Part One: What is Money, 2008 Was Just a Warning!

Part One of Four: What is Money

How many times can you be lied to if you do not know the truth?

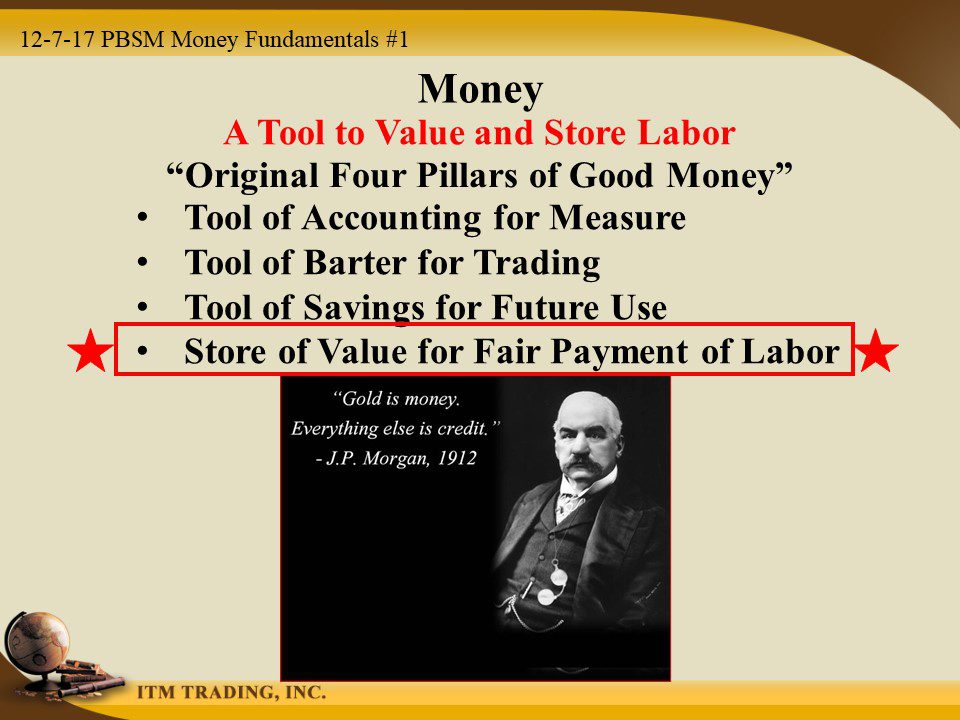

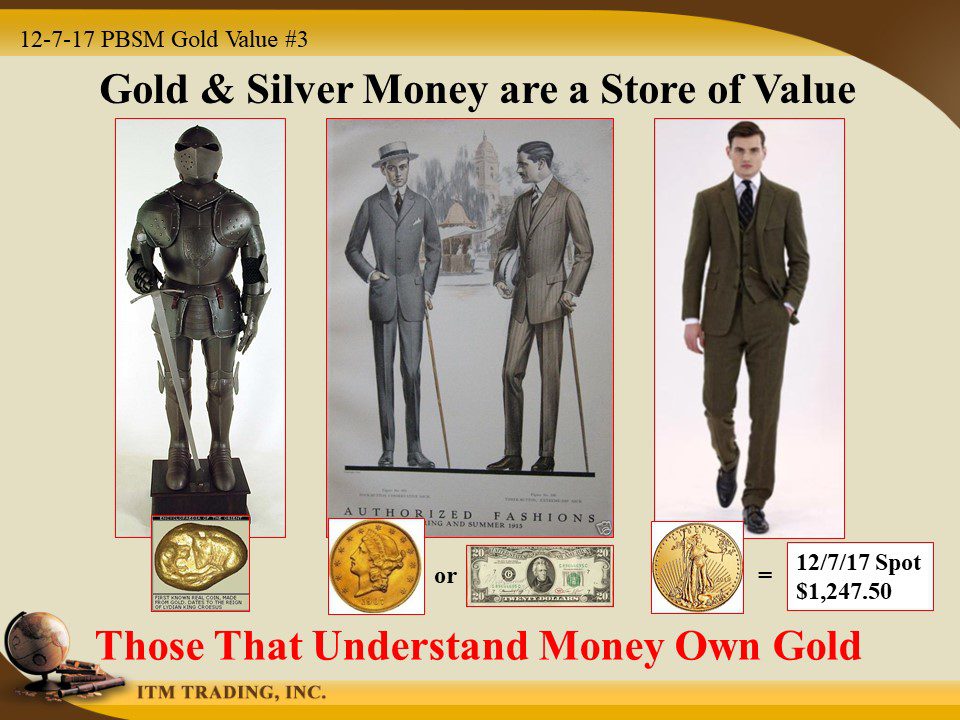

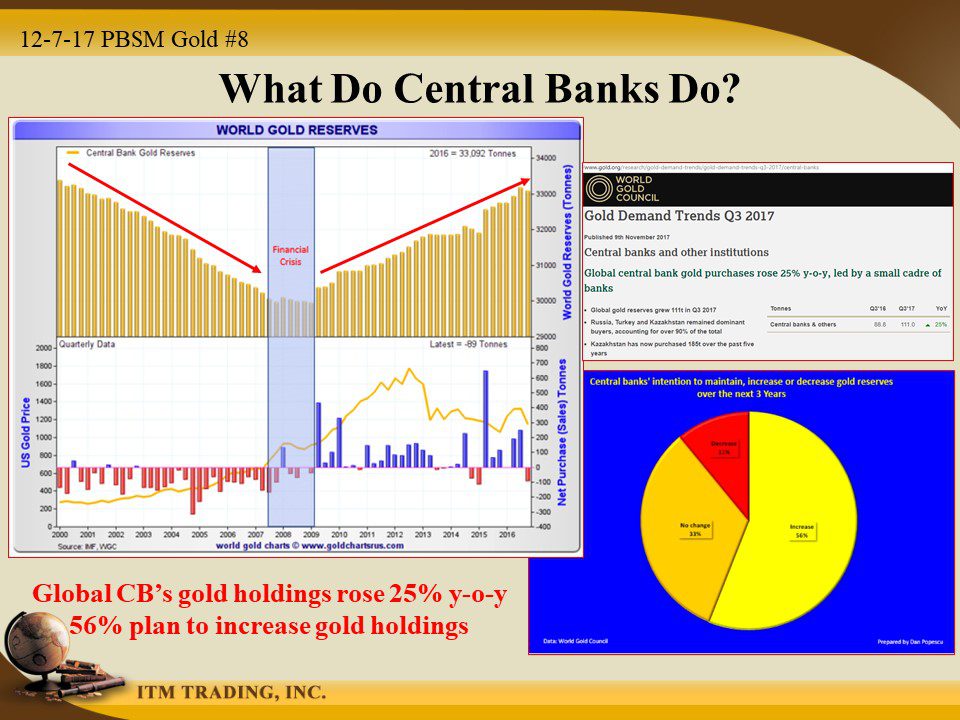

What is the truth about money? We work for it, use it as our tool of barter and if there’s any left, save it for future use. Over the years many different things have been used as money; large immovable stones, shells and beads, gold and silver and of course paper currencies backed by government promises (fiat money). Only gold and silver have stood the test of time. Why?

