SHOCKER: SEC Notices Manipulative Insider Activity

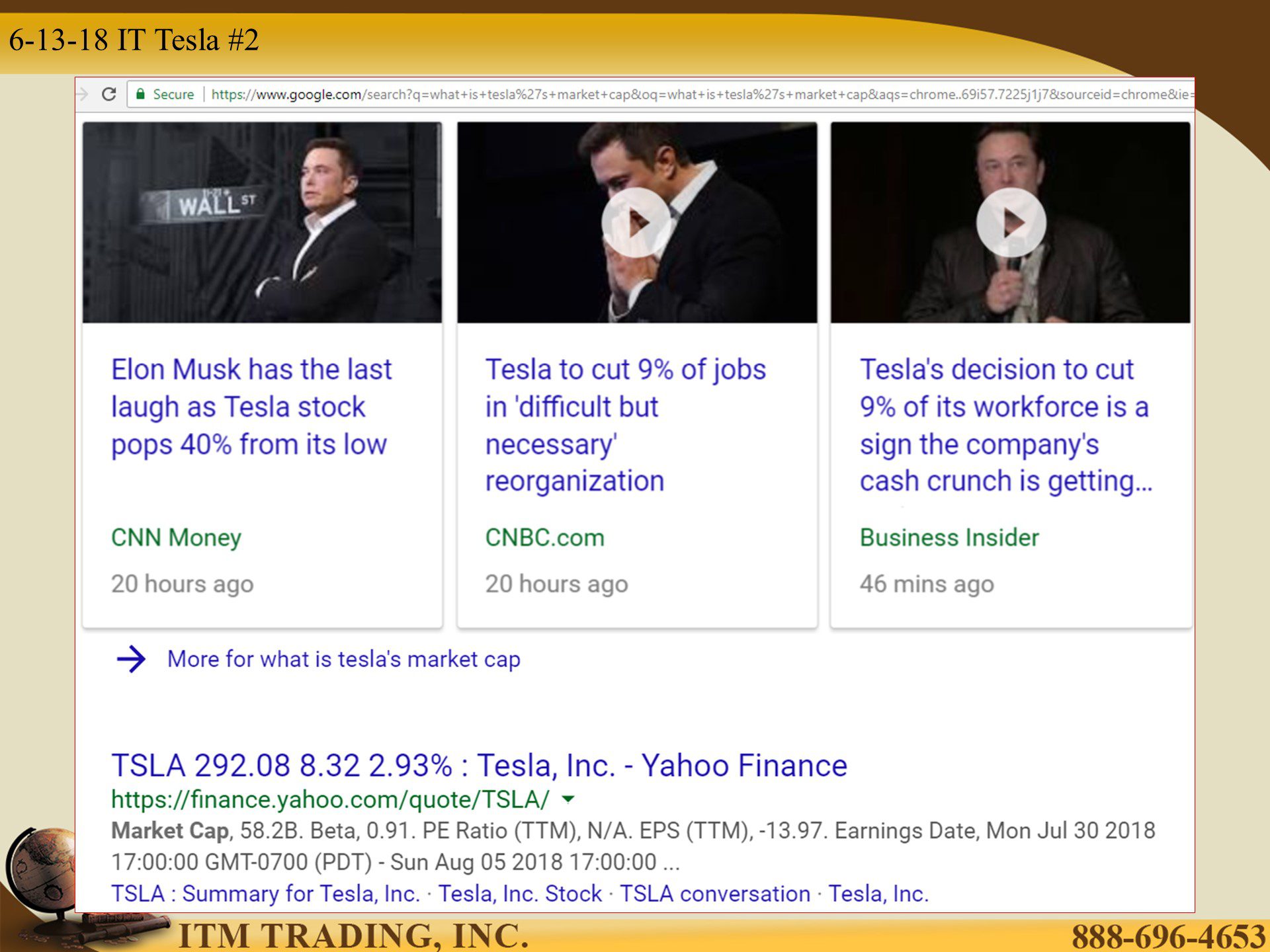

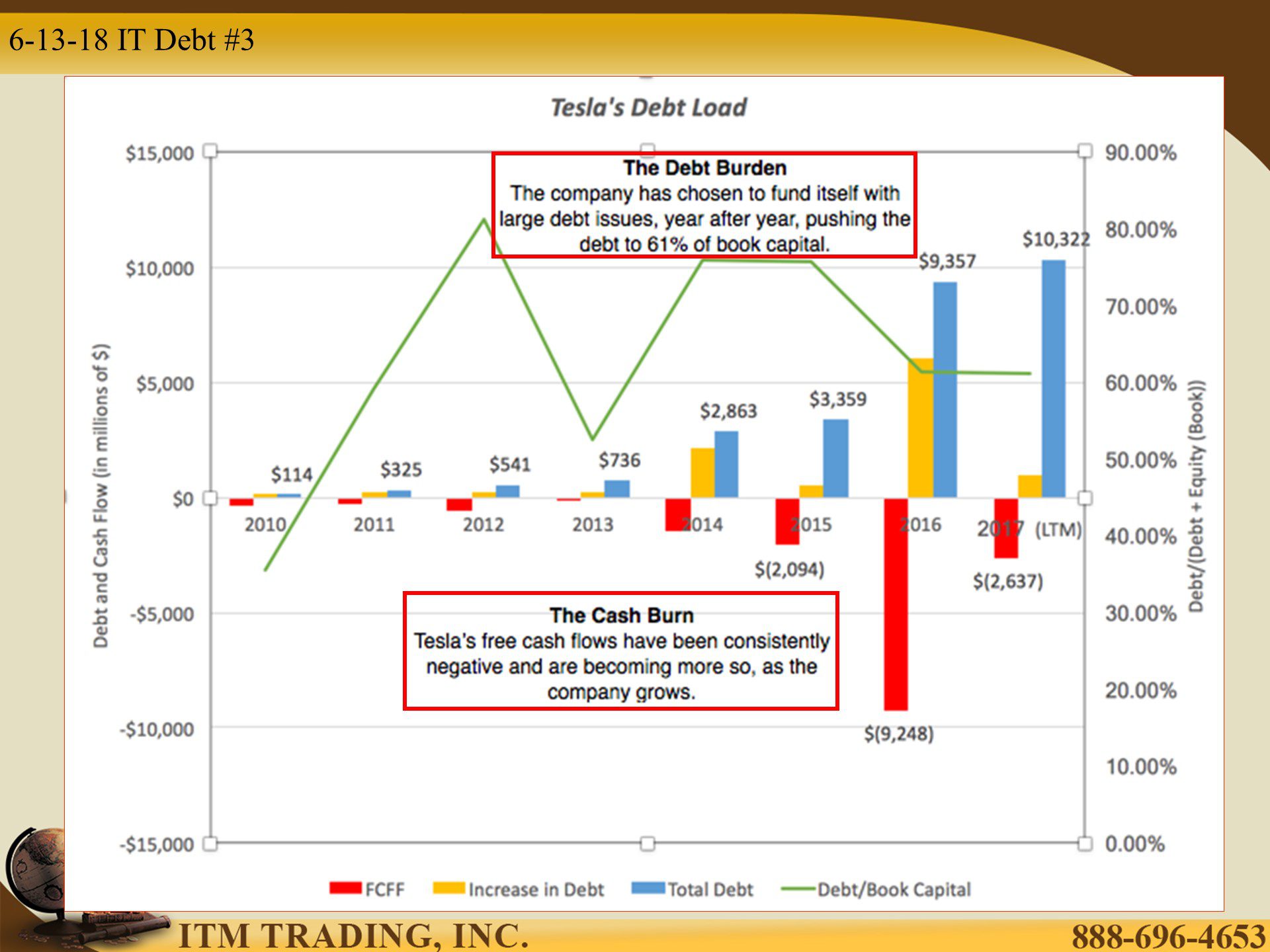

We’ve talked about Tesla several times in the past. As a Wall Street “Unicorn†it’s current market cap is $58.2 billion, even though there are losses as far as the eye can see.

