MARKET MELT UP ACCELERATES: Dangers of the Rising Stock Market …by Lynette Zang

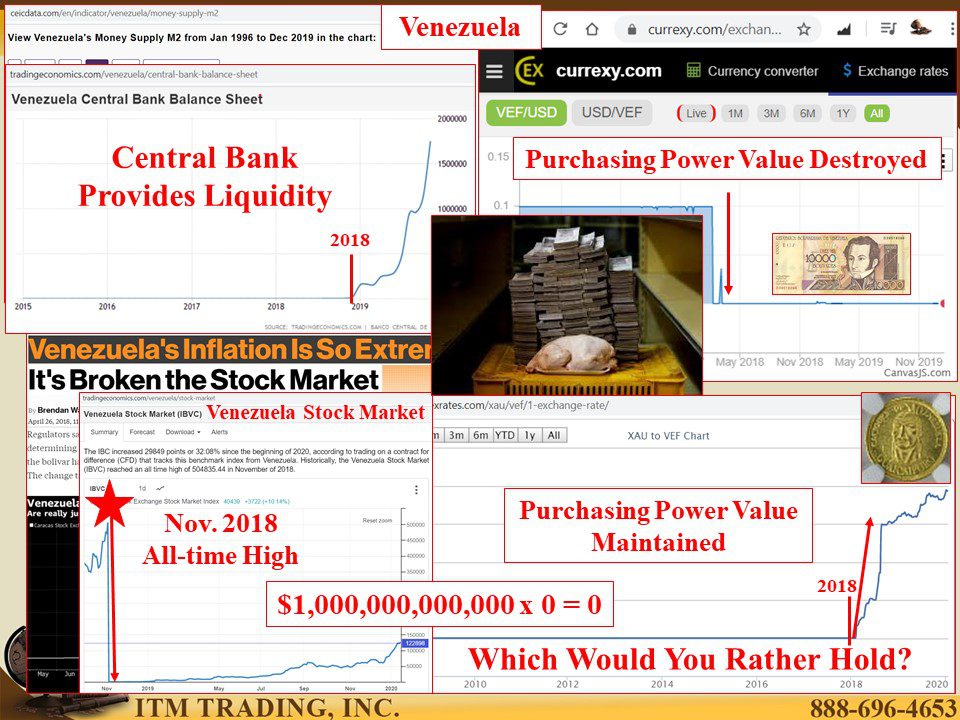

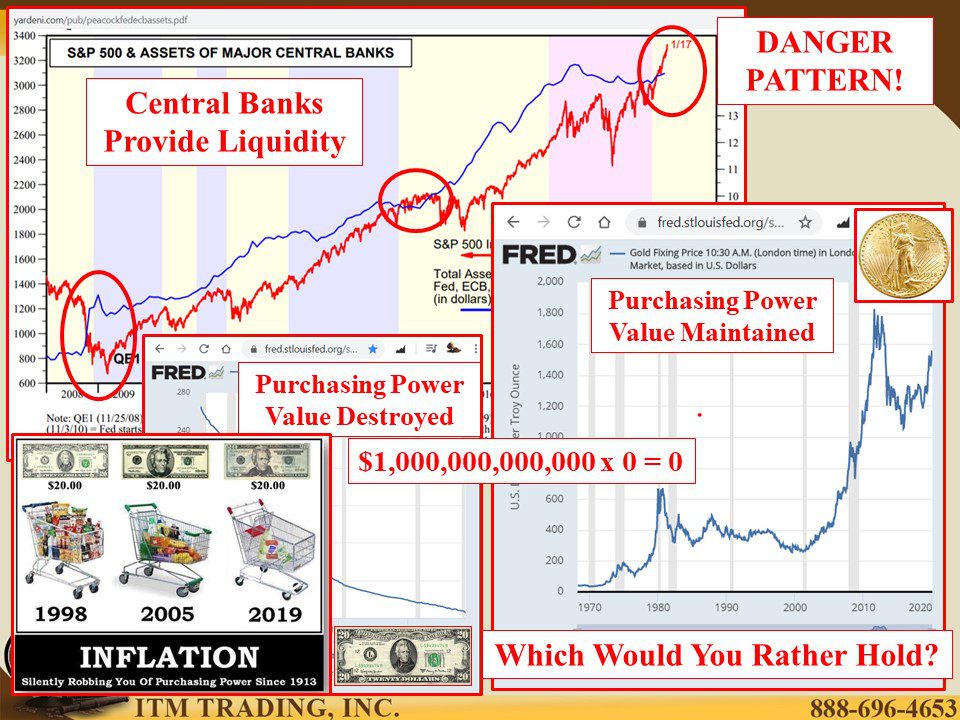

After the liquidity shock that hit the repo market in September, global stock markets ended 2019 near all-time highs and surged into 2020 buoyed by central bank new money. What’s the problem? After all, isn’t a rising stock market a good thing?

After all, we’ve been taught that a rising market is an indication of a growing economy. Now we’re being told that the US economy is growing strongly relative to other economies and that the US dollar is a lot stronger at 97.4 (at today’s writing) than it was when it hit the all-time low of 71.33 on 4-22-08. Of course, that’s relative to a basket of other fiat (government legalized) currencies.

Have more questions that need to get answered? Call: 844-495-6042

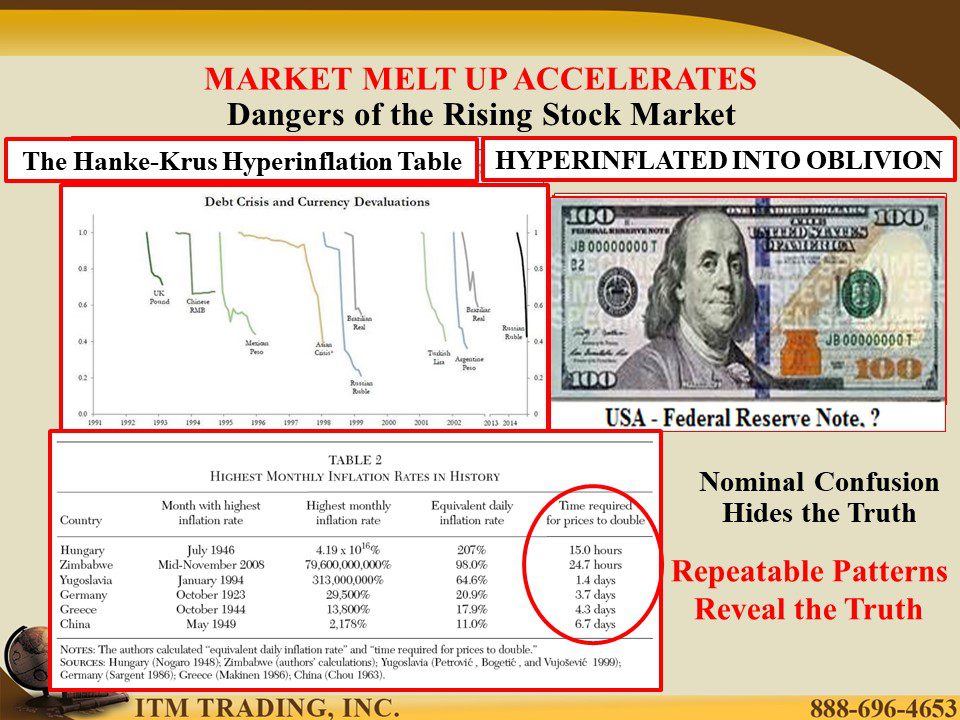

Governments and central bankers want us to believe and have confidence in their experiments, but the reality is a lot different since, by design, inflation is built into every fiat currency which guarantees a loss of purchasing power value over time. Has the loaf of bread that used to cost $0.11 and now costs $4.75, really changed in value or has the US dollar lost that much in purchasing power value?

The unique and largely successful central bank experiment that began in 1913 was the control of the rate and speed of inflation. To do this, they gave themselves tools. Prior to 1971, when most currencies were backed by gold, central bankers and governments simply reduced the level of gold backing. This devalued the currency at a measured pace, while still demanding a level of fiscal responsibility.

But during the 1960’s Viet Nam war era, with the US reneging on the global Bretton Woods agreements by: 1. Printing more dollars to reserve gold than agreed to fund the cost of war. The result was a run on US gold by foreign governments that was only stopped when 2. President Nixon declared that foreign governments would no longer be able to convert USDs into gold.

After that the USD (and eventually all other fiat currencies) was backed by the “Full Faith and Credit of the government.†In other words, the government’s ability to create more debt. As more debt dollars are created, the less value they have and more it takes to buy things, like food and shelter and stocks.

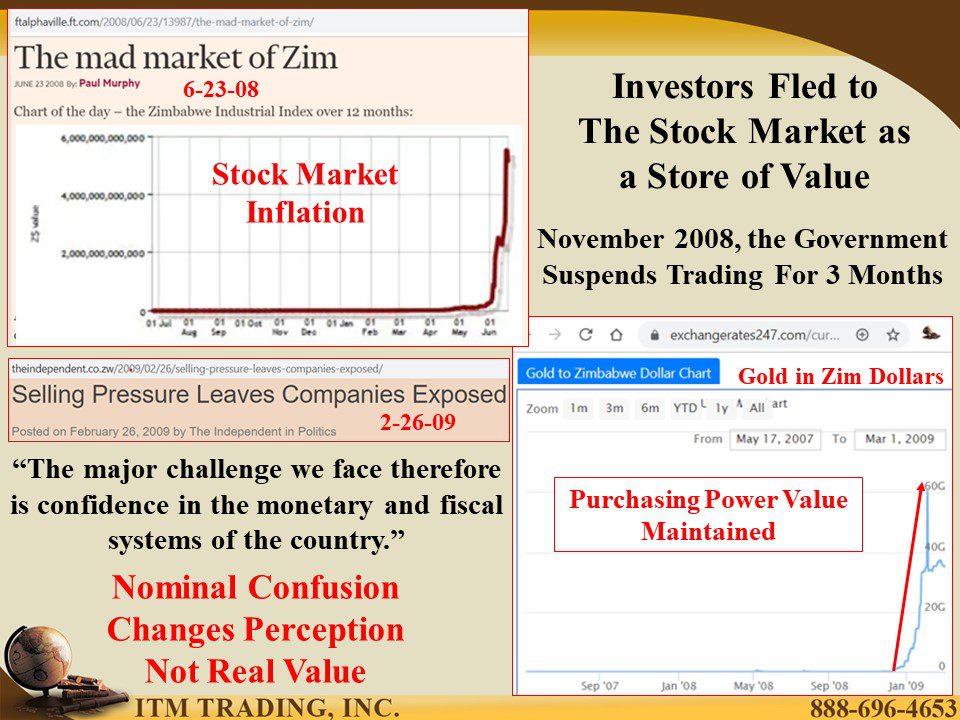

And while the average income NEVER keeps pace with inflation, the stock market was designed to do just that, since the cost of goods and services provided by corporations determines inflation rates (though official inflation rates don’t reflect all costs). So, a rising stock market, in reality, hides the declining purchasing power value of a fiat currency.

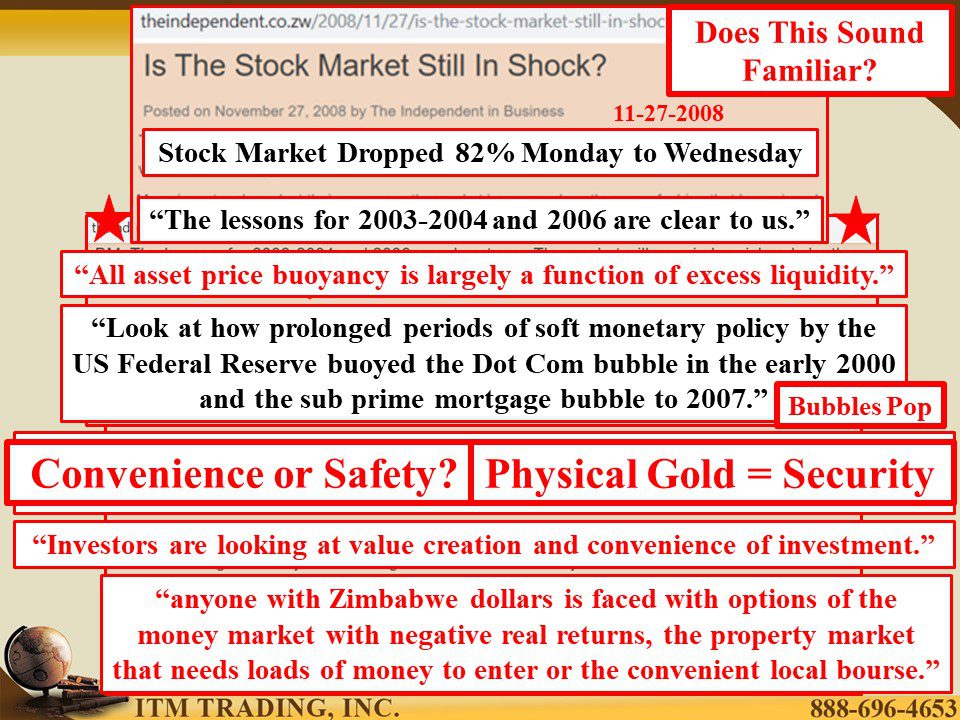

It works as long as central bankers have the tools to control the speed of debt (money) growth and the confidence of the public. But in 2008, the debt-based system died, and central bankers lost their key tool interest rates, and was left with just one tool…debt growth.

But you cannot fix a too much debt problem with even more debt. This makes visible the bias of the system. We see it in income and wealth inequality. Now, the public veil is lifting as confidence in the current system is falling, which is why the populist movement continues to pick up steam.

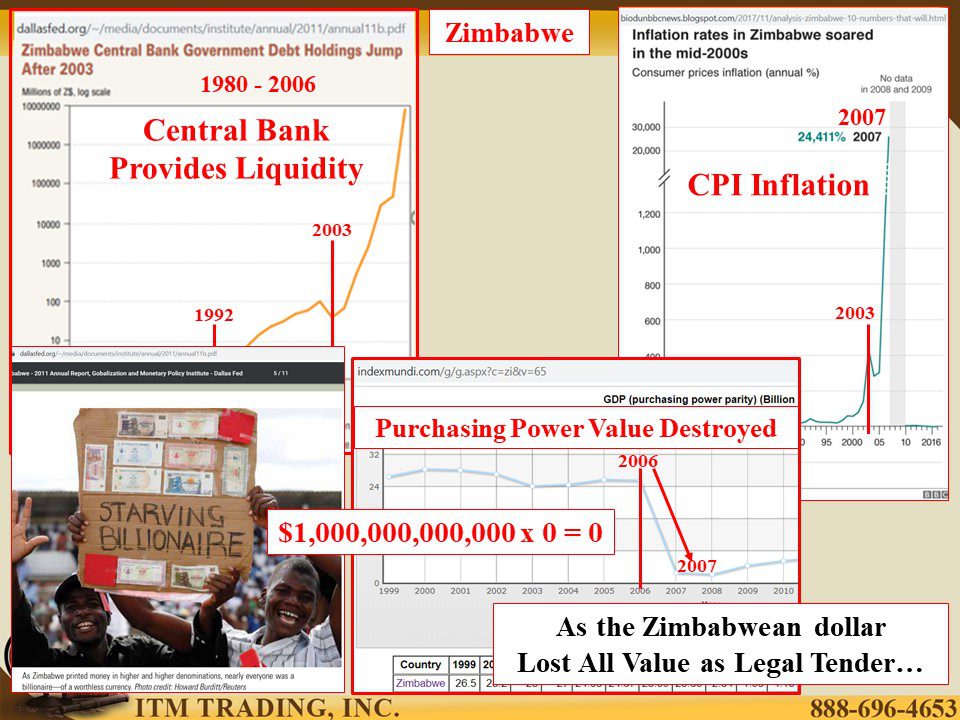

What does a central banker do when there is only one tool left? They shift that tool into hyper drive. That’s what QE and the current “not†QE is all about.

When central bankers create new money, it first goes into the banking system which is then pushed into fiat money instruments like intangible stocks, bonds and derivatives. This pushes nominal value up (numbers) as it erodes the real value of all the fiat money already in the system and your pocket. Additionally, it shifts the power from central planners to markets.

We saw this shift early in 2019 as the Federal Reserve and global central bankers were forced by crashing markets, into pivoting from “normalization†where they attempted to raise rates and reduce balance sheets to give themselves tools to deal with the next financial crisis, back into easy money policies.

In fact, in the 3rd quarter of 2019, 46 central banks cut interest rates 67 times as balance sheets began expanding once again. In the US, the Federal Reserve’s balance sheet is nearing $4.2 trillion which is up from $800 billion in 2008, $3.76 trillion in September 2019 and nearing their highest level of $4.5 trillion in 2015.

The truth is out, central banks only tool is money inflation.

Consequently, in my opinion, the final melt-up phase has begun. But before you go rushing into the most nominally expensive stock markets in history, look at the facts. As central banks create new debt money:

- Purchasing power value is destroyed

- Public confidence in the ruling class and fiat money is lost

- $1,000,000,000 x 0 = 0

We’ve been trained to think there is no other place to hold wealth but fiat markets. Holding that wealth in an account with a statement is certainly more convenient than holding physical gold and silver that must be stored.

But intangible contract wealth can easily be taken away in a market lock-up and crash. And governments can lop off zero’s and/or demonetize currencies. In fact, history shows us that this happens every time.

What else happens every time? Physical gold and silver holds purchasing power value.

You have a choice. What do you want to hold into this next crisis and subsequent financial system reset?

Slides and Links:

https://en.wikipedia.org/wiki/File:The_Hanke_Krus_Hyperinflation_Table.pdf

https://www.cato.org/research/world-inflation-and-hyperinflation-table

https://ftalphaville.ft.com/2008/06/23/13987/the-mad-market-of-zim/

https://www.dallasfed.org/~/media/documents/institute/annual/2011/annual11b.pdf

http://biodunbbcnews.blogspot.com/2017/11/analysis-zimbabwe-10-numbers-that-will.html

https://www.dallasfed.org/~/media/documents/institute/annual/2011/annual11b.pdf

https://indexmundi.com/g/g.aspx?c=zi&v=65

https://tradingeconomics.com/zimbabwe/stock-market-turnover-ratio-percent-wb-data.html

https://ftalphaville.ft.com/2008/06/23/13987/the-mad-market-of-zim/

https://www.indexmundi.com/g/g.aspx?c=zi&v=65

https://www.theindependent.co.zw/2009/02/26/selling-pressure-leaves-companies-exposed/

https://ftalphaville.ft.com/2008/06/23/13987/the-mad-market-of-zim/

https://central-banks.economicblogs.org/jp-koning-moneyness/2017/koning-stock-market

https://www.theindependent.co.zw/2008/11/27/is-the-stock-market-still-in-shock/

https://tradingeconomics.com/venezuela/central-bank-balance-sheet

https://www.worldforexrates.com/xau/vef/1-exchange-rate/

https://www.currexy.com/https://tradingeconomics.com/venezuela/stock-market

https://www.economist.com/finance-and-economics/2018/01/25/venezuelas-currency-plumbs-unknown-depths

https://www.ceicdata.com/en/indicator/venezuela/money-supply-m2

https://fred.stlouisfed.org/series/CUUR0000SA0R

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://stockcharts.com/h-sc/ui

https://fred.stlouisfed.org/series/GOLDAMGBD228NLBM

YouTube Short Description:

In my opinion, the final melt-up phase has begun. But before you go rushing into the most nominally expensive stock markets in history, look at the facts. As central banks create new debt money;

- Purchasing power value is destroyed

- Public confidence in the ruling class and fiat money is lost

- $1,000,000,000 x 0 = 0

We’ve been trained to think there is no other place to hold wealth but fiat markets. Holding that wealth in an account with a statement is certainly more convenient than holding physical gold and silver that must be stored.

But intangible contract wealth can easily be taken away in a market lock-up and crash. And governments can lop off zero’s and/or demonetize currencies. In fact, history shows us that this happens every time.

What else happens every time? Physical gold and silver holds purchasing power value.

You have a choice. What do you want to hold into this next crisis and subsequent financial system reset?