Percentage of Interest Expense Rolled over in our National Debt

How much of the current 14.6 trillion in total National Debt is accrued interest?

By Lynette Zang:

Some have said up to 45%, but I prefer to do my own analysis. So I went to the CBO (Congressional Budget Office) and the Federal Reserve and used their data for this study. I had to make some assumptions (which I will cover) so I cannot tell you that what I’m about to show you is 100% accurate. I did however send it off to two of my colleagues that are accountants for them to double check my figures and they confirmed and said that it looks right. Still I cannot guarantee exact accuracy, only the Fed can do that. I have included the data I used in this blog and you can judge for yourself.

First I pulled the data from the CBO from 1971 through 2010. I looked at income, outlays, and public debt. A portion of the outlays was interest on that public debt, which is only a portion of the total debt, but they don’t count the interest due on the “Intra-governmental Holdings†which is the excess funding that has come in over the years for Social Security and Medicare, that was put into the general fund as income and used by our government. So the interest is only on the bonds held on public debt.

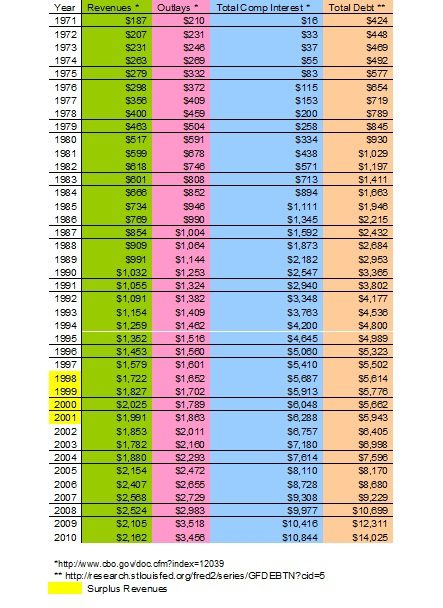

From that, I could easily calculate what the average interest rate was for that year. If deficit spending (spending money you do not have) was greater than the interest due, I assumed they did not pay the interest for that year and it rolled into next year and we paid interest on that interest (compound interest). If there was a surplus (it actually happened between 1998 and 2001) I assumed that all of the excess went toward the previously accrued interest. The table below shows the numbers from the CBO and Federal Reserve, followed with links to the underlying data; the figures are in billions of dollars, so add 9 zero’s to the following numbers.

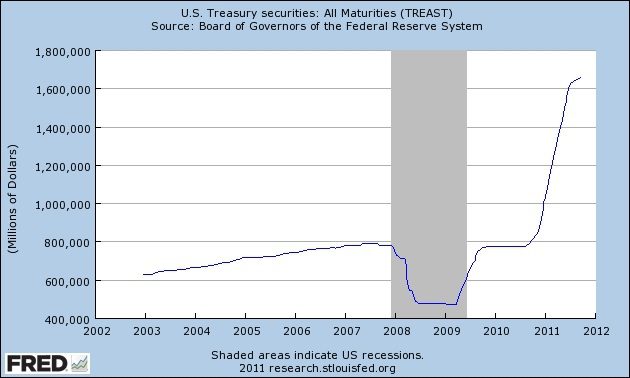

Let me walk you through the chart below (which is a graph of the data above). The dark green line represent revenues and you can see that in the 1970’s, when we first went on to a fractional reserve currency system (debt based), income and total outlays were pretty much the same, and the interest which is included in the total outlays, was a small portion of the debt. Also in the 1970’s we exported more than we imported and we were a creditor nation. In the 1980’s we began to shift into an import and debtor nation. The blue line, which represents the compounding interest, and the orange line, which represents total debt, began lift off then, clearly growing at a rate much faster than our revenues.

If I’ve done the compounding correctly as of the end of 2010, the accrued interest that we are compounding is 77% of the total debt! No wonder our debt levels are growing at a faster and faster rate. So the next question is if most of our debt is compound interest and our deficit spending has also increased dramatically (1.5 trillion a year) how can we get out from under that? It seems improbable doesn’t it? They’re talking about cutting deficit spending by 1.5 trillion over the next ten years which is not nearly enough.

The chart above shows us that despite all of the talk of reducing deficit spending, even if we stopped deficit spending and actually lived within our means, our debt would continue to grow at alarming rates because of the compounding of interest!