On June 12th the stock price surged 3.19% and is now up 40% from its April low, when Wall Street questioned its ability to sell more debt. Why? Because Tesla is cutting it’s work force by 9%.

But don’t worry, these cuts won’t come from the production (lowest pay scale) or highest management (highest pay scale) levels. They will come from middle management white collar workers.

Since there are now more jobs than workers, it shouldn’t be a problem for these people to find new employment. Perhaps they’ll even end up earning more than they were at Tesla. After all, when one door closes another one opens…but the hallways are the pits.

Last week I asked if the tax changes and repatriation had kicked into gear. The speech by SEC Commissioner Robert Jackson, Jr. confirms this as he looked at insider trading at corporations in a speech titled “Stock Buyouts and Corporate Cashoutsâ€. Keep in mind that insiders are; Boards of Directors, CEOs, CFOs etc. So those that understand, better than anyone, what is really happening inside a company.

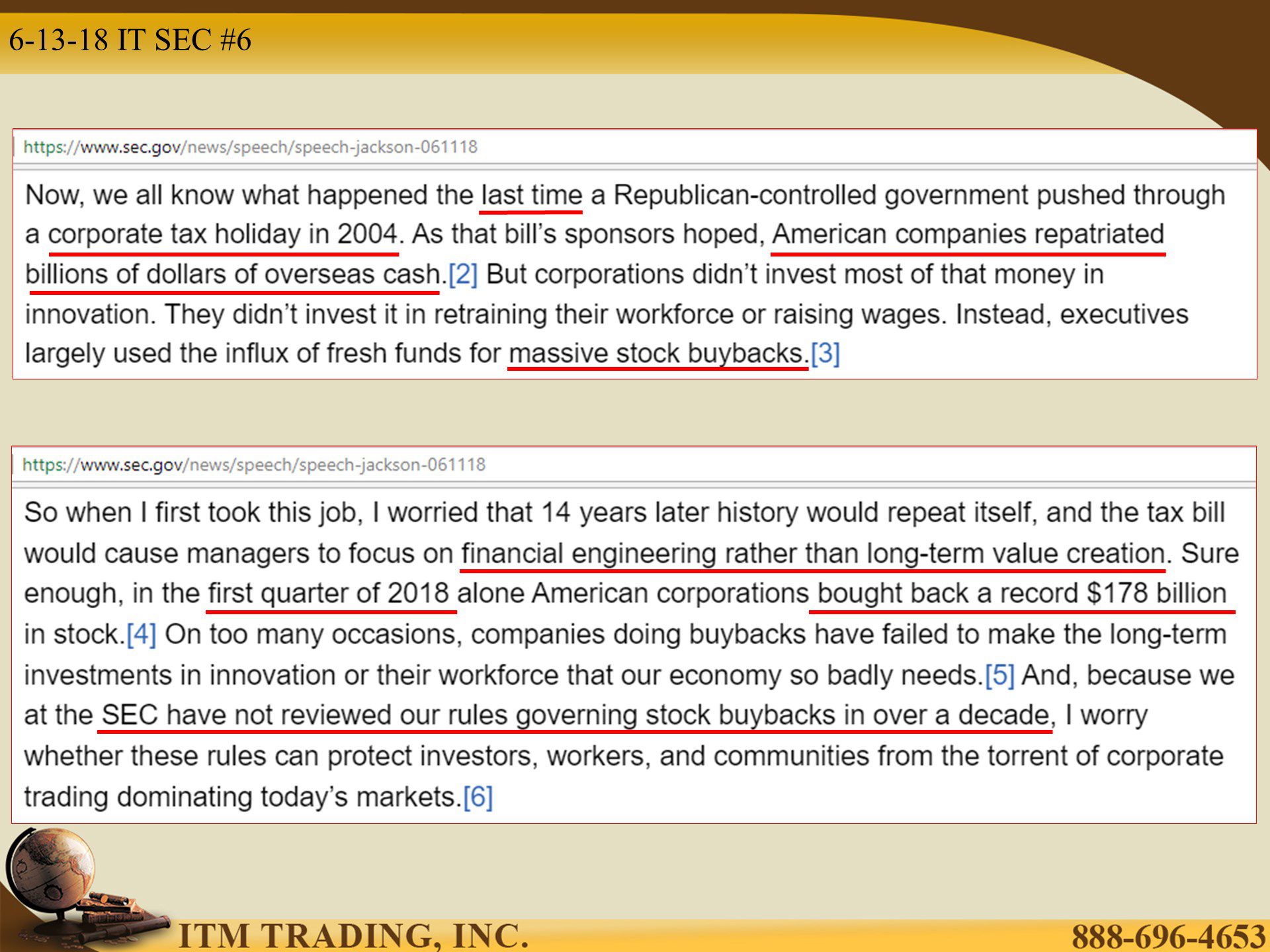

He recalls that the 2004 corporate tax “holiday†saw companies using billions of repatriated dollars for massive stock buybacks that benefitted corporate executives. He sees that this time is no different.

In fact, in the first quarter of 2018 American corporations “bought back a record $178 billion in stock†and CNBC points out that there is $2.5 trillion set to “pour into buybacks, dividends and M&A this yearâ€. It seems the tax changes and repatriation has indeed, kicked into gear, pushing markets higher.

This is a good thing, right? After all, underfunded retirement programs as well as insurance products need a higher stock market to bail them out. And it will…until the next financial crisis, when liquidity evaporates and the markets crash. Then those left holding wall street products will end up holding the bag…again.

