubble breakdown pattern shift coupled with a lack of liquidity in both the stock and, more importantly, bond market. They know that this is an accident waiting to happen.

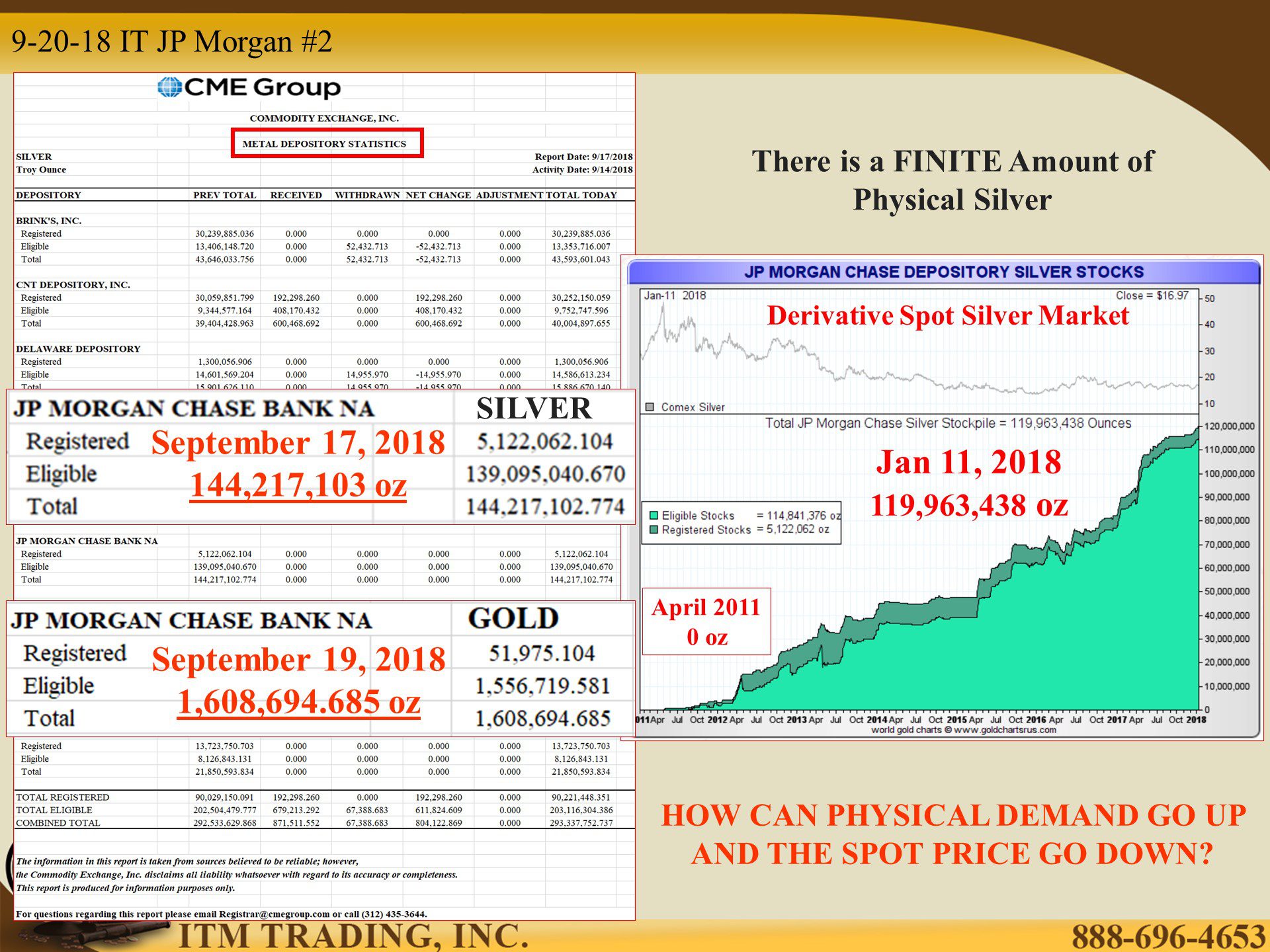

Perhaps that’s why they’ve accumulated 1,608,694.685 ounces of physical gold and 114,217,102.774 ounces of physical silver. In fact, by all accounts, JP Morgan has now accumulated the largest physical silver hoard in history.

