NO LIQUIDITY = FLASH CRASH: Any Questions? by Lynette Zang

Thanks to the changes in corporate tax rates and the ability to bring back corporate cash held overseas at an even better tax rate, corporate buybacks are at all-time highs, even beating 2007 levels! In fact, since 2010 increasing corporate buybacks have helped pushed stock markets to new all-time highs.

While the public has been loathe to sell stocks into this rally (unlike corporate insiders), they have not rushed in to buy either, removing a layer of market support. The Fed has been rolling off their balance sheet and global interest rates are rising as they break key technical levels and signal the slow down of the debt/credit binge that has also supported a higher stock market.

On July 2, 2018 CNBC told us that “Companies buying back their own shares is the only thing keeping the stock market afloat right now.†If corporate buybacks are now the only thing supporting the stock market, what we’re now experiencing is what happens when corporations stop buying, because there is no liquidity (broad base of buyers) in these markets.

What happens when the last buyer leaves the market? Flash crashes.

What would cause corporations to stop buying? At this time, earning season.

Under SEC rules, companies can’t buy back any of their shares during earning season. This blackout period ends two days after the company’s results are released. This is most likely a key cause of the recent stock market declines. But this should really be taken as a warning gift.

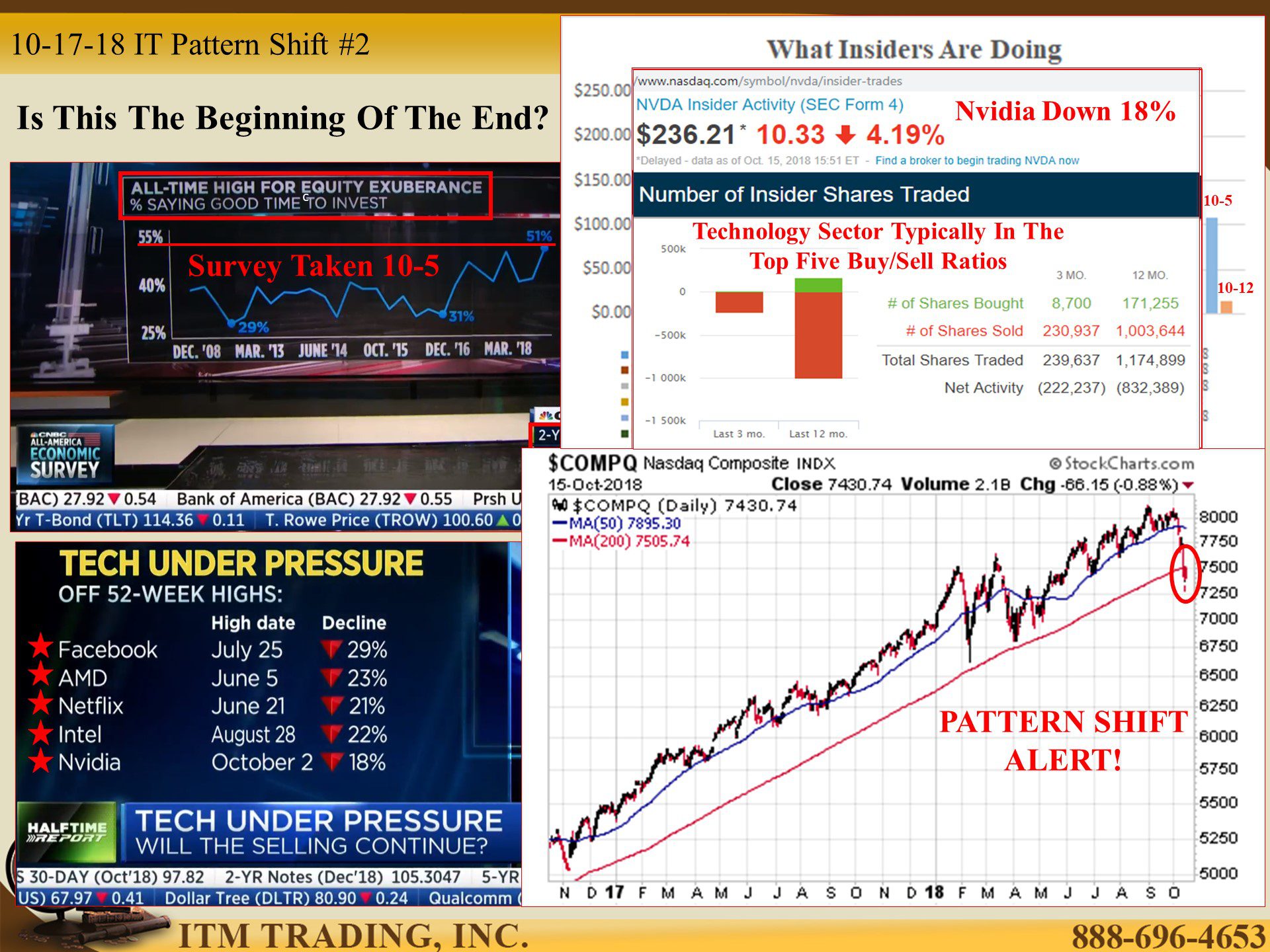

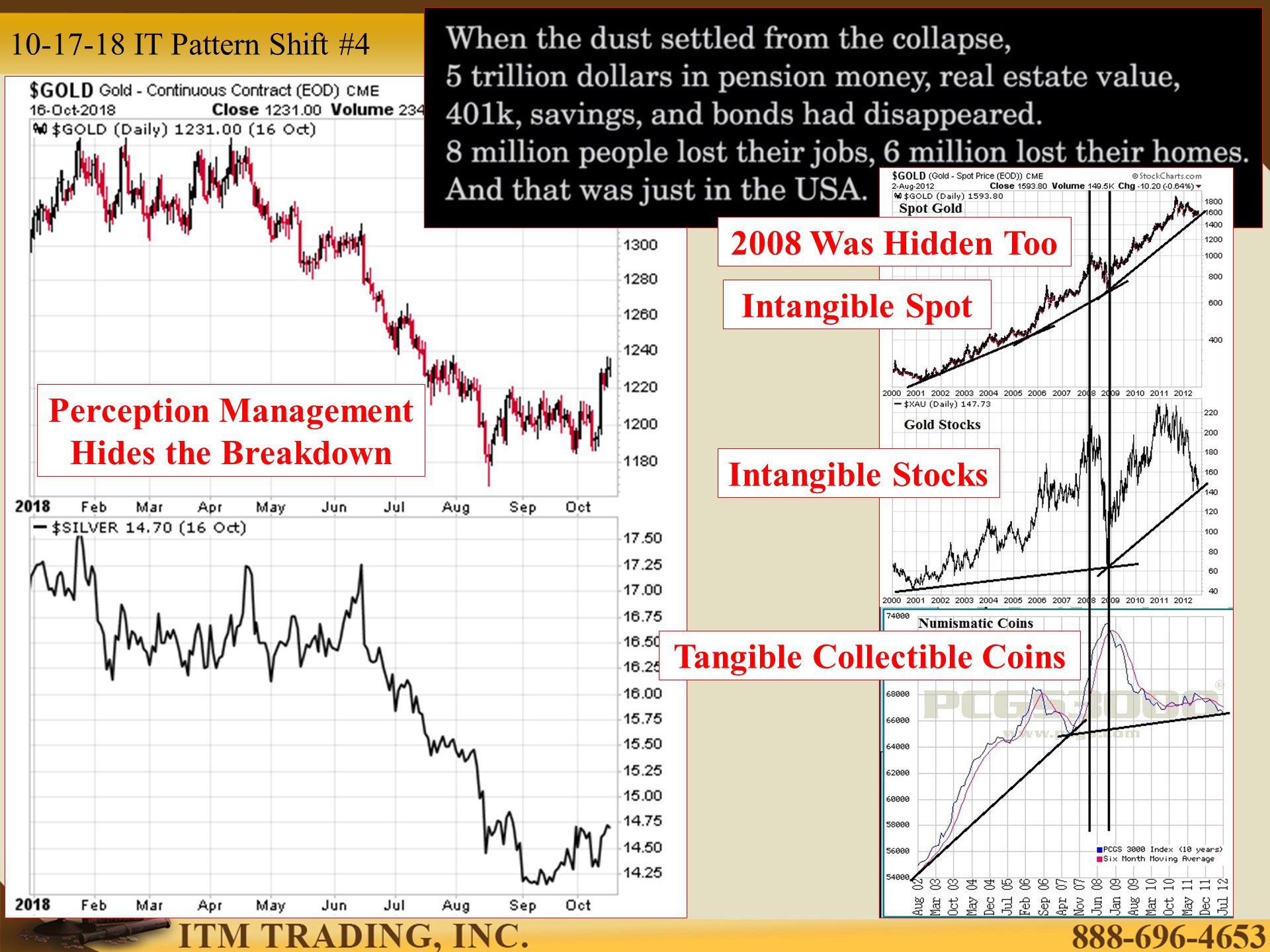

Since last October we’ve been witnessing an escalating pace of pattern shifts with a major escalation that began last January, when interest rates and stock markets coordinated pattern diverged. In May the global synchronized markets diverged with the US markets rising as the rest of the world fell. But now, that synchronization appears to be back…on the downside.

These pattern shifts seem eerily similar to what I saw between July 2007 and the September 2008 when the crisis became visible to all. I take these pattern shifts very seriously, they are telling us that something nasty this way comes.

What happened to gold and silver? The spot markets dropped along with the other fiat markets, but physical supply dried up and collectible gold coins hit this trend highs.

Slides and Links:

http://www.wsj.com/mdc/public/page/2_3024-insider1.html

https://www.nasdaq.com/symbol/amd/insider-trades

https://www.nasdaq.com/symbol/fb/insider-trades

https://www.nasdaq.com/symbol/nvda/insider-trades

https://www.nasdaq.com/symbol/intc/insider-trades

https://www.nasdaq.com/symbol/nflx/insider-trades

https://stockcharts.com/h-sc/ui

https://stockcharts.com/freecharts/perf.php?$UST10Y,$indu