WHO IS SELLING AND WHO IS BUYING? Real Estate and Risk Transfer

A 2016 article, “China’s Anbang Insurance Just The Tip Of The Iceberg For Foreign Investment In U.S. Real Estateâ€, CREDiFi reveals that a substantial price driver and support of US Real Estate were  rapidly expanding Chinese multinational companies that were growing through massive acquisitions and debt expansions. This was also a way to funnel wealth out of China.

RED FLAGS WERE FLYING, because that meant that the buyer and holder of key global real estate, was vulnerable. Additional vulnerabilities became evident as shopping continued to shift on-line and over leveraged companies (i.e. Toys R Us, Sears) shuttered stores.

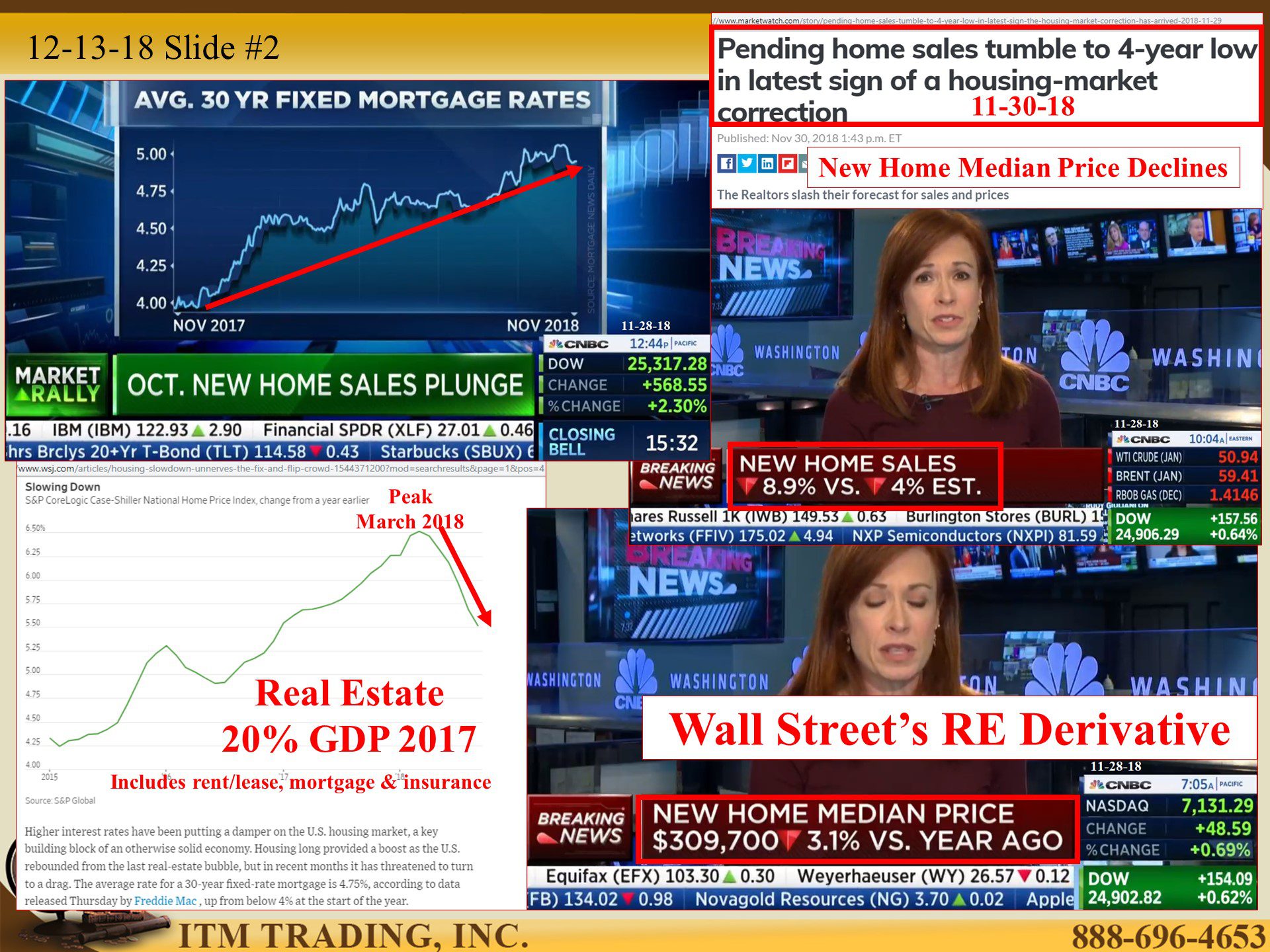

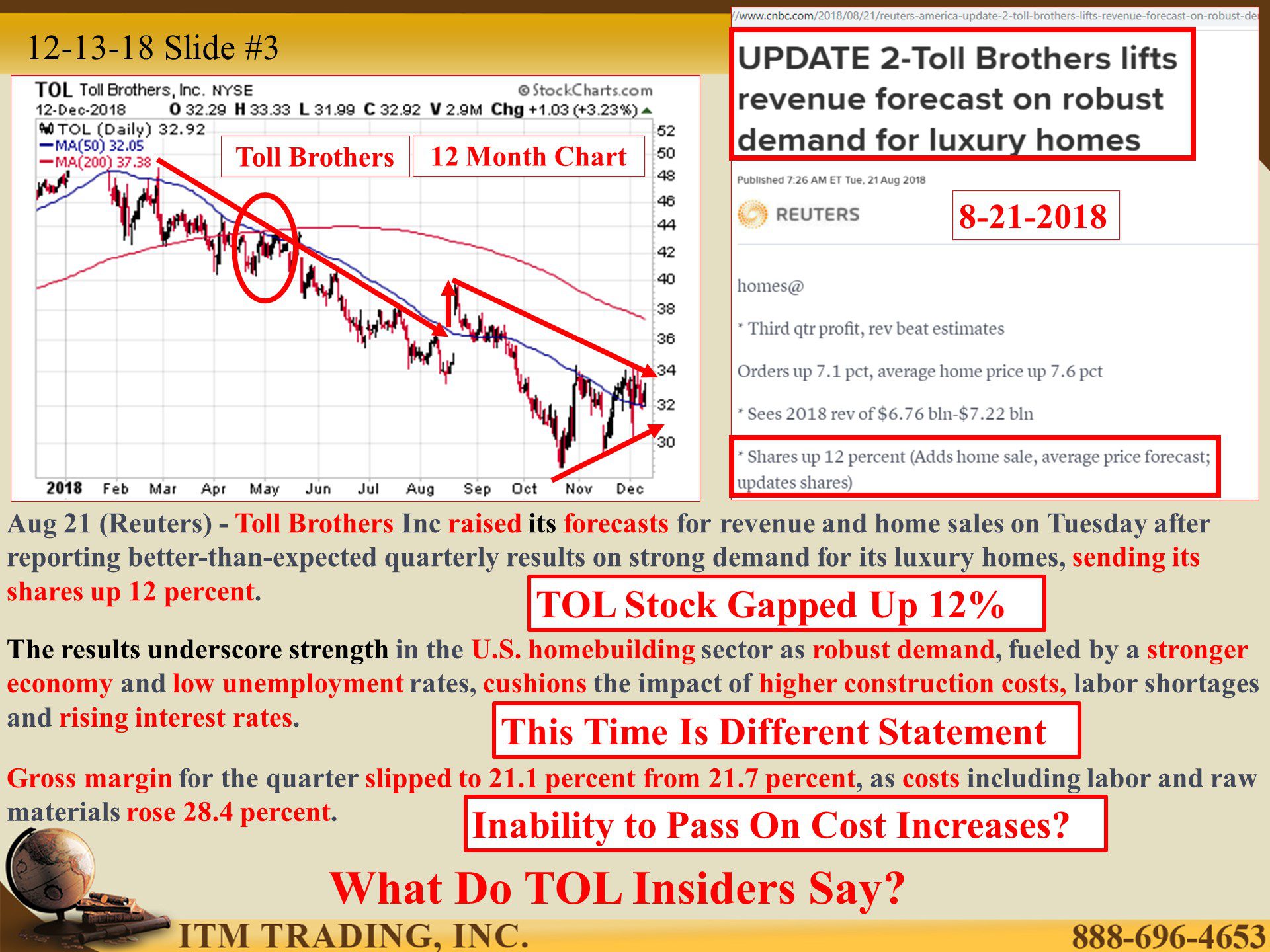

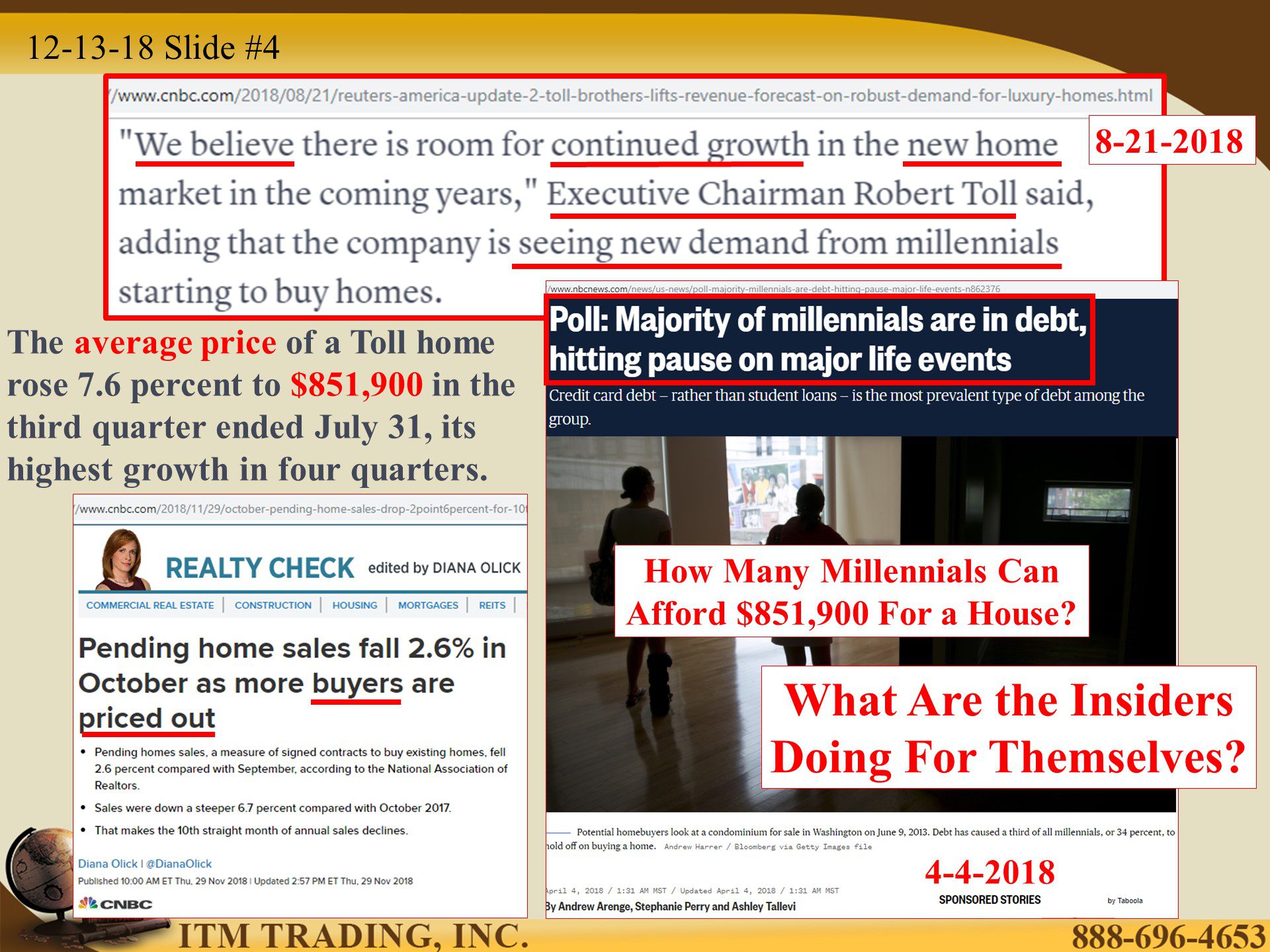

The negative trend picked up momentum in 2018 as the Chinese government crack down on those companies and is now pushing real estate on to the global market at a time of central bank tightening (i.e. rising interest rates and shrinking balance sheets). At this writing, housing demand is rapidly falling with sales down 8% YOY.

Real estate makes up 20% of the US GDP and hundreds of trillions in wall street derivatives (i.e. MBSs, CDOs, ETFs), leverage real estate associated markets. Almost all of these derivatives are tied to a dying benchmark and these derivative contracts must be “reset†by the end of 2020. These derivative contracts are blanketed throughout the global banking system, which is why this is a global crisis.

