Mortgage Market Derivatives in Dangerous Territory

Are you ready for the next Derivatives shoe to drop? It doesn’t appear that many are, but this time it is prime mortgages that will deal the next shock, and it is already under way.

On April 28, 2010 Markit Group Ltd., a London based firm owned by banks including Goldman Sachs, Bank of America and JP Morgan Chase, created and introduced four PrimeX indexes. These indexes are similar to those that were tied to sub prime mortgages which enabled easier bets on whether homeowners with bad credit would default or not.

The four PrimeX indexes are each linked to 20 originally AAA rated securities. Two of the indexes are tied to fixed rate mortgages and two to variable rate mortgages. Fitch Ratings has just completed a review of the US prime mortgage backed security sector and the news is not good.

First of all, 12% of all prime borrowers are seriously delinquent on their loans. Fitch believes that the default rate will remain high over the near term as home prices fall further and unemployment levels remain high. According to Fitch, with a further 10% home price decline, roughly half of performing borrowers will be under water.

In addition to the pressure exerted by declining home prices the timeline for the foreclosure and liquidation process has increased significantly and put upward pressure on the severity of the loss to the banks. Fitch expects that any possible recovery will remain under pressure as the market struggles to absorb the increased inventory.

With regard to those variable rate loans, payment reset risk remains a concern. Over half of the performing ARM borrowers have already passed their reset dates but an additional 20% will reset within the next three years. At the moment, with rates being held artificially low, this is not a problem. However, in the future, this could pose a substantial risk. Might this be one of the reasons for the Feds “Operation Twist?â€

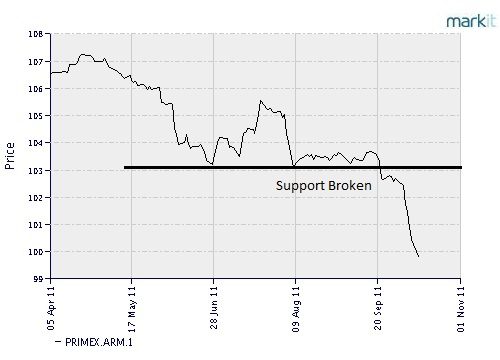

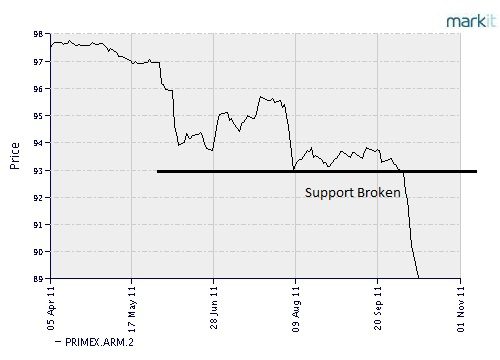

All of these current conditions along with extremely tight bank lending sets up the next wave of defaults and the charts reflect this dynamic. The following 2 charts are on the variable rate derivative contracts and they are pretty nasty looking.

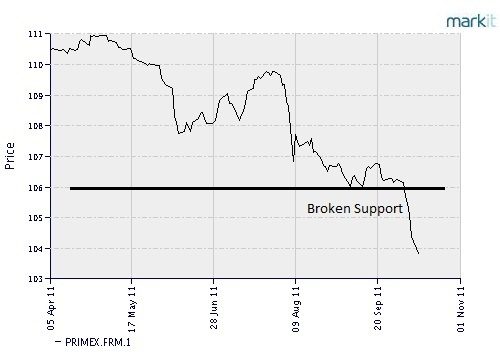

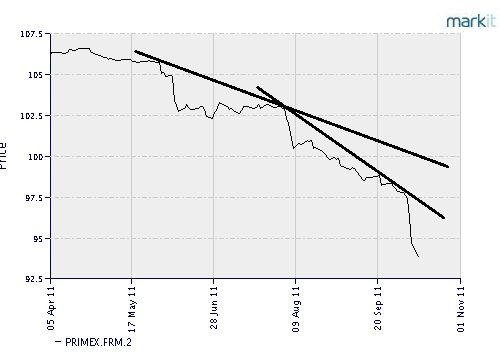

These next 2 charts are on the fixed rate derivative contracts and on one I couldn’t even find a support level!

You might ask why none of this seems to be having an impact on the market right now. I would answer that these derivative products are neither available nor very visible to the general market. But rather they are traded among banks and hedge funds. So my best guess is that we will probably know about this as a shock some time in the future. But since you are now aware and have the links to follow what is happening (below), you won’t be shocked as much. We just don’t know the full impact yet, could be very scary.

Copy and Paste into you Browser:

PrimeX launch article here http://www.bloomberg.com/news/2010-04-28/wall-street-takes-bets-on-pools-of-jumbo-mortgage-bonds-as-trading-starts.html

Follow this link to Markit http://www.markit.com/en/products/data/indices/structured-finance-indices/primex/primex-prices.page?#

Read the Fitch report here http://www.scribd.com/fullscreen/67893616?access_key=key-1k239p7gb1gijsqb4yvh

Very scary things these derivatives.