WHAT IS MONETARY VELOCITY? The Most Important Chart on Inflation By Lynette Zang

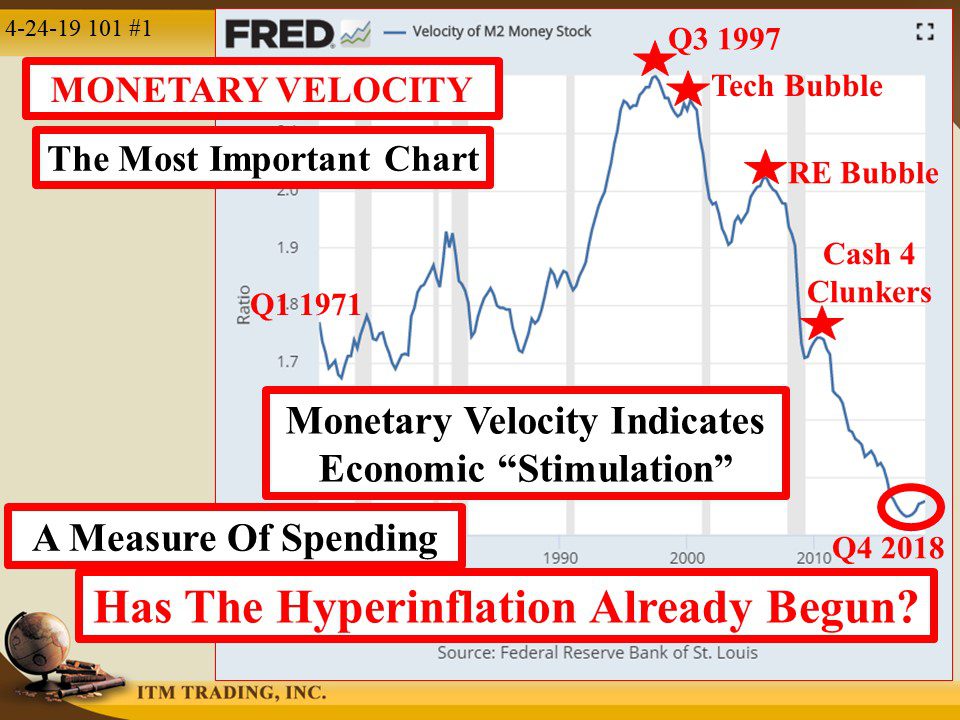

In my opinion, the chart on Monetary Velocity from the Federal Reserve, is the most important chart because it can give us the early warning of hyperinflation.

I say this because it’s really a measure of the speed that money changes hands and how many hands the same money passes through. In this way, it’s a gauge of inflation, because if people believe prices are going up, they’re more likely to buy something today, using debt, to avoid paying higher prices in the future. What is referred to as “pulling spending forwardâ€, means spending today and paying tomorrow. With consumer spending driving almost 70% of US GDP, I’d say the economy needs the consumer to keep on spending!

For this cycle to continue, wages would also have to inflate, so more debt could be accumulated. Then corporations could justify price increases. As we know, the average wage NEVER keeps pace with inflating prices and this is why corporate profits and CEO compensation are at all-time highs, while 63% of the population can’t come up with $500 in an emergency or have $10,000 saved for retirement, after working their entire lives.

In addition, since the current fiat system is debt based, it’s also a good indicator of the ability of debt to “stimulate†the economy and create the desired inflation that is then passed off as “growthâ€, which means price inflation… then wage inflation and on and on.

But what monetary velocity tells us about debt is that compounding interest now consumes most income, thereby hindering faster spending. Perhaps people are concerned about the future? But with 70% of the economy dependent on consumers, the big question is how can central bankers get people to spend?

