Saudi Aramco

Petrodollar Saudi Aramco Video

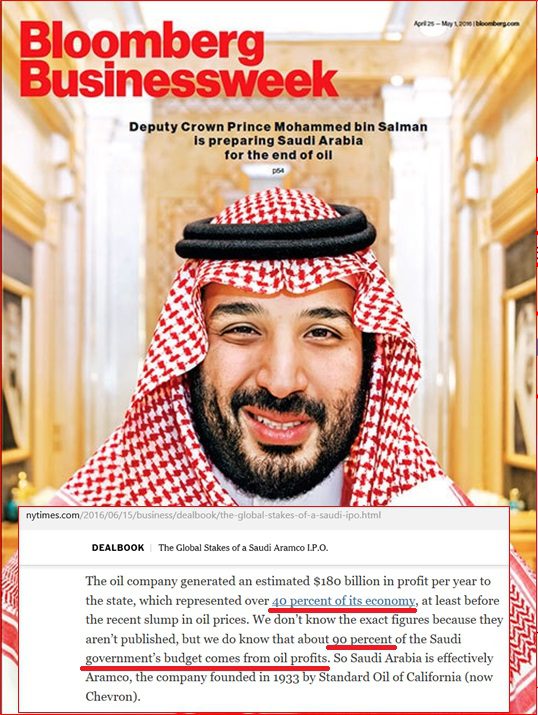

hi everyone I’m Lynette Zang chief market analyst here at ITN trading a full-service physical precious metals gold and silver brokerage house so today I want to keep you updated on what’s happening with the petro dollar because keep in mind that globally everybody must use dollars in order to buy oil that’s the petro dollar well what we know is that Saudi Arabia was the one that signed that petro dollar deal wants to break away from oil since they are so highly dependent on it in this environment and in fact they generate % of their economy is based on oil and % of the Saudi government’s budget comes from oil production or profits.

