Meet the SDR, “The†New World Reserve Money

By Lynette Zang

Chief Market Analyst, ITM Trading, Inc.

How the SDR Got Started

At the Bretton Woods Accord in 1944, the US was granted the sole privilege of “The†World Reserve Currency (WRC), overseen by the newly created independent International Monetary Fund (IMF). Since then, global assets have been priced and paid for in US dollars, which we could print as needed. Everyone else had to buy dollars to pay international debts. In return, the US legally agreed to hold the dollars purchasing power value at $35 to one ounce of monetary gold.

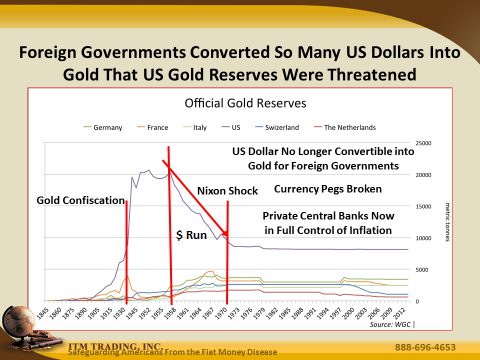

By the 1960’s it was becoming clear that the US was funding the Vietnam War with excessive money printing, breaking the agreement and causing global inflation. Consequently, foreign governments began a run on the US Dollar.

In 1965 French President Charles De Gaulle defied the US dollar standard, calling for the return to “An indisputable monetary base, one that does not bear the mark of any particular country…gold.†https://www.youtube.com/watch?v=i-g2iGskFPE It was clear that the world was on the verge of a global financial crisis.

This led to the birth of the IMFs money, the Special Drawing Rights (SDR) in 1969. According to the IMF, SDR’s are neither a currency nor a claim on the IMF. They are potentially, a claim on the fiat currencies in the SDR basket. Originally created and pegged to a fixed amount of gold, its primary function was to replace the US Dollar as “The†WRC and provide global liquidity during the upcoming crisis.

In August 1971, to stop the loss of gold holdings, then President Richard Nixon defaulted on Bretton Woods, when he eliminated foreign governments’ ability to convert US dollars into US gold. We were now on a pure fiat dollar system.

If you were alive in 1971, like I was, you just lived through a global monetary “Reset†as gold was revalued in US dollars from $35 to $42.22, almost a 21% overnight devaluation. Without gold to anchor purchasing power value, central bankers now had full control over the rate of inflation and a new monetary system was being created.

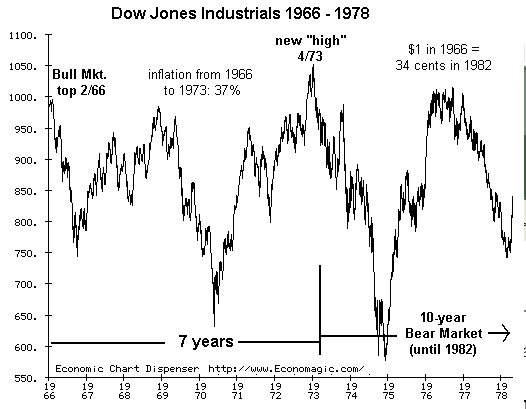

Did you know? What might have distracted you? The Vietnam War and protests, the oil embargo and long gas lines, the 37% inflation rate or the roller coaster ride of the stock market. Multiple crises are typical when a monetary system resets but what you were really experiencing was wealth transfer as the current monetary regime morphed into a new monetary system.

Even though Nixon had stopped the loss of more gold, he did not stop the run on the dollar as spot gold went from the official price of $42.22 to the market price of $825 per ounce.

“In 1972, at the IMF Annual Meetings, then U.S. Treasury Secretary George Shultz offered the international community a bold plan to reform the international monetary system and end the special role of the dollar as a reserve currency.†http://www.ousmenemandeng.com/comments/Historic-perspectives-on-SDR.pdf At that time, 70% of all official reserves other than gold was held in dollars, so the world needed a way to control the shift out of dollars.

He was handing WRC status to the SDR and global financial control to the IMF whose members are unelected, independent and unaccountable. They had a plan.

According to the IMF “An allocation of SDR’s by the IMF provides each recipient (a participating member country) with an unconditional and costless line of creditâ€. Think of it like an overdraft account. https://www.imf.org/external/pubs/ft/history/2001/ch18.pdf If the world refused to use the dollar in global transactions, member countries had easy access to convert dollars into SDR’s through the substitution fund and therefore, access to any of the currencies in the currency basket. In this way they could continue to pay their bills.