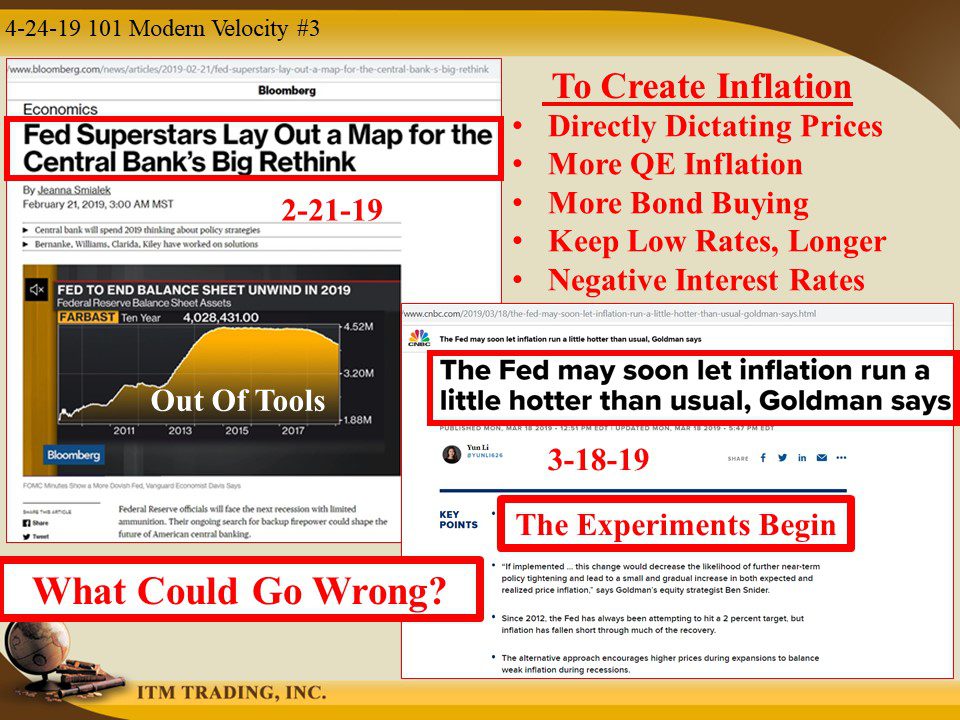

Since the current tools are not giving them the desired velocity results, it’s time to unleash some more of the same (QE Money Inflation, Bond Buying, Low Rates) and some NEW EXPERIMENTS (Price Targeting, Negative Rates). If central bankers don’t make another misstep, like they almost did with QT (slowing the money spigots), will the real economy actually take off “like a rocket ship,†as President Trump has promised? Will the central bankers be able to “control†the rate and speed of inflation, as they have since 1913?

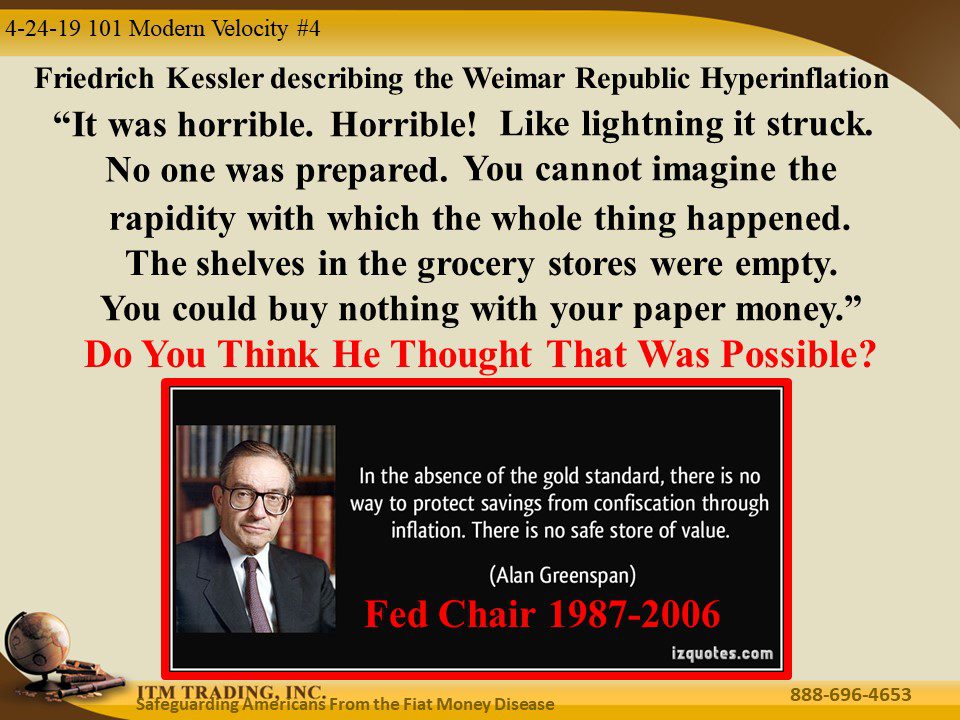

What happens when the next crisis becomes apparent, or inflation causes enough pain for the public to rebel? What happens if central bankers make a deadly mistake (think the Lehman Shock) and lose control? What tools do they have? Hyperinflation, the final tool, when inflation goes into hyper-drive.

Gold and silver are the shields to protect your wealth from burning up. “In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.†Alan Greenspan, Fed Chair from 1987 through 2006.

Slides and Links:

https://fred.stlouisfed.org/series/M2

https://fred.stlouisfed.org/series/M2V

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://www.cnbc.com/2015/08/18/st-louis-fed-official-no-evidence-qe-boosted-economy.html

https://www.cnbc.com/2015/08/18/st-louis-fed-official-no-evidence-qe-boosted-economy.html

YouTube Short Description:

In my opinion, the chart on Monetary Velocity from the Federal Reserve, is the most important chart because it can give us the early warning of hyperinflation.

I say this because it’s really a measure of the speed that money changes hands and how many hands the same money passes through. In this way, it’s a gauge of inflation, because if people believe prices are going up, they’re more likely to buy it today, using debt, to avoid paying higher prices in the future.

Gold and silver are the shields to protect your wealth from burning up. “In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.†Alan Greenspan, Fed Chair from 1987 through 2006.