Not Much Talk about the Dollar Approaching an All-Time Low

It seems wild to me that the dollar is approaching its all-time closing low of 71.33 and there is virtually no talk of it anywhere. It makes me think that the same will be the case even after the dollar breaks below the 71.33 figure. Should the dollar break below 71.33 it will be in uncharted territory, meaning that there is no telling where it will end up. Some technical analysis can give indications but no one knows for sure.

Today the US dollar index sits at 72.90, which is only 1.57 points away from the all-time low. The US dollar index is comprised of a basket of 6 fiat (debt based) currencies which include: Euro 57.6%, Yen 13.6%, Pound 11.9%, Canadian Dollar 9.1%, Swedish Krona 4.2% and Swiss Franc 3.6%. As other fiat currencies become stronger the dollar becomes weaker.

To only be 1.57 points away from the all-time low, you might expect to garner some attention, but I just don’t think that anyone wants to draw peoples focus to the dollar. It is just too scary to be so close to uncharted water, especially when all the government seems to be doing right now is devaluing the dollar through money printing. So what can you do to protect yourself?

The other way to value any currency is to do so against gold, the primary currency metal.

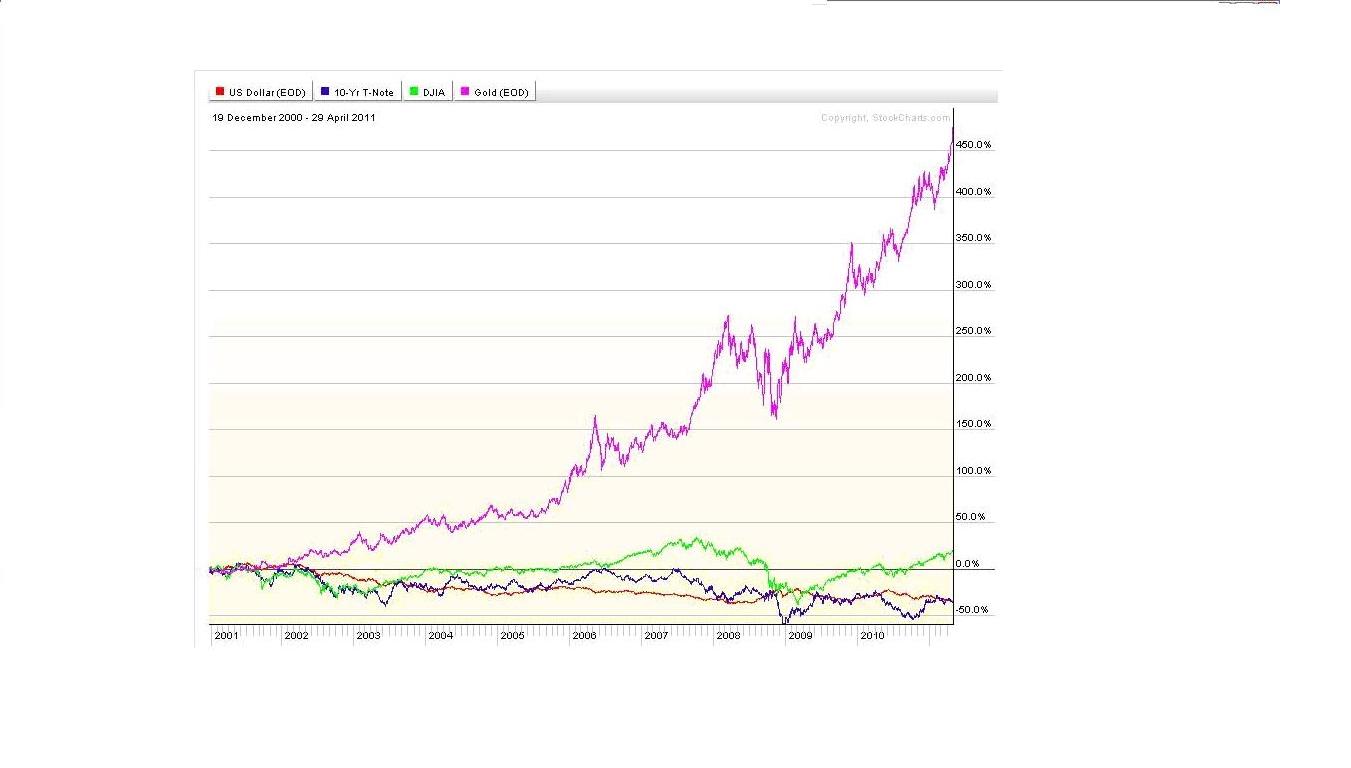

Over the last ten years the dollar has gone from 110 to 72.9 which is a loss in value of over 33%. Meanwhile gold has risen from $263.95 to $1,555.90 over the same time frame, which is a gain of over 489%. Gold is an excellent hedge against a falling dollar. If you look at the last 10 years, to cover a 33% loss in the dollar you would have needed to make 50% on your money just to break even. Gold has cleared 489% thus far, a very adequate hedge.

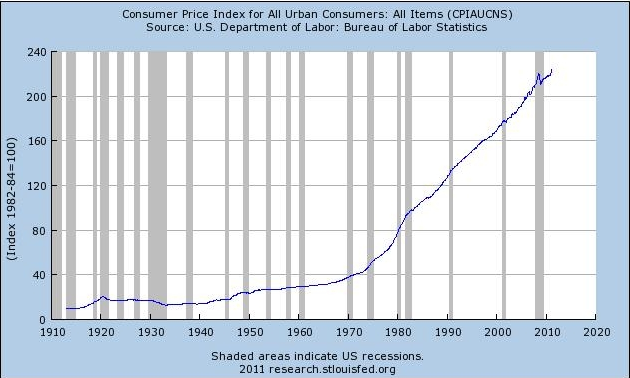

If you look at the DJIA over the same 10 year time span the Dow went from 10,876 to 12,803 (5/2/2001 to 5/2/2011), only a 17.72% gain. Not even close to the 50% gain needed to cover the loss in the dollar. Therefore if you were using the Dow to hedge the dollar you would be in losses. A similar thing has happened with bonds. On 5-2-01 a 10 year bond paid a dividend yield of 5.3% now it pays a paltry 3.29%. At the same time, the cost of everything except real estate, has gone up (CPI chart below).

This is why gold is used for preserving purchasing power (chart Gold against stocks, bonds and cash).

If you haven’t considered gold up to this point, it makes sense to do so as we are getting close to the all-time low closing for the dollar. To buy gold coins call us at 888-696-4653.