Market Patterns

YouTube Video Transcription

Hi guys Lynette Zang chief market analyst here at ITM Trading a full-service physical precious metals brokerage house.

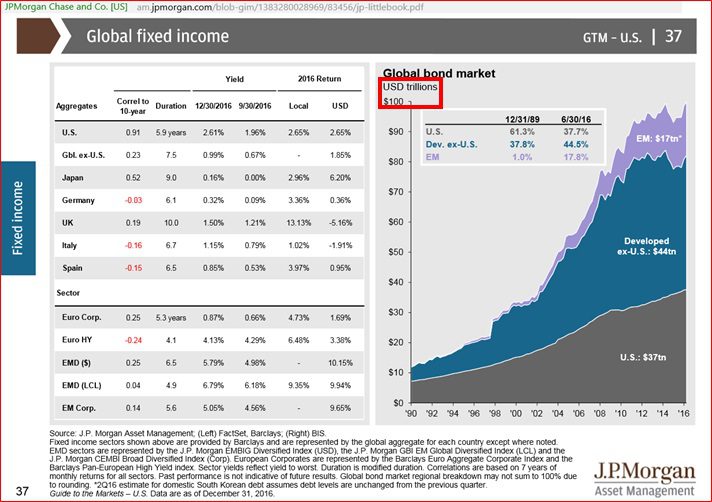

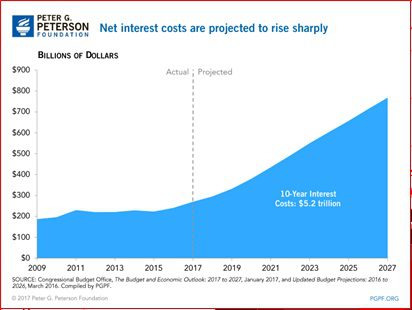

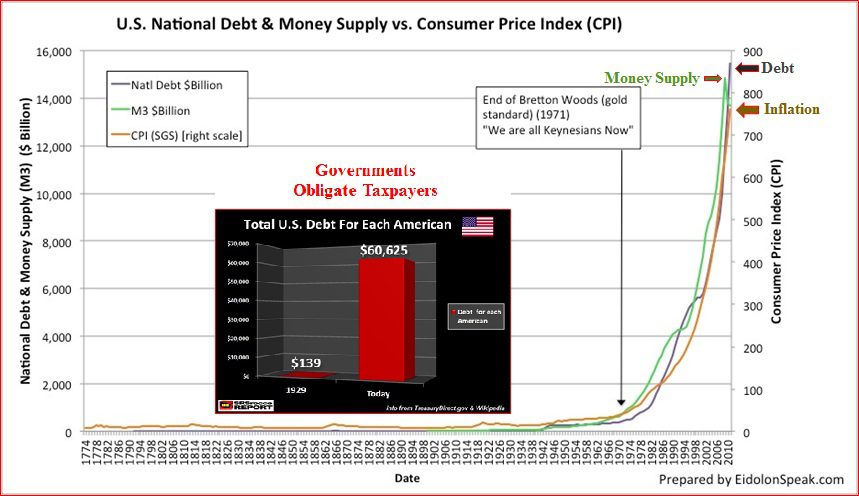

We’re going to be talking a lot more about bonds in the days to come particularly with the rate increase and we do know because we’ve been looking at it that are too big biggest foreign creditors especially in have been selling off US Treasury bonds so really what I want to talk about today is pattern because when a pattern shift it matters even if you don’t know why it matters so let me show you ok this goes always better to ok and you can see what we’re on the gold standard purchasing power letting supply inflation were pretty much flat line but this is when really right here is with the shift occurred and you can see it looks like a hockey stick the reason why that matters is because that’s how money is created in our system but looking at long-term chart you can see that pattern shift okay well let’s look at today now this goes back to look you want to go back to the s right so it picks up from there but can you see right here where I have long-term capital management ltcm that was the first derivative explosion and you can see that pattern shift that indicated that they were failing something out and then look at this speed that the debt increase in other words increasing the money supply to inflate the currency of pull us out of a problem now look at this this is when the crisis-hit can you see how that patterns and shifted as well and got a whole lot more choppy so what I’m trying to show you here is that every time there is a pattern shift that means that something is going on in these markets and you could see it clearly from a distance so the pattern shift that we’re going to be talking more about as time goes on it’s really what’s happening with interest rates and there are a number of reasons why that matters and we’ll talk about that and you go on but what I really want to show you a little bit more is this the right side no upside down sorry is the interest rate pattern shift now this is the two-year this is a year and this is the -year treasury bond and i like using to see I don’t know if you can see this but go to the jpegs will be underneath there that the current two-year rate as of today is as high as been back in add the crisis was unfolding we see that actually since mid- interest rates have clearly been rising with this could be a signal to a shift in those interest rates plus we have the said that is most likely going to raise I’m March that’s a trigger date that we wanted to pay attention to but this is really one of the reasons why arrays and interest rate for an increase in interest rates matters to you and that’s because of the carrying costs on this mountain of deck all the carrying costs on that ok so there is default sovereign bond defaults etc etc but this is one of the big problems coming up with it now increasing debt doesn’t really matter as long as you have the income to service that debt we all know that from an individual level but this is the monetary velocity which actually indicates whether or not an economy is being sued related this little insert chart here is from the Federal Reserve comparing the monetary velocity today to the monetary velocity during the Depression and this goes to and that’s why i put those red arrows in there so it should be pretty clear that the monetary velocity or the speed at which money changes hands and indicate whether or not an economy is being stimulated you could see that does not look like it stimulated you can also see that this is true on a global level which is what does that graph indicates so can you see this problem we’ve got mountains of debt rising interest rates we cannot and we’ve got declining income to pay it it’s a bit of a problem ok so we’re going to talk more about this in the future but the other thing I wanted to talk about is what is happening in the silver and gold spot market this was the silver dump that occurred last night and I don’t know if you can read everything that i have on there with each contract until control five thousand ounces and the contracts worst-case scenario if you’re like a change their well far or Goldman Sachs one of those does it cost you a dollar for each contract is not very expensive to do a complete dump the same thing is happening or similar thing is happening in the gold market this morning so the things that I want to point out to you and how you know it’s an indication of manipulation besides all of this happening and light trading and where they can’t reach it down so well is again the supply and you can see the deficits as the dumb man ok it’s all about patterns is all about logic is you get those two little pieces nobody’s going to be able to pull the wool over your eyes so that’s it for today like us on Facebook subscribe to us on YouTube follow us on Twitter

Be safe out there bye-bye

Images