RESERVE CURRENCY DOLLAR COLLAPSE? Buy Gold and continue to Buy Says Big Wall Street Investor… by Lynette Zang

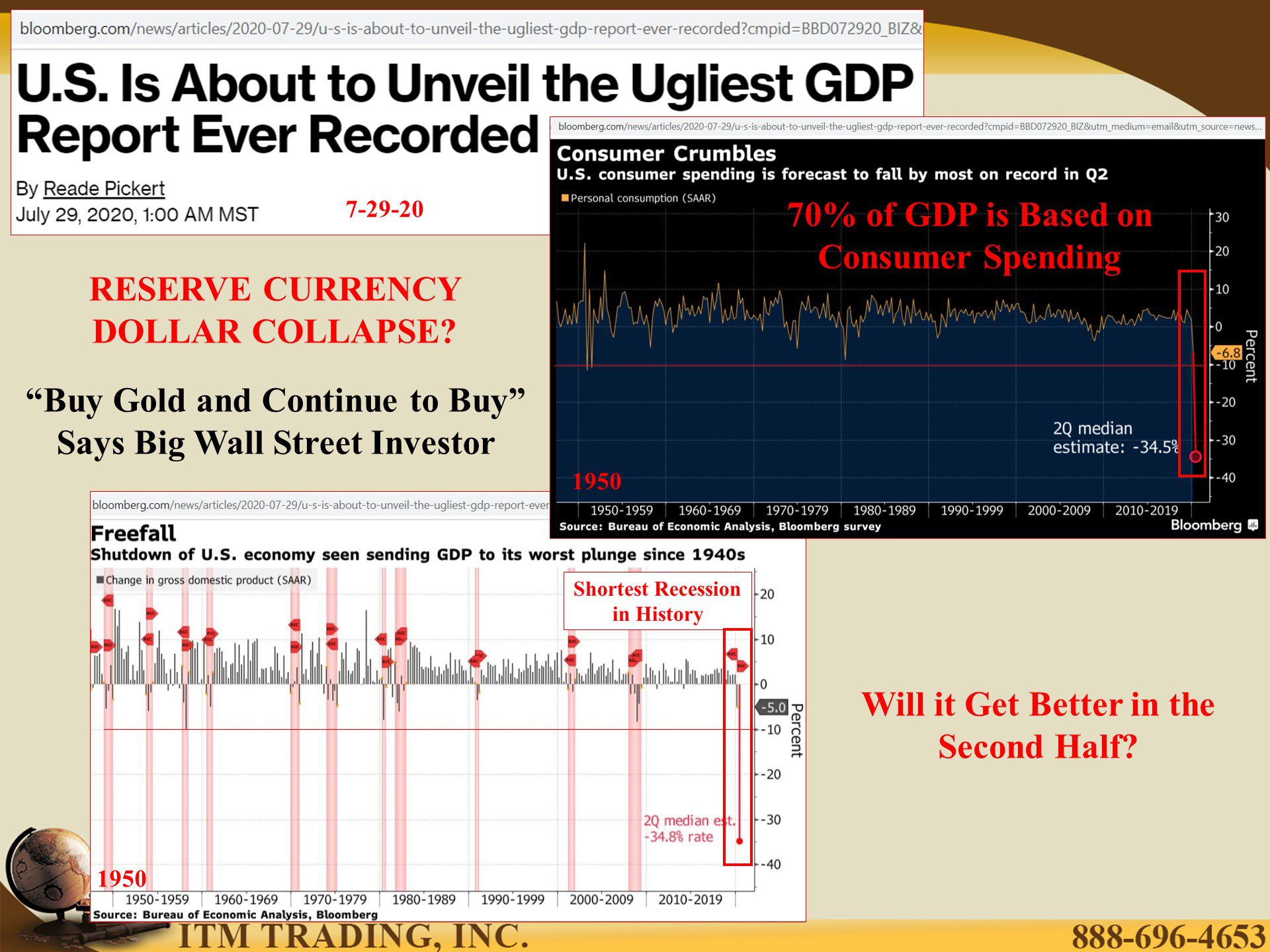

This morning the BEA (Bureau of Economic Analysis) announced that the GDP, which reflects all the money that flows through the global economy, plummeted at an annual rate of 32.9% in the second quarter of 2020. So much for Wall Streets prediction of a V-shaped recovery.

Have more questions that need to get answered? Call: 844-495-6042

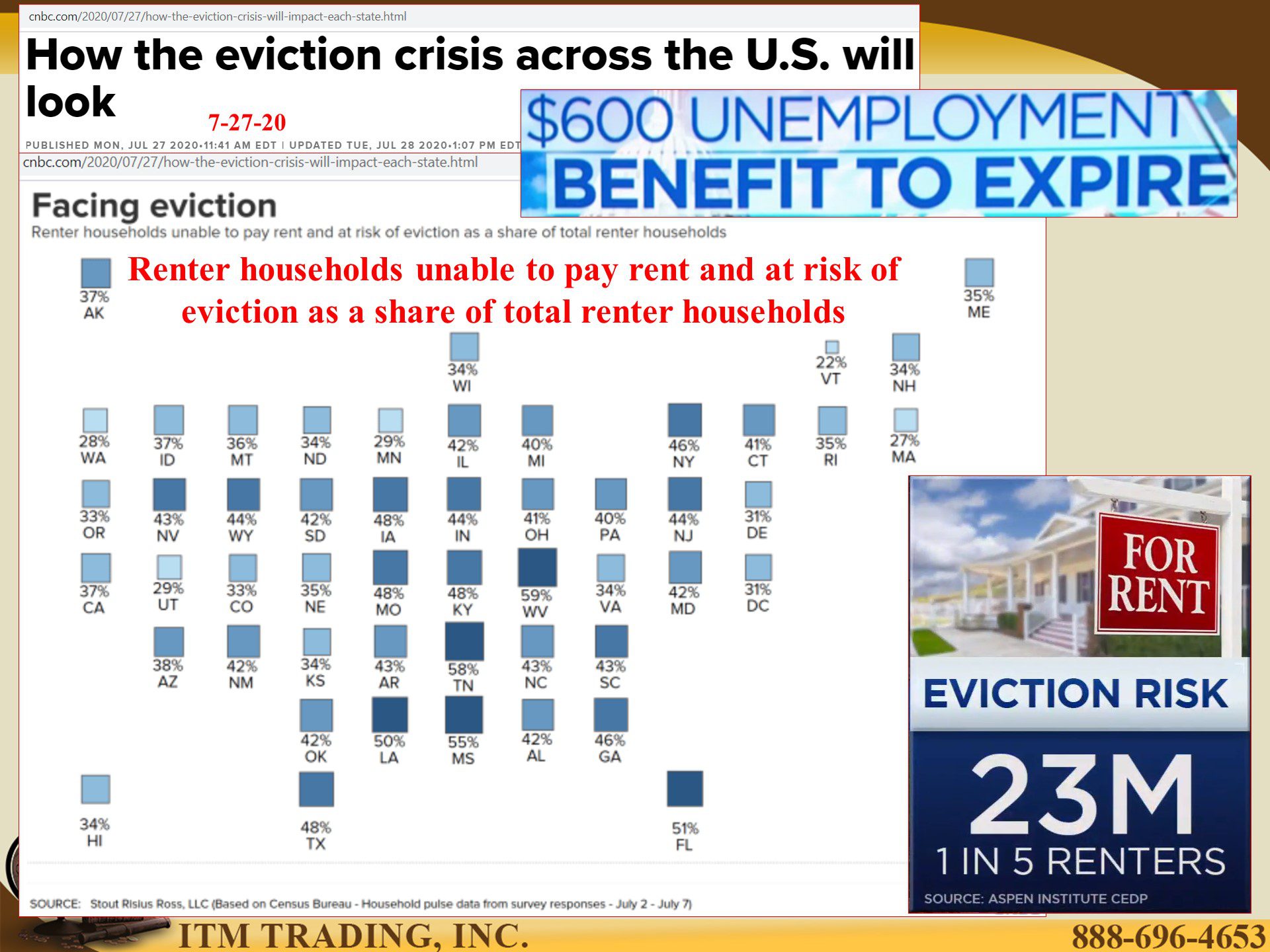

Of course, with consumer spending plunging 34.5%, this should not be a big surprise. Adding to the problem is the log jam that is Washington. So while the Feds have extended all their experimental spending programs and promised “Whatever it takes†in new money, many of the government programs have just expired (rent moratorium) or are about to expire ($600 unemployment benefit as example). So, Wall Street gets as much money as they want, and Main Street gets squeezed. Shocker!

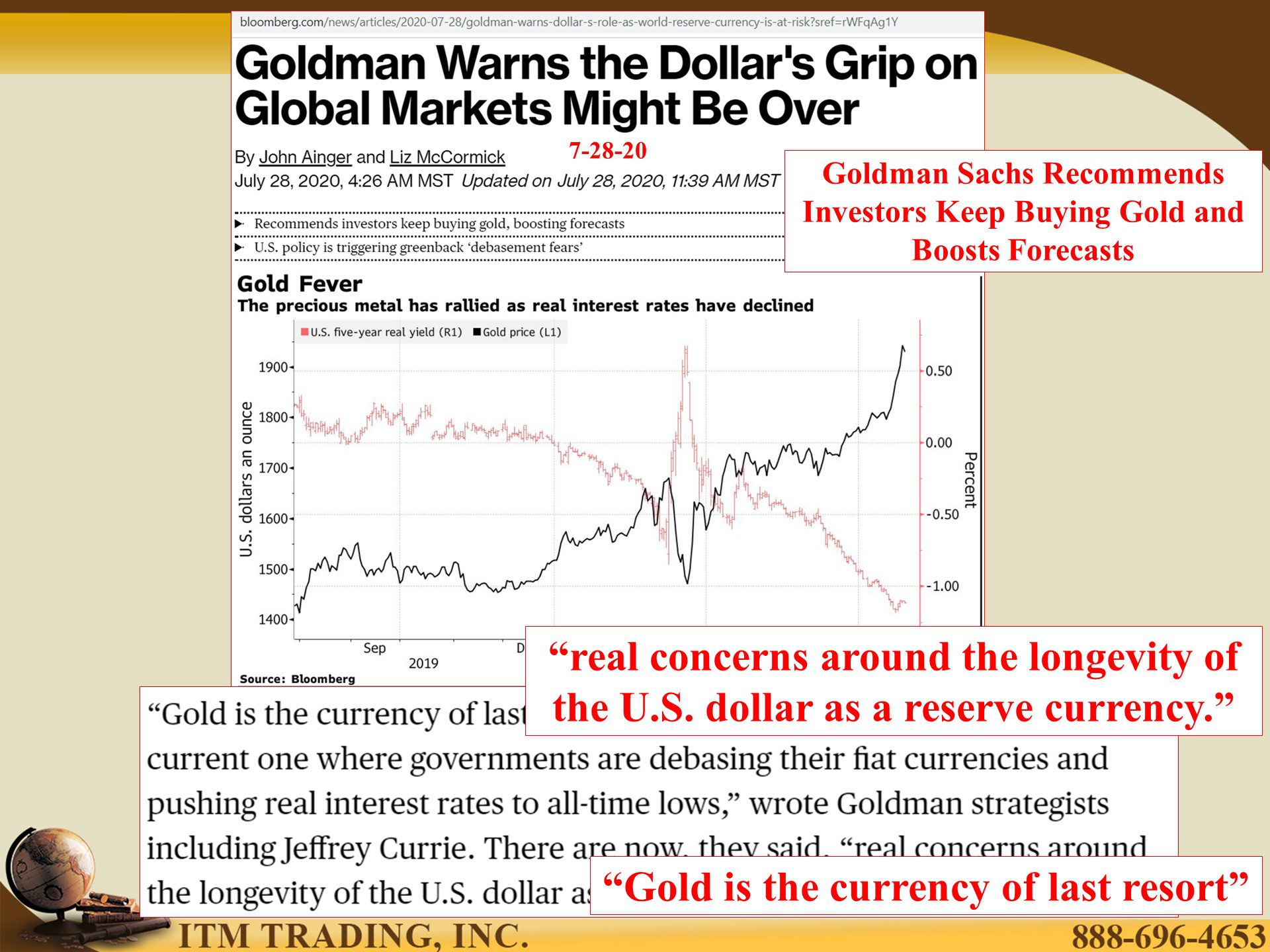

But what this also means is that currency debasement is the central banks weapon of choice and it appears that Wall Street is beginning to take notice. I’ve recently noticed multiple articles referencing the USD’s potential loss as “The†Worlds Reserve Currency with Goldman Sachs analysts stating that they have “real concerns around the longevity of the U.S. dollar as a reserve currency.†Therefore, they recommend investors buy gold as they continue to boost their forecasts for the nominal price of gold.

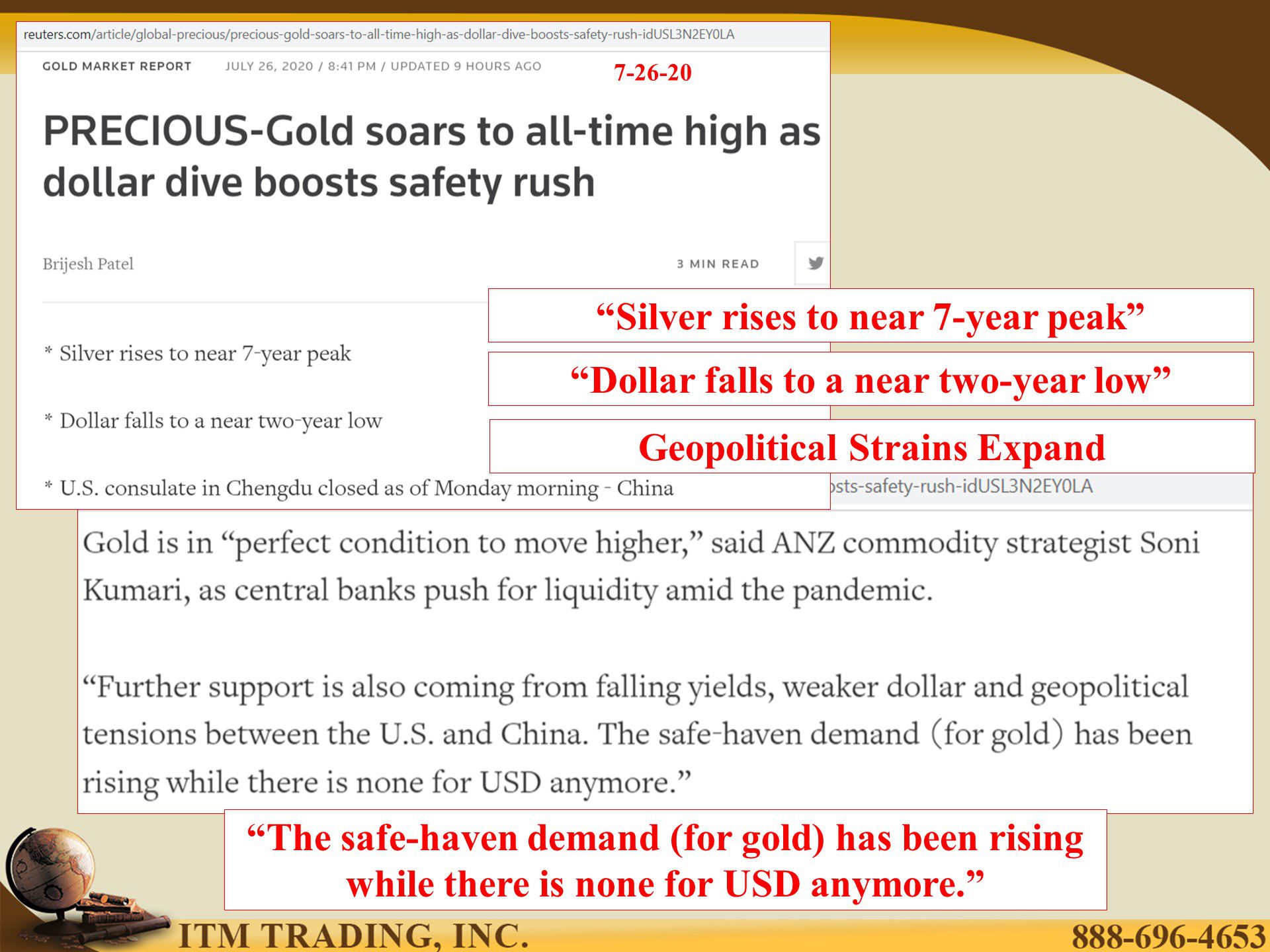

They are not the only one, ANZ commodity strategist Soni Kumari surprised me when he stated that “The safe-haven demand (for gold) has been rising while there is none for USD anymore.†Additionally, veteran investor Mark Mobius told Bloomberg TV that “I would be buying now and continue to buy†because he believes Gold and Silver are just getting started in a long-term run.

Did you get that? Wall Streets safe-haven contracts are beginning to fail (USD, Yen, US Treasuries) and gold is now starting to be recognized, once again, for its most important function, as a true store of value. I agree, now is the time to buy, you cannot have too much in this environment since physical gold and silver, in your possession, are your wealth shield. And if you ever needed one, now is the time.

Slides and Links:

- https://www.bloomberg.com/news/articles/2020-07-29/gold-gains-as-fed-vows-to-use-all-tools-extends-swap-lines?srnd=fixed-income&sref=rWFqAg1Y

- https://www.bloomberg.com/news/articles/2020-07-28/goldman-warns-dollar-s-role-as-world-reserve-currency-is-at-risk?sref=rWFqAg1Y

- https://www.reuters.com/article/global-precious/precious-gold-soars-to-all-time-high-as-dollar-dive-boosts-safety-rush-idUSL3N2EY0LA

- https://www.advisorperspectives.com/commentaries/2020/07/24/i-believe-gold-and-silver-are-just-getting-started

YouTube Short Description:

This morning the BEA (Bureau of Economic Analysis) announced that the GDP, which reflects all the money that flows through the global economy, plummeted at an annual rate of 32.9% in the second quarter of 2020. So much for Wall Streets prediction of a V-shaped recovery.

Additionally, Wall Streets safe-haven contracts are beginning to fail (USD, Yen, US Treasuries) and gold is now starting to be recognized, once again, for its most important function, as a true store of value. I agree, now is the time to buy, you cannot have too much in this environment since physical gold and silver, in your possession, are your wealth shield. And if you ever needed one, now is the time.