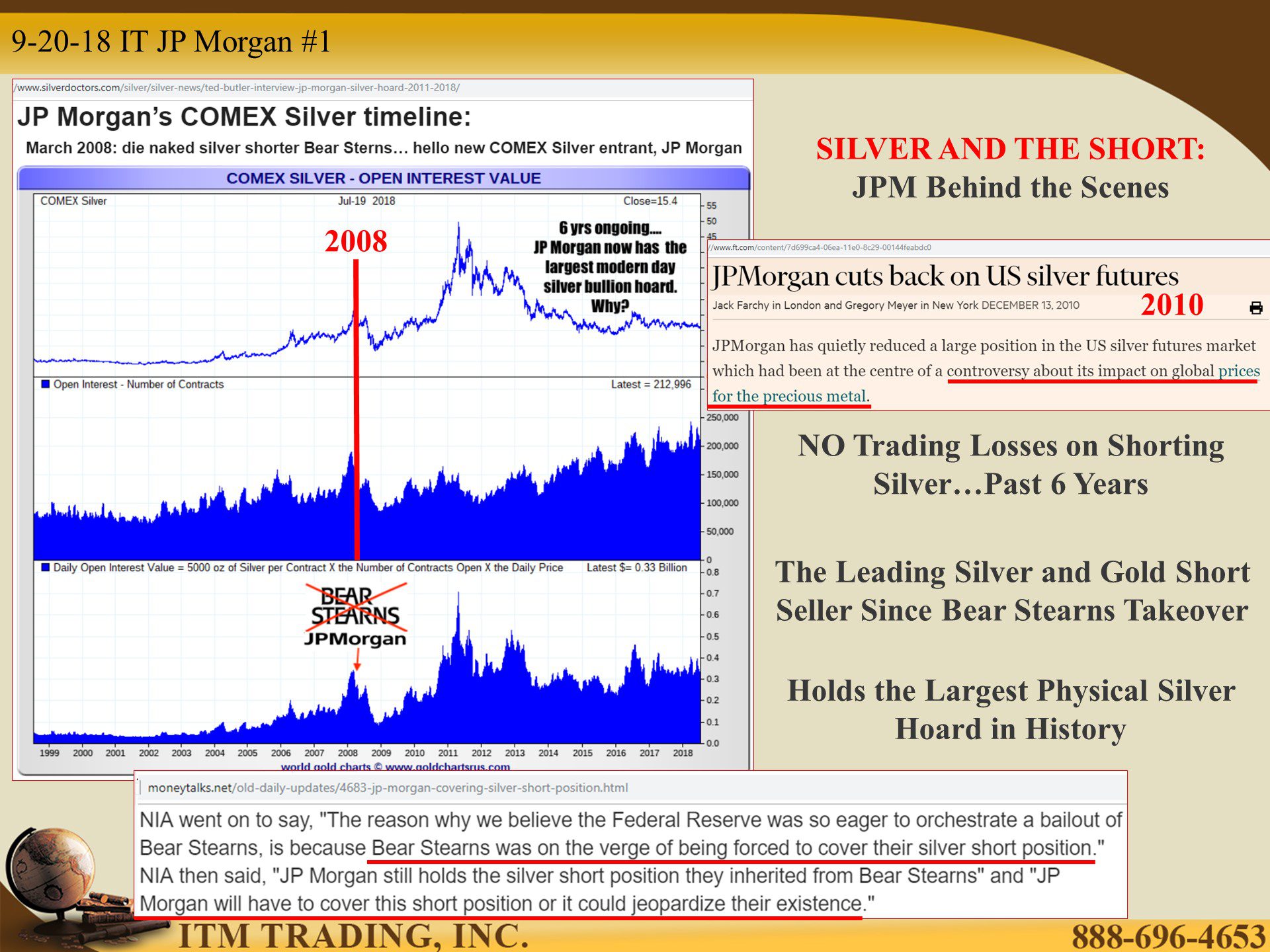

Perhaps there are additional reasons. We know they inherited the largest and most dangerous NAKED short (derivative) silver position when the Feds engineered they’re takeover of an imploding Bear Sterns. The key to understand from that Wall Street Speak is that as silver prices rise there are NO LIMITATIONS ON LOSSES on these contracts. Some think that’s why Bear Sterns failed.

JPM had to neutralize this derivative bomb. How could they do this and make money too? By controlling the entire silver market.

In 2011 they began accumulating physical silver as they were managing the buying and selling of these contracts. This is a very complicated operation and is conducted on and off exchanges and therefore, on and off-balance sheets. The bottom line is an almost opaque market…why?