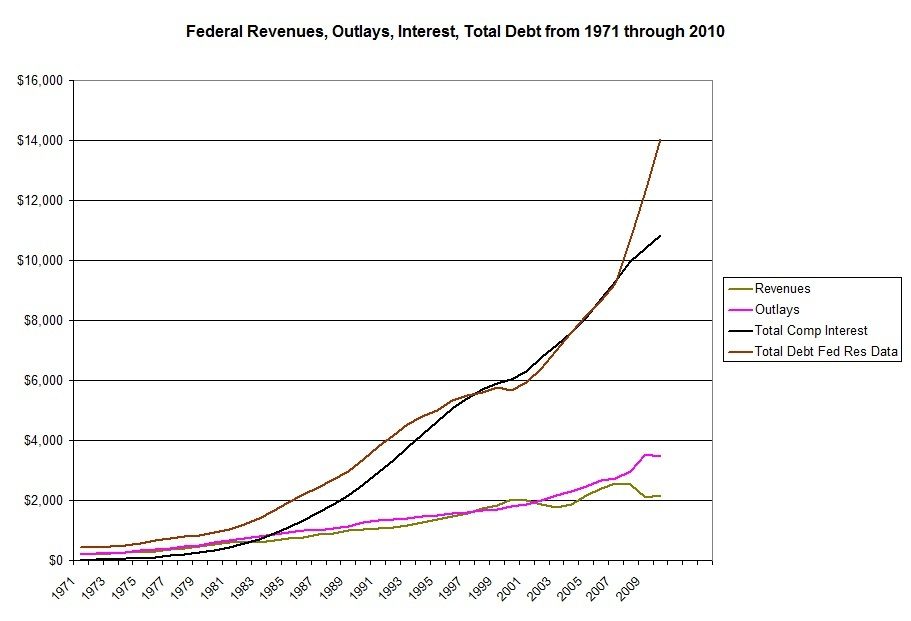

When you have debt you must deal with it in some way. You can roll it over, you can default on it or you have to pay it. It will not just evaporate. But remember, in a fractional reserve monetary system, currencies are supported by “The Full Faith and Credit†of the government, in other words, the government’s ability to create more debt. Quantitative easing (buying our own debt because no one else will) tells us that we are losing the ability to grow more debt, as seen in the chart below, which depicts the total bond purchases by the Fed since 2003. This is something they never had to do before because there were always governments and central banks to buy enough of our bonds.

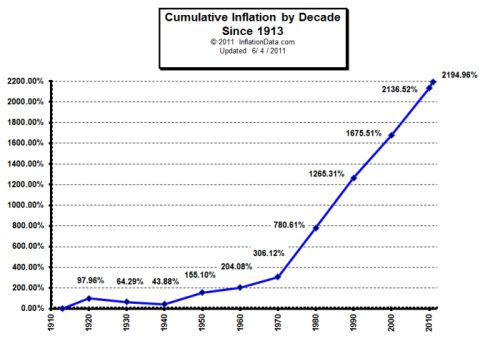

So if we attempt to pay the debt we have to either generate a lot more income or devalue the currency through inflation, so that we repay the debt with cheaper dollars. Clearly the Fed has chosen to pay the debt with inflation as evidenced by the chart below, particularly since 1971 when our currency became debt based (fiat currency).

So if inflation is the Fed’s answer to handling the debt, thereby devaluing the dollar what can you do to protect yourself? There are only two ways to value a currency, one is against other debt based currencies and the other is against how much gold (savings based currency) it will buy. Even though the relative performance chart below looks like gold is exploding, in reality, it is showing you the race to devalue those debt based currencies.

Once compounding interest becomes the predominant factor in debt build up, even at artificially low rates, your debt builds faster and faster (at some point becomes exponential). If on top of that you knowingly continue to spend more than you have coming in (deficit spending), I am sorry to say, you are doomed. This is the choice of governments and central banks around the world.

Unfortunately someone has to pay and central bankers and governments have chosen the public to be the payor of this unpayable debt, and history tells us it will cost your entire wealth if you let it. You have a choice in how you will participate. Remain in fiat currency assets when the dollar is completely devalued (stocks, bonds, cash) and watch your wealth evaporate as you participate in their race to debase. Or convert to the only asset class that is pure savings based, physical gold and silver, and take back your right to plot your destiny and thrive through this global debt mess as well as our own national debt.