MODERN MONEY THEORY: Is This the Next Step? By Lynette Zang

The recent about face by global central banks shows the world that they have used up the experimental tools created during the 2007 financial crisis. In addition, they’ve made it clear, the free money punch bowl will NOT be taken away and they will not be raising interest rates. In fact, not only will central bank balance sheets not be reduced, but central banks are prepared to provide banks all the free money they may need in the future. This news has provided stock markets push higher into overvaluation territory, as the flood of Unicorn IPOs take advantage of this last hurrah to cash out and transfer risk.

Everyone knows the next financial crisis is near, so what are Central Banks likely to do then? I think they will likely employ Modern Money Theory (MMT) because frankly, current policy is already doing most of what MMT proposes, so the shift will not be radical.

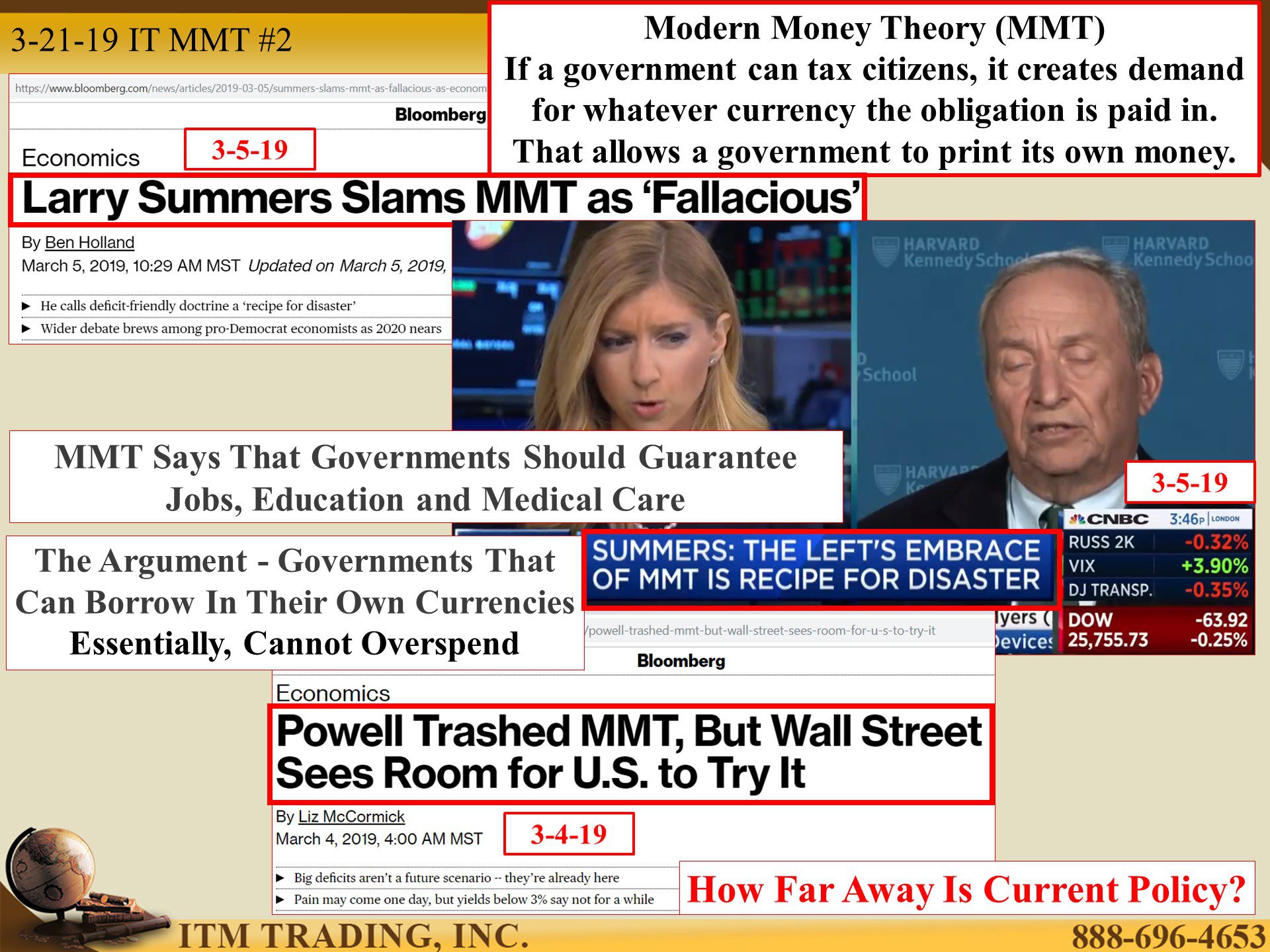

What are the similarities and differences between current policy and MMT? Not much. MMT says that if a government can tax citizens, it created demand for whatever currency the obligation is paid in and that allows a government to print its own money. That’s the foundation for the fiat money experiment, so that’s not different.