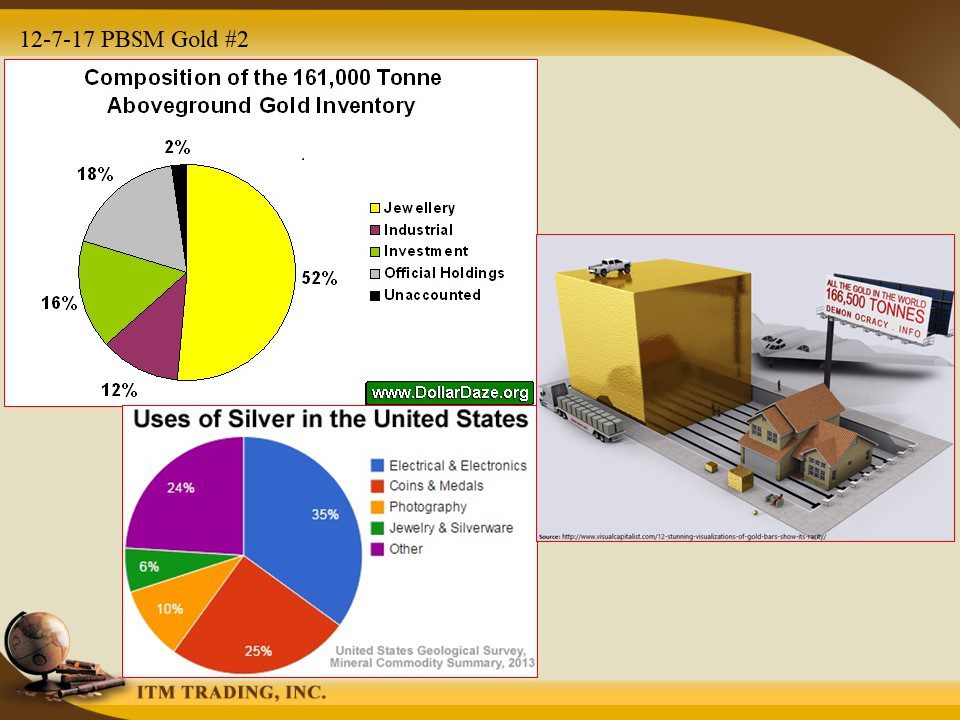

Gold is finite, indestructible and malleable with use across the entire global economic spectrum. Silver also possesses many of those same qualities. This is the reason gold is the primary commodity money and silver the secondary commodity money. But the finite quality of commodity money creates restrictions for governments that want to tax and spend.

