Market Update November 11, 2013

From the Desk of Craig Griffin

The piece below is from Richard Russell’s, Daily Remarks section and I thought it was a good read with some valuable information. Check it out and remember, “It would be foolish to acquire gold for the short term but it would also be unwise not to own some gold for the long term!”

Richard Russell November 7, 2013

“It is incumbent on every generation to pay its own debts as it goes. A principle which if acted on would save one-half the wars of the world.” — Thomas Jefferson

The following excerpt is from our friends at Peak Prosperity, www.peakprosperity.com. The first part of this article was posted October 31, 2013.

Part II: The Near Future May See One of the Biggest Wealth Transfers in Human History Which side will you be on?

The (Delusional) Plan: Growth Will Cover Past & Future Debts

Currently, the U.S. debt-to-GDP ratio stands at around 350% in 2013. This is an historically elevated number, so much so that we really don’t have anything in our economic history books to tell us what comes next. Robust economic growth, we suppose, that can reduce that imbalance painlessly.

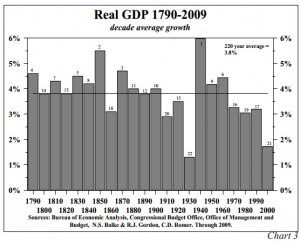

But looking at the past 220 years of history, we find that the average yearly growth in U.S. GDP has been 3.8%:

Now, I have some quibbles with the idea that the U.S. will be able to sustain that long-run average of 3.8% over the next 30 years, because debt levels are already crushing growth, as are high oil prices (double whammy!). But let’s spot the Fed every advantage here.

If U.S. GDP grows at 3.8% annually, but credit grows at 8%, this means the nation’s debt-to-GDP ratio would balloon to 1,130% by 2043. That’s equivalent to someone with a $50,000 salary carrying $573,000 on their credit card.

Again, this just seems to be so completely unworkable that I’m pretty certain it’s not going to happen.

The alternative of growing credit at roughly the same rate as GDP, ~4% vs. 3.8%, means that not much really changes in regards to debt-to-GDP ratios, but they remain elevated at over 350%.

Of course, the difficulty in this story is that over the past thirty years, GDP has grown at only an average of 2.6%. The most recent decade was the second worst in 220 years of U.S. economic record-keeping, clocking in at an anemic 1.7%.

If we use the past thirty years of GDP growth (2.6%) as our guide, then the numbers just get a lot worse. Instead of 1,130% debt-to-GDP under the 8% credit growth future, we come up with a 1,600% debt-to-GDP figure.

Even under the 4% credit growth scenario, the ratio mushrooms from 350% to 515% debt-to-GDP.

What I take from this is the idea that GDP growth is very, very unlikely to support the rate of credit growth that the Fed wants to recreate.

If the Fed cannot do this, if credit is destined to grow far more slowly, or even – gasp! – go backwards again, like in 2008-2009, then what’s likely to happen?

2008 All Over Again (Only Worse)

If you understand our monetary system, you know that by its very design, it must grow. If it’s growing – and exponentially, at that – then it’s relatively happy. When it stops growing or even goes into reverse, then the wheels come off and it literally threatens collapse.

That happens to be the system that we’ve all inherited. I’m sure it made a lot of sense when the world had a billion or fewer people on it and the horizons were seemingly limitless, but now it’s just a vast liability. And yet the central banks and politicians cannot imagine any other system and would probably have a very hard time even understanding the argument I am making here.

Not because the ideas themselves are terribly difficult (they are actually quite simple), but because they run so counter to their entrenched belief systems that they’d most likely reject them before they even got close enough to cause mild discomfort.

So, what happens when a system that must grow in order to survive cannot grow any longer? Well, we’re living through the early stages of that transformation. So far, so ugly.

Nothing works quite right anymore, monetary policy has no traction, new policies from the political class seem to do more harm than good, and weaker member states and poorer citizens are slowly slipping further away from the “good life.”

My expectation is for central banks to just keep trying and then trying harder, doing the same things that are not working currently. And they will not discuss any concerns that perhaps there’s something wrong with their approaches or acknowledge any mistakes they made to help get us into this predicament.

The era of easy money is shaping up to keep going into 2014.

The Bank of Canada’s dropping of language about the need for future interest-rate increases and today’s decisions by central banks in Norway, Sweden and the Philippines to leave their rates on hold unite them with counterparts in reinforcing rather than retracting loose monetary policy.

The Federal Reserve delayed a pullback in asset purchases, while emerging markets from Hungary to Chile cut borrowing costs in the past two months.

“We are at the cusp of another round of global monetary easing,†said Joachim Fels, co-chief global economist at Morgan Stanley in London.

Policy makers are reacting to another cooling of global growth, led this time by weakening in developing nations while inflation and job growth remain stagnant in much of the industrial world.

The risk is that continued stimulus will inflate asset bubbles central bankers will have to deal with later. Already, talk of unsustainable home-price increases is spreading from Germany to New Zealand, while the MSCI World Index of developed-world stock markets is near its highest level since 2007.

“We are undoubtedly seeing these central bankers go wild,†said Richard Gilhooly, an interest-rate strategist at TD Securities Inc. in New York. They “are just pumping liquidity hand over fist and promising to keep rates down. It’s not normal.â€

No, this is definitely not normal. It’s quite unusual, and the risks are extraordinary. And yet the world’s central banks are all locked into the game, not because they all privately think this is a good idea, but because the monetary system they manage demands it of them.

The basic problem is that growth is not coming back and yet claims on the growth, in the form of tertiary wealth such as currency, stocks, and bonds are skyrocketing.

If the claims on real wealth are growing like crazy, but real wealth is not, then someday – and nobody knows when – there will be a great rebalancing to bring all of those excess claims back in line with reality.

This is also known as a “wealth transfer,” and they’ve been conducted numerous times throughout history. This time is a bit different because the world’s major central banks have teamed up to assure that there’s nowhere to hide – no relative safe haven to escape to – but otherwise the dynamic will be exactly the same as before.

A relatively few people will have most of the wealth transferred to them, and the vast majority will lose. This will be experienced as a period of rapidly rising prices, but the true explanation will be rapidly falling values for tertiary wealth, as all those claims get adjusted to actual amount of real wealth available for purchase.

Those holding real wealth will discover themselves to suddenly have all the wealth, while those holding the paper claims will discover they have lots of bits of paper (or the electronic equivalent).

The most surprising thing to me at this juncture is just how despised gold is, given the obvious inflation of paper claims that have now bled into every financial market, including the art market.

There are some very curious things going on right now, and this has to do with the international art market.

For people who follow the various auctions at Sotheby’s or Christie’s, the amount of money they are getting at these auctions for fine art is unimaginable. We are seeing astonishing 100% gains in just 6-to-8-months, in many cases, for fine art. These art pieces are flying out of the auction houses at stratospheric prices.

So, people don’t understand, and they wonder to themselves, ‘What is happening here? Is this because people are making such incredible amounts of money?’ Here is the answer: We are seeing money coming in from Russia, China, as well as other nations, but the reality here is that these people want to hold tangible assets.

Remember, this is the ‘smart money.’ They know what is coming and they want to acquire things that will hold their value. Nobody is making genuine Monet’s anymore so it is a very elite and limited market. The reality here is that governments can’t manipulate prices of fine art like they do with prices of assets which compete as currency for the masses such as gold and silver.

So we are seeing incredible inflation in fine art and luxury goods. But this is very telling because it’s going to move down the food chain, into other key markets such as gold and silver, and it is also the type of thing you see before a massive inflation begins.â€

Yes, all that central bank liquidity is sloshing around, driving up the prices of all sorts of things besides stocks and bonds, including real estate and fine art. How long before that spreads to other basic commodities?

Conclusion

The Fed is desperately trying to recreate the credit growth of the past 30 years, but it will not be able to do this unless the dollar loses a lot of value. The reason they want to do this has nothing to do with what’s best for you or me or even the nation. It has to do with the demands of a debt-based fiat money system that simply has to continue growing exponentially in order to survive.

So the Fed works tirelessly to debase the dollar and boost borrowing, because that’s what the banking system needs in order to survive.

Unfortunately the jig is about up. The globe can no longer muster the sort of growth required to sustain high rates of borrowing and support the repayment of prior loans. One prime reason is that high-net-energy oil is slipping into the distance and it is being replaced with low-net-energy oil.

We experience that as high oil prices, but the reality lurking underneath is that there is simply less net energy available for society to do all the various things it would like to do with it, including rack up enormous piles of fresh, new debt.

In short, there’s a collision coming between what our monetary system demands and what the world can provide.

There are plenty of ways to begin adjusting ourselves to the new reality, but the central banks and their respective political classes have zero interest in going down that route. For a variety of reasons, they’d much prefer the good old days of increasing the total amount of borrowing by 8%, even as underlying GDP is only growing at 2.6%.

And of course they do. Living beyond your means is quite a lot of fun – and addictive, too.But it’s not a workable long-term plan.

All I can tell you is that when the wealth transfer begins in earnest, it will be nasty, brutish, and short. Most will be unable to get out of the way in time to avoid being one of the scalped masses.

I truly pity those responsible for managing pension funds and the like, who are fiduciarily restricted from buying hard assets, because they really have no way out. Someday they will have to look their poor beneficiaries in the eye and say, Sorry about that; there’s nothing left here for you.

So we’ll see more money printing, more pumping, more distorted markets, more bizarre gold-price slams, as the central banks desperately try to maintain the illusion that theirs is the best game in town. But it’s all for naught.

The past 30 years were abnormal, and efforts to recreate them now are distorted and becoming grotesque.

So do what you can to increase your resilience. Accumulate gold and silver and other tangible and useful items, and learn the skills and daily practices that will bring you joy today and quite probably extraordinary relief in the future.

I admit, it’s frustrating to watch policy makers try everything but the right things, but that’s just how these things tend to go, I guess. So let’s keep an eye on them, but work to increase our own fulfillment and joy – because, after all, what else is there besides today and this moment in time?

~ Chris Martenson

………………………………….

Richard’s Remarks

Yesterday ended with the Dow at a new record high, thereby confirming the new high in the transports. I continue to think that this bull market will end in an upside explosion. I believe it is fated to go higher than anybody now believes. A wise move here might be buy the farthest out calls as possible on the thesis that the sellers are convinced they will never be hit. Wise heads are now warning that this market has now passed all sane appraisals, and as such it is highly dangerous. Nevertheless I believe that this market is fated to go higher than even the most bullish practitioners can conceive.

I note that talk about debt has simmered down. The US debt is so huge that reasonable talk about it is almost impossible. I believe in the end the US will turn to hyperinflation in its effort to minimize the debt. The debt is now so huge that I believe there are only two possible outcomes: default or hyperinflation. With the advent of hyperinflation, gold will come into its own. In the end, those who have been patient enough to hold bullion will be rewarded. Ultimately, a new monetary system will come into being, and its core will be built around gold. I think it may be three to five years before this country moves into hyperinflation, but the only alternative is default.