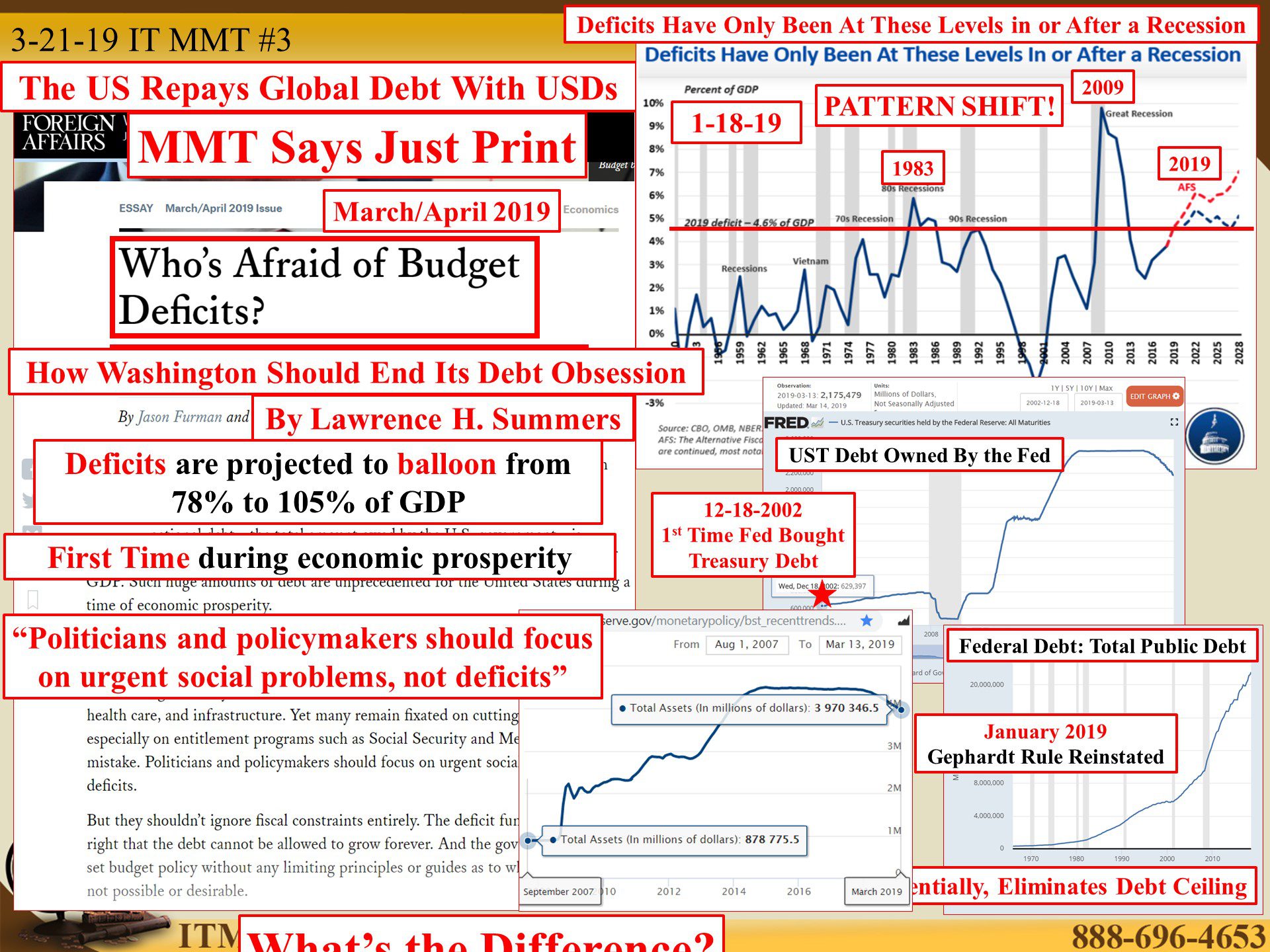

MMT also says that governments should guarantee education (Federally guaranteed student loans), Medical Care (Medicare/Obamacare) and jobs, the difference here is employment vs unemployment, either way there is a guaranteed income. MMTs argument is that governments, such as the USD, that can borrow in their own currencies cannot overspend because they can create the money to repay the debt. The bulging debt levels and balance sheets of governments show this is the same. But MMT also believes that the money can be easily created at will so taxation and debt isn’t necessary. That seems to be the biggest difference that I see.