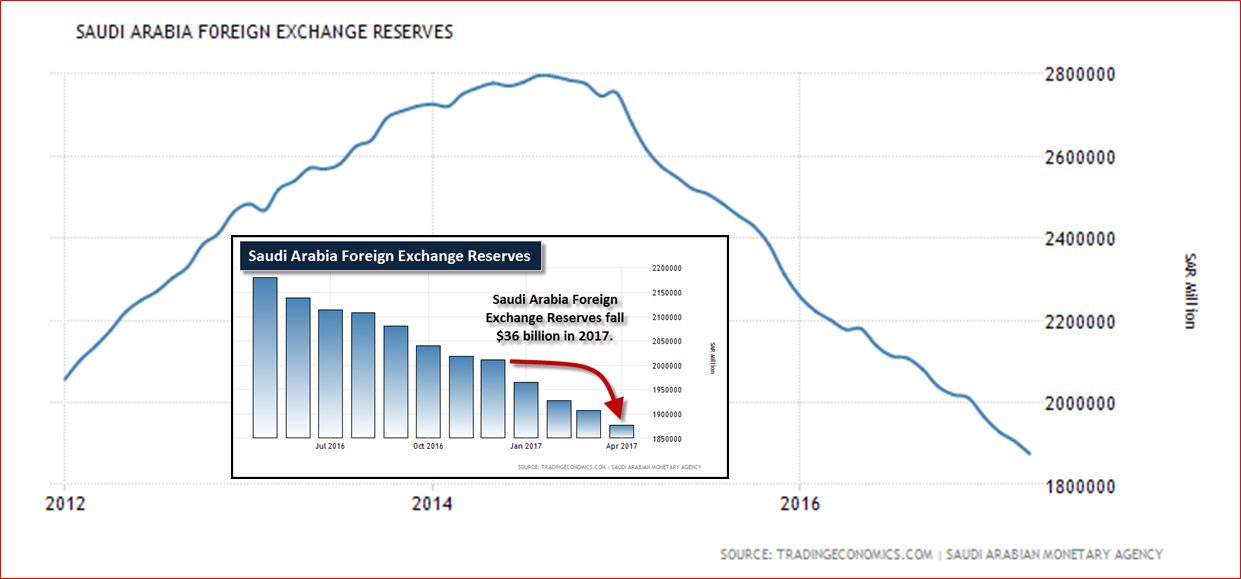

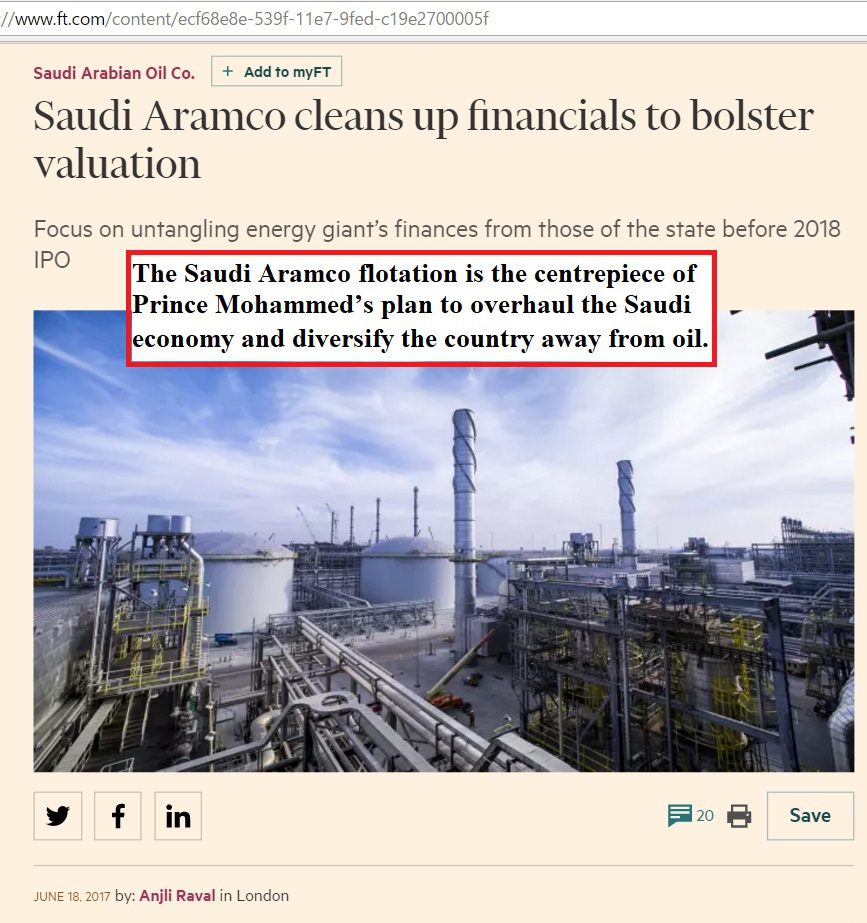

So you can see that’s pretty significant for them and in this environment of very low oil prices what have they been doing they have been selling off reserves particularly US Treasuries oops this way sorry selling off reserves in order to support their economy so the other thing and this is something that always happens in a money standard a transition is government states etc are forced to sell off income producing assets if they need money that’s what they’re going to do so we’ve talked about the IPO initial public offering that they’re positioning their crown jewel now what I want you to know about that is that’s how they generate their money and they’re working on cleaning up their balance sheet they plan on coming out with that IPO in but it’s so interconnected with the state and the government and all of the funding that they have to try and disconnect it so they’re working on it .