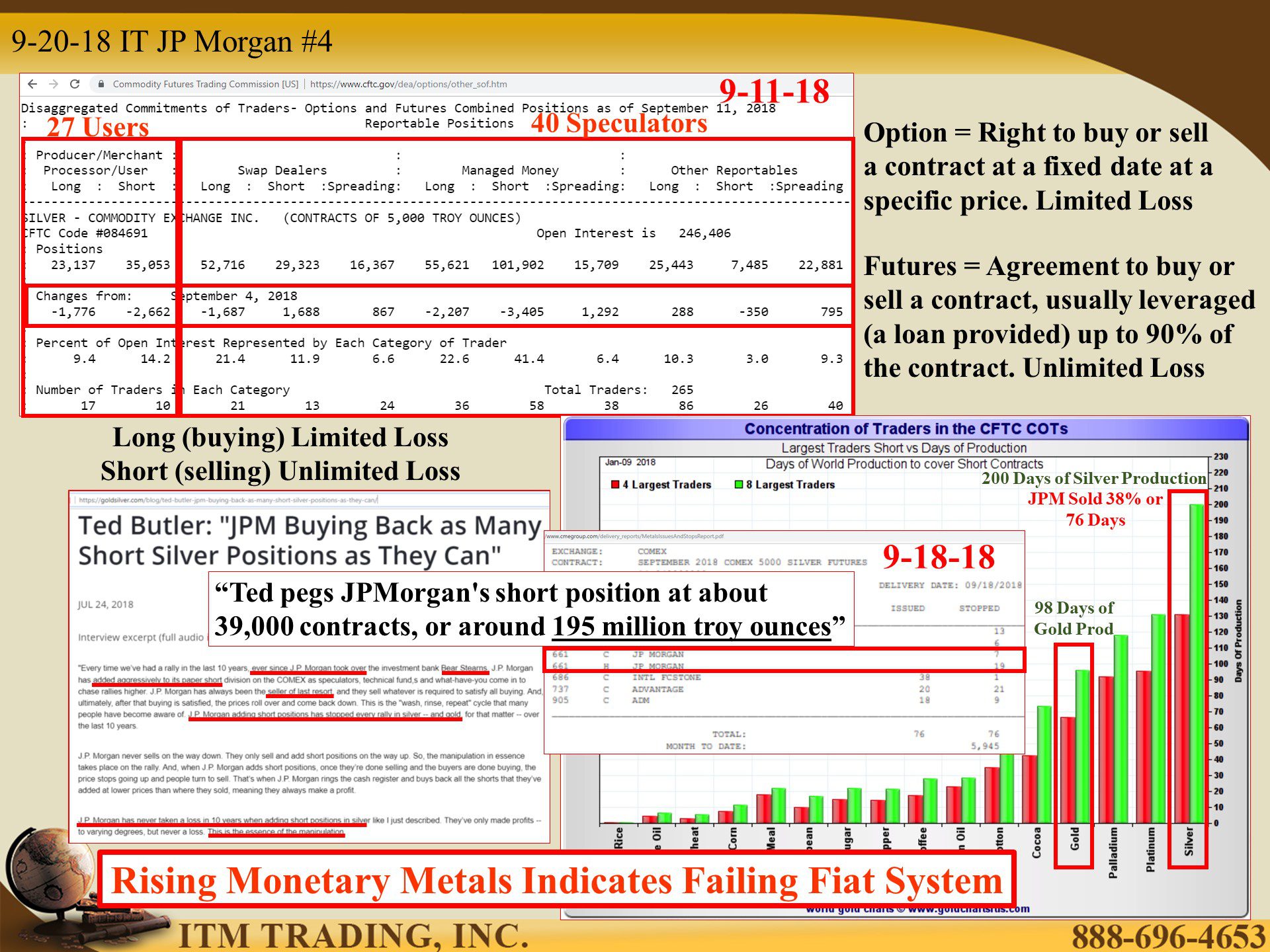

What we can see is that the top 8 Silver Speculators (manipulators) have sold 200 days of mine production. JPM accounts for 38% or 76 days of silver production.

I wonder how much physical labor and energy that takes. And here, wall street pushes a button and reduces the “NOMINAL†value of that silver and therefore all that human labor and energy.

All in the name of speculation and profits, because, interestingly enough, since JPM began accumulating physical silver, they have NEVER TAKEN A LOSS on their short derivative silver position. Defies normal market luck.

At the same time taking advantage of depressed prices by accumulating physical silver and buying back those Bear Stern legacy silver derivatives. Doesn’t sound legal does it.

You might be wondering if perhaps you should accumulate silver too. Some even ask, is silver better than gold? Of course, those are answers must be determined by you, but I believe that everyone needs both. It just depends on what we’re trying to accomplish.

We can see that JPM holds both too. I’d bet they have a plan. Do you?

Slides and Links:

https://www.ft.com/content/7d699ca4-06ea-11e0-8c29-00144feabdc0

http://moneytalks.net/old-daily-updates/4683-jp-morgan-covering-silver-short-position.html

https://www.cmegroup.com/delivery_reports/Silver_stocks.xls

