news-4-25-2017

Video

Hi guys Lynette Zang chief market analyst here at ITM Trading a full-service physical precious metals brokerage house.

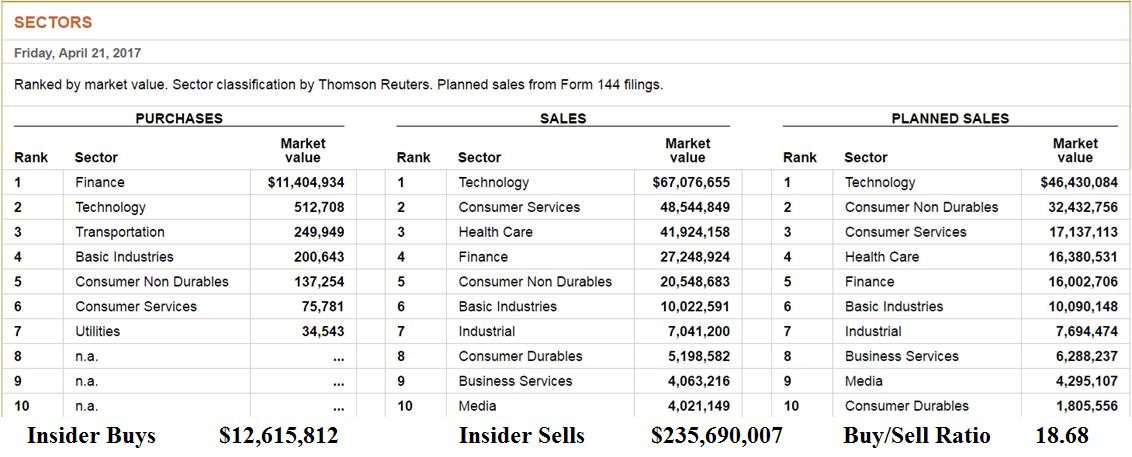

First we’ll go through our what’s going on with the insiders and you can sell that you can see this is from last week ok so the buy-sell ratio for last week was almost times selling to buy it specifically the banks you may have heard how great the banks are doing and how much they are flying well we’re going to start with JPMorgan Chase one of the best known banks and remember this little I guess rust colored area is the selling this is the buying this is three months this is twelve months and this is a graph of the stock for the last months so you can see pretty clearly lots more cells than buys but I also wanted to do it real quickly for Wells Fargo now you can see where the scandal-hit which was right there that’s where the scandal-hit and look at where the stock is today and look at what the insiders are doing you know it’s incredible to me that they can steal two million identities and their stock is higher so it really doesn’t matter and that’s really because we’re inside of monopolies even though we don’t realize because of that illusion of choice all right.