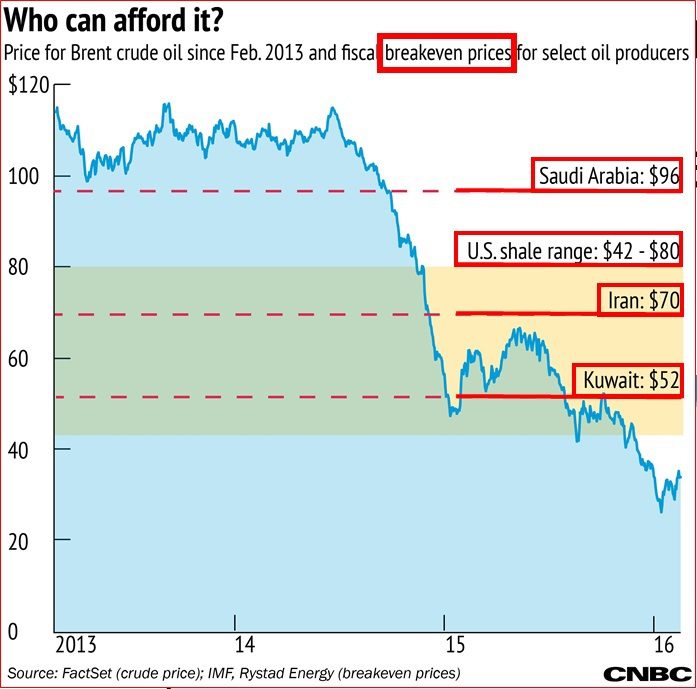

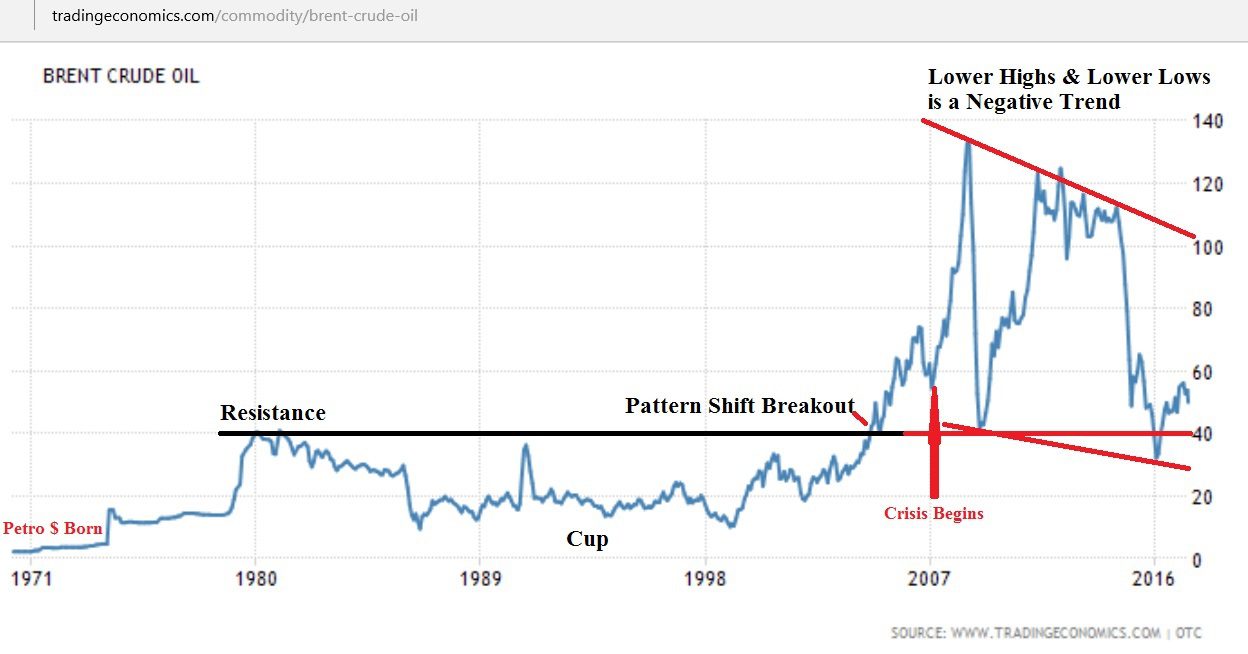

Okay why does this really matter well this is the global break-even but here Saudi Arabia’s break even is bucks a barrel so that’s why they’re having to use all of those reserves in this very low environment for oil you might recall this chart Carl’s got them ok well that’s right ok sorry what smoke zone oh I did ok sorry about that ok so you might recall this graph and this is a long term chart on spot oil this is where we had the pattern shift and certainly it’s pretty obvious that the pattern is different here then all the way across here a whole lot more volatility and in a negative trend now this is Wall Street and then the government has even done Studies on the impact of derivatives in the oil markets but for Saudi Arabia they want the price of oil to be up so we know that in September they went ahead and they cut production both OPEC and non-opec nations cut production and then because that didn’t it worked for a minute or two but then it started to decline again they came out in May and they said that they would extend those cuts through because the higher the price of oil the more they’re going to be able to generate in that IPO