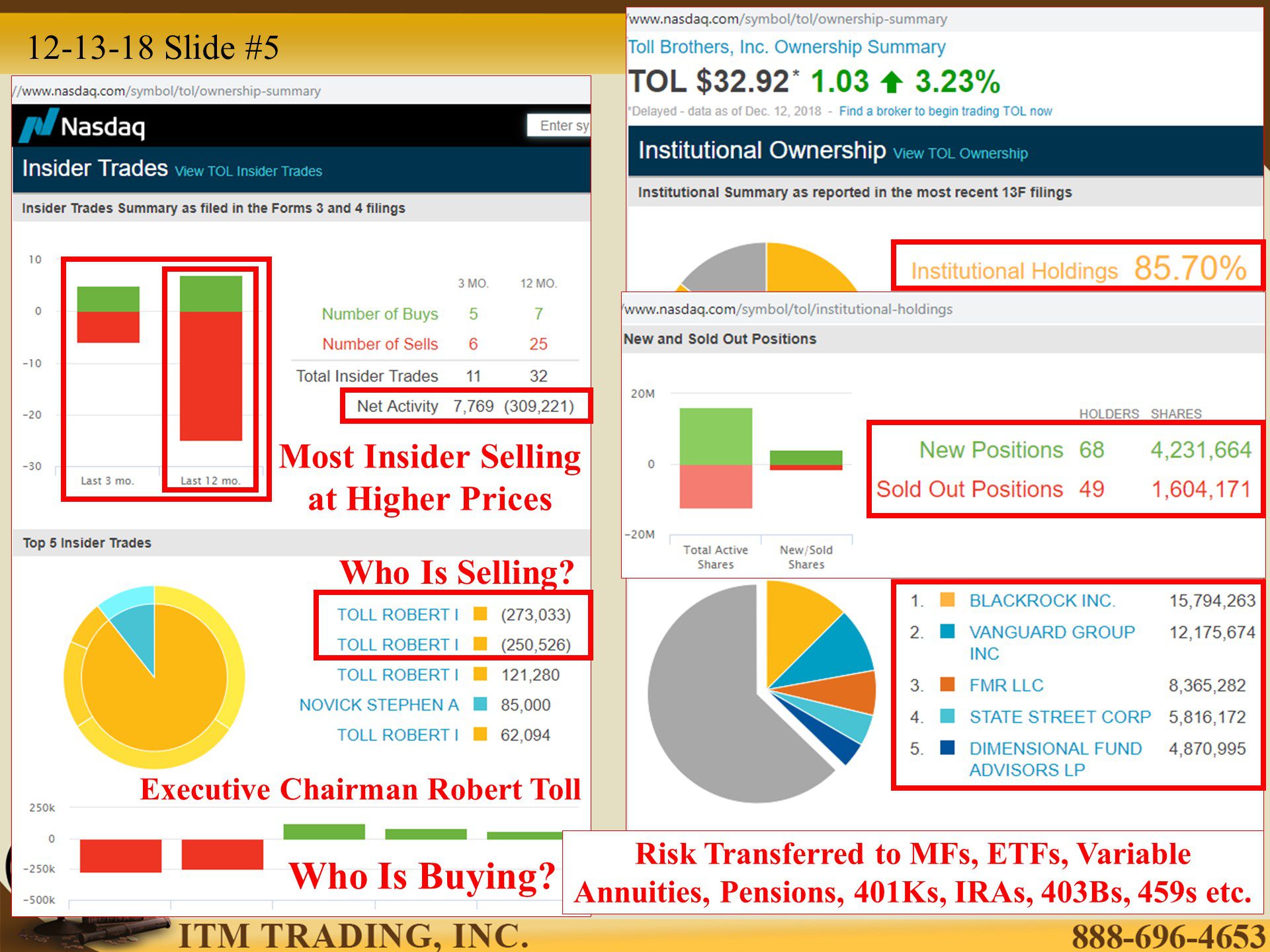

While everyone will be impacted, some will benefit and some will lose everything. What was the most important lesson learned from 2008? That the elite held too much risk.

Using free money, leverage, legislation and perception management, governments, central banks and corporations transferred risk from themselves to you, invisibly.

The big question is, “Has enough risk been transferred?†The current global nukes being hurled at the financial system and markets, indicates to me, that the answer is YES. If I’m correct, the next crisis is already in process.

Make no mistake, everyone will feel the impact. Most will be devastated, but some will thrive. Who will thrive? Those that can maintain purchasing power, because they will have the ability to buy real assets when everyone else needs to sell.

“Only gold is money, everything else is credit.†JP Morgan.

Links:

http://www.globaltimes.cn/content/1131244.shtml

https://stockcharts.com/h-sc/ui

https://www.ft.com/content/049b4340-b96e-11e5-bf7e-8a339b6f2164

https://stockcharts.com/h-sc/ui

https://www.cnbc.com/2018/12/11/yellen-warns-of-another-potential-financial-crisis.html

https://www.nasdaq.com/symbol/tol/institutional-holdings

- NA

- https://ftalphaville.ft.com/2018/07/11/1531308482000/The–marginal-buyers–in-credit-are-neither-marginal-nor-buyers/

https://www.wsj.com/articles/china-bonds-send-fresh-stress-signal-1494500938

https://in.reuters.com/article/eurozone-bonds/europe-snared-by-yield-curve-flattening-phenomenon-idINL5N1NE2TT