Stock Market News – Insider Trading – IMF and SDR Replacement

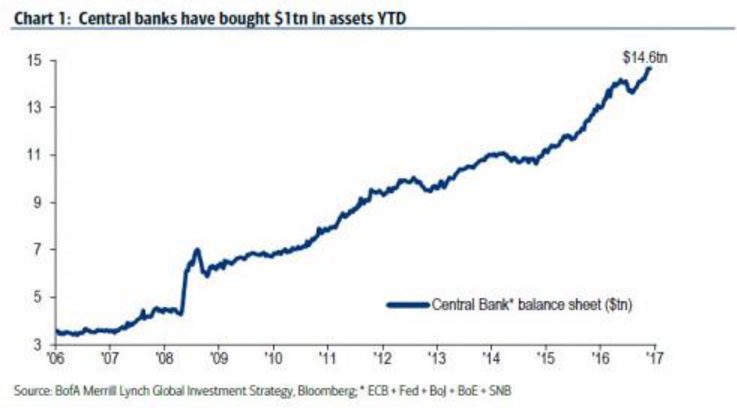

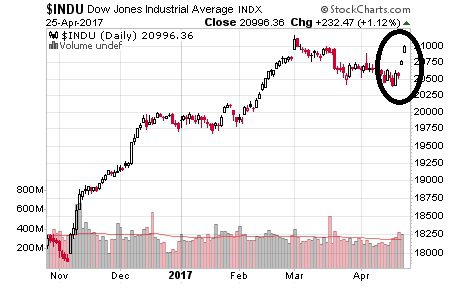

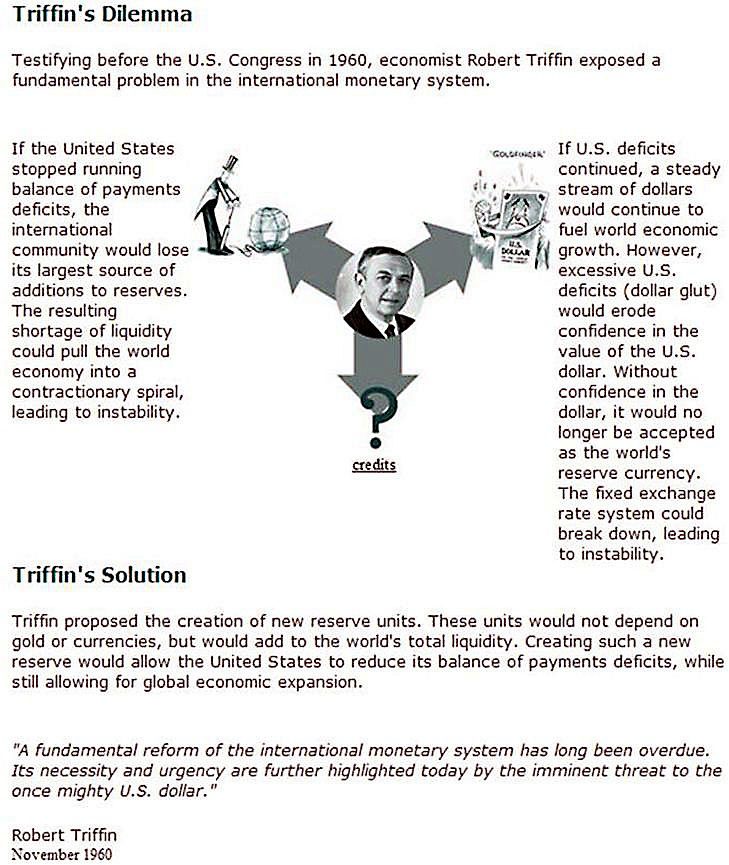

so you probably also know where you will know shortly that we’re above , on the Dow with some of the other indexes making new highs one thing I want to point out here is yesterday moved up two hundred points see the gaps there and they’re so gap up gap up still didn’t hit the all-time high that was created last March but an interesting thing to watch particularly says OOP this is why these are the central bank oops the central bank balance sheets and you can see this nice little jut up right here Thank You Bank of Japan Thank You the ECB and many others okay so that’s on the stock market but what I really want to talk about today is what happened at the World Bank and the IMF meeting last week and it was really interesting i’m going to have bills going to post the link so if you want to watch this whole discussion yourself you can but the problem that they’re facing and the reason why we have to go to the SDR is actually the tripping dilemma where you have one country the u.s. in this case the dollar as the reserve currency so they have to constantly in order to create liquidity in the world since it’s just based on government debt they always have to run deficits but the problem is is they run deficits for so long that confidence in the fiat currency declines that’s where we are that’s why the SDR was created and and go in and get this this image it’s pretty interesting but that’s why the SDR was created back in was exactly for that reason okay so I’m going to read part of it and these are our transcripts but again go listen to the discussion really interesting.

Stock Market News – Insider Trading – IMF and SDR Replacement

The one that I’m mostly going to focus is focus on is Antone jose antonio ocampo who is considered one of the leading scholars on the SDR and there’s not a whole lot that’s been written or researched on it so this man knows what he’s talking about so the advantages of the SDR the reason why they were created to begin with is as a global financial instrument because everybody in the world has some sdrs to provide global liquidity and again that goes back to the fact that everybody has them but then this is the piece that they need to really deal with now can provide conditional liquidity so please bear with me and and I might have gotten a few these aren’t exact transcripts I did it myself but I got it as close I could all right this is a truly global asset okay so it could be used as a way of financing conditional liquidity for that but for that a major reform has to be undertaken so this is what we’re going to be paying attention to when they do this the recommendation is to eliminate the division in the accounts of the IMF between the general resource so that’s that’s the money that all the countries deposit into the IMF and the SDR accounts and those are the quotas that the IMF gives all of the countries now this was part of a very complex complex negotiation leading to the creation of the SDR back in the s and what it implies is that the STRs are a separate account not really used for the creation of additional liquidity in his proposal the countries that hold excess sdrs like the US would be one of those they would deposit them in the IMF and the IMF could then use those sdrs to finance its lending along with all of the deposits of the different countries so you don’t have the need to have quotas or other arrangements to borrow to finance IMF products you can actually use like any decent central bank and this is verbatim oh how to listen to this for a long time to get this verbatim you can actually use like any decent central bank in the world your own creation of liquidity as a sort of financing of the activities of that central bank which is how all central banks in the world operate did you hear what he just said this is something that they create from nothing but then they turn around and use it in exchange for the paper of the masses right because who’s responsible for any debts that any government Roll that’s the taxpayers that’s us so they create this from nothing and that’s what they want you to work for.

okay so they did not announce that the SDR was replacing the dollar in global trade but they did bring up the obstacles to doing so and the solution on how they would do that so perhaps we have a little more time now there was another one there was in gang who is the from the central bank of china and he was on this board as well and he actually said that china World Bank and Standard Chartered Bank are instrumental in creating the infrastructure and the secondary markets in SD ours so they are leading the charge on that they are encouraging even more use of scrs now I went into the website to see who can issue SD are denominated bonds or or loans or anything like that and actually according to the website there are no limitations on who can actually do it so it’s kind of like in China where these corporations that earn Rijn mb issue debt in terms of dollars so and but they have to go out and they have to they earn ran in be so they have to convert those ran in be into dollars in order to pay that debt as long as the dollar is weaker than the rin mb or the same not a problem but when it’s strengthens now you’ve got you’ve got defaults etc so that’s what they’re really talking about doing here is if the global central banks particularly those that are reserve currencies like the dollar and now the yuan and any of those that are currently in that basket they would be kind of the market makers in the SDR so they didn’t announce that this was an official replacement but they are definitely moving it along in their arguments it is worth listening to that to the discussion on it because these are the leaders that are really talking about how they’re going to do it so that’s it for the moment there will be more on this as we move forward I’m going to be watching very closely to see when they lift that division between the sdrs that they’ve given all of these countries and all of the taxpayer funding that they’re different countries have given the IMF that will probably be a trigger for how they will roll this out unless also in their theory which they didn’t really go into in great detail that there is like a time bomb where the SDR comes into play and that goes to crisis which you just saw the vulnerability in the markets so that’s it for today.

Follow us on a follow us on Facebook Like us on Twitter subscribe to us on YouTube and give us a call and you be safe out there bye-bye

Images from video