The IMF’s “SDR Substitution Fund†was completed in 1979. Holders of dollar denominated financial instruments, (bonds, currency, loans etc.) would simply deposit them into the Substitution Fund and they would be converted into SDR denominated financial instruments. Though now that gold no longer backed the dollar, the IMF also removed the SDR’s peg to gold and from here forward, the SDR became a currency basket. Though he was referring to gold at the time, De Gaulle had called for a reserve currency “that does not bear the mark of any particular country.†Initially, there were 16 currencies in the SDR basket. SDR’s are allocated (given) to IMF members.

Global liquidity systems were now in place, it was up to the US to convince the world to agree to a US dollar standard backed by “the full faith and credit of the US governmentâ€.

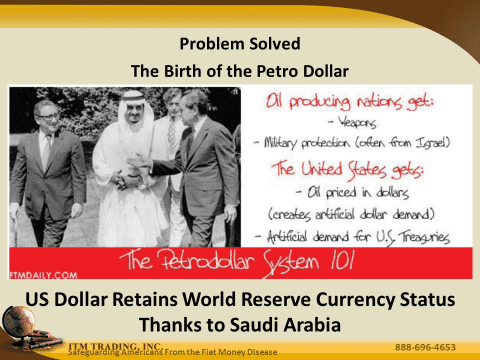

The Petro Dollar

That same year, “The U.S.-Saudi Arabian Joint Commission on Economic Cooperation†was signed. Globally, this is known as the “Petro Dollarâ€. http://www.gao.gov/products/ID-79-7 . Renewed every five years, this agreement established the continued support of the US dollar standard, because if you were buying Arabian oil, you had to do so with US dollars.

So the US dollar sustained “The†reserve currency status and the global economy’s foundation was now based upon the growth of debt and inflation.

In 1981 the basket was reduced to the top 5 global economic currencies; US dollar, German Mark, French Franc, British Pound and the Japanese Yen. There were no further changes to the composition of the SDR Basket other than converting the French Franc and German Mark into the Euro Dollar in 2001.

With all systems of change in place, the SDR slumbered, not needed at that time, but ready when opportunity and need arises.

Fast forward to 2009, at the depth of the current global financial crisis.

Why Now?

Central bankers, having already depleted traditional inflationary tools, turn to untested experiments to buy time as they put the finishing touches on the upcoming monetary standard shift.

There is no choice, just like 1971, the current system no longer works. Global geopolitical tensions threaten to escalate into WWIII and all markets must be “managed†to avert a major correction. And just like 1971, we are now experiencing a global financial monetary standard shift, from a US dollar standard, based on debt, to an SDR standard, based on nothing. The SDR is created out of thin air and is not a claim against the IMF. I ask you this, how can something that requires no effort to create, can be created in unlimited amounts and attaches no claim, have value?

The SDR system, was tested that same year. “2009 SDR allocations totaling SDR 182.6 billion played a critical role in providing liquidity to the global economic system and supplementing member countries’ official reserves amid the global financial crisis.†It was a successful test.

China’s Role

China is front running this shift, calling for the reform of the international monetary system. “The SDR has the features and potential to act as a super-sovereign reserve currency,†wrote Zhou. In addition, China wanted inclusion in the SDR basket.

From the 2011 IMF Template, “SDR’s are especially valuable at times of systemic crisis, as they give confidence to the market that the member can access foreign exchange funding without liquidating assets in financial markets that may be impaired or would be subjected to added stress from simultaneous action by several central banks.†With that backstop in place, the next step was to get commercial banks involved and create a market.

Early 2016, China opened their interbank market to foreign investors for the first time. China’s interbank market is the second largest in the world, next to the US. China has embraced the task of creating this new M-SDR market because they can mandate State owned enterprises support this new market until it takes off on its own. Significantly, commercial banks can issue SDR bonds and loans, so things are now in place to create an M-SDR market.

The first M-SDR denominated bond was issued exclusively by China in August 2016. On October 1st, the Chinese Yuan entered the SDR currency basket. Done and done.

While this is a global shift, it will be those of us in US dollars that will feel the change the most, because not only will future dollar demand dry up, but any excess dollars no longer in demand, will flow back to our shores. Move over king dollar, the SDR is ready to reset global debt and restructure the global financial system.

Did you know you can buy gold and silver online? Visit Our Store Here

We are dealing with the biggest credit bubble in history, what is most likely to serve you the best is real money, physical gold in your possession and out of the resetting system.

1965 Charles DeGaul Monetary Crisis speech. https://www.youtube.com/watch?v=i-g2iGskFPE

http://www.federalreserve.gov/bankinforeg/resolution-plans/bk-of-china-3g-20131231.pdf

http://www.worldbank.org/financialcrisis/pdf/levrage-ratio-web.pdf

Petro Dollar Agreement http://www.gao.gov/products/ID-79-7

Meet the SDR, “The†New World Reserve Money