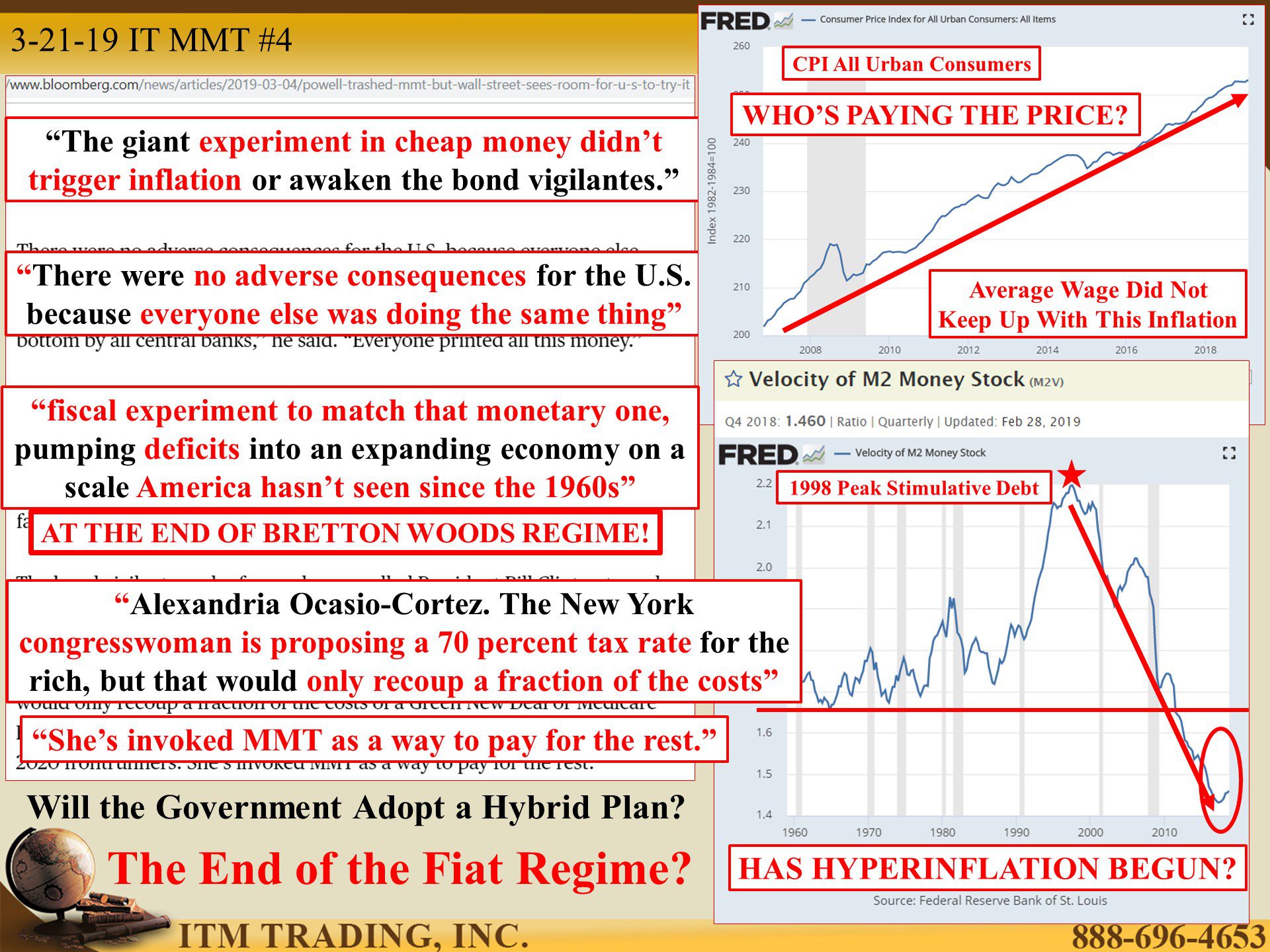

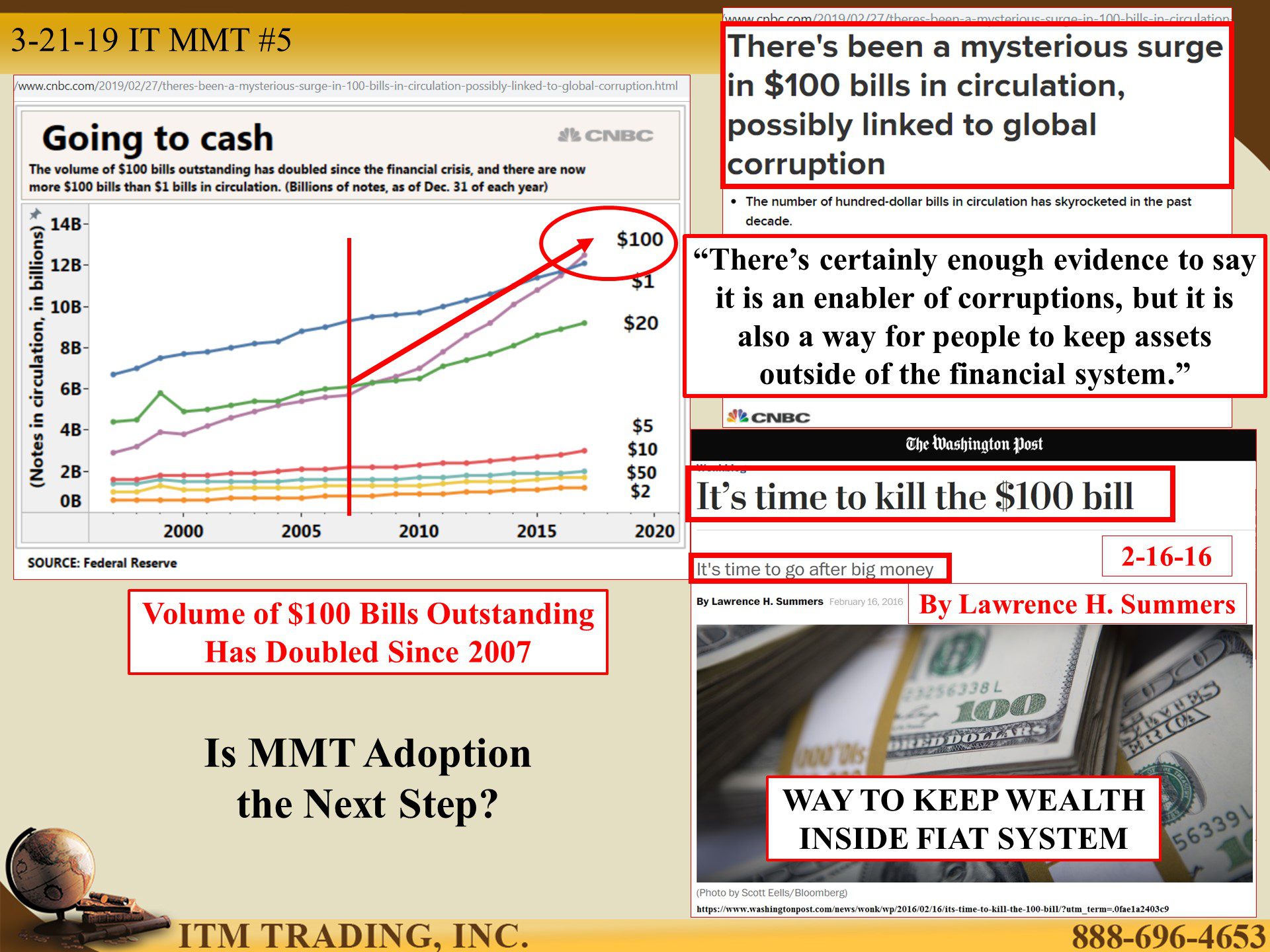

What I find interesting is who is bashing MMT, while at the same time, promoting it. Larry Summers, former treasury secretary, for one, says that MMT is a “recipe for disaster†that could send us into hyperinflation, though he thought allowing deposit and risk-taking banks to merge was good idea. He also was part of the team supported bank deregulation and blocked oversight of OTC derivatives, which was a big part of the set-up to the last financial crisis.

While he blasts MMT, in the March/April 2019 issue of Foreign Affairs, he ask’s “Who’s Afraid of Budget Deficits?†stating that “Politicians and policymakers should focus on urgent social problems, not deficitsâ€, which always seems to be the justification but somehow almost always seems to be postponed.

Rather, the trillions in new money created since the last crisis benefited the elites, as the income inequality gave rise to populism.