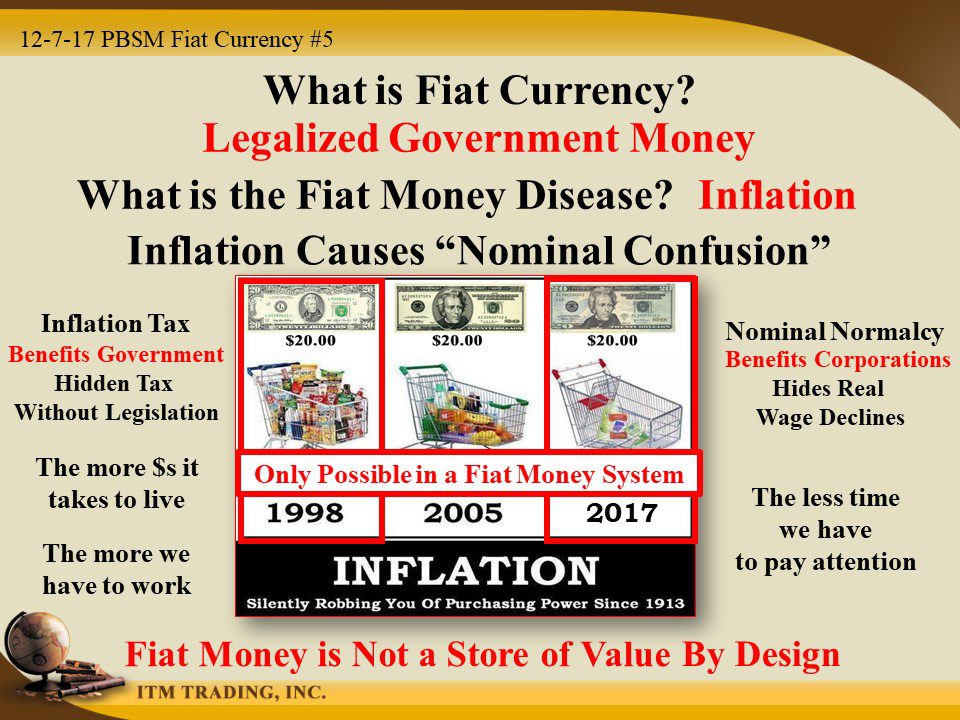

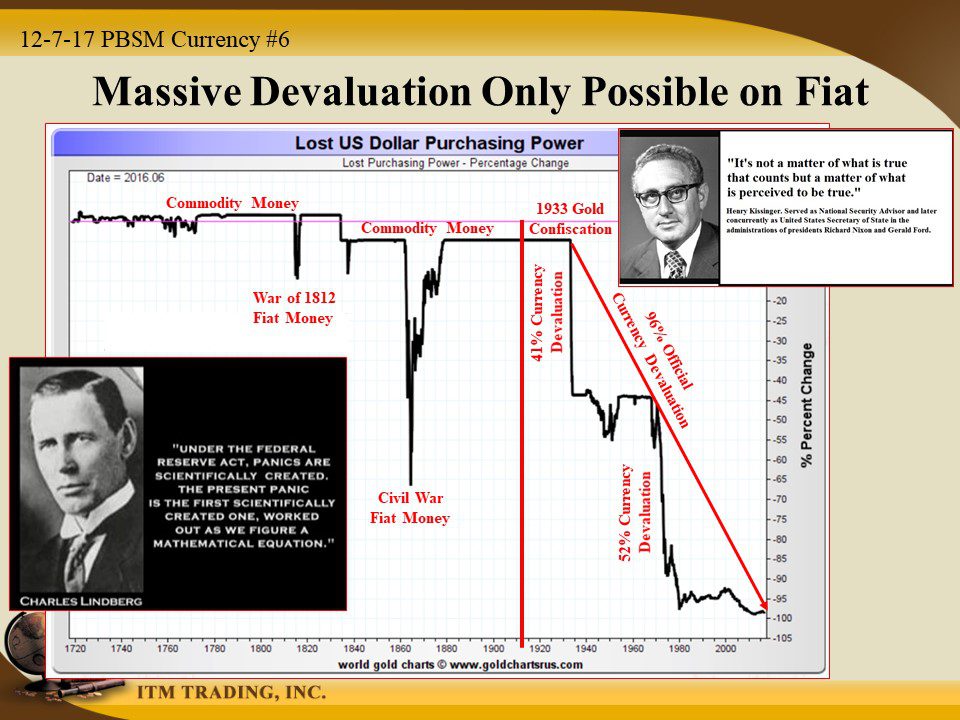

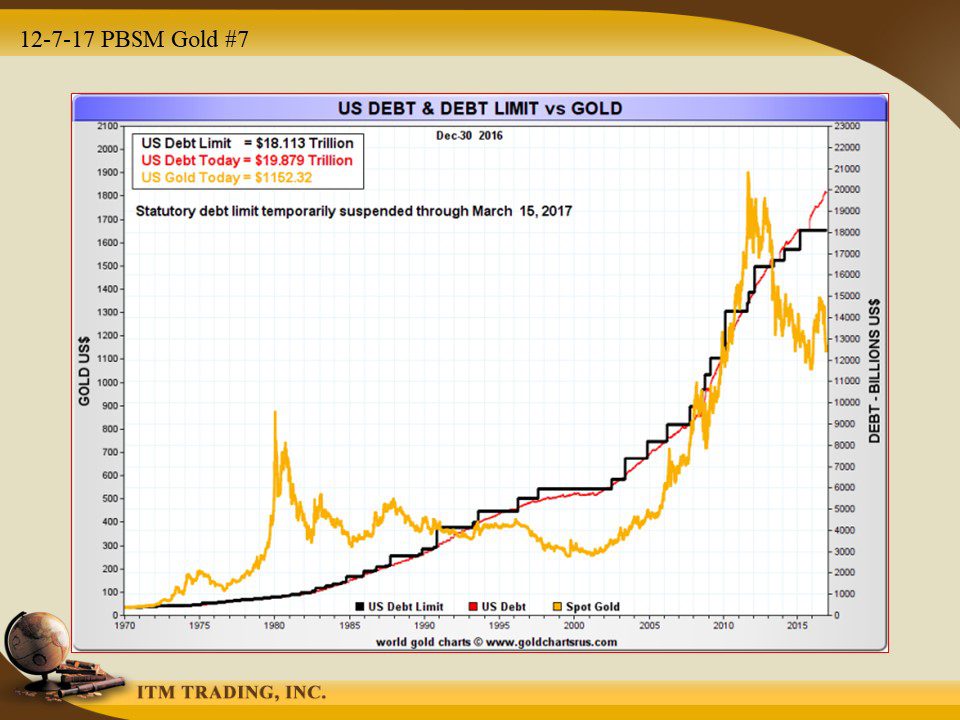

So in 1913 the Federal Reserve partnered with the US government and began a gold/fiat money experiment based upon inflation. In the 1960’s it became clear to global governments and central banks that the system was failing. This required a new money standard, this time based purely on debt.

In August of 1971 the new debt based system was instituted and inflation escalated. Today, we are at the end of the current fiat money experiment having officially devalued the US dollar by 96% since 1913.

As a new money standard is being developed, it’s important to understand what money really is and how we got here, since history has a way of repeating itself. If enough people understand this fact, perhaps we can have a fairer system. At the least, armed with this knowledge, any individual would be empowered and enabled to protect the fruits of their labor. In part two of this 4 part series we will cover how the 2008 crisis occurred and how it has become even more dangerous.

To View Part 2 of 4: https://www.itmtrading.com/blog/part-two-problems-caused-last-crisis-bigger-today-2008-just-warning/

Slides and Links:

http://www.visualcapitalist.com/12-stunning-visualizations-of-gold-bars-show-its-rarit

www.goldchartsrus.com

https://popescugolddotcom.wordpress.com/2017/01/26/gold-and-silver-outlook-2017/