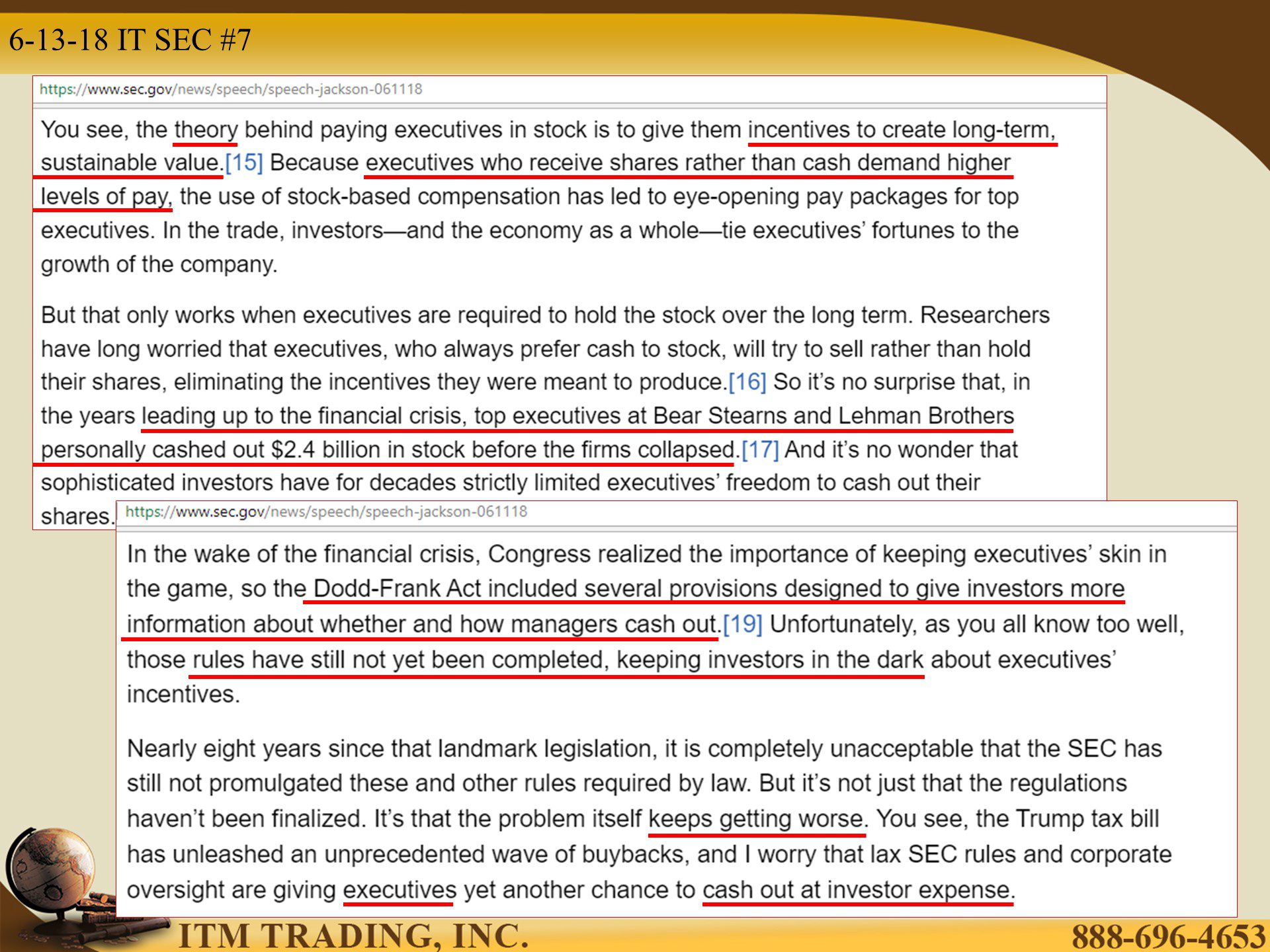

But what about those insiders? This report states clearly, they use corporate buybacks to hide their selling. He uses the collapses of Bear Sterns and Lehman Brothers to illustrate the insider behavior he sees taking place today. Jackson states, “leading up to the financial crisis, top executives at Bear Stearns and Lehman Brothers personally cashed out $2.4 billion in stock before the firms collapsed.â€

He laments the fact that the Dodd-Frank Act that went into effect in 2010 had “several provisions designed to give investors more information about whether and how managers cash outâ€. But those “rules have still not yet been completed, keeping investors in the dark†and that the “SEC have not reviewed our rules governing stock buybacks in over a decadeâ€. Doesn’t that make you feel safe?

