PSM THE PARTY IS OVER: Who Will Clean Up the Mess?

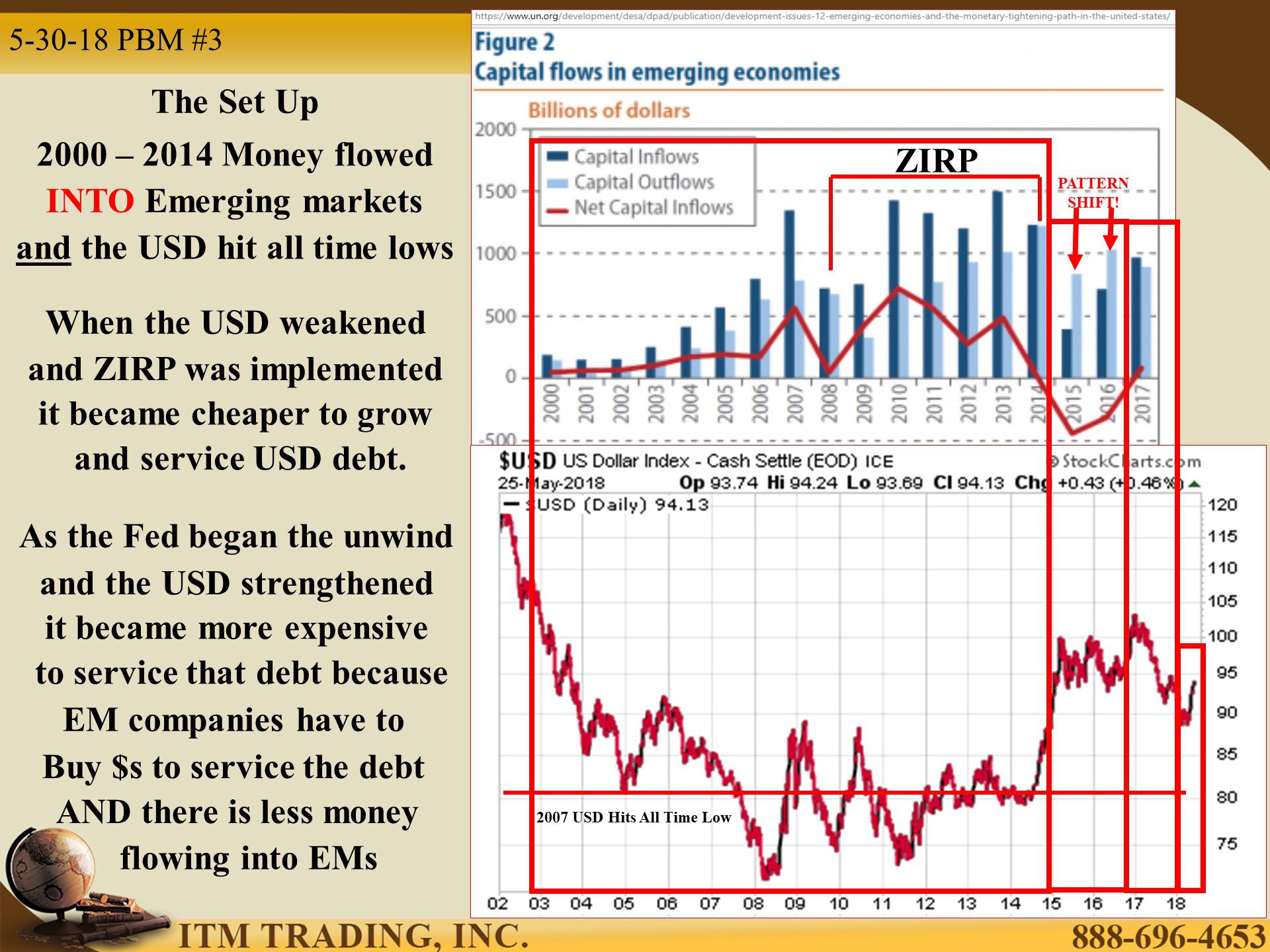

In 2007 the financial crisis began to unfold as the US dollar crashed through the last long-term support level and rapidly plunged to lows never before seen. Emerging markets benefited from this in several ways; As capital exited the USD it flew to emerging markets in droves flooding them with lots of cash and since the USD was not much weaker against emerging market currencies the USD carry trade was born.