https://snbchf.com/2018/01/skoyles-silver-prices-surge-jp-morgan-acquired-silver/

https://stockcharts.com/freecharts/perf.php?$SILVER,slv

https://stockcharts.com/freecharts/perf.php?$gold,gld

https://www.cftc.gov/dea/futures/other_sf.htm

https://www.cftc.gov/dea/options/other_sof.htm

https://www.cftc.gov/sites/default/files/files/dea/cotarchives/2018/options/other_sof090418.htm

http://news.goldseek.com/COT/1536348350.php

https://snbchf.com/2018/01/skoyles-silver-prices-surge-jp-morgan-acquired-silver/

https://goldsilver.com/blog/ted-butler-jpm-buying-back-as-many-short-silver-positions-as-they-can/

https://www.cmegroup.com/delivery_reports/MetalsIssuesAndStopsReport.pdf

Https://am.jpmorgan.com/blob-gim/1383407651970/83456/MI-GTM_3Q18_linked.pdf

https://www.cnbc.com/video/2018/09/04/jp-morgans-top-quant-warns-of-next-liquidity-crisis.html

https://www.jpmorgan.com/global/research/10-years-after-crisis

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq218.pdf

http://www.fsb.org/wp-content/uploads/P211117-1.pdf

YouTube Short Description:

A couple of weeks ago I was asked why JP Morgan was accumulating so much physical silver. Since you are asking the questions, I jumped down that rabbit hole. The silver stockpile is well known but wait till you see what I found behind the scenes. This video shows you some of what I found.