Populist politicians see a way to promise the public a free lunch, with some promoting a hybrid system of higher taxes AND just money printing. Sounds good in theory, but we all know there is really no such thing as a free lunch. What will most likely be the cost to all this money printing? Hyperinflation. Why? Because when something is abundant, free and requires no effort, it has no value.

What effort does pushing a button on a computer take? No effort and one can create as much as they want. What effort does it take to mine gold and silver? Lots, and it’s in limited supply. When hyperinflation rears it’s ugly head, and I am 100% certain it will, what do you want to be holding?

Slides and Links:

https://en.wikipedia.org/wiki/Lawrence_Summers

https://www.foreignaffairs.com/articles/2019-01-27/whos-afraid-budget-deficits

https://fred.stlouisfed.org/series/M2V

https://fred.stlouisfed.org/series/CPIAUCSL

https://www.reuters.com/article/us-venezuela-gold-exclusive-idUSKCN1QG2QG

https://www.reuters.com/article/us-venezuela-gold-exclusive-idUSKCN1QG2QG

https://www.federalreserve.gov/faqs/currency_12771.htm

YouTube Short Description:

The recent about face by global central banks shows the world that they have used up the experimental tools created during the 2007 financial crisis. In addition, they’ve made it clear, the free money punch bowl will NOT be taken away and they will not be raising interest rates. In fact, not only will central bank balance sheets not be reduced, but central banks are prepared to provide banks all the free money they may need in the future. This news has provided stock markets push higher into overvaluation territory, as the flood of Unicorn IPOs take advantage of this last hurrah to cash out and transfer risk.

Everyone knows the next financial crisis is near, so what are Central Banks likely to do then? I think they will likely employ Modern Money Theory (MMT) because frankly, current policy is already doing most of what MMT proposes, so the shift will not be radical.