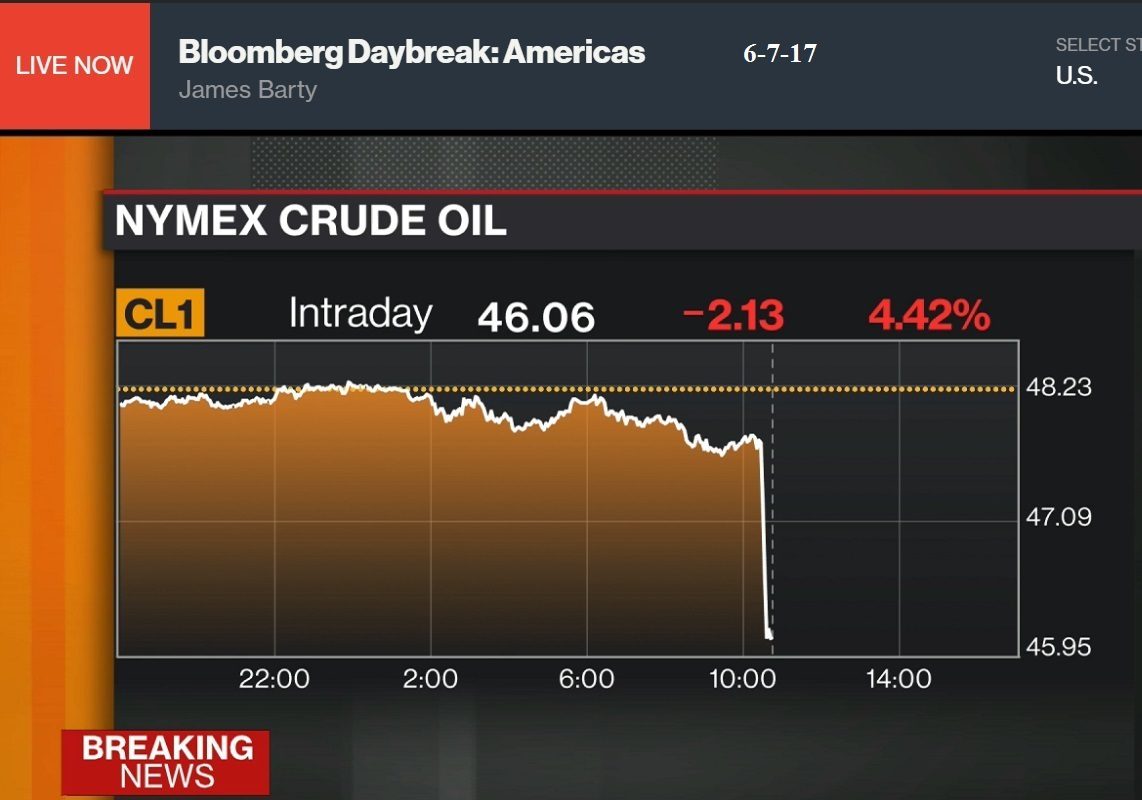

Wall Street said no now look they managed to keep it pretty stable between that announcement that they would extend the cuts and up until June would you have known at any point along here that this is what’s going to happen and that’s part of the point is that people think that they can anticipate when there’s going to be a sudden drop or there’s going to be a drop and I got news for you Wall Street’s a lot smarter than we are and they have a whole lot more tools than we do so this graph I actually pulled yesterday from stock charts and you can see lower highs and lower lows and can also see that this is where they sign that Accord in September it did manage to put push the price up a little bit but now it’s testing this upper support level on increasing volume that means that there’s a lot of selling of these oil contracts this was this morning before I even came into work so they need a $ break even this morning it was at can you see the problem can you see why they have to sell their crown jewel.

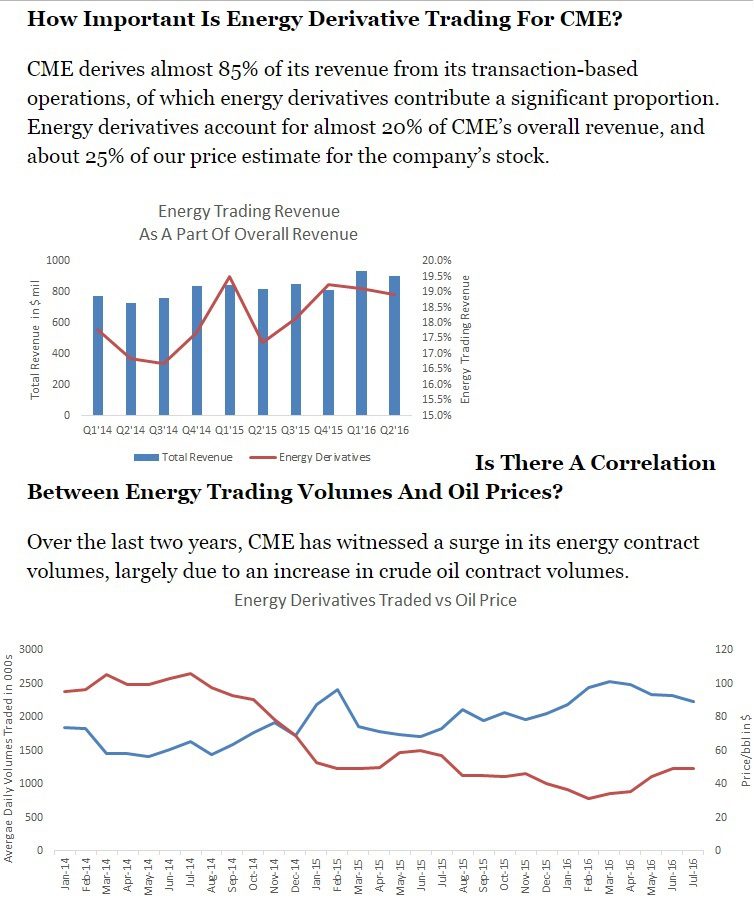

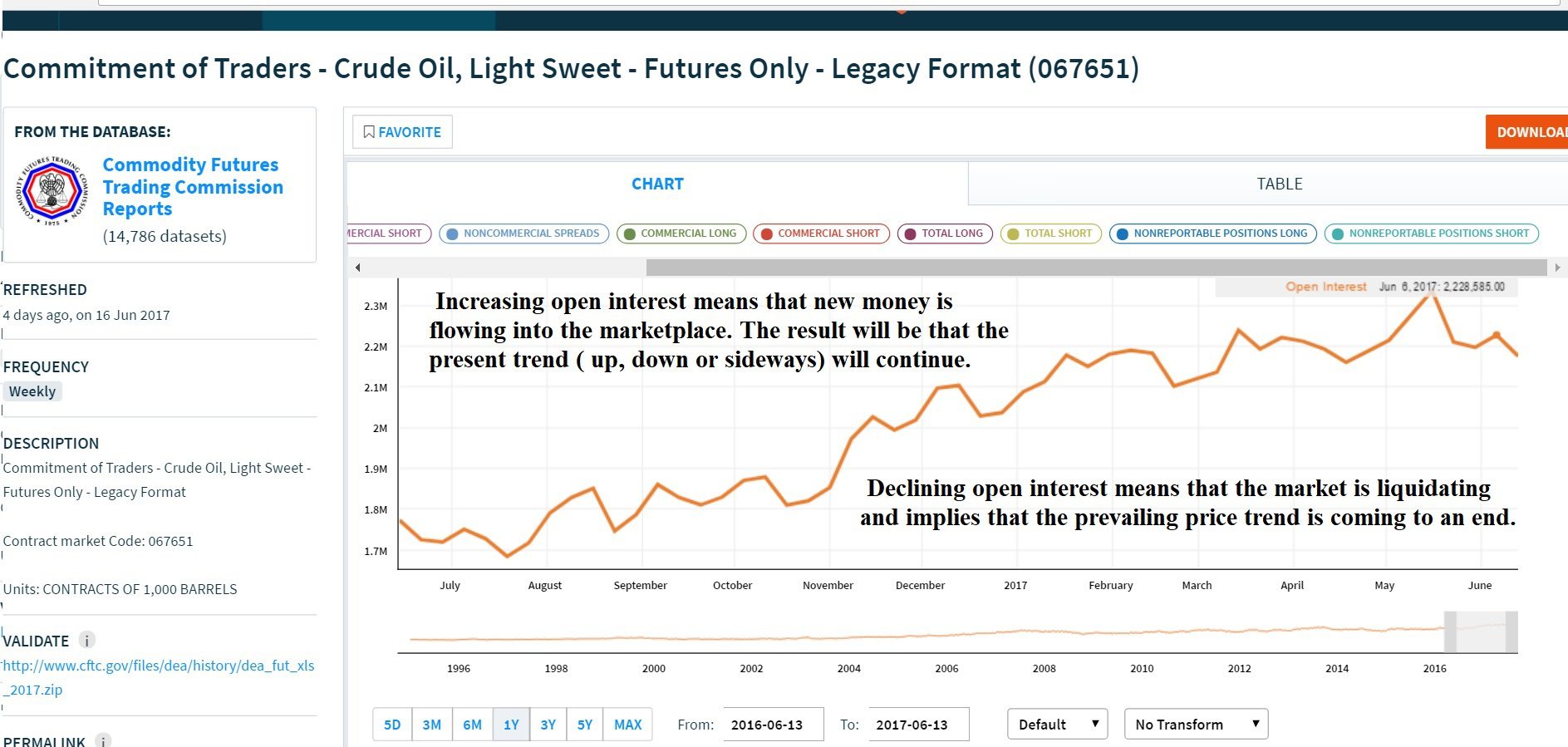

can you see why they do not want to be dependent on oil and because oil is priced in terms of dollars how that might impact you and me that use dollars work for dollars save dollars well I don’t save dollars I save gold and silver but most people will save in their dollars is they don’t need to use dollars to buy oil then they don’t need those excess dollars and you see a decline in reserves okay so this is where the competition is coming in we know what the sovereigns with the government wants they want higher oil prices they need it and not just them but any energy dependent country but Wall Street does not because this whole market has been turned into a financial product just like everything else there is no real price discovery so up here we’ve talked about the CMA a lot the CME generates percent of their income on trading those oil futures percent of their revenue it benefits them to continue to trade and what happens is the more that they trade in this particular case it’s pushing the price down now I want you to think about that for a minute because any anybody that uses oil to generate their income they need a higher price but Wall Street if they can force them to sell off their crown jewels who buys okay now this is the most current contra port commitment of traders and you can see that it’s rising and it’s actually at the highest level that it’s ever been since they started tracking it but when there is an increase that means that open interest means that new money is flowing into this marketplace and the result is most likely to be that the present trend so up down or sideways in this case up is likely to continue that means let me just grab this again okay we can see that this trend is clearly down now they’re trying Saudi Arabia and other all income producing nations are trying to push it down but they’re not doing it as much with derivatives which I don’t know why.

they don’t frankly doesn’t cost them but about ten to move barrels of oil but maybe Wall Street can with that okay maybe Wall Street is more powerful than the sovereigns we’ve seen it with sovereign debt and wall street going in and forcing payment we’re seeing it with oil and all of this brings us back to the death of the petro dollar now again this impacts you and me because we work for and attempt to save dollars the fewer dollars that are needed globally the less value that the dollar has and that could easily generate hyperinflation here so we’re going to continue to keep our eye on this keep those questions coming and to follow us on Twitter like us on Facebook and subscribe to us on YouTube if you like this video give us a thumbs up but please make sure you call us there’s lots of smart people here to answer any questions that you have and we all work together as a team eight eight eight six nine six four six five three and you be safe out there bye bye

Stop by our online store for gold and silver. Amazingly low prices!

Saudi Aramco and other Images