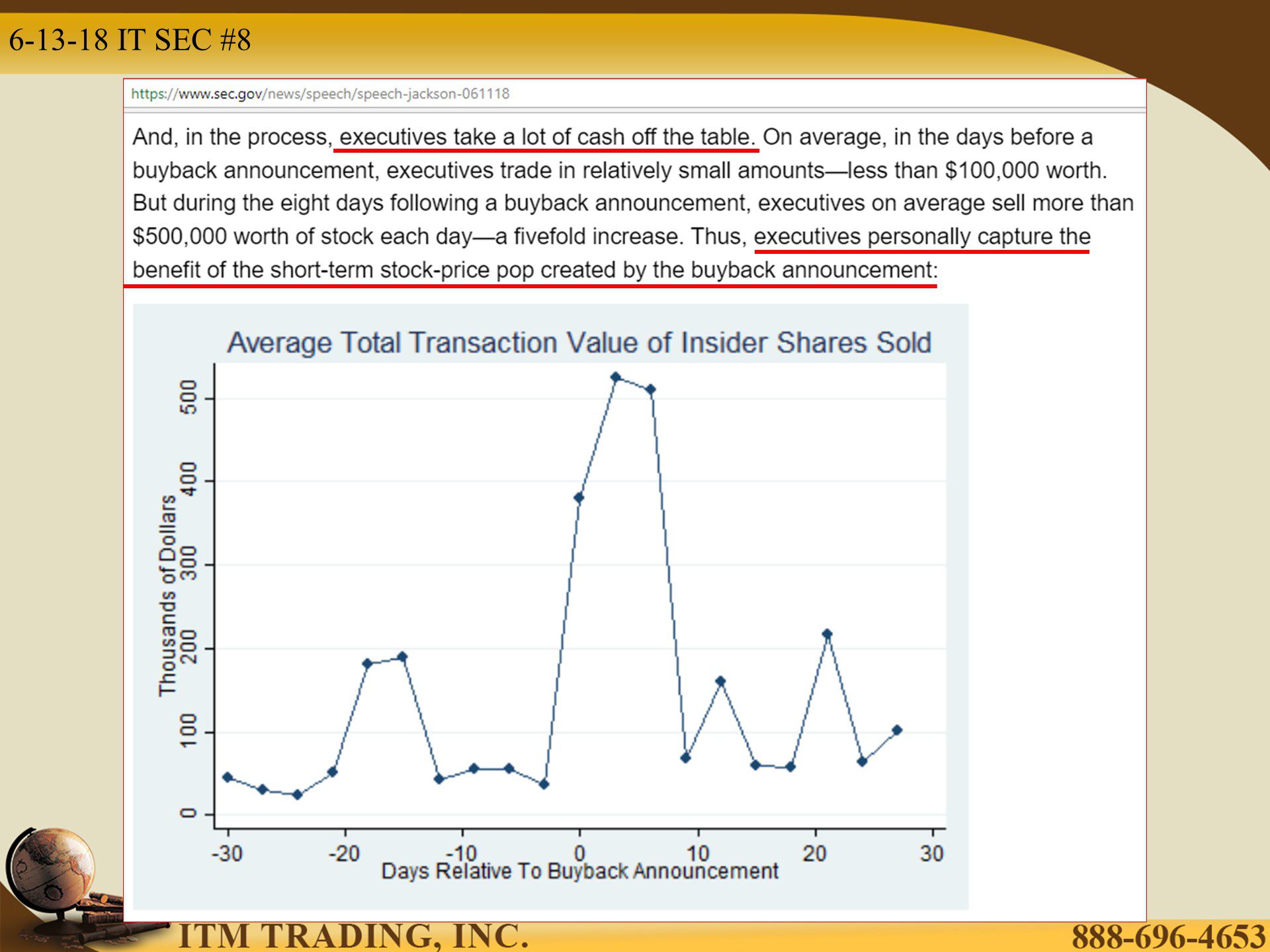

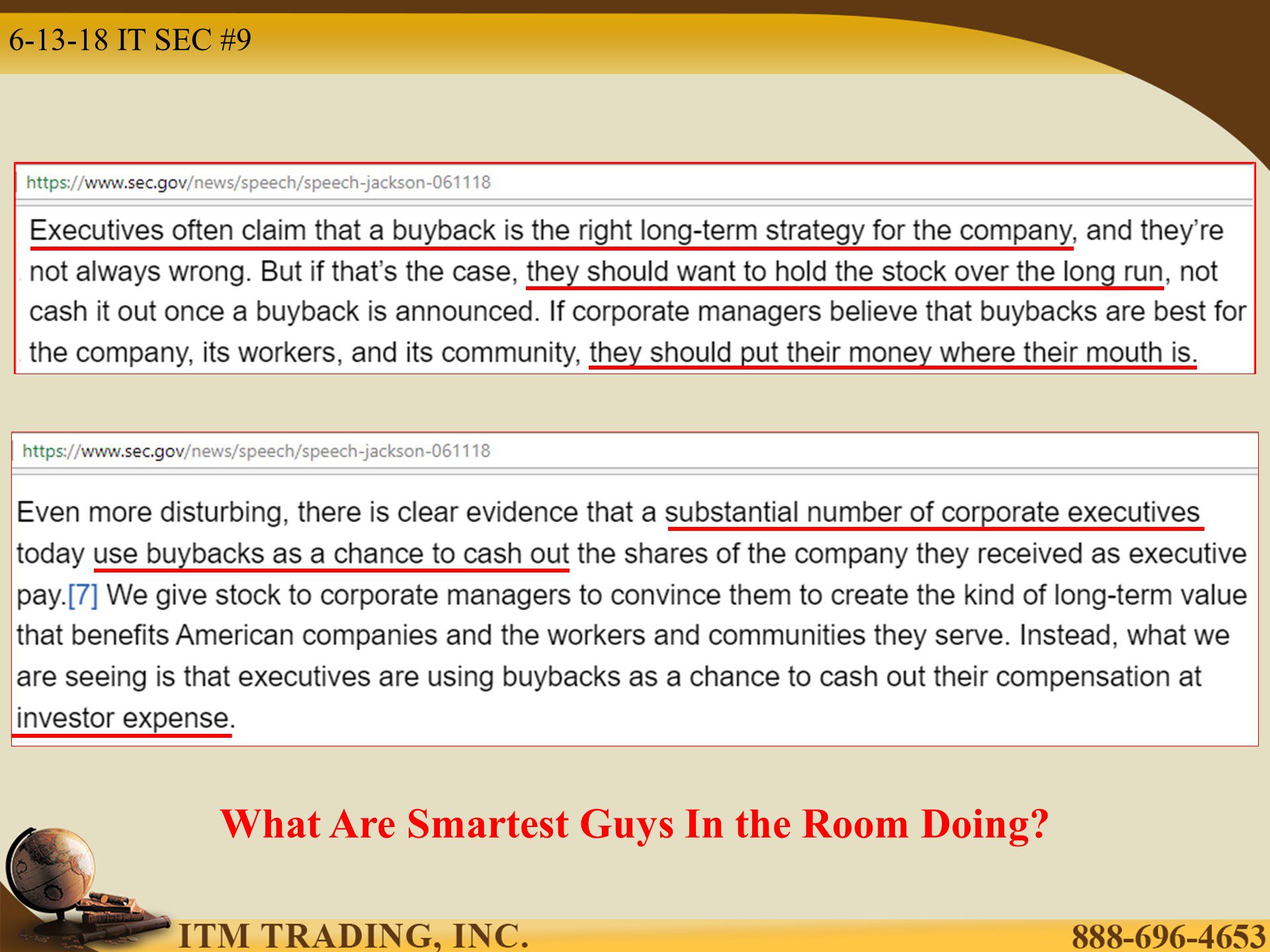

Of course, “Executives often claim that a buyback is the right long-term strategy for the companyâ€, but if this were the case “they should want to hold the stock over the long runâ€, “they should put their money where their mouth is.†But what he discovered is “that a substantial number of corporate executives today use buybacks as a chance to cash out†at “investor expense.â€

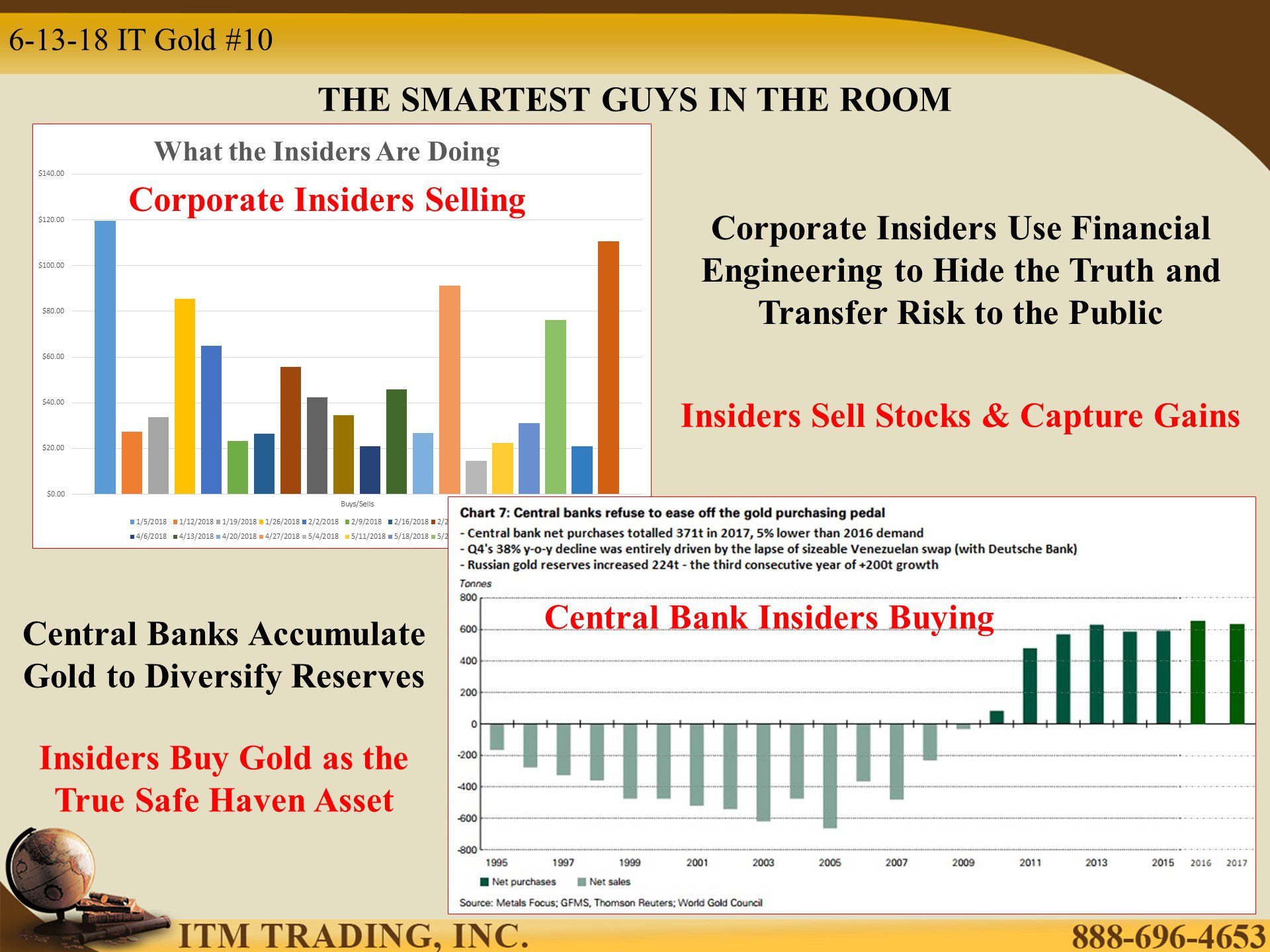

Personally, I think you should always do what the smartest guys, on any given topic, do for themselves. Corporate insiders are selling stocks and central banks are buying gold. I think that says it all.

- cartoonistgroup.com/subject/The-Board+Of+Directors-Comics-and-Cartoons.php

- https://www.google.com/search?source=hp&ei=aW0hW-GhBuuV0gLrhbyACw&q=What+is+tesla+market+cap&oq=What+is+tesla+market+cap&gs_l=psy-ab.3..0.4380.9012.0.9471.27.19.0.0.0.0.1004.3160.2j13j1j7-1.18.0….0…1.1.64.psy-ab..9.18.3250.6..35i39k1j0i131k1j0i3k1j0i20i264k1j0i22i30k1.99.wvu-fLZ3Bdg

- https://www.investing.com/analysis/a-tesla-2017-update-a-disruptive-force-and-a-debt-puzzle-200206881

- https://www.Nasdaq.com/symbol/tsla/insider-trades

http://stockcharts.com/h-sc/ui?s=TSLA

https://www.sec.gov/news/speech/speech-Jackson-061118

- https://www.sec.gov/news/speech/speech-jackson-061118

- https://www.sec.gov/news/speech/speech-jackson-061118

- https://www.sec.gov/news/speech/speech-jackson-061118

- https://www.sec.gov/news/speech/speech-jackson-061118

https://www.bullionstar.com/blogs/ronan-manly/worlds-central-banks-hold-gold-words/

https://www.bullionstar.com/blogs/ronan-manly/worlds-central-banks-hold-gold-words/