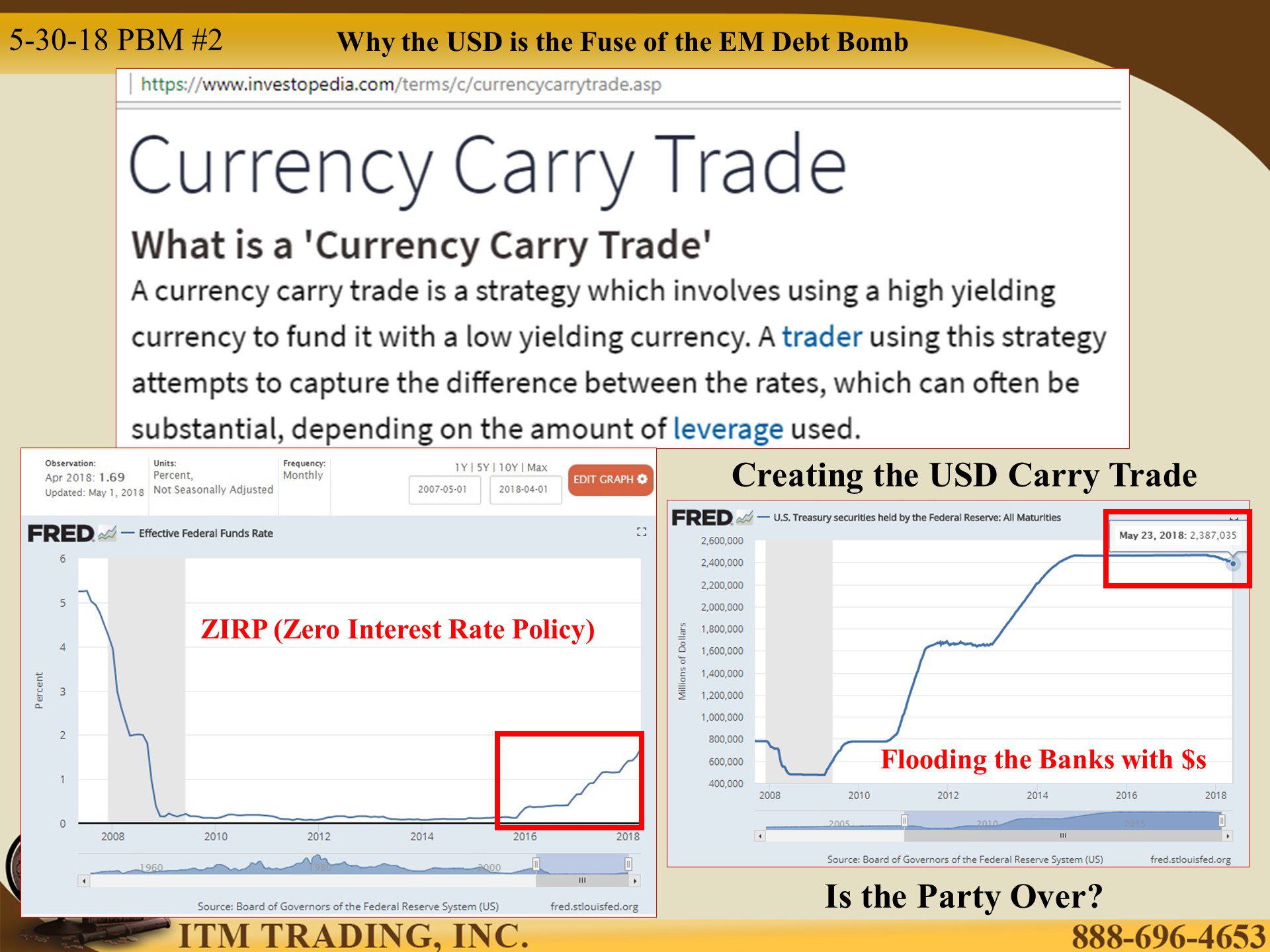

The currency carry trade is a leveraged strategy (normally 10 to 1) utilizing a stronger currency (EM currencies) buying a weaker currency (USD), the difference between the two is where the money is made or lost.

By 2008, as credit markets froze, and global central banks began hyperinflating the fiat money supply through quantitative easing, massive amounts of capital flowed into emerging markets. In addition, global central bankers pushed interest rates to zero and below, forcing savers to search for yield.

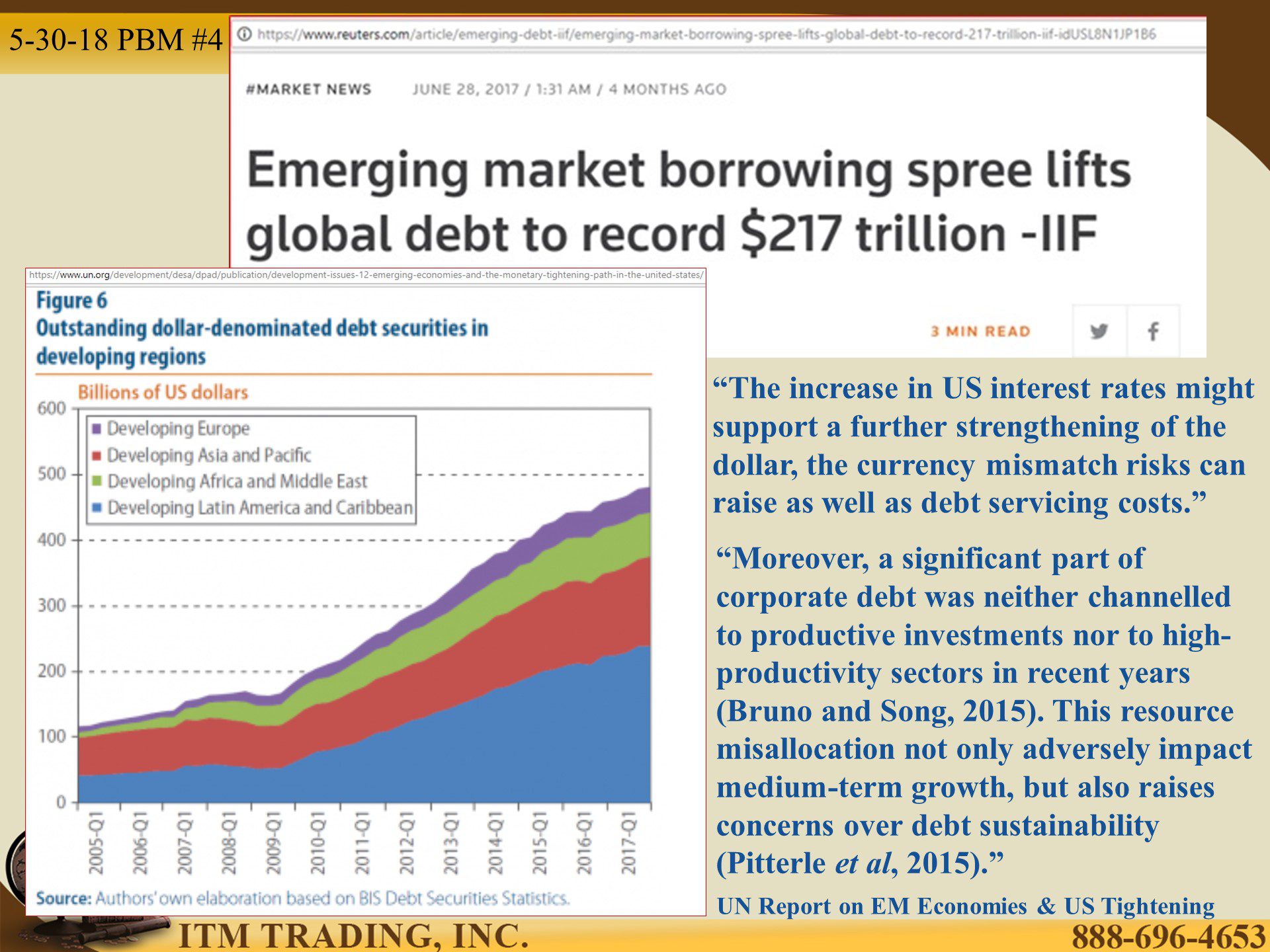

The USD carry trade debt party binge began in earnest. Risky governments and corporations saw huge demand with interest rates ridiculously low, that borrowing spree lifted the global debt record to over $217 trillion.

But now the party is over. In the US, the Federal Reserve began raising interest rates in 2015. In November 2017 they no longer fully reinvested dividends and principal from their $2.4 trillion treasury bond portfolio. These actions have pushed the USD up in relationship to other fiat currencies.

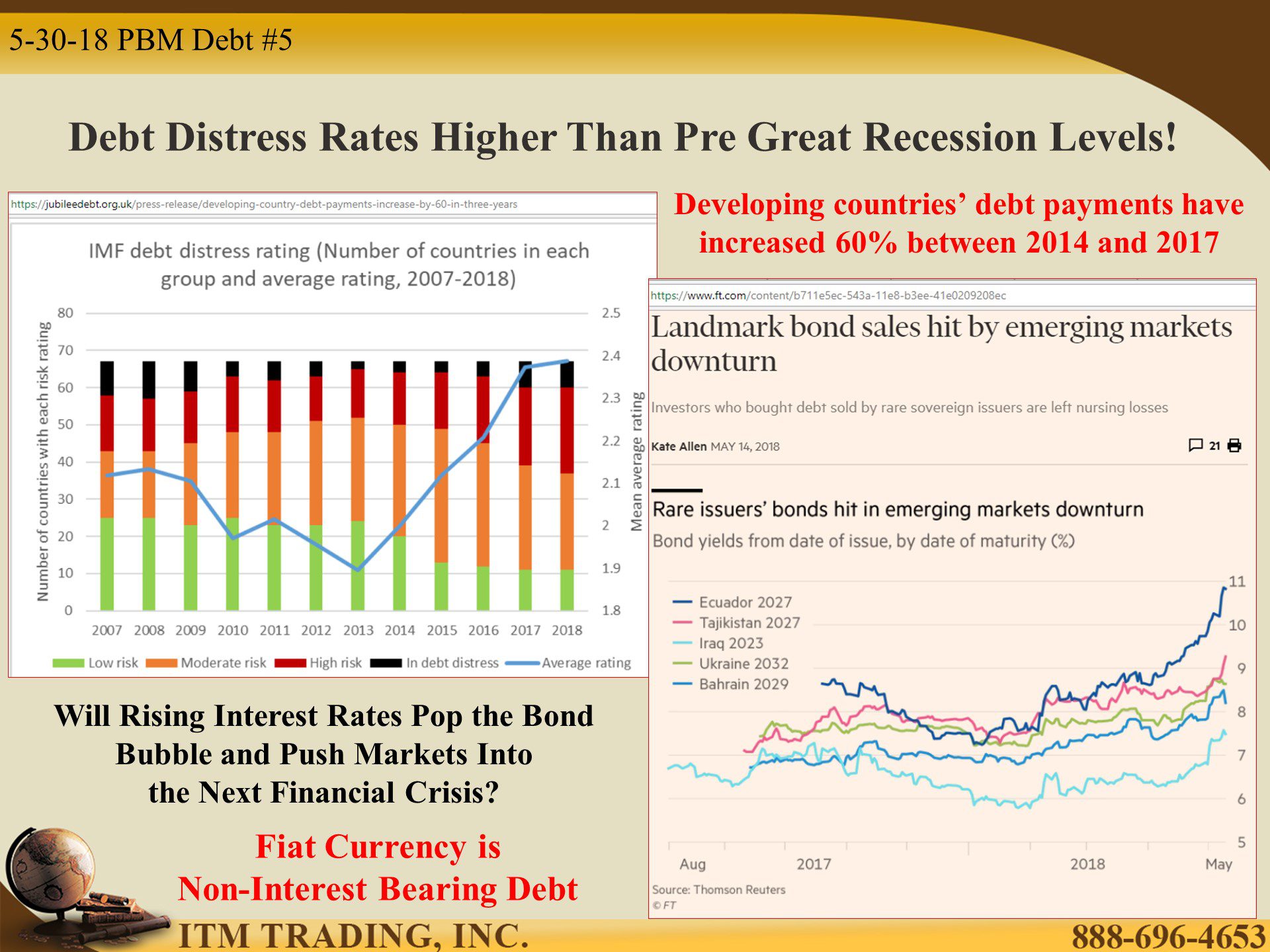

The impact is undeniable. According to the IMF, emerging markets debt payments have soared 60% between 2014 and 2017 causing a rising tide of debt stress and distress higher than crisis levels! Since the beginning of 2018, EM interest rates have risen rapidly as well. That destroys the market value of the bonds, but its also adds addition costs on any debt that gets rolled over.

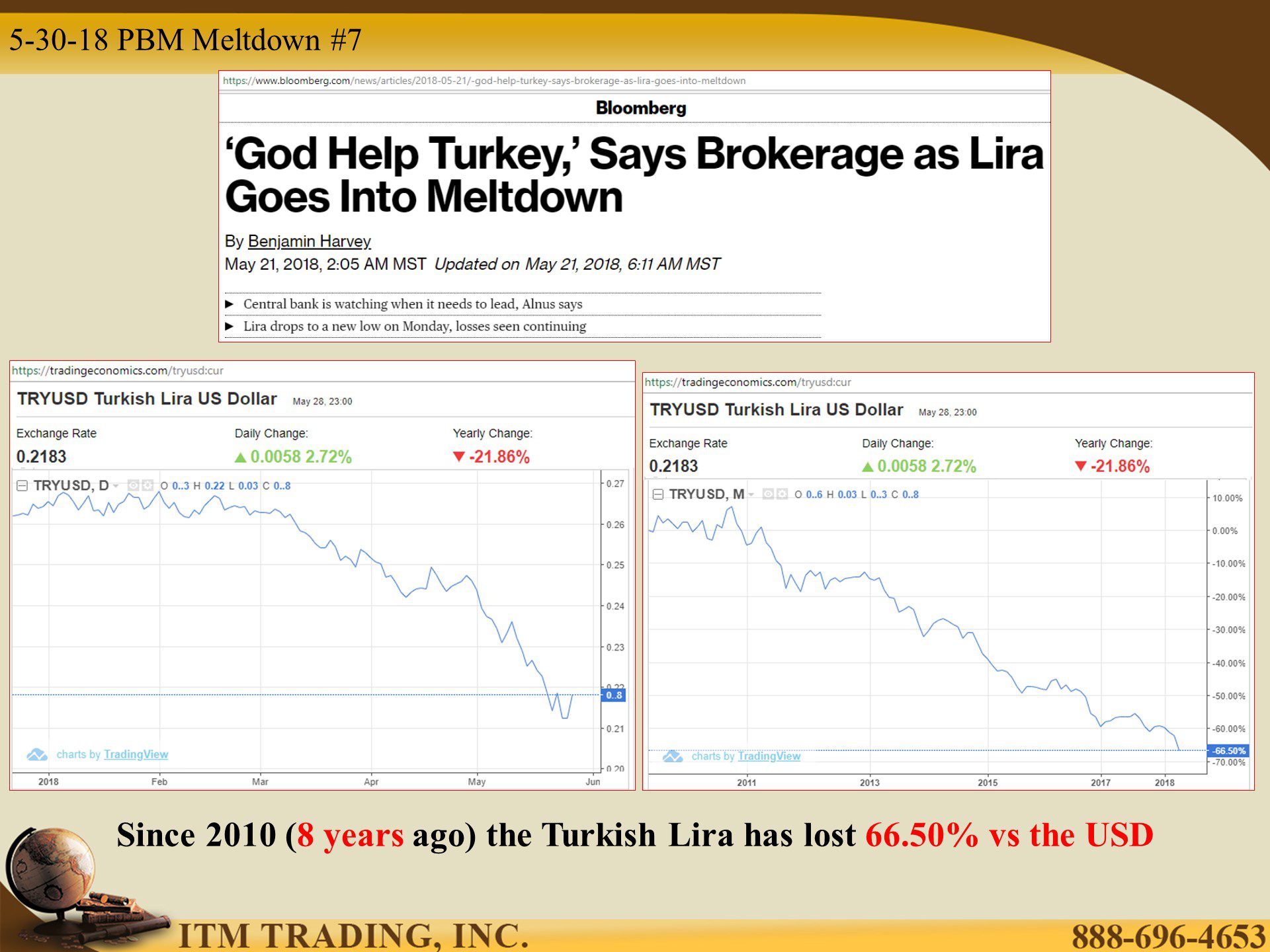

For the general public, this debt binge is reflected in the value of their currencies against the USD dollar. As example, the Argentine Peso has lost over 77% of it value over the last 5 years, with 21.86% just since the first of this year. Many other currencies look similar.

But even that masks the true nature of the declines since the USD, over the same time, has lost 14% of it’s purchasing power value. In fact, according to the most recent Federal Reserve posting, for the first time in history, the USD now has less than $.04 in value as compared to the gold backed dollar of 1913.

We have experienced the battle the central bankers and governments have waged against gold. After all, a rising gold price indicates a failing currency. But one look at the derivative spot gold markets in terms of emerging market currencies says it all. They are up. At some point, when these governments are forced to show the truth, gold will be reset much higher.

If you own it when this happens, you will not have to clean up the mess.

Slides and Links:

https://fred.stlouisfed.org/series/FEDFUNDS

https://fred.stlouisfed.org/series/TREAST

http://stockcharts.com/h-sc/ui

http://www.dw.com/en/argentina-hikes-interest-rate-to-40-percent-to-avoid-new-meltdown/a-43663063

https://tradingeconomics.com/argentina/government-bond-yield

https://tradingeconomics.com/argentina/stock-market

https://tradingeconomics.com/argentina/central-bank-balance-sheet

https://www.bloomberg.com/news/articles/2018-05-18/why-investors-have-become-skittish-about-turkey

https://tradingeconomics.com/tryusd:cur

https://tradingeconomics.com/turkey/central-bank-balance-sheet

https://tradingeconomics.com/turkey/government-bond-yield

https://tradingeconomics.com/turkey/stock-market

https://tradingeconomics.com/idrusd:cur

https://tradingeconomics.com/brlusd:cur

https://tradingeconomics.com/zarusd:cur

https://tradingeconomics.com/mxnusd:cur

https://tradingeconomics.com/rubusd:cur

https://tradingeconomics.com/myrusd:cur

https://tradingeconomics.com/idrusd:cur

https://tradingeconomics.com/brlusd:cur

https://tradingeconomics.com/zarusd:cur

https://tradingeconomics.com/mxnusd:cur

https://tradingeconomics.com/rubusd:cur

https://tradingeconomics.com/myrusd:cur

https://tradingeconomics.com/idrusd:cur

https://tradingeconomics.com/brlusd:cur

https://tradingeconomics.com/zarusd:cur

https://tradingeconomics.com/mxnusd:cur

https://tradingeconomics.com/rubusd:cur

https://tradingeconomics.com/myrusd:cur

https://fred.stlouisfed.org/series/CUUR